90% OFF Sale

All Evaluation Accounts – Any Size 90%

In the world of funded futures trading, Apex Trader Funding has surged in popularity, but is it really the best choice in 2026? As someone who has personally passed multiple Apex evaluations and withdrawn real payouts, I can speak from experience: this firm offers serious upside, but only if you understand the rules.

In this Apex Trader Funding review, we’ll evaluate its pros, cons, pricing, and rules, helping you determine whether Apex is truly legit and if it’s worth your time and money.

Disclaimer: Rules, pricing, and trading conditions may change over time. Traders should always verify the latest terms directly on the official Apex Trader Funding websites before purchasing any challenge.

1. Our take on Apex Trader Funding

While Apex Trader Funding is popular for its straightforward evaluation and generous profit share, letting traders keep 100% of their first $25,000, it faces criticism for significant trade-offs. The firm’s model is challenged by relatively high monthly fees and limited flexibility in trading platforms.

Furthermore, when compared to leading competitors, it falls short by offering minimal educational resources and lacking a deeply integrated community support system, forcing traders to weigh direct funding rules against a more supportive environment.

Pros and Cons of Apex Trader Funding

Apex Trader Funding has gained popularity for its flexible rules and competitive pricing, but like any trading partner, it isn’t without trade-offs. In this section, I will break down the key pros and cons to help you determine whether Apex aligns with your trading goals and risk tolerance.

| Pros | Cons |

|---|---|

| One-step evaluation process: A streamlined, single-stage evaluation requires only 7 trading days to qualify for a funded account, simpler than the multi-step processes of competitors like Fidelcrest. | Real-time trailing drawdown: The trailing threshold, calculated with unrealized profits, requires careful monitoring and may favor scalping over longer-term strategies. A static drawdown option is available. |

| High profit split: Traders keep 100% of the first $25,000 in profits per account, followed by a 90% split, one of the most generous in the industry compared to Topstep’s 90% after $10,000. | Minimum 7 trading days rule: Traders must trade for at least 7 days during evaluation, which may feel restrictive for those aiming for quick qualification. |

| No daily drawdown: Unlike some firms, Apex imposes no daily loss limits, allowing flexibility for day traders, swing traders, and scalpers. | 30% consistency rule: For funded accounts, no single day’s profit can exceed 30% of total profits, potentially limiting aggressive trading strategies. |

| Frequent discounts: Apex offers regular promotions, such as 80-90% off evaluation accounts and $35 reset discounts, reducing costs significantly. | Limited to futures trading: Only futures contracts (e.g., CME, COMEX, NYMEX) are available, excluding forex, stocks, or crypto trading. |

| Trade on holidays and news: Traders can engage in news trading and holiday trading without restrictions, provided they adhere to consistency rules. | Occasional payout delays: Some traders report delays in receiving payouts, particularly for international transfers, though Apex claims processing takes 3–7 business days. |

| Wide range of account sizes: Accounts from $25,000 to $300,000 cater to both beginners and experienced traders, with up to 20 accounts manageable simultaneously. | Rithmic connection issues: A minority of users report connectivity problems with Rithmic, though Apex states these are not widespread. |

| Free NinjaTrader and Tradovate licenses: Apex provides free access to these platforms, saving traders high costs (e.g., NinjaTrader licenses cost over $1,000). | No educational resources: Apex lacks a formal education center, which may disadvantage beginners needing structured learning. |

| Multiple payout methods: Payouts via Deel support bank transfers, PayPal, and cryptocurrency (e.g., USDC), offering flexibility for global traders. | Restricted countries: Traders from countries like South Africa, Russia, and Ukraine are excluded from participation. |

👉 You can watch H2T Funding’s detailed review video here to better understand the actual experience:

Apex Trader Funding excels with its trader-centric features, including a high profit split, flexible trading rules, and cost-saving discounts. However, the trailing drawdown, futures-only focus, and occasional reported issues with payouts or connectivity may pose challenges. Traders should weigh these factors against their strategies and goals.

2. What is Apex Trader Funding, and how does it work?

Apex Trader Funding offers a straightforward path for traders looking to access capital without risking their own money. As a proprietary trading firm, Apex provides funded accounts to traders who can demonstrate consistent performance through a simple evaluation process.

In return, traders pay an evaluation fee and share a portion of their profits with the firm. This model benefits both sides: traders gain access to significant capital, while the firm earns from evaluation fees and profit splits with successful traders.

Apex’s key advantage: The one-step evaluation process

Apex Trader Funding distinguishes itself in the competitive prop firm industry primarily through its one-step evaluation process. While many leading firms require traders to navigate a two-phase challenge to qualify for funding, Apex has removed this barrier, creating a more direct and accessible path for traders.

This streamlined approach significantly accelerates the timeline from evaluation to a funded account. For the trader, this means less time spent under evaluation pressure and a faster opportunity to start earning real profits. It simplifies the rules and reduces the psychological burden of having to pass multiple, lengthy stages.

3. Is Apex Trader Funding legit and safe to use?

Trust is the most critical factor when choosing a prop firm. Before committing your time and money, you need to know if the company is a legitimate operation with a proven track record of paying its traders.

3.1. Payout proof and community trust

One of the most compelling arguments for Apex’s legitimacy is the overwhelming amount of payout proof shared by its community. The company has fostered a transparent environment, particularly in its official Discord and Facebook groups, where hundreds of traders voluntarily post their payout certificates each month.

As of 2024, Apex proudly reports having paid out over $100 million to its traders worldwide, a figure prominently displayed on its website. This constant stream of verifiable evidence, shared directly by successful traders, provides powerful social proof and confirms that Apex consistently honors its profit-sharing agreements.

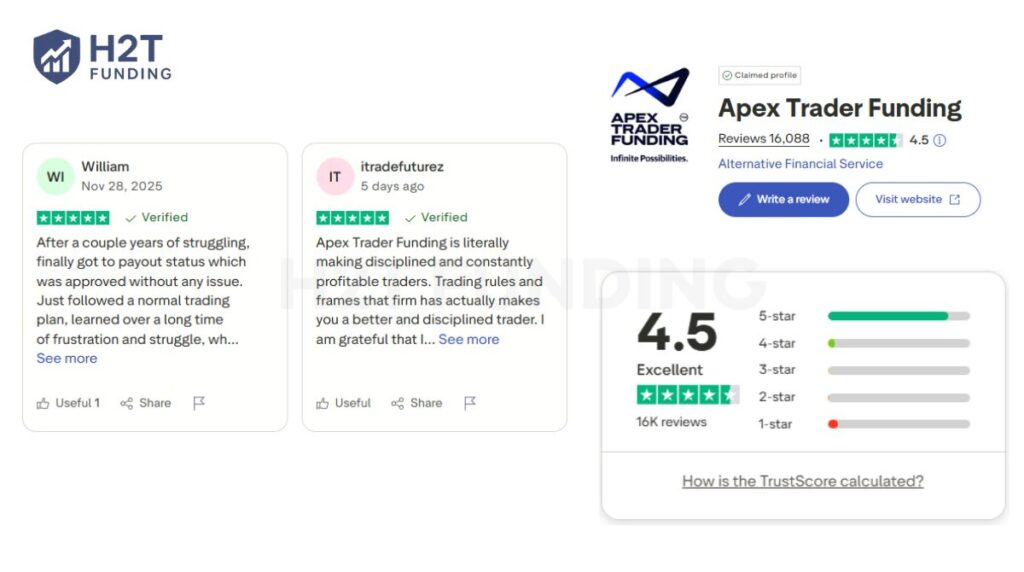

3.2. Analyzing its Apex Trader Funding Trustpilot score and real user reviews

On Trustpilot, Apex Trader Funding currently holds an impressive rating of 4.5 out of 5, based on 14,119K of verified user reviews. The majority of positive feedback highlights three core strengths: fast and reliable payouts, simple and transparent trading rules, and responsive customer support.

Many traders appreciate how clearly the evaluation rules are outlined and how efficiently the support team resolves any issues. On the other hand, a small percentage of negative reviews usually come from users who misunderstood the trailing drawdown rule, a common pitfall for new traders not fully familiar with how it works.

This honest mix of feedback adds to the platform’s credibility, showing that it does not suppress criticism but uses it to clarify and educate. Overall, the high rating and consistent praise suggest that Apex delivers on its promises and maintains a strong reputation among futures traders.

4. Apex Trader Funding accounts and costs

Apex Trader Funding offers a flexible range of account sizes and pricing models tailored for different types of futures traders. Whether you’re new to the space or looking to scale, Apex provides straightforward rules and transparent fees to help you focus on performance without surprises.

4.1. Comparison table of account sizes

The table below compares all available Apex accounts, highlighting key factors like cost, profit target, and drawdown rules. This makes it easier to choose the best fit for your trading strategy.

| Account size | Price | Profit target | Max contracts | Trailing threshold | Min trading days |

|---|---|---|---|---|---|

| $25,000 | $167/month | $1,500 | 4 | $1,500 | 7 |

| $50,000 | $187/month | $3,000 | 10 | $2,500 | 7 |

| $100,000 | $297/month | $6,000 | 14 | $3,000 | 7 |

| $150,000 | $397/month | $9,000 | 17 | $5,000 | 7 |

| $250,000 | $497/month | $15,000 | 27 | $6,500 | 7 |

| $300,000 | $597/month | $20,000 | 35 | $7,500 | 7 |

4.2. Tradovate accounts

Tradovate accounts offered by Apex Trader Funding are built for accessibility and multi-device convenience. If you value flexibility in where and how you trade, whether on desktop, tablet, or mobile, Tradovate is a user-friendly choice. It also integrates with TradingView, ideal for those who appreciate intuitive charting and analysis tools.

Key Features:

- Device Compatibility: Seamless access across web, Mac desktop, and mobile platforms.

- Integrated Charting: Use TradingView directly through your funded account.

- Flexible Scaling: Account sizes range from $25,000 to $300,000 with proportional contract limits.

- Trailing & Static Drawdown Options: Choose based on your risk preference, either a dynamic trailing threshold or a fixed drawdown with the Static model.

Tradovate accounts support both beginners and experienced traders by providing a smooth, modern interface and reasonable monthly fees.

Tradovate Account Types

| Account Type | Max Contracts (Micros) | Profit Target | Trailing Threshold | Platform Compatibility | Monthly Fee |

|---|---|---|---|---|---|

| 25K Full | 4 (40) | $1,500 | $1,500 | TradingView, Tradovate Web/Mac/Mobile | $167 |

| 50K Full | 10 (100) | $3,000 | $2,500 | TradingView, Tradovate Web/Mac/Mobile | $187 |

| 100K Full | 14 (140) | $6,000 | $3,000 | TradingView, Tradovate Web/Mac/Mobile | $297 |

| 100K Static | 2 (20) | $2,000 | – | TradingView, Tradovate Web/Mac/Mobile | $157 |

| 150K Full | 17 (170) | $9,000 | $5,000 | TradingView, Tradovate Web/Mac/Mobile | $397 |

| 250K Full | 27 (270) | $15,000 | $6,500 | TradingView, Tradovate Web/Mac/Mobile | $497 |

| 300K Full | 35 (350) | $20,000 | $7,500 | TradingView, Tradovate Web/Mac/Mobile | $597 |

4.3. Rithmic Accounts

For traders who prioritize speed, data precision, and advanced functionality, Rithmic accounts are the superior choice. These accounts are designed to work with NinjaTrader, a platform known for its custom indicators, algorithmic strategies, and low-latency data feeds.

Key Features:

- Performance-Oriented: Optimized for high-frequency traders and scalpers.

- Advanced Platform Support: Includes NinjaTrader access, suitable for technical and automated traders.

- Contract Scaling: Similar to Tradovate, with up to 35 standard contracts or 350 micros on higher-tier accounts.

- Trailing or Static Drawdown: Choose between dynamic risk control or fixed-limit risk.

In addition to account fees, Rithmic accounts require payment for data access and the NinjaTrader platform. These are typically bundled in the monthly cost for clarity.

Rithmic Account Types

| Account Type | Max Contracts (Micros) | Profit Target | Trailing Threshold | Platform & Data Included | Monthly Fee |

|---|---|---|---|---|---|

| 25K Full | 4 (40) | $1,500 | $1,500 | NinjaTrader + Real-Time Data | $167 |

| 50K Full | 10 (100) | $3,000 | $2,500 | NinjaTrader + Real-Time Data | $187 |

| 100K Full | 14 (140) | $6,000 | $3,000 | NinjaTrader + Real-Time Data | $207 |

| 100K Static | 2 (20) | $2,000 | None (fixed $625) | NinjaTrader + Real-Time Data | $157 |

| 150K Full | 17 (170) | $9,000 | $5,000 | NinjaTrader + Real-Time Data | $397 |

| 250K Full | 27 (270) | $15,000 | $6,500 | NinjaTrader + Real-Time Data | $497 |

| 300K Full | 35 (350) | $20,000 | $7,500 | NinjaTrader + Real-Time Data | $597 |

4.4. Evaluation fees (one-time) and platform/data fees (recurring)

Apex charges two types of fees: Evaluation Fees and Platform/Data Fees.

The Evaluation Fee is a recurring monthly charge paid while you’re in the evaluation phase. You can cancel anytime, and you only risk the fee you’ve already paid.

Once you pass and receive a funded Performance Account (PA), the evaluation fee stops. You then pay a Platform/Data Fee, which is $85/month for Rithmic or $105/month for Tradovate. This covers access to real-time market data and platform connectivity.

Apex also runs frequent promotions offering a Lifetime PA Fee, where you pay a one-time fee (usually between $130 and $340, depending on account size) instead of monthly charges. This is ideal for traders planning to stay long-term and can lead to significant savings.

4.5. Tradovate vs. Rithmic: Which account type should you choose?

When signing up, you must choose between a Rithmic or Tradovate-based account. This choice determines which trading platforms and data connections you can use, so it’s an important decision based on your personal workflow.

| Feature | Tradovate | Rithmic |

|---|---|---|

| Best for | Web-based traders, TradingView users | Scalpers, advanced desktop users |

| Platform access | Web app, mobile app, TradingView | NinjaTrader, Jigsaw, Bookmap |

| Speed | Moderate latency | Ultra-low latency |

| Ease of use | Easy setup, no install needed | Requires setup, desktop-only |

| Analytics tools | Basic | Advanced order flow, DOM |

| Monthly fee | $105 | $85 |

In summary, choose Rithmic if you’re focused on execution speed and complex tools. Choose Tradovate if you value ease of access, simplicity, and TradingView compatibility.

5. The trading rules you must know before you start

Navigating the trading rules of Apex Trader Funding is critical for success, whether you’re aiming to pass the evaluation phase or manage a funded account. These rules are designed to foster disciplined, consistent, and responsible trading practices, ensuring traders can grow their accounts sustainably.

5.1. Profit target and minimum trading days

To qualify for a funded account, traders must pass Apex Trader Funding’s evaluation phase by meeting specific profit targets while adhering to risk management rules. The profit target varies by account size, as outlined below:

| Account size | Profit target |

|---|---|

| $25,000 | $1,500 |

| $50,000 | $3,000 |

| $100,000 | $6,000 |

| $150,000 | $9,000 |

| $250,000 | $15,000 |

| $300,000 | $20,000 |

| $100,000 Static | $2,000 |

Additionally, traders must complete at least 7 trading days during the evaluation. A trading day is defined as the period from 6 PM ET to 5 PM ET the next day, with half-day trading holidays counting toward the following day (unless you buy a 1‑Day Pass promotion).

This requirement ensures that traders demonstrate consistent performance over time, rather than relying on a single large trade to meet the profit target. For example, a trader with a $50,000 account must achieve a $3,000 profit over at least 7 days without exceeding the drawdown limit.

5.2. The trailing threshold drawdown

The trailing threshold drawdown is a dynamic loss limit that adjusts based on your account’s highest balance during the evaluation phase. It’s designed to enforce strict risk management and prevent significant losses.

For instance, in a $50,000 account, the trailing threshold is set at $2,500, meaning your account balance cannot drop more than $2,500 below its peak value at any point.

As your account balance grows, the trailing threshold increases, providing more room for drawdowns. However, if your balance falls below this threshold due to either realized or unrealized losses, you will fail the evaluation.

This rule emphasizes the importance of careful position sizing and risk management to maintain your account’s equity above the threshold.

5.2.1. How the drawdown is calculated (real-time/intraday)

The trailing threshold drawdown is calculated in real-time based on your account’s total equity, which includes both realized profits (from closed trades) and unrealized profits or losses (from open positions). The system continuously monitors your account balance against the highest balance achieved during the evaluation.

For example:

- If your $50,000 account reaches a high of $52,000, the trailing threshold becomes $52,000 – $2,500 = $49,500.

- If your account equity drops to $49,499 or below at any time, even intraday due to open trades, you fail the evaluation.

This real-time calculation means that every trade impacts your equity, and you must monitor open positions closely to avoid breaching the threshold. The trailing nature of the drawdown allows more flexibility as profits grow, but requires constant vigilance to prevent large losses.

5.2.2. A clear example to avoid costly mistakes

Consider a $50,000 account with a $2,500 trailing threshold. After successful trades, your balance increases to $51,000, setting the trailing threshold at $51,000 – $2,500 = $48,500.

Now, suppose you enter a trade with a potential loss of $3,000. If that trade goes against you, your account equity could drop to $51,000 – $3,000 = $48,000, which is below $48,500, resulting in a failed evaluation.

To avoid this:

- Limit risk per trade: Risk no more than 1% of your account per trade. For a $50,000 account, this means a $500 stop-loss per trade.

- Monitor open positions: Ensure that the total potential loss from open trades doesn’t push your equity below the trailing threshold.

- Use smaller position sizes: For example, if trading futures, choose fewer contracts to keep potential losses within safe limits.

By carefully managing your risk and monitoring your equity in real-time, you can prevent breaching the trailing threshold and protect your evaluation.

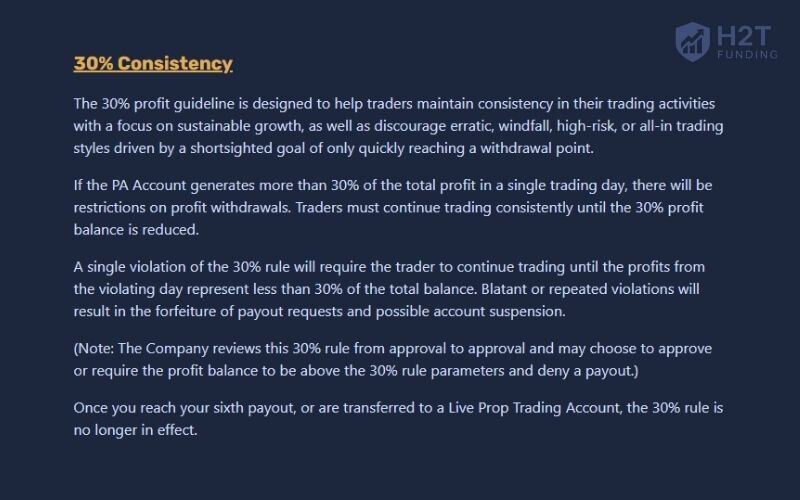

5.3. The 30% consistency rule

The 30% consistency rule applies to funded accounts (Performance Accounts or Live accounts) and not to the evaluation phase. It ensures that traders maintain steady, consistent performance rather than relying on a single highly profitable day. Specifically, the profit from any single trading day must not exceed 30% of the total profits accumulated in the account.

Formula: Highest Profit Day / 0.3 = Total Profit Needed

For example:

- If your total profits in a funded account are $10,000, no single day’s profit can exceed $3,000 (30% of $10,000).

- If you make $4,000 in one day, you violate the rule, and you may not be eligible for a payout until you increase your total profits to make that day’s contribution less than 30%.

This rule encourages traders to develop strategies that generate consistent returns over time, aligning with Apex’s goal of funding disciplined traders. It helps prevent risky, all-or-nothing approaches that could lead to large drawdowns.

5.4. Prohibited trading strategies

Apex Trader Funding enforces strict rules on trading strategies to maintain fairness and integrity on the platform. The following strategies are prohibited, and violations can lead to account closure or a ban:

| Prohibited strategy | Description |

|---|---|

| Automated trading systems | Using AI, bots, algorithms, or high-frequency trading (HFT) is not allowed. Trading must rely on human decision-making. |

| Exploitative strategies | Strategies that exploit system inefficiencies or manipulate markets are forbidden. |

| Group or scheme participation | Joining groups or schemes to game the system results in account closure and a platform ban. |

| Third-party trading tools | Tools like Replikanto Stealth Mode or allowing others to trade your account are prohibited. |

| Unauthorized DCA strategies | Dollar-Cost Averaging (DCA) across multiple markets (e.g., NQ, ES, YM) for small gains is not permitted unless consistent with other rules. |

| Payout abuse | Cycling first payouts across multiple accounts to inflate performance is strictly forbidden. |

While news trading is allowed, it must comply with consistency rules and avoid multi-directional positions during news events. Traders should focus on disciplined, strategic trading to align with Apex’s guidelines.

6. Supported trading platforms

Apex Trader Funding supports a wide range of trading platforms to accommodate different trading styles and preferences. Among them, NinjaTrader and Tradovate stand out as the primary platforms, both of which are free to use for traders during the evaluation and funded account stages.

In addition, traders can also connect their Apex account to TradingView by routing through Tradovate, allowing for seamless chart-based trading directly within the TradingView interface.

For those who prefer more advanced or customized tools, Apex also allows integration with several paid platforms, although additional licensing fees may apply depending on the provider.

| Platform | Type | Cost | Key Features | Accessibility |

|---|---|---|---|---|

| NinjaTrader 8 | Primary | Free (License Key) | Advanced charting, strategy automation, and custom indicators | Desktop, Mobile (Rithmic) |

| Tradovate | Primary | Free | User-friendly, browser-based, mobile access, TradingView integration | Web, Mobile, Desktop |

| Rithmic (RTrader Pro) | Supporting | Free | Data feed activation, account monitoring | Desktop, Mobile |

| TradingView | Supporting (via Tradovate) | Free (through Tradovate) | Powerful charting, community insights | Web (via Tradovate) |

| Sierra Chart | Alternative | Paid (Separate License) | Advanced charting, data analysis | Desktop (Requires Broker) |

| Jigsaw Daytradr | Alternative | Paid (Separate License) | Order flow trading, advanced analytics | Desktop |

| MotiveWave | Alternative | Paid (Separate License) | Technical analysis, Elliott Wave tools | Desktop |

7. Pricing and Commission Fees

Apex Trader Funding’s fee structure involves several components that traders should consider. These include initial evaluation fees, account activation charges, and ongoing commissions on trades. For active traders, these costs can accumulate, especially when factoring in optional add-ons for enhanced market data.

7.1. Activation and monthly fees

Once you pass the evaluation, you must pay an activation fee for a Performance Account (PA). You can choose a recurring monthly payment or a one-time lifetime fee. For Rithmic-based accounts, the monthly option is $85, while the lifetime fee varies from $130 to $340, depending on the account’s size. Tradovate accounts have a higher monthly fee of $105, with lifetime options ranging from $150 to $360.

7.2. Commission rates

Commissions are an integral part of trading costs and differ based on the platform and instrument. On Tradovate, commissions for popular equity futures like the E-mini S&P 500 (ES) are approximately $3.10 for a round turn. For the same product, Rithmic charges a higher commission of about $3.98 for a round turn.

Trading micro contracts comes with lower commission costs. For example, a round-turn trade of the Micro E-mini S&P 500 (MES) costs around $1.02 on Rithmic and $1.04 on Tradovate. These lower rates make trading smaller contract sizes more accessible.

7.3. Data service fees

While standard Level 1 market data is included with the account, traders who require more in-depth market information can opt for Level 2 data at an extra cost. For instance, the CME Bundle for Level 2 data is available for a monthly fee of $41, which also includes a small processing fee. These data subscriptions are managed directly through the trading platforms.

8. Futures markets

Apex Trader Funding provides access to a focused selection of 46 futures markets, allowing traders to engage with some of the most liquid and popular assets. The offerings span several major categories and are traded on leading exchanges such as CME, CBOT, COMEX, and NYMEX.

Available Asset Classes

Traders can access a variety of markets to suit their strategies. This includes key currency futures like the Euro FX (6E) and British Pound (6B), and highly-traded equity index futures such as the E-mini S&P 500 (ES) and E-mini NASDAQ 100 (NQ). The platform ensures there are diverse opportunities for different trading styles.

The firm also supports trading in agricultural futures, with products like Corn (ZC) and Wheat (ZW) available. For those interested in the energy sector, popular contracts such as Crude Oil (CL) and Natural Gas (NG) are offered.

Additionally, traders can speculate on metal futures, including Gold (GC), Silver (SI), and Copper (HG). For those interested in the digital asset space, cryptocurrency futures are available, although they are limited to micro contracts like Micro Bitcoin (MBT) and Micro Ether (MET).

9. The payout process: How you get paid

Apex Trader Funding’s payout process is streamlined to reward funded traders while enforcing consistency and risk management. Traders can access their profits through a clear schedule, a lucrative profit split, and multiple payout methods, making it one of the more trader-friendly prop firms.

However, adherence to trading rules and account requirements is essential to avoid delays or denials.

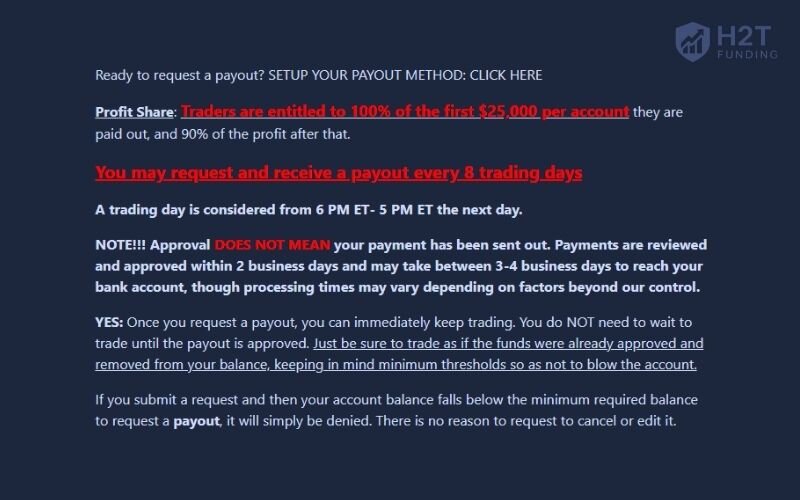

9.1. Payout schedule and policy

Apex Trader Funding allows traders to request payouts twice per month, with specific windows from the 1st to 5th (processed by the 15th) and the 15th to 20th (processed by the end of the month). To qualify, traders must complete at least 10 trading days in their funded Performance Account (PA), with at least 5 of those days showing a profit of $50 or more.

A trading day runs from 6 PM ET to 5 PM ET the next day, and half-day trading holidays count toward the next day. The account must remain compliant with Apex’s rules, including the 30% consistency rule and safety net requirements for the first three payouts, where the balance must exceed the drawdown limit plus $100 (e.g., $2,600 for a $50,000 account).

Payout requests are reviewed within 2 business days, with funds typically arriving in 3–7 business days, though some users report occasional delays, particularly for international transfers. Traders can continue trading after submitting a request, but must maintain the minimum balance to avoid denial.

9.2. Profit share split

Apex Trader Funding offers one of the most attractive profit-sharing models in the prop trading industry. Traders retain 100% of their first $25,000 in profits per account, incentivizing strong performance early on.

After surpassing this threshold, the split shifts to 90% for the trader and 10% for Apex, which remains highly competitive compared to other firms like Topstep (90/10 after $10,000) or MyFundedFutures (90% throughout). This structure applies per trader across all PA accounts, allowing those managing multiple accounts (up to 20) to maximize earnings.

For example, a trader with a $50,000 account who earns $30,000 in profits keeps the full $25,000 and 90% of the remaining $5,000 ($4,500), totaling $29,500. This generous split, combined with no cap on maximum payouts, makes Apex a top choice for traders aiming to scale their profits.

9.3. Available payout methods

Apex Trader Funding processes payouts through Deel, a platform that offers multiple withdrawal options to suit traders’ preferences, particularly for a global user base. The available methods include:

- Bank wire transfers (ACH/Wire): The primary method for U.S. and international traders, requiring bank account details (name, account number, routing number). Domestic transfers typically take 3–4 business days, while international transfers may take 3–7 days, with potential bank fees.

- PayPal: A faster option for smaller payouts, though fees may apply depending on the trader’s location and PayPal’s policies.

- Cryptocurrency (e.g., USDC): A modern, efficient method with lower fees and faster processing, ideal for traders preferring digital currencies.

- Other methods via Deel: Deel supports additional options like direct deposits in certain countries, depending on availability.

U.S. traders receive a Form 1099-NEC for tax reporting, while non-U.S. traders must submit a W-8BEN form. Traders are advised to update their payout method and address in Deel to avoid delays.

10. Apex Trader Funding vs. top competitors

A head‑to‑head snapshot makes it easier to see where Apex outperforms, and where its rivals still lead. The grid below distils the practical rules that most affect real money, so you can decide which funding path matches your style and risk limits.

| Feature | Apex Trader Funding | Topstep | FTMO |

|---|---|---|---|

| Evaluation steps | One-step: Achieve profit target (e.g., $3,000 for $50 account) over 7 trading days. | Two-step: Trading Combine (profit target, e.g., $3,000 for $50K) + Express Funded Account. | Two-step: FTMO Challenge (profit target, e.g., 10% for $100K) + Verification phase. |

| Profit split | 100% of the first $25,000 per account, then 90/10 (trader/firm). Highly competitive. | 100% of the first $10,000, then 90/10. Generous but lower initial threshold than Apex. | 80/20 (trader/firm), scalable to 90/10 with consistent performance. Less generous initially. |

| Daily drawdown | No daily loss limit; trailing threshold drawdown (e.g., $2,500 for $50K) calculated in real-time. | Daily loss limit (e.g., $1,000 for $50K) on non-TopstepX platforms; trailing drawdown end-of-day. | No daily loss limit; trailing drawdown based on initial balance, adjusted intraday. |

| Scaling rule | Up to 20 accounts; half max contracts until balance exceeds drawdown + buffer. | Scaling plan limits contracts (e.g., 5 for $50K); increases with profits. Strict enforcement. | The scaling plan increases capital up to $2M with 10% profit every 4 months; less restrictive. |

| Promotions | Frequent 80-90% discounts on evaluations; $35 resets. Cost-effective entry. | Occasional 20-50% discounts; $99 resets. Higher subscription fees ($49-$149/month). | Rare promotions; one-time fee (€155-€1,080) refunded on passing. Less frequent discounts. |

| Payout policy | Twice monthly (1st-5th, 15th-20th); requires 10 trading days, 5 with $50+ profit. | Up to 4 times monthly; requires 5 winning days ($200+ profit). Faster processing (1-2 days). | Bi-weekly payouts after 10 trading days; stricter withdrawal rules (e.g., 30-day profit hold). |

11. Customer support and education

Apex Trader Funding provides a support and education system designed for efficiency and self-service. The focus is on providing traders with the essential tools to resolve technical issues and understand basic concepts, rather than offering in-depth, personalized mentorship.

11.1. Support channels

The firm ensures that traders can get help whenever they need it through a streamlined, around-the-clock system.

- 24/7 Help Desk: The primary method of support is an online help desk that operates 24/7. This system is ideal for submitting technical or account-specific questions at any time.

- Focus on Technicals: Support is heavily geared towards resolving platform-related issues for NinjaTrader, Rithmic, and Tradovate, as well as answering common questions about rules and billing.

- Extensive FAQ and Guides: A comprehensive knowledge base allows traders to find answers independently, with detailed guides for platform setup and troubleshooting.

What is not offered is live phone support or direct one-on-one strategy coaching, as the model prioritizes a scalable ticketing system.

11.2. Educational materials

The educational resources are aimed at building a foundational understanding of trading, making them most suitable for those who are new to futures.

- Introductory Video Content: Apex provides a library of videos covering the essentials of risk management, basic trading strategies, and market fundamentals.

- Beginner-Friendly Focus: The material is designed to get a new trader up and running, but does not delve into advanced or complex trading theories.

Compared to other firms that might offer structured courses, live webinars, or mentorship programs, Apex’s educational suite is more limited. It serves as a solid starting point but is not a comprehensive trading academy.

Apex Trader Funding’s approach is functional and practical. The 24/7 help desk is a significant advantage for technical problem-solving across different time zones.

However, traders seeking hands-on guidance, advanced educational pathways, or personalized mentorship will find the offerings to be quite basic. The system is best suited for independent traders who are comfortable with a self-directed learning and support model.

12. How to sign up for Apex Trader Funding: A step-by-step guide

Follow these steps to register for an Apex Trader Funding evaluation account and begin your journey toward a funded futures trading account. The process is user-friendly, with frequent discounts reducing costs significantly.

12.1. Step 1: Visit the official website and look for discounts

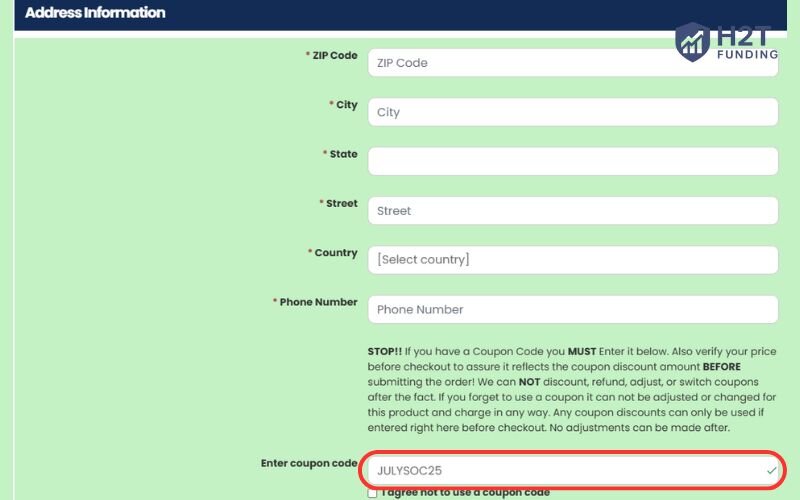

Navigate to apextraderfunding.com. Check the homepage for promotional banners advertising discounts, often 80-90% off evaluation fees. Look for codes like TF50 or WQDCQMMC, or click the provided discount links to auto-apply offers.

12.2. Step 2: Choose your account size

Scroll to the “Select Your Plan” section. Options range from $25,000 to $300,000, with profit targets (e.g., $1,500 for $25K, $20,000 for $300K) and trailing drawdowns (e.g., $1,500-$20,000). Select an account that matches your trading style and capital.

12.3. Step 3: Select your platform (Tradovate/Rithmic)

Choose between Rithmic or Tradovate plans. Rithmic offers lower fees ($137-$657/month), while Tradovate ($167-$677/month) supports TradingView integration and mobile trading. Ensure your choice aligns with your preferred platform (e.g., NinjaTrader for Rithmic).

12.4. Step 4: Enter your personal information and apply the discount code

Click “Start Now” to access the signup form. Enter your email, name, address (use 00000 for non-US zip codes), and payment details. In the “Enter Coupon Code” field, input a valid code (e.g., TF50) and verify the discount before proceeding. Avoid checking “I agree not to use a coupon code” to secure savings.

12.5. Step 5: Complete the payment and check your email for login details

Submit payment via credit card or other methods. You’ll receive an email with your Apex dashboard login credentials and separate Rithmic or Tradovate credentials within 10-90 minutes. Log in to the member’s area at apextraderfunding.com to access your account and start trading.

Note: Avoid creating multiple logins, as this may lead to account cancellation per Apex’s terms. Contact support immediately if issues arise during setup.

Sign up now: Apex Trader Funding Coupons Code [Verified]

13. Latest Apex Trader Funding discount codes and promotions

One of the standout features of Apex Trader Funding is its frequent, massive discounts, often slashing evaluation fees by 80-90%, making it highly affordable to start your funded trading journey.

To find the latest offers, always check the prominent banner at the top of apextraderfunding.com before signing up, as promotions are updated regularly. You can also follow Apex on social media platforms like X or subscribe to their newsletter for real-time updates on codes and flash sales, such as $50 reset fees.

Be aware that discounts typically apply to new accounts only and cannot be combined with other offers. Don’t miss out, grab the latest deal now!

14. Frequently asked questions (FAQs)

Yes, absolutely. Apex Trader Funding has a proven track record, and community feedback on platforms like Trustpilot, with an 86% 5-star rating from over 14,125 reviews, and posts on X confirm successful payouts, though some note occasional delays. Apex’s transparent payout policy, with bi-weekly withdrawals via Deel, reinforces its reliability for funded traders.

Apex Trader Funding imposes no maximum cap on total withdrawals, allowing traders to access all earned profits. However, each payout request is limited by the account’s size and safety threshold, requiring a balance above the trailing drawdown plus $100 (e.g., $2,600 for a $50,000 account).

It depends on the trader. Apex excels with its one-step evaluation, 100% profit split on the first $25,000, then 90/10, making it cost-effective and straightforward. Topstep’s two-step Trading Combine is more structured, offering robust coaching ideal for beginners but with higher fees ($49-$149/month) and daily loss limits.

The 30% consistency rule applies only to funded Performance Accounts, ensuring stable trading. No single day’s profit can exceed 30% of the total profits. For example, if your total profit is $10,000, no day can contribute more than $3,000. This rule promotes consistent, disciplined trading, preventing reliance on large, risky trades and aligning with Apex’s risk management guidelines for sustainable performance.

If you violate a rule on a funded Performance Account, such as breaching the trailing drawdown or 30% consistency rule, the account will be closed. Unlike evaluation accounts, funded accounts cannot be reset. You’ll need to purchase and pass a new evaluation to regain funded status.

15. Conclusion

This Apex Trader Funding review highlights why Apex will remain a leading futures prop firm in 2026. It’s a one-step evaluation, requiring just 7 trading days, simplifies the path to funding, while the 100% profit split on the first $25,000 per account, followed by 90/10, is among the most generous in the industry.

However, the real-time trailing drawdown, 30% consistency rule for funded accounts, and futures-only focus may challenge some, with occasional payout delays noted on platforms like Reddit.

As someone who has tested prop firm evaluations, I find Apex’s balance of low costs and high profit potential compelling, though beginners may need to master risk management to navigate its rules.

For traders seeking a cost-effective path to funded futures trading, Apex is a strong choice, particularly if you’re disciplined and futures-focused. If you need forex trading or extensive coaching, consider alternatives like FTMO or Topstep. Explore more prop firm review insights at H2T Funding, including our reviews of Topstep and FTMO to find the best fit for your trading goals.