25% OFF Sale

Flat 25% OFF Sitewide. Withdraw weekly or request payouts anytime you reach your target.

When I first signed up with Finotive Funding, I felt a genuine rush of excitement. The sleek platform, the bold promises, the sense that I was stepping into something built for serious traders, it all pulled me in.

But that excitement faded quickly. Just a few days in, I realized Finotive Funding isn’t built for beginners. It demands discipline, sharp risk control, and a professional mindset. This isn’t a place to test the waters; it’s a firm for those ready to dive deep.

To be fair, the perks are real: weekend trading, rapid payouts, and a drawdown system that feels more grounded than many competitors. But those advantages don’t mean much if you can’t navigate the pressure. The rules are strict, and with over 20% one-star reviews on Trustpilot, it’s clear many traders felt overwhelmed or let down.

In this Finotive Funding review, H2T Funding will walk you through the highs, the hard truths, and whether this firm is really the right fit for your trading journey.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Finotive Funding Review websites before purchasing any challenge.

1. Our take on Finotive Funding

I first came across Finotive Funding when I learned it was founded in 2021 under Finotive Group KFT by Oliver Newland, an experienced trader. What caught my attention right away was how they offer different account types and starting balances, so it’s easy to choose one that matches your own trading style and budget.

Another thing I really value is that Finotive utilizes its own proprietary broker, Finotive Markets LLC, which connects directly to deep liquidity pools. From my experience, this usually means tighter spreads and lower trading costs, something you’ll notice if you trade often or with larger volumes.

They also have a wide range of products: Forex, cryptocurrencies, stocks, indices, commodities, and futures, with leverage up to 1:400 depending on the asset. You can hold trades overnight, trade on weekends, and use EAs (advisers), which adds flexibility. Just keep an eye on the drawdown limits so you don’t break the rules.

The fee structure is simple; it starts from $50, and there are no hidden charges. Profit splits start at 75% for challenge accounts, while Instant Funding accounts offer splits starting from 65% to 70%. If you grow your account steadily every 90 days, you can increase your profit share to 95%. But if you miss the target, your balance resets to the starting level, which some traders might find discouraging.

It’s also worth noting that Finotive does not accept traders from certain countries due to regulations, including the United States, Iran, and North Korea. For everyone else, if you’re okay with their rules and structure, Finotive can be a solid option worth considering.

Key features of Finotive Funding

- Scaling potential up to $3,200,000

- Profit split up to 95% (or 100% for Finotive Pro)

- 300+ tradeable assets across Forex, metals, indices, crypto, energies, and stocks

- Weekly withdrawals, including via Finotive Pay, PayPal, Revolut, bank, or cryptocurrency,…

- Support for automated trading via MetaTrader 5 (MT5) with EA compatibility

- No time limit on challenge accounts

- Leverage up to 1:400 on select accounts and instruments

- Salary program and custom global payroll integration

Pros and cons of Finotive Funding

| Pros | Cons |

|---|---|

| Instant funding available | Brokerage partner is unregulated |

| Weekly withdrawals via Finotive Pay, PayPal, crypto, bank | Limited learning materials for beginners |

| Up to 100% profit split (Finotive Pro) | No access to MetaTrader 4 (MT5 only) |

| High leverage up to 1:400 | Geo-restrictions in certain countries |

| Access to 300+ instruments across 6+ markets | Customer support channels could be improved |

| Custom payroll/salary program | Some users report platform UX quirks |

| Refundable fees once funded | Must pass strict rules to qualify for scaling |

| No time limit for evaluation challenges |

Still, Finotive isn’t for everyone. The firm’s exclusive reliance on its proprietary brokerage partner, Finotive Markets LLC, is a significant factor. This broker is registered offshore but is not regulated by a top-tier financial authority, which is a key consideration for traders prioritizing capital safety.

This structure can raise concerns about potential conflicts of interest and the absence of oversight from a top-tier regulatory body, which is a key consideration for traders prioritizing capital safety.

2. Finotive Funding program evaluation

Finotive Funding takes a flexible, trader-first approach to funding. Instead of locking everyone into the same rigid process, it offers three core programs:

- Challenge Two-stage/ One-stage

- Instant Funding Standard/ Lite

- Finotive Pro Two-stage/ One-stage

Each is built for a different trading style and mindset. Whether you’re looking for a classic challenge, instant capital, or top-tier rewards with Finotive Pro, there’s a path designed to match your strengths.

| Criteria | Challenge program | Instant Funding program | Finotive Pro | |||

|---|---|---|---|---|---|---|

| Challenge 2-Step | Challenge 1-Step | Instant Funding Standard | Instant Funding Lite | Finotive Pro 2-Stage | Finotive Pro 1-Stage | |

| Profit Target | 7.5% → 5.0% | 10.0% | None | None | 7.5% → 5.0% | 10.0% |

| Daily Drawdown | 5.0% | 4.0% | 3.5% | 3.0% | 5.0% | 4.0% |

| Max Total Drawdown | 10.0% | 8.0% | 7.0% | 6.0% | 10.0% | 8.0% |

| Instrument Risk Limit | 2.5% | 2.0% | 2.5% | 2.0% | 3.5% | 2.75% |

| Profit Split | 75% | 75% | 70% | 65% | 75% → 100% | 75% → 100% |

| Min. Trading Days | 2 (≥ 0.5%) | 3 (≥ 0.5%) | None | 5 (≥ 0.5%) | 2 (≥ 0.5%) | 3 (≥ 0.5%) |

| Payout Frequency | After funding | After funding | Weekly | Bi-weekly | Monthly (salary + profit) | Monthly (salary + profit) |

2.1. Challenge program

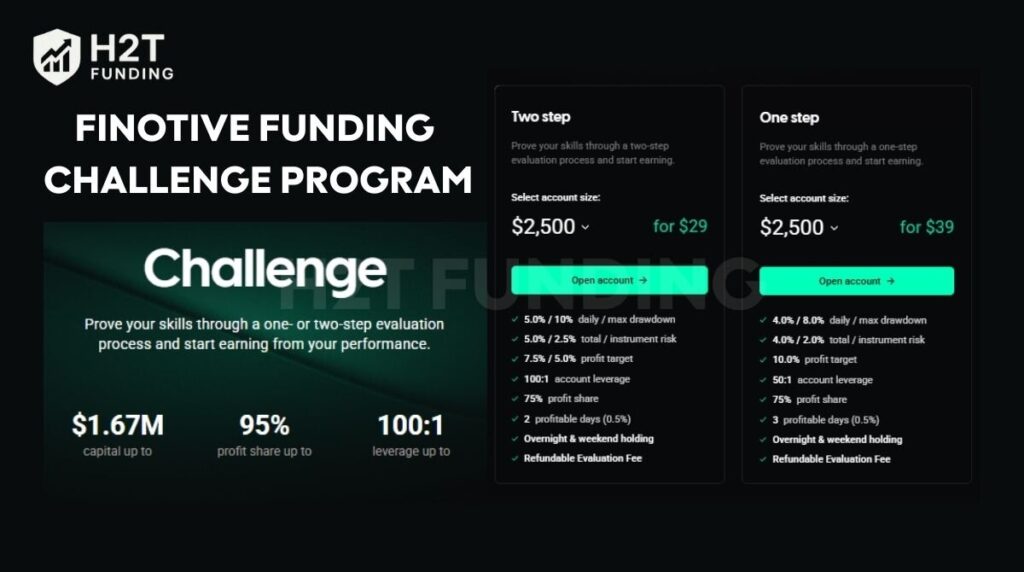

The Challenge is Finotive Funding’s classic evaluation model, a structured, performance-based path that lets traders prove their edge. Whether you choose the one-step or two-step format, the program rewards consistency and control, not just high returns.

You can choose account sizes ranging from $2,500 to $200,000, with rules designed to balance risk with real-world conditions. The higher your account, the more capital you can eventually scale, all the way up to $1.67 million.

2.1.1. Two-stage challenge

This is the traditional route, perfect for traders who thrive under clear structure and step-by-step validation. With more forgiving drawdowns and a lower initial profit target, it allows time to build up discipline while staying profitable.

Key parameters at a glance:

| Metric | Phase 1 | Phase 2 |

|---|---|---|

| Profit target | 7.5% | 5.0% |

| Max daily drawdown | 5.0% | 5.0% |

| Max total drawdown | 10% | 10% |

| Max instrument risk | 2.5% | 2.5% |

| Min trading days | 2 (≥ 0.5% profit/day) | 2 (≥ 0.5% profit/day) |

| Leverage | 1:100 | 1:100 |

| Profit split | 75% | 75% |

| Overnight & Weekend holding | ✅ Allowed | ✅ Allowed |

| Refundable fee | ✅ Yes | ✅ Yes |

Why traders like it:

- Lower pressure across two phases.

- Encourages consistent, low-risk strategies.

- Ideal for traders focused on long-term evaluation and drawdown control.

2.1.2. One-stage challenge

For traders who want to skip straight to proving their strategy in a single round, this is the fast lane. It requires tighter risk management and a higher profit target, but eliminates the need for two phases.

Key parameters at a glance:

| Metric | One-Step Challenge |

|---|---|

| Profit target | 10.0% |

| Max daily drawdown | 4.0% |

| Max total drawdown | 8.0% |

| Max instrument risk | 2.0% |

| Min trading days | 3 (≥ 0.5% profit/day) |

| Leverage | 1:50 |

| Profit split | 75% |

| Overnight & Weekend holding | ✅ Allowed |

| Refundable fee | ✅ Yes |

Why traders choose it:

- Shorter path to a funded account.

- Best suited for confident, sharp execution.

- Efficient route for those with proven consistency.

2.2. Instant Funding program

Sometimes, you don’t want to prove yourself; you just want to trade. Finotive’s Instant Funding program is made for traders who are ready to skip the evaluation process and access real capital immediately. It’s fast, flexible, and perfect for those who’ve already tested their edge elsewhere.

The program offers account sizes ranging from $2,000 to $100,000, with scalability up to $3.27 million. It comes in two tiers: Standard and Lite, giving you the choice between higher profit potential or a more accessible, low-drawdown alternative.

2.2.1. Instant Funding Standard

This is Finotive’s most powerful instant access option. With up to $3.27 million in scalable capital, weekly payouts, and a profit share of up to 70%, it’s built for traders who want freedom with funding and are ready to manage risk with precision.

Key parameters at a glance:

| Metric | Instant Funding Standard |

|---|---|

| Max daily drawdown | 3.5% |

| Max total drawdown | 7.0% |

| Max instrument risk | 2.5% |

| Leverage | 1:33 |

| Profit split | 70% |

| Min trading days | None |

| Consistency rule | ❌ Not required |

| Overnight & Weekend holding | ✅ Allowed |

| Payout frequency | Weekly |

Why traders love it:

- No challenge phase, get funded instantly.

- Generous 70% split with no restrictions on consistency.

- Weekly withdrawals for fast income generation.

2.2.2. Instant Funding Lite

Designed for traders who want instant access at a lower cost and lower risk threshold, the Lite version provides bi-weekly payouts, slightly reduced drawdowns, and a 65% profit split. It’s a great entry point for those easing into prop trading without evaluation pressure.

Key parameters at a glance:

| Metric | Instant Funding Lite |

|---|---|

| Max daily drawdown | 3.0% |

| Max total drawdown | 6.0% |

| Max instrument risk | 2.0% |

| Leverage | 1:25 |

| Profit split | 65% |

| Min trading days | 5 (≥ 0.5% profit/day) |

| Consistency rule | ❌ Not required |

| Overnight & Weekend holding | ✅ Allowed |

| Payout frequency | Bi-weekly |

Why it works for many traders:

- Lower drawdown, lower risk.

- Still no challenge phase.

- Perfect for refining strategy under real capital.

2.3. Finotive Pro program

For serious traders ready to turn their strategy into a career, Finotive Pro is where performance meets profession. This program is more than funding; it’s a long-term structure designed to reward consistency with up to a 100% profit share and a monthly salary that starts at $500 and can scale up to $16,700.

Available for account sizes between $50,000 and $200,000, Finotive Pro includes two evaluation paths: a one-stage fast track and a two-stage classic route. Both options allow overnight/ weekend holding and are designed to ease the transition into professional trading, with real income from day one.

2.3.1. Finotive Pro – Two Stages

The two-stage model is for traders who thrive with structure and want to grow their income over time. Starting with a 75% profit split, you can scale up to 100% as you progress, while also unlocking a $500 base monthly salary once funded.

Key parameters at a glance:

| Metric | Two Stages |

|---|---|

| Profit target | 7.5% (Stage 1) / 5.0% (Stage 2) |

| Max daily drawdown | 5.0% |

| Max total drawdown | 10.0% |

| Max instrument risk | 3.5% |

| Leverage | 1:100 |

| Profit split | 75% → 100% |

| Monthly salary (starts at) | $500 |

| Min trading days | 2 (≥ 0.5% profit/day) |

| Overnight & Weekend holding | ✅ Allowed |

| Refundable fee | ✅ Yes |

Why this model works well:

- Structured path with achievable targets.

- Base salary adds stability to the payout model.

- Ideal for long-term traders aiming for sustainability.

2.3.2 Finotive Pro – One Stage

Prefer a quicker route to professional status? The one-stage version lets you pass a single phase and start earning immediately, both from your trading and a guaranteed monthly salary.

Key parameters at a glance:

| Metric | One Stage |

|---|---|

| Profit target | 10.0% |

| Max daily drawdown | 4.0% |

| Max total drawdown | 8.0% |

| Max instrument risk | 2.75% |

| Leverage | 1:50 |

| Profit split | 75% → 100% |

| Monthly salary (starts at) | $500 |

| Min trading days | 3 (≥ 0.5% profit/day) |

| Overnight & Weekend holding | ✅ Allowed |

| Refundable fee | ✅ Yes |

Why choose this path:

- Faster time to funding and earnings.

- Salary cushion reduces performance pressure.

- For experienced traders confident in shorter evaluations.

Verdict on Finotive Funding Program Evaluation

From my perspective, Finotive Funding has done an impressive job designing programs that cater to real traders’ needs, not just rigid profit targets. I appreciate how they allow you to choose between fast access (instant funding), structured growth (challenge), or a real career path (Finotive Pro with salary).

Personally, I find the Pro program’s salary model both refreshing and motivating; it’s rare to see a prop firm reward stability, not just performance. Finotive isn’t just funding trades; it’s helping traders build a future.

3. Finotive Funding trading rules

Every prop firm comes with a rulebook, but Finotive’s approach feels more trader-aware than restrictive. Instead of smothering creativity, the firm allows you to explore your style within clearly defined limits.

From using Expert Advisors to managing trades during news events, Finotive gives traders room to breathe, while still protecting the firm’s capital integrity.

3.1. Allowed trading rules

Finotive Funding empowers traders with flexibility, while preserving risk control through clear, rule-based systems. Here’s what traders are allowed to do across all programs:

- Use of VPN & VPS: Traders are allowed to use VPNs or VPS setups to trade securely and efficiently, especially if trading remotely or using expert advisors. However, their use must not involve any intent to manipulate or misrepresent trading behavior (e.g., spoofing location/IP).

- Hedging (with limits): Hedging is permitted within a single account. However, hedging between multiple accounts or during high-impact news events is not allowed. Traders must also avoid collusion-style behavior such as mirroring trades across accounts.

- Martingale strategies (conditional): Finotive allows the use of Martingale strategies under strict risk limits. These strategies must remain within defined drawdown and instrument risk levels. Aggressive grid-based recovery attempts may still trigger breaches if limits are exceeded.

- Expert Advisors (EAs): Traders can use EAs on the MT5 platform. However:

- Allowed: Custom EAs, manual-to-EA strategies if consistent.

- Not allowed: Arbitrage EAs, HFT bots, latency exploit tools.

Switching from manual to EA trading after funding may reduce your profit share unless declared upfront.

- News trading (permitted): Trading during news events is allowed, but strategies like straddling (placing buy/sell stops before release) are not. Traders are expected to manage risk responsibly, particularly during volatile economic releases.

- Strategy continuity: For Challenge and Finotive Pro traders, your trading strategy (e.g., instrument type, lot size, trading frequency) must remain reasonably consistent post-funding. Large, unexplained changes may result in lowered payouts or a review.

- Mandatory stop-loss enforcement: Every trade must include a stop loss placed within 60 seconds of execution. Finotive allows the system to auto-apply a substitute SL if a trader forgets. Breaching this rule may reduce the next payout to 10% profit share.

- Minimum stop-loss distance: Since July 24, 2025, Finotive enforces a minimum SL distance for each instrument (e.g., 75 points for EURUSD). Trades not complying will be automatically rejected.

- Drawdown protection: Total open risk (across all positions or per instrument) must never exceed 2× the remaining account balance. This rule protects accounts from sudden liquidation once nearing drawdown thresholds.

3.2. Prohibited trading rules

While Finotive Funding offers flexible trading environments, it also enforces strict rules to ensure fair usage and risk containment. The following behaviors are not permitted under any of its programs:

- High-Frequency Trading (HFT): All forms of HFT, including ultra-fast execution strategies, are strictly prohibited. These typically involve trade durations in milliseconds or microseconds and are often flagged for attempting to exploit infrastructure speed.

- Arbitrage strategies: Traders must not use latency, triangular, or tick arbitrage to take advantage of price feed discrepancies. Exploiting server inefficiencies is a breach of Finotive’s terms and leads to disqualification.

- Straddling during news events: Placing opposing stop orders on both sides of the market before a scheduled high-impact news release (e.g., NFP, FOMC) is considered too risky and is not allowed.

- Hedging between accounts: Traders cannot hedge across multiple accounts, including funded and evaluation accounts. This applies even if accounts are in different programs or under different names within the same household/IP.

- Strategy switching post-challenge: Once funded, traders must maintain consistency in:

- Instruments traded

- Lot sizes

- Trading frequency

- Drastic changes (e.g., switching from Forex to Crypto or low-risk to high-risk behavior) may result in a payout reduction or loss of funding status.

- Exceeding risk limits: Cash risk, total risk, and instrument risk must always remain within the defined thresholds. Violations, especially if repeated, can result in:

- Account closure (in Challenge)

- Payout drops to 10% (in Funded stage)

- Downgrade to a standard funded account (in Finotive Pro)

- Failing to meet the minimum profitable days. Each program requires a specific number of profitable days (≥0.5% daily gain) before withdrawal or scaling is allowed. Failing to complete them:

- Delays payouts

- Prevents advancement or scaling

- Example: Instant Lite requires 5 profitable days; Finotive Pro One-Stage requires 3.

- Account inactivity: Any account, funded or in evaluation, that stays inactive for 30 consecutive days may be terminated without refund.

Verdict on the rule trading of Finotive Funding

Every prop firm has rules, and you need to know that Finotive’s are very strict. This is good because it teaches you discipline, but it can be tricky for beginners. The most important thing is to read the rules carefully before you trade, so you don’t get any surprises. Think of it like a game where you must know the instructions to win.

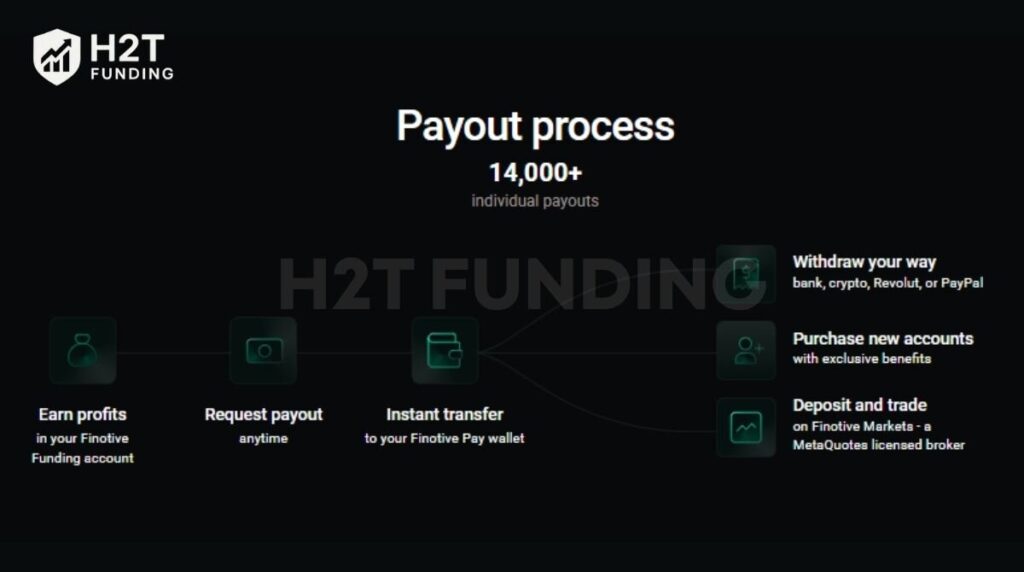

4. Payout structure Finotive Funding

With over $19 million paid out to traders and 14,000+ individual payouts processed, Finotive Funding shows a strong commitment to rewarding performance. Whether you’re trading with Challenge, Instant, or Pro accounts, the payout process is designed to be flexible, fast, and trader-focused.

4.1. Payout process

Once you start generating profits, requesting and receiving payouts is simple. Traders appreciate the ease of the process and the range of supported withdrawal methods.

Key highlights of the payout process:

- First payout can be requested on demand, without any waiting period.

- Subsequent payouts are available every week, processed every Friday.

- All profits are first credited to your Finotive Pay wallet.

- From there, you can withdraw via:

- Cryptocurrency (e.g., BTC, ETH)

- Revolut (via RevTag)

- PayPal

- UK Faster Payments

- EU Same-Day SEPA

- International Wire Transfer

Finotive Pay also allows you to purchase new accounts and trade directly on Finotive Markets.

4.2. Finotive Pay features

More than just a payment processor, Finotive Pay acts as an all-in-one wallet and transaction hub tailored for funded traders. It simplifies access to profits while offering additional perks.

Main features of Finotive Pay:

- Reliable withdrawal schedule: Every Friday, for a consistent payout flow.

- Personal wallet system: Manage, track, and organize all trading-related transactions.

- Exclusive offers: Get access to Finotive-only deals when using the Pay wallet.

- Upcoming card integration: Virtual and physical cards will soon let you spend your balance directly, online, or in stores.

Verdict on Finotive Funding’s payout structure

Finotive Funding’s payout system is among the most flexible in the prop trading space. The ability to request your first payout on demand, followed by weekly withdrawals, gives traders a level of liquidity and control that’s hard to beat. The integration of Finotive Pay adds a professional edge, acting as both a wallet and a financial hub, which many traders find efficient and reliable.

User feedback reflects general satisfaction with payout speed and transparency, although a few note that Finotive Pay’s exclusivity in handling payouts can be inconvenient for those unfamiliar with it. Still, with multiple withdrawal options, a clean schedule, and a proven track record of over $19 million paid out, their payout system is reliable and designed to be easy for traders. In simple terms, getting your profits is straightforward, and you can count on it.

5. Scaling plan Finotive Funding

Finotive Funding isn’t just about getting funded; it’s about growing with the firm. Their scaling plan rewards consistent traders with larger capital allocations and better profit splits over time. Whether you start with a Challenge, Instant Funding, or Finotive Pro account, you can scale your account up to millions of dollars if you meet the performance milestones.

5.1. Challenge & Pro account scaling

For traders on the Challenge and Finotive Pro programs, the scaling structure is designed to recognize sustained profitability:

Profit Split increase per phase:

- Challenge account: Starts at 75%, increases 5% per phase until it reaches 95% at Phase 5.

- Finotive Pro account: Starts at 75%, scales up to 100% by Phase 5, a rare and generous offer in the prop firm industry.

Important note: Virtual profits used for scaling are not withdrawable. If you want to withdraw actual profit, you must do so before requesting account scaling.

5.2. Instant Funding account scaling

The Instant Funding account scaling works similarly, focusing on increasing the account’s capital based on consistent performance. The profit split is determined by the program chosen:

- The profit split is set at 65% for the Instant Funding Lite account and 70% for the Instant Funding Standard account.

- Scaling is performance-based, and profits used to scale are virtual, meaning they must remain in the account to be counted toward growth.

Verdict on scaling plan

Finotive’s scaling structure is one of the most transparent and performance-driven in the prop trading world. The gradual increase in profit targets and profit splits offers a realistic growth trajectory for disciplined traders. The ability to scale to over $3 million in funding gives serious professionals a clear incentive to stay consistent.

However, the requirement to lock in profits before scaling (rather than withdrawing) may feel restrictive to some. Still, this system is fair and aligned with long-term growth, and those committed to the journey will likely find the rewards worth it.

6. Challenge fee, commission, and spreads

Finotive Funding maintains a competitive and transparent fee model across all its programs. While evaluations are free from commissions, funded accounts are subject to specific trading costs based on asset class and account type.

6.1. Finotive Funding account fees

Choosing the right program at Finotive Funding doesn’t just depend on trading style; it also comes down to cost. Whether you prefer to prove your skills through a challenge or skip straight to live trading via instant funding, knowing the exact fee structure upfront helps you plan better.

| Account Size | 2-Step Challenge | 1-Step Challenge | Finotive Pro (2 Stages) | Finotive Pro (1 Stage) | Instant Funding Standard | Instant Funding Lite |

|---|---|---|---|---|---|---|

| $2,500 | $29 | $39 | – | – | $109 | $59 |

| $5,000 | $44 | $59 | – | – | $219 | $109 |

| $10,000 | $74 | $99 | – | – | $389 | $199 |

| $25,000 | $164 | $199 | – | – | $789 | $449 |

| $50,000 | $290 | $349 | $469 | $514 | $1,599 | $699 |

| $75,000 | $405 | $487 | $624 | $714 | $2,199 | $849 |

| $100,000 | $489 | $589 | $744 | $914 | $2,699 | $999 |

| $150,000 | $729 | $834 | $1,119 | $1,369 | – | – |

| $200,000 | $899 | $999 | $1,484 | $1,799 | – | – |

Notes:

- ✅ Refundable: Challenge & Finotive Pro fees are refundable upon passing the evaluation and becoming funded.

- ❌ Non-refundable: Instant Funding fees (Standard & Lite) are not refundable as traders receive live accounts immediately.

6.2. Commission & Spread structure (funded accounts)

Evaluation phases across all programs are completely commission-free, allowing traders to focus on performance without worrying about cost overhead. However, once a trader is funded, standard commissions and spreads apply depending on the account type and asset class.

| Asset Class | Evaluation Phase | Funded Account – Challenge / Instant | Funded Account – Finotive Pro |

|---|---|---|---|

| Forex | Free | $4 per round lot | $3 per round lot |

| Metals | Free | $5 per round lot | $5 per round lot |

| Indices | Free | $4 per round lot | $3 per round lot |

| Energy | Free | $4 per round lot | $3 per round lot |

| Crypto | Free | 0.06% per trade | 0.06% per trade |

Verdict on Challenge fee, commission, and spreads

The best thing about Finotive is that the fee you pay for a Challenge account is refundable. This means if you pass the test and start making profits, you get your initial fee back! That’s a huge plus.

Commission rates are competitive and transparent, with Finotive Pro standing out thanks to its lower $3/lot fee structure. Combined with tight spreads averaging just 0.2 pips. Overall, the costs are fair, especially since you can get your main fee back.

7. Trading platform Finotive Funding

At the core of Finotive Funding’s infrastructure is MetaTrader 5 (MT5), a powerful, industry-standard platform that supports both discretionary and algorithmic trading. Whether you’re a price action purist or a data-driven EA developer, MT5 offers the speed, flexibility, and features required to execute your strategy with precision.

Finotive Funding operates under Finotive Markets LLC, a licensed broker offering direct market access, fast order execution, and ultra-low latency infrastructure. By integrating MT5 into its ecosystem, Finotive ensures traders benefit from:

- Lightning-fast execution speeds

- Tight raw spreads, especially on Forex and metals

- 24/7 access to crypto markets

- No server overcrowding, even during high-impact news

- Support for Expert Advisors (EAs) and advanced indicators

Verdict on Trading Platform

Finotive’s use of MetaTrader 5 provides traders with a robust, fast, and reliable platform that supports both manual and automated trading strategies. Its seamless integration with Finotive Markets ensures excellent execution quality, low latency, and support for advanced tools like custom EAs and third-party indicators, giving traders the technical flexibility they need.

However, the platform’s exclusive reliance on MT5 can be limiting for those who prefer modern web-based platforms like cTrader or TradingView. Traders migrating from other platforms may face a learning curve, and some legacy tools or custom indicators may not be compatible. In short, if you’re not an MT5 user or are unwilling to adapt, Finotive might feel restrictive in terms of platform options.

8. Trading instruments & leverage

Finotive Funding provides access to a wide variety of CFD instruments, allowing traders to diversify strategies and trade across multiple markets. The firm offers over 60 FX pairs, from majors to exotics, along with metals, indices, commodities, cryptocurrencies, and selected global stocks. This variety ensures traders have the tools to adapt to different market conditions.

8.1. Available instruments

The range of tradable products includes:

- Forex (FX): 60+ pairs, covering majors, minors, and exotics

- Metals: Gold, silver, and other precious metals

- Indices: Major global indices such as S&P 500, NASDAQ, DAX

- Energy: Oil, natural gas, and other energy commodities

- Crypto: Popular cryptocurrencies like BTC, ETH, and more

- Stocks: Selected international equities

Leverage varies depending on the program type. On Premium Challenge accounts, leverage can be as high as 1:400 for major FX pairs, one of the highest in the industry. Other programs have more conservative limits, particularly for high-volatility assets like crypto.

8.2. Leverage

Finotive Funding provides access to a wide variety of CFD instruments, allowing traders to diversify strategies across multiple markets. This includes over 60 FX pairs, metals, indices, commodities, cryptocurrencies, and selected global stocks.

The firm employs a flexible leverage model designed to suit different trading styles. While each funding program comes with a standard leverage setting, traders have the option to select higher leverage add-ons during the checkout process, potentially reaching up to 1:400 on certain instruments.

This structure allows traders to choose between default risk parameters or opt for significantly increased buying power if their strategy demands it. The specific standard leverage for each program is detailed in the program evaluation tables in Section 2 of this review.

For example, the standard 2-Step Challenge operates with 1:100 leverage, while the 1-Step Challenge uses 1:50. Higher leverage options are available as paid add-ons at the time of purchase.

Verdict on Trading Instruments & Leverage

Finotive’s instrument variety is solid, especially for forex-focused traders. The leverage system is highly flexible, offering a clear choice between conservative standard limits and aggressive high-leverage options up to 1:400. This caters to both cautious and high-frequency traders alike.

However, traders must be aware that higher leverage is an optional add-on and should check the specific costs and terms before committing.

9. Finotive Funding education & resource

Finotive Funding provides traders with a solid set of practical tools and community support, but does not focus heavily on structured, academic-style education. Instead, their resources lean towards actionable utilities and peer interaction.

Key tools and resources include:

- Trader Dashboard: A centralized hub offering a complete overview of account metrics and market data.

- Risk Calculator: Helps assess position risk aligned with personal trading style and risk appetite.

- Economic Calendar: Highlights upcoming events likely to impact markets.

- MetaTrader 5 Platform: Advanced charting, customizable indicators, and smooth trade execution.

- Real-time News Feed: Live market insights, analysis, and breaking news.

Educational content and blog:

- Finotive’s blog covers updates on trading rules, account types, profit maximization strategies, scaling methods, and trading psychology.

- While the blog serves as their main educational outlet, the posting frequency is low, and the most recent article was published at the end of July, leaving gaps in continuous knowledge updates.

Verdict on Education & Resources

From my perspective, Finotive’s resource set is more valuable for traders who already have a solid foundation and need tools, not training. The Trader Dashboard, Risk Calculator, and community are practical, but the lack of consistent, high-quality educational updates makes it less appealing for beginners.

The blog is a nice touch for ongoing learning, but with the last post dating back to late July, its low posting frequency reduces its impact as a reliable knowledge source. Traders should see this more as a supplemental rather than a primary educational resource.

10. Customer support

Finotive Funding emphasizes accessible and expert support for its traders. Whether you’re just starting or actively trading on funded accounts, the firm claims to be your reliable partner every step of the way. Let’s break down how their support structure works, and how real traders feel about it.

Available support channels

Finotive gives traders multiple ways to reach out for help:

- Live Chat on their website, for quick, real-time assistance

- Communication via Discord and Telegram, where traders can seek support or connect with the community

- Email support for more detailed or formal inquiries

- A FAQ section for instant access to common questions and guidelines

Verdict on customer support

Finotive’s customer support offers broad accessibility, with multiple channels catering to different needs. Many traders highlight quick and informative replies via live chat or Discord, but others report slower responses during high-demand periods, particularly for KYC verification or payout-related queries. For the fastest resolution, community channels and live chat tend to be the most responsive options.

11. Finotive Funding Trustpilot – What did other traders say about Finotive Funding?

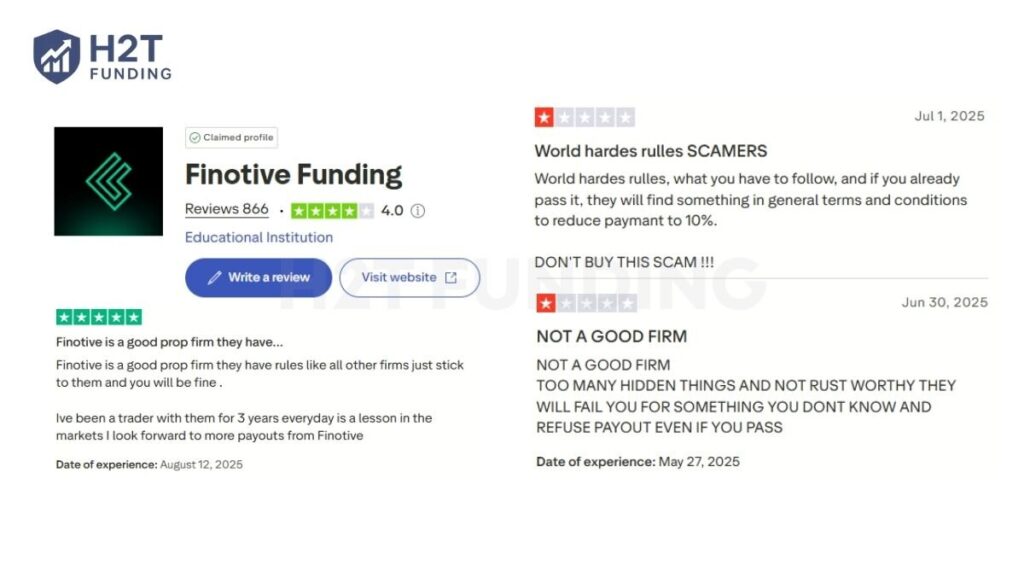

Trader feedback on Finotive Funding is mixed. Many praise the near-instant account setup and the support team’s strong trading knowledge, often delivering tailored answers with practical examples. On Trustpilot, the firm holds a 4.0/5 rating, showing overall positive sentiment.

“Finotive is a good prop firm they have rules like all other firms just stick to them and you will be fine.

Ive been a trader with them for 3 years everyday is a lesson in the markets I look forward to more payouts from Finotive” – martin DINSDALE, Trustpilot

“I was tired of firms promising fast payouts and then taking a week. Here i requested my first withdrawal and it was in my bank account in less than 48 hours.

The whole process was smooth and I could track it on the dashboard” – Bryan Gibbs, Trustpilot

However, 21% of reviews are 1-star, with traders citing issues like wide spreads (GBP crosses allegedly up to 40 pips during NY close), payout delays or reductions, high commissions, and perceived dismissiveness toward criticism. These highlight the need to study Finotive’s rules and policies in detail before committing.

“World hardes rulles, what you have to follow, and if you already pass it, they will find something in general terms and conditions to reduce paymant to 10%.

DON’T BUY THIS SCAM !!!” – Michal Krasňan, Trustpilot

“NOT A GOOD FIRM

TOO MANY HIDDEN THINGS AND NOT RUST WORTHY THEY WILL FAIL YOU FOR SOMETHING YOU DONT KNOW AND REFUSE PAYOUT EVEN IF YOU PASS” – OMAR AHMAD – Trustpilot.

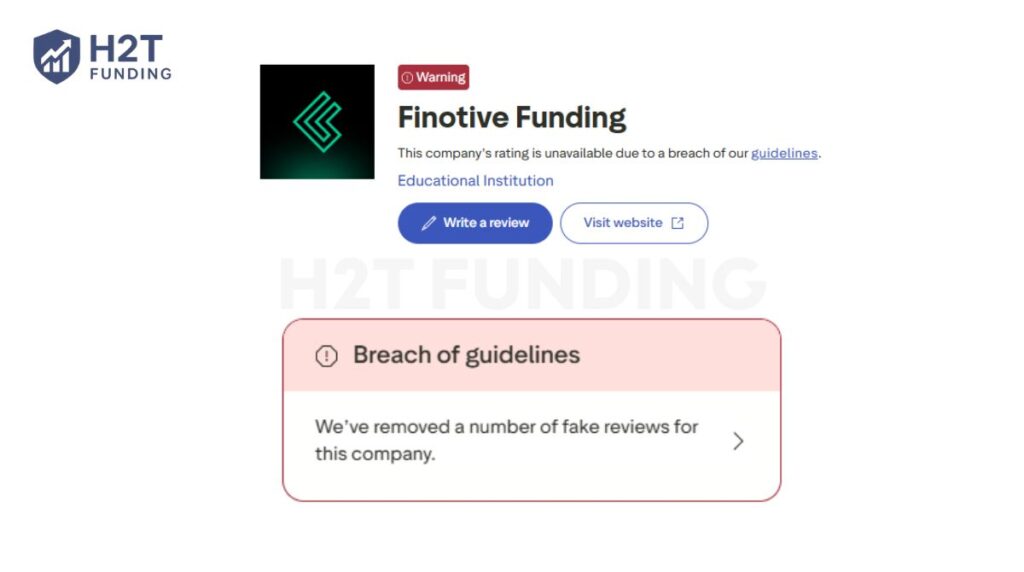

However, upon rechecking the information on December 10, 2025, we found that this firm’s rating is no longer available due to violations of Trustpilot’s regulations.

While Finotive Funding can offer competitive conditions and fast payouts for many, its rules are strict, and trader experiences vary significantly. Reviewing all policies in detail before committing is essential to avoid surprises later.

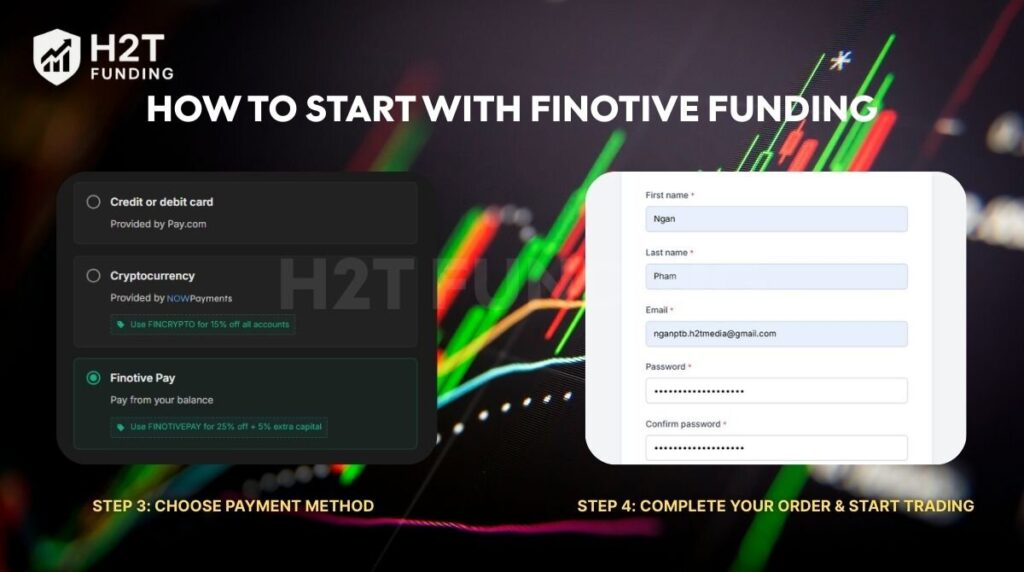

12. How to start with Finotive Funding

Getting started with Finotive Funding is straightforward, but the choices you make at the very beginning will shape your trading journey. Whether you prefer proving your skills through a challenge or diving straight into live trading, the process is designed to be quick and intuitive. Here’s how it works:

Step 1: Choose your account type

- Challenge: Pass a trading challenge to demonstrate your skills before receiving a funded account.

- Instant Funding: Skip the challenge phase and start trading a funded account immediately.

- Finotive Pro: Trade a funded account with a monthly salary and potential for capital scaling.

Step 2: Configure your account

- Select Currency: USD, GBP, or EUR.

- Select Account Size: From $2,500 up to $200,000.

- Extra Options: Enable swap-free trading to avoid overnight swap or interest fees.

Step 3: Choose payment method

- Multiple payment options are available.

- You must agree to the terms of both Finotive Funding and its partnered brokerage, Finotive Markets LLC.

Step 4: Complete your order & start trading

- Finalize your purchase and receive account credentials

- Download the MetaTrader 5 platform from the Finotive Funding dashboard or the Finotive Markets website.

- Log in and start trading under your chosen program.

The onboarding process is quick and digital from start to finish, with account credentials often delivered within minutes. By carefully selecting your account type, size, and options upfront, you can align your funding setup with your personal trading style and long-term goals.

13. Finotive Funding vs other prop firm – Which one is suit for you?

Finding the right prop firm can be as tricky as navigating volatile market conditions. At first glance, many look similar, all promising big funding, high profit splits, and room to grow. But beneath the surface, small differences in evaluation rules, leverage, and platform options can dramatically shape your trading experience.

That’s why I’ve selected three firms: Finotive Funding, FundedNext, and Funded Trading Plus, that share certain similarities yet cater to different trading personalities.

| Feature | Finotive Funding | FundedNext | Funded Trading Plus |

|---|---|---|---|

| Account size range | $2.5K–$200K (scale with Pro) | $6K–$200K (up to $4M) | $5K–$200K (scale to $2.5M) |

| Funding model | Challenge, Instant, Pro (salary) | 1-step or 2-step challenge | Instant or challenge |

| Profit split | Up to 100% (Pro) | Up to 95% | Up to 90% |

| Drawdown limits | 5–10% (varies by program) | 5–10% | 6–10% |

| Leverage | Up to 1:400 | Up to 1:100 | Up to 1:100 |

| News trading | Allowed (some restrictions) | Limited (per account type) | Allowed (with certain plans) |

| Platforms | MT5 only | MT4/5, cTrader | MT4/5, DXTrade, cTrader |

| First payout timing | From 14 days | From day 1 (some plans) | From day 1 (instant) |

| Scaling potential | Yes, especially with Pro track | Yes, up to $4M | Yes, up to $2.5M |

| Fee structure | One-time or monthly (Pro) | Refundable fee | Refundable or subscription |

With experience testing multiple prop firms, I’d say Finotive Funding stands out for offering three distinct funding tracks, higher leverage, and a Pro program with fixed monthly pay, rare in the industry.

However, being limited to MT5 may feel restrictive if you prefer platform variety. FundedNext is strong for traders who want multiple platform choices and the option to start payouts from day one, while Funded Trading Plus strikes a balance between instant funding and generous scaling potential. The best choice depends on whether your edge lies in speed, flexibility, or long-term capital growth.

14. FAQs

No, Finotive Funding does not accept traders from the United States. This restriction applies to all account types and programs.

Finotive Funding was founded in April 2021 by Oliver Newland, who serves as the firm’s CEO.

There is no minimum withdrawal amount for most payouts. However, if you’re withdrawing via cryptocurrency using Finotive Pay, the minimum is $100.

They exclusively use MetaTrader 5 (MT5) for all trading programs, offering advanced charting, EA compatibility, and fast execution.

Finotive Pay is their integrated digital wallet for payouts. All profits are deposited here first, and you can then withdraw via bank transfer, Revolut, PayPal, or crypto.

No, there is no maximum lot size limit. Traders are free to open volume based on risk rules and capital, without lot size caps.

Finotive enforces strict risk management policies: you must adhere to all drawdown limits, use mandatory stop-loss, avoid excessive risk behaviors, and follow the full risk framework detailed in their terms. Violations can result in payout reduction or account termination.

Finotive Funding is a legally registered prop firm under Finotive Group KFT, founded in 2021 by Oliver Newland, and many traders report smooth funding and payouts. However, it has received mixed feedback; about 21% of reviews on Trustpilot are 1-star, with some traders calling it a “scam” or criticizing strict rules, high spreads, and payout reductions. While the firm is legitimate, these reviews highlight the importance of understanding its policies before committing.

The timeline depends on the route you choose. With the two-phase evaluation, it typically takes as long as you need to meet the profit targets. With Instant Funding, you can start trading a funded account immediately after payment and setup.

Finotive Funding offers leverage of up to 1:400, depending on the asset class. Forex pairs generally allow the highest leverage, while other instruments like stocks or commodities may have lower limits.

Yes, the fee for Challenge and Pro accounts is refundable. According to Finotive’s policy, traders can have their initial fee refunded with their first profit split, provided the funded account remains profitable after a set period (typically 30 days).

15. Final verdict about Finotive Funding

This Finotive Funding review shows the firm offers flexible account options, strong leverage on its Challenge programs, and knowledgeable support that many traders value. Still, its MT5-only setup, certain restrictive trading rules, and occasional reports of wide spreads mean it’s not a one-size-fits-all solution.

For disciplined traders who can adapt to its structure and risk policies, Finotive Funding delivers solid scaling opportunities and competitive profit splits. Before committing, review its rules carefully and compare with other prop firms. You can explore more H2T Funding prop firm reviews to find the one that best suits your strategy.