FTUK has truly made a wave in the prop firm community with its enticing promises, particularly the Instant Funding program. Because of both its prominence and the controversies surrounding it, I decided I had to dive deep myself to uncover the truth.

In this FTUK instant funding review, I’ll break down everything, from its funding programs, its allegedly “hidden” trading rules, to the profit-sharing structure, and supported platforms. Most notably, I will weigh the glowing reviews on Trustpilot against the harsh complaints on Reddit to give you the most multi-dimensional perspective possible.

My first impression of FTUK was truly like a ‘double-edged sword’. On the surface, it looks like an incredibly attractive prop firm with flexible conditions and massive profit potential.

However, as I dug deeper, my initial excitement gradually turned into concern when faced with numerous ‘red flags’ raised by the trader community, revealing an alarming gap between the marketing and the experience.

Let’s dive into the analysis together to determine whether FTUK is the launchpad for your trading career or a risk best avoided.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official FTUK websites before purchasing any challenge.

1. Our take on FTUK

Founded in 2021 and headquartered in the United States, FTUK is a prop trading firm offering products such as forex, commodities, indices, and cryptocurrencies, making it a focal point in this FTUK instant funding H2T Funding review. It provides traders with up to 80% profit split and the potential to scale their accounts up to $6.4 million.

The firm offers three funding models: One-step challenge, two-step challenge, and instant funding, catering to various trading styles, from scalping to swing trading. Among these, the Instant Funding program stands out for its immediate access to a funded account.

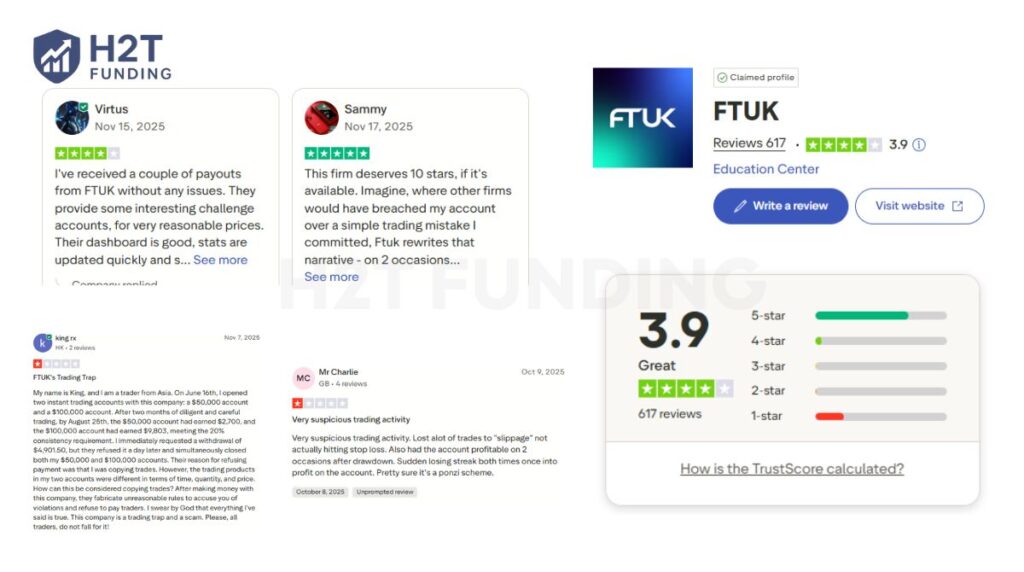

However, FTUK’s reputation is divided. On Trustpilot, it holds a 4.2/5 rating, with many praising its clear rules and fast payouts. In contrast, Reddit features numerous complaints about sudden rule changes and denied payouts.

Pros & cons table:

| PROS | CONS |

|---|---|

| Excellent Trustpilot score of 4.2/5 | Minimum 3-Day requirement for 2-Step program |

| Three distinct funding options | Stop-loss rules vary by program and account start date |

| Customize your plan with add-on features | The withdrawal process still has some limitations |

| Real-time professional data through the FTUK dashboard | Lack of transparency in applying the rules |

| Wide range of trading instruments (Forex, commodities, indices, cryptos) | Additional costs for add-ons |

2. Funding program of FTUK instant funding

This FTUK instant funding review outlines the funding programs currently offered by the prop firm, including specific metrics such as profit targets, loss limits, challenge duration, and key distinguishing features.

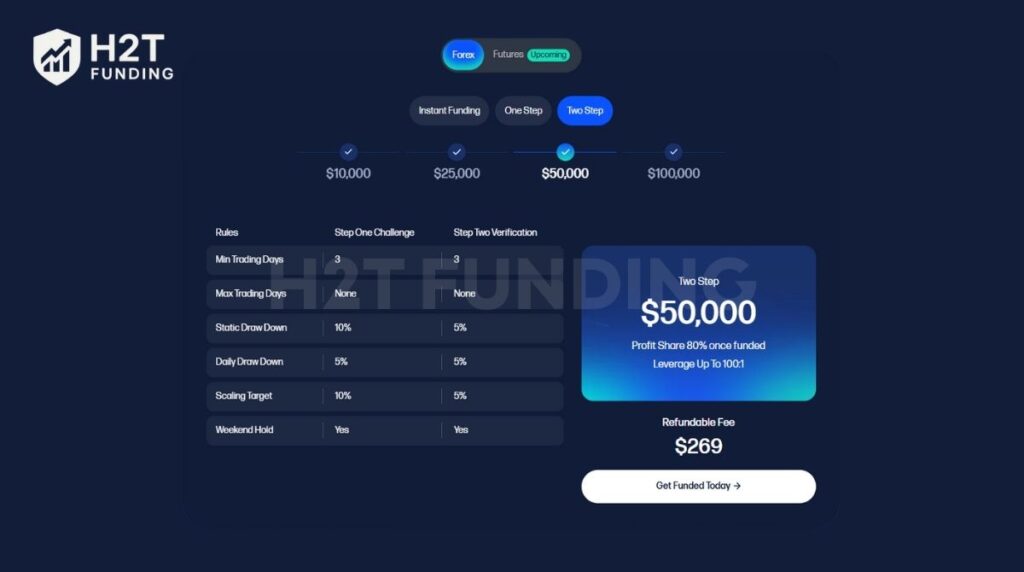

2.1. Two-step challenge

FTUK’s Two-Step Challenge offers traders the chance to prove their skills by managing virtual accounts from $10,000 to $100,000. This evaluation process is designed to spot traders who demonstrate both consistent profitability and strong risk management. Participants can take advantage of leverage up to 1:100 during the challenge’s two evaluation phases.

Phase One of the evaluation requires traders to achieve a 10% profit target without breaching a 5% daily loss or a 10% overall loss limit. There’s no cap on how many days you can take to complete this phase, but you must trade for at least three separate days to move on to the next stage.

Phase Two lowers the profit target to 5%, with the condition that you do not exceed a fixed 5% drawdown. Similar to phase one, there’s no maximum time limit, but again, a minimum of three trading days is required before qualifying for a funded account.

Once both phases are completed, traders receive access to a funded account. The minimum withdrawal threshold is $250, and the only rules to follow are the 5% daily and 10% overall loss limits.

The first payout is available after 10 trading days from the start of your funded account. Subsequent withdrawals can be made every two weeks or weekly if the optional weekly payout add-on is selected. You’ll keep 80% of the profits generated from your funded trading.

FTUK two-step challenge add-ons:

- Option for weekly payouts vs 14 days

- Permission to trade during news events

- Access to scaling level 7 vs level 6 max

- Built-in scaling plan

Trading rules and objectives – Two-step challenge:

- Profit target: To successfully pass each evaluation phase, traders must meet a specific profit goal. Phase 1 requires a 10% profit, while Phase 2 has a 5% target. Funded accounts do not have a fixed profit goal, except for the 10% benchmark required to qualify for account scaling.

- Daily loss limit: Traders must not exceed a 5% loss on any single trading day, regardless of account size. Breaching this limit results in account violation.

- Overall loss limit: Each account has a maximum overall drawdown of 10%. If this threshold is exceeded at any point, the account is disqualified.

- Minimum trading days: Both evaluation phases require at least 3 trading days, with a minimum daily gain of 0.5% for each qualifying day.

- Restrictions on news trading: Opening or closing trades within 5 minutes before and after major news releases is prohibited unless you’ve added the News Trading feature to your plan.

- Risk on open positions: The total risk exposure from open trades must not surpass 2% of the account balance at any given time.

2.2. One-step challenge

FTUK’s one-step challenge offers traders a chance to demonstrate their skills by managing accounts ranging from $10,000 to $100,000. This program is designed to find consistent, disciplined traders who can maintain profitability while managing risk effectively during a single evaluation phase. Participants can trade with leverage of up to 1:50.

During the evaluation stage, traders must achieve a 10% profit target without breaching the risk parameters: a 4% maximum daily loss and an 8% maximum trailing drawdown. There is no set limit on the number of trading days to reach the target. However, to qualify for a funded account, a minimum of four trading days is required.

Once the evaluation is completed, traders receive a funded account with a minimum withdrawal threshold of $250. The same risk rules apply 4% daily loss and 8% trailing loss must be respected. The first withdrawal becomes available after at least 10 trading days from the start of the funded account.

After that, payouts can be requested either bi-weekly or weekly (with the weekly add-on), regardless of the number of active trading days. Profit sharing ranges from 50% to 80%, depending on the trader’s progress within the scaling plan.

FTUK one-step challenge add-ons:

- Weekly payout option

- Permission to trade during news events

- Access to scaling level 7

- One-step challenge scaling structure

One-step challenge: Trading rules & key objectives:

- Profit target: To pass the evaluation stage, traders must meet a profit goal of 10%. Funded accounts do not have ongoing profit targets, but reaching 10% during funded phases enables scaling.

- Maximum daily loss: Traders must not exceed a 4% loss of the account balance in a single day. This applies across all account sizes.

- Maximum trailing loss: A trailing drawdown limit of 8% is enforced, calculated from the highest balance achieved. Breaching this threshold will violate account rules.

- Minimum trading days: To complete the evaluation, you must actively trade on at least four separate days.

- News trading restriction: Trading during major news events is restricted. Opening or closing trades within 5 minutes before or after a high-impact news release is not permitted unless you’ve added the News Trading Allowed add-on.

- Open position risk limit: The total risk exposure across all open trades must not exceed 2% of the account balance.

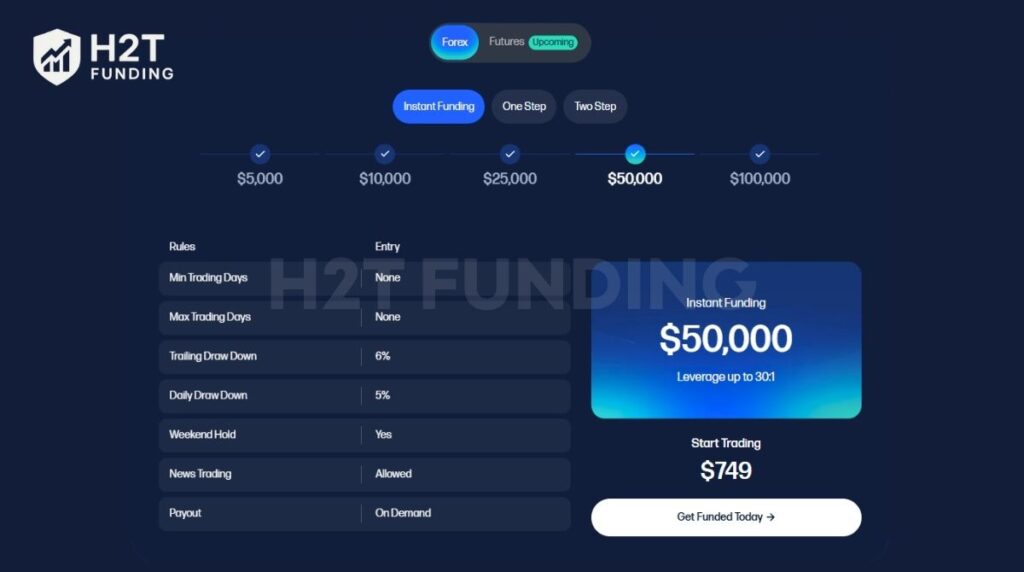

2.3. Instant funding

As detailed in this FTUK Instant Funding H2T Funding review, FTUK’s Instant Funding Program gives traders immediate access to accounts ranging from $5,000 to $100,000, with no evaluation phase required. This option is designed for those who want to begin live trading and earning profits right away. Traders can operate with leverage of up to 1:30.

When you purchase Instant Funding, you’re granted immediate access to a funded trading account with no evaluation required. To maintain your account, you must follow the 6% maximum loss rule and meet the Consistency Score requirement.

There’s no fixed payout schedule; you can request a withdrawal whenever you’re ready, as long as the Consistency Score is met during each payout cycle. Profit sharing starts at 50% and can increase to 80%, depending on your current level within the scaling plan.

Add-ons for FTUK instant funding:

- 20% profit boost

- An additional 2% drawdown allowance

- Access to scaling level 7

- Instant funding scaling plan

Verdict on FTUK funding program:

FTUK’s funding programs offer a wide spectrum of choices for traders at different skill levels. The Two-Step Challenge is well-suited for disciplined traders who want a structured evaluation with fixed drawdown rules.

The One-Step Challenge provides a faster route with fewer stages, but tighter risk limits make it more demanding. Finally, the Instant Funding program stands out for its accessibility, allowing traders to skip evaluations and start live trading immediately, though it comes with stricter conditions, such as the Consistency Score and lower leverage.

Overall, FTUK strikes a balance between flexibility and accountability. The firm accommodates scalpers, swing traders, and those seeking immediate capital access, while maintaining controls that encourage consistent, responsible trading. For traders who value variety and scalability, the funding program lineup presents a strong alternative to more rigid prop firms.

3. FTUK instant funding trading rules

FTUK enforces a comprehensive set of trading rules within its Instant Funding program to ensure robust risk management and maintain fair evaluation standards. While the program offers flexibility in several areas, such as holding trades overnight and on weekends, and allowing the use of EAs, traders must comply with strict guidelines around drawdown limits, lot size consistency, and prohibited trading behaviors.

3.1. Allowed trading practices

FTUK permits several trading styles within its Instant Funding program, but only under strict conditions. Manual strategies such as Martingale, Tick Scalping, Hedging on a single account, general Scalping, and Intraday Trading are allowed, while most automated approaches using EAs or bots are prohibited.

In contrast, high-risk or exploitative methods, including latency arbitrage, reverse arbitrage, hedge arbitrage, multi-account hedging, high-frequency trading, and grid trading, are strictly forbidden. To ensure fair trading, all positions must remain open for at least 30 seconds before being closed.

Additionally, stop losses must be placed within 60 seconds of entering a trade unless traders purchase the no stop-loss add-on. For Instant Funding accounts acquired on or after February 20, 2025, stop losses are no longer mandatory, offering more flexibility to experienced traders who can manage risk independently.

3.2. Prohibited trading practices

To prevent system exploitation and high-risk behavior, FTUK enforces clear restrictions:

- High-frequency trading & arbitrage: Strategies like latency arbitrage, reverse arbitrage, and high-frequency trading (HFT) are strictly prohibited.

- Consistency score: For Instant Funding accounts purchased after February 20, 2025, a “Consistency Score” is applied. This rule must be met before a payout or account scaling is processed. The calculation compares the profit of the best trading day to the total accumulated profit, with required ratios varying from under 20% to under 40% depending on the account level. This indirectly discourages sudden, large deviations in lot size.

- News trading: For Instant Funding programs purchased on or after February 20, 2025, news trading is permitted. For older accounts and other programs, trading within 5 minutes before and after high-impact news events is forbidden unless the “News Trading Allowed” add-on has been purchased.

- Copy trading and signal usage: Copying trades from a non-FTUK account to an FTUK account is allowed. However, copying trades between multiple FTUK accounts is prohibited and can lead to account termination.

- Gambling-like behavior: FTUK discourages sharp increases in lot size or risking a disproportionate amount of the account balance on a single trade. To enforce this, some accounts have an “Account Protector” tool that limits the maximum floating loss to 2% of the initial balance.

- Prohibited EA strategies: Using EAs for Martingale or tick scalping strategies is forbidden. While manual Martingale strategies may be allowed, arbitrage is strictly prohibited.

- IP address usage: While using a fixed VPS or VPN is permitted, attempting to hide your IP address or using multiple IPs from different countries is against the rules and can result in account termination.

- Hedging: Hedging is allowed within a single account but is prohibited across multiple accounts.

Verdict on trading rules

FTUK’s rules reflect a balance: they offer flexibility for swing traders and those using EAs, while maintaining strict oversight on risk exposure and strategy integrity.

This is good, but the lack of clear guidelines on consistency scoring or the ambiguity around trade copying can be challenging. Bottom line, if you value autonomy in your trading style, FTUK provides a competitive framework, as long as you truly understand and respect their expectations.

4. FTUK instant funding payout

Having a clear understanding of FTUK’s payout process is essential for any trader aiming to maximize returns from the Instant Funding program. The payout system is designed for flexibility and efficiency, allowing traders to access profits with minimal delays and no hidden charges.

Here are the core elements of the payout structure:

- Maximum profit split: Up to 80%, depending on your level in the scaling plan

- Approval time for payout requests: Typically 1–2 business days

- Payout processing time: Usually completed within 1–3 business days after approval

- Minimum withdrawal: $250 (based on your share of the profit)

- Payout methods: Funds are disbursed with options to transfer to a bank account or a USDT TRC-20 crypto wallet

One unique aspect of FTUK’s system is the Payout Locker, a secure mechanism that temporarily holds your funds during specific stages of the process. This locker is triggered under the following conditions:

- When you hit a 10% profit target

- After being approved for account scaling

- Once you’ve completed 10 trading days at a new level

- When you submit a payout request

Verdict on FTUK payout

FTUK’s payout system offers a strong balance between flexibility and structure. With no fees, fast processing times, and multiple withdrawal options, it caters well to both casual and serious traders. The built-in Payout Locker may introduce a brief holding period, but it reflects FTUK’s commitment to operational discipline and sustainable scaling.

Overall, this payout framework rewards consistency and makes profit access both predictable and trader-friendly.

5. Scaling plan

Applies to all funded accounts in the Two-Step Challenge, One-Step Challenge, and Instant Funding programs.

Traders must achieve a 10% profit target on the current account size to qualify for the next level upgrade.

Levels and scaling: The plan includes 7 levels, with the account size doubling at each level.

Initial account sizes: $5,000 (Instant Funding only), $10,000, $25,000, $50,000, $100,000 (all programs).

Scaling progression (example for each initial account size):

| Initial Capital | Level 1 | Level 2 | Level 3 | Level 4 | Level 5 | Level 6 | Level 7 (Add-on required) |

|---|---|---|---|---|---|---|---|

| $5,000 | $5,000 | $10,000 | $20,000 | $40,000 | $80,000 | $160,000 | $320,000 |

| $10,000 | $10,000 | $20,000 | $40,000 | $80,000 | $160,000 | $320,000 | $640,000 |

| $25,000 | $25,000 | $50,000 | $100,000 | $200,000 | $400,000 | $800,000 | $1,600,000 |

| $50,000 | $50,000 | $100,000 | $200,000 | $400,000 | $800,000 | $1,600,000 | $3,200,000 |

| $100,000 | $100,000 | $200,000 | $400,000 | $800,000 | $1,600,000 | $3,200,000 | $6,400,000 |

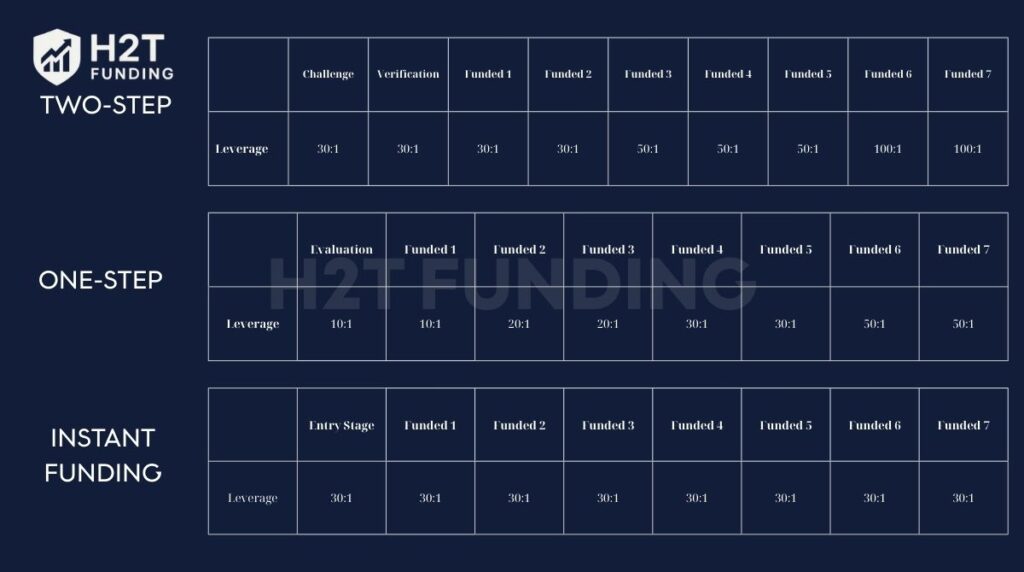

Leverage increase:

- Two-step challenge: 1:30 (Levels 1–2), 1:50 (Levels 3–5), 1:100 (Levels 6–7).

- One-step challenge: 1:10 (Levels 1–2), 1:20 (Levels 3–4), 1:30 (Levels 5–6), 1:50 (Level 7).

- Instant funding: 1:30 at all levels.

Maximum limit: Up to $6.4 million for accounts starting at $100,000, one of the highest in the industry. Level 7 requires a paid add-on package to unlock.

Example: With a $100,000 account, a trader earns $7,000 in week 1 and $3,000 in week 2, reaching the 10% profit target ($10,000). The account is then upgraded to $200,000, and the process repeats for the subsequent levels.

So is this scaling plan really that good?

Admittedly, FTUK’s scaling plan is one of the most “aggressive” in the industry. Doubling your account every time you hit a 10% profit target is a huge motivator for any trader. However, it’s worth noting that having to pay an extra fee to unlock Level 7 might be a small drawback. All in all, this is a clear and very attractive growth path for disciplined traders.

6. Cost & commissions

FTUK applies a flat commission rate of $4 per standard lot exclusively on Forex pairs. No commissions are charged for trading commodities, indices, or cryptocurrencies.

Swaps are fees incurred for holding a trading position open overnight or over the weekend, typically associated with the interest rate differential between the currencies or assets in a trade.

FTUK has eliminated swap fees across all instruments on the DXtrade and MatchTrader platforms to simplify trading costs and enhance trader profitability.

For other platforms like MT5 and TradeLocker, swap fees may still apply depending on the broker’s policies, but FTUK encourages checking specific platform terms for clarity.

Verdict on costs & commissions:

FTUK’s cost structure is highly competitive. The removal of swap fees on the DXtrade and MatchTrader platforms is a significant advantage, particularly for swing traders who hold positions overnight or over weekends.

This straightforward and trader-friendly fee model reduces overhead costs, making FTUK an attractive option for those prioritizing low trading expenses. Overall, FTUK’s cost structure aligns well with its goal of providing flexible and cost-effective trading conditions.

7. Trading platform

Traders can choose to use the following platforms:

- MatchTrader

- DXtrade

- MetaTrader 5 (MT5)

- TradeLocker

FTUK’s trading platforms, MatchTrader, DXtrade, MetaTrader 5, and TradeLocke,r cater to a wide range of trading styles, from scalping to swing trading. This variety ensures flexibility: MT5 supports advanced traders with algorithmic trading and multi-asset capabilities, while TradeLocker and MatchTrader serve beginners with user-friendly interfaces and mobile accessibility.

DXtrade’s risk management tools align well with FTUK’s strict rules (e.g., 2% risk per position), making it ideal for disciplined traders. The absence of MetaTrader 4 may disappoint traditionalists, but MT5’s enhanced features compensate for this, and TradeLocker’s mobile focus stands out for on-the-go trading.

Stability is a strong point, with no major issues reported, although occasional bugs suggest room for improvement. User-friendliness is high, especially with TradeLocker and MatchTrader, though MT5 can be challenging for beginners due to its complexity.

Verdict on trading platform: FTUK offers a well-rounded selection of trading platforms that cater to both novice and experienced traders. Overall, the platform choices are robust, stable, and aligned with FTUK’s trading rules, making them a solid fit for a wide range of trading strategies and preferences.

8. Trading instruments & leverage

Instruments: Forex, Indices, Commodities, Crypto.

The leverage available through this prop firm varies depending on the type of asset you’re trading. Below is a breakdown of the leverage offered by the asset class:

- Forex pairs:

- Two-step challenge: Leverage starts at 30:1 for Challenge, Verification, and early funded stages, then rises to 50:1 at mid-levels, and up to 100:1 at the highest scaling levels.

- One-step challenge: Begins at 10:1, gradually increases to 20:1 at mid-levels, and reaches 50:1 at the top.

- Instant funding: Fixed at 30:1 across all stages.

- Other instruments:

- Crypto: Fixed at 2:1 for all levels.

- Indices: Fixed at 5:1 for all levels.

- Non-metal commodities: Fixed at 5:1 for all levels.

- Metals: Fixed at 10:1 for all levels.

FTUK’s trading tools and leverage options provide significant flexibility for a variety of trading strategies. The broad asset portfolio, including forex, commodities, indices, and cryptocurrencies, allows traders to diversify their portfolios, hedge risks, and capitalize on global market trends.

This flexibility suits scalpers, day traders, and swing traders alike, with the allowance of overnight and weekend positions further enhancing the adaptability for longer-term strategies.

9. Education & resource

FTUK does not provide structured educational resources, and it’s generally advised that novice traders avoid prop trading. While the lack of beginner-focused tools discourages inexperienced traders from jumping in prematurely, the firm does maintain a blog with helpful content for those already exploring the prop trading space.

FTUK supports its community by offering a comprehensive blog that covers various educational topics. The content is organized into four main sections:

- General knowledge

- Trader psychology

- Technical strategies

- Trader interviews

In addition to the blog, FTUK provides clients with an intuitive trading dashboard designed to help manage risk effectively while staying aligned with their performance goals.

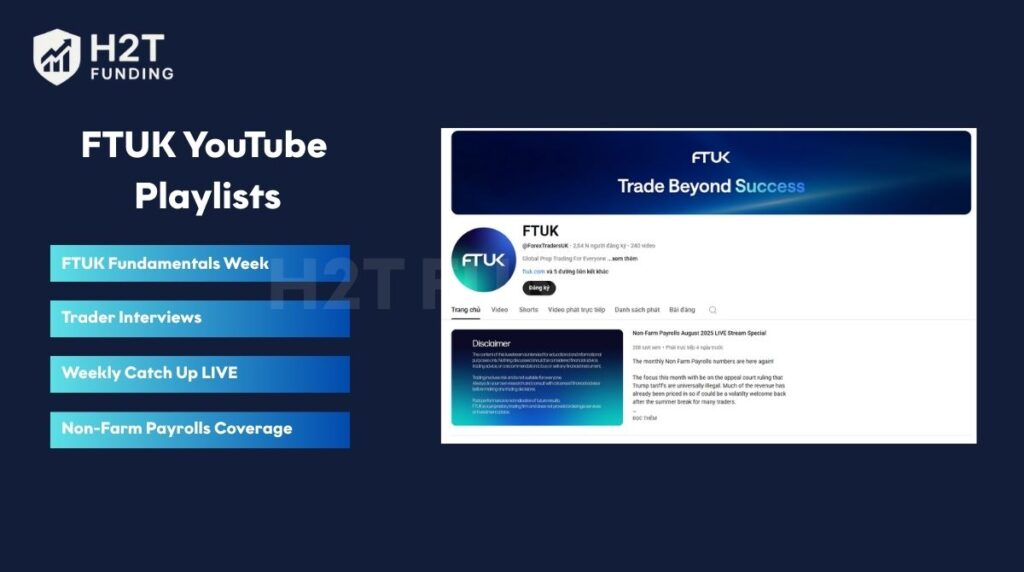

They also maintain an active YouTube channel, featuring trader interviews, valuable insights, and practical tips to assist users in navigating their prop firm challenges.

Verdict on education & resource: FTUK’s educational offerings are best suited for intermediate to advanced traders who already have a foundational understanding of trading.

While the absence of structured beginner courses may be a drawback for novices, the firm compensates with a rich content library through its blog and YouTube channel.

The focus on trader psychology, strategy, and real-world experiences provides valuable insights for those looking to enhance their skills and mindset. Overall, FTUK prioritizes practical, self-directed learning rather than hand-holding, making it a better fit for self-motivated traders rather than complete beginners.

10. Customer support

- Support channels: FTUK offers assistance via email and live chat.

- Availability: Live chat is accessible 24/7, while the company’s office hours are Monday to Friday, from 09:00 to 18:00 (HMY).

From my experience with FTUK, the live chat feature was consistently available at all hours, making it convenient for traders in different time zones. However, I suggest checking the FAQ section first, as it addresses a wide range of common questions. One drawback is the lack of a dedicated contact for the finance department, where many user concerns are likely to occur.

11. Trader feedback and real experience of FTUK instant funding – FTUK Trustpilot ratings

To provide a balanced perspective, we’ve gathered authentic user reviews from Trustpilot and Reddit. These insights highlight the experiences of real traders, showcasing both the strengths and potential pitfalls of trading with FTUK. Below, we analyze the firm’s standout features and reported issues, alongside my personal take on its offerings.

Trustpilot reviews:

- Evelyn (US, 5 stars, July 7, 2025): “Third prop firm I’ve tried this year, first one I’m keeping. FTUK’s process is straightforward without hidden tricks. Got funded in March, first payout in April. The scaling system doubled my account after meeting their targets. The platform never crashes during major news events, which was a constant problem with my last firm. Support speaks plain English instead of corporate talk. Payouts arrive much faster than traditional methods. Skip the gimmicky firms and go straight to FTUK.”

- Mandar Shrivastav (IN, 1 star, May 1, 2025): “This FTUK prop firm is cheating people. I have recently entered a competition account. I was performing well in the leaderboard, and all of a sudden, my account got suspended. They stated the reason that you should have purchased the account earlier, before these rules were not there. And if they are telling the truth, why have they allowed me in the competition? This is a fake cheating company. will not advise anyone.”

Reddit feedback:

- Bzyczek77 (Feb 15, 2023): “I made it to level 2… I get an email ‘We’ve assessed your account… and noticed that you violate our trading rules. The rule that you’ve violated is the 1.5% max loss with soft breaches… I thought they rectified the issue… I didn’t expect that outcome… it feels very shady to me… Why let me complete it? Why not inform me that this soft breach should not be taken lightly?”

Analysis of FTUK’s strengths and limitations:

Strengths:

- Transparent and flexible process: Users like Evelyn praise FTUK for its straightforward evaluation process with no hidden tricks, ideal for part-time traders due to no time limits and weekend trading availability.

- Fast payouts and reliable platforms: Positive feedback highlights quick payouts via Risework and stable platforms that don’t crash during major news events.

- Responsive support: The 24/7 live chat and clear communication in “plain English” are appreciated for their accessibility and helpfulness.

Limitations:

- Inconsistent rule enforcement: Complaints from Mandar and Bzyczek77 point to sudden account suspensions and unclear communication about “soft breaches,” raising concerns about transparency and fairness.

- Payout and account issues: Some traders report unexpected account closures and payout denials despite meeting targets, suggesting potential discrepancies between advertised promises and actual practices.

As someone who has explored FTUK’s offerings, I find their Instant Funding model appealing for its immediate access to capital and flexible trading conditions, such as flexible stop-loss rules and weekend trading. The ability to scale up to $6.4 million is a strong incentive for disciplined traders.

However, the reported issues with rule enforcement and account suspensions make me cautious. The “soft breach” policy, as seen in Bzyczek77’s case, feels ambiguous and could undermine trust.

While the platform’s stability and support are commendable, I’d advise traders to meticulously review the rules and maintain strict risk management to avoid unexpected penalties.

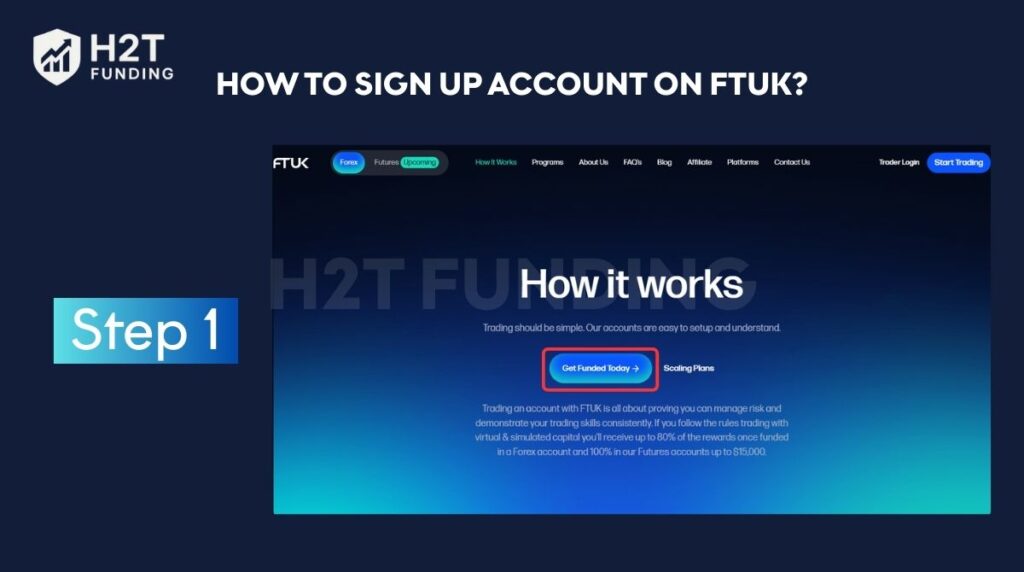

12. How to sign up for an account on FTUK

If you’re ready to start trading with FTUK, the first step is setting up your account. Fortunately, FTUK offers a straightforward and beginner-friendly sign-up process. Here’s a step-by-step guide to help you register and get started with your trading journey on FTUK:

Getting started with FTUK takes just three simple steps:

Step 1: Select your challenge

Choose the program that fits your style: Instant Funding, One-Step, or Two-Step. Then pick your preferred account size (from $5,000 to $100,000) and trading platform (DXtrade, MatchTrader, TradeLocker, or Platform 5).

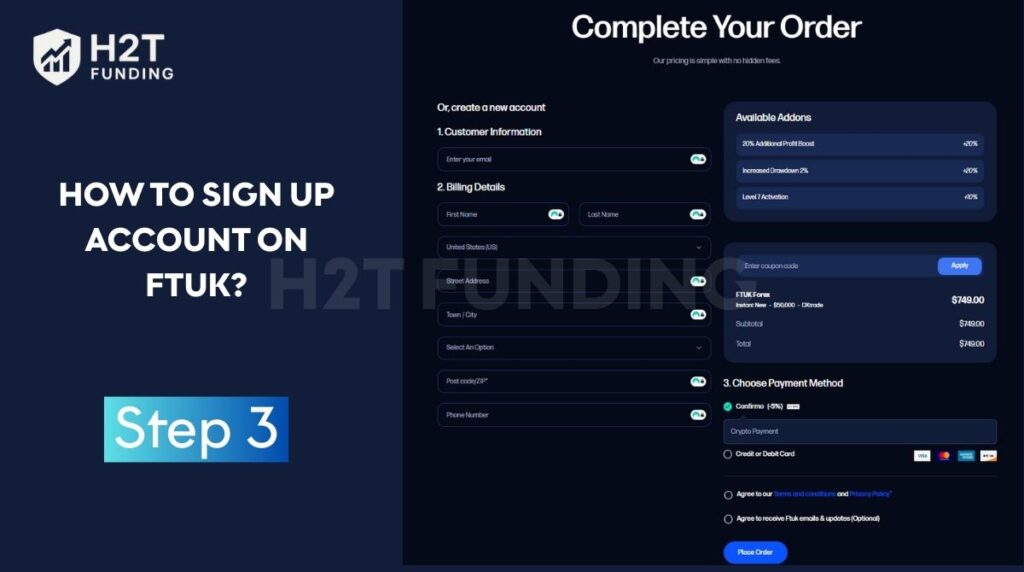

Step 2: Customize your plan

Review the one-time fee displayed for your selection. At this stage, you can also add extra features such as a 20% Profit Boost, Increased Drawdown, or Level 7 Activation to tailor your funding package.

Step 3: Complete your order

Fill in your personal and billing information, choose a payment method (credit/debit card or crypto), and confirm the order. Once payment is processed, you’ll gain immediate access to your trading account if you select Instant Funding.

FTUK’s onboarding process is relatively smooth and efficient, especially with Instant Funding, which provides platform access immediately after payment, a key highlight in this review. The registration process is user-friendly, with clear steps outlined on the website and flexible program options that suit a wide range of trader profiles.

13. Compare vs other prop firm

The following table compares FTUK, FTMO, and Alpha Capital Group, three prominent proprietary trading firms, across key criteria such as evaluation difficulty, profit split, trading rules, platform support, instruments, evaluation fees, payout frequency, and trust/community ratings.

This comparison aims to provide a clear overview of each firm’s offerings, helping traders evaluate which firm best aligns with their trading goals and preferences.

| Criteria | FTUK | FTMO | Alpha Capital Group |

|---|---|---|---|

| Evaluation difficulty | Medium – Offers 1-phase, 2-phase, and Instant Funding models with varying drawdown and profit targets. | Medium – standard 2-phase challenge (10% -> 5%) | Medium – 1‑ to 3‑phase models with varying drawdown options |

| Profit split | 50%–80% | 80% -> 90% after scaling; scaling available | 80%, with scalable account growth up to $2 million |

| Trading rules | Daily drawdown: 4% (One-step), 5% (Two-step), 6% (Instant funding); Max drawdown: 6% (Instant), 8% (One-step), 10% (Two-step); News trading is restricted unless an add-on is purchased. 2% risk per open position | Daily drawdown 5%, Max drawdown 10%, limited news trading | Daily drawdown 4–5% Max drawdown 6–10% News trading allowed (Swing only) |

| Platform support | MT5, MatchTrader, DXtrade, TradeLocker | MT4, MT5, cTrader, DXtrade | MT5, cTrader, DXtrade |

| Instruments | Forex, indices, commodities, crypto | Forex, indices, commodities, crypto | Forex, indices, metals, oil |

| Evaluation fee | $99–$1,499 depending on account size ($5K–$100K) | ~$300 USD for $100K challenge (refundable on success) | ~$50–997 depending on size |

| Payout frequency | Bi-weekly or on-demand (Instant Funding); first payout after 10 days | Bi-weekly after funding; first payout from 30 days | Bi-weekly or on-demand (2% rule) |

| Trust & community rating | 4.2/5 with 625 reviews (73% 5-star, 21% 1–2 star) | 4.8/5 with 24K+ reviews | 4.6/5 with 9% 1-star reviews |

14. FAQs

The evaluation fee at FTUK ranges from $99 to $1,499.

Yes, FTUK is a legitimate prop trading firm, established in 2021 and based in the United States.

FTUK is a proprietary trading (prop trading) firm that provides capital to traders to trade financial instruments such as forex, indices, commodities, and cryptocurrencies.

The profit share at FTUK depends on the program and scaling level: Two-Step Challenge: Fixed at 80% across all levels. One-Step Challenge and Instant Funding: Starts at 50% at Level 1, increasing to 60% (Levels 2–3), 70% (Levels 4–5), and 80% (Levels 6–7). This structure is competitive in the industry, especially for Instant Funding, where offering up to 80% profit share is rare compared to other prop firms.

News trading is restricted within 5 minutes before and after major news events across all programs, unless you purchase the add-on. For Instant Funding accounts opened after Feb 20, 2025, news trading is allowed by default.

FTUK allows EAs on all platforms, but high-risk strategies like arbitrage, HFT, or Martingale via EAs are prohibited.

15. Conclusion

So, after all, is FTUK the right choice for you?

This FTUK instant funding review has highlighted FTUK’s standout features: Its Instant Funding program that requires no evaluation, up to 80% profit splits, and an ambitious scaling plan. However, the concerns about high spreads and occasional payout delays are real, requiring traders to stay disciplined.

So who should join? FTUK is best suited for experienced traders who are comfortable with strict risk management (2% per position, 4-6% daily drawdown) and those seeking flexibility in holding trades overnight or over weekends.

And who should reconsider? If you are a novice, the lack of educational resources and the reported transparency issues could be a major hurdle.

Whatever your decision, feel free to share your experience in the comments. And don’t forget, to explore more in-depth prop firm reviews, keep following the blog here at H2T Funding.