If you're looking for a straightforward way to get control of your money, a clear financial plan is the best place to start. Think of it less as a strict set of rules and more as your personal game plan for hitting your goals, big or small.

In this article, I’ll walk you through everything you need, from where to find the best personal budget spreadsheet free to how to build one that truly works for you.

1. Why use a personal budget spreadsheet free?

You don't need expensive software to get your finances in order. In fact, a simple, free spreadsheet can be one of the most effective ways to see exactly where your money is going. It’s a no-frills approach that puts you in the driver's seat without costing a dime.

These spreadsheets offer a practical and flexible way to manage money, making them ideal for beginners and seasoned budgeters alike.

Here’s why they stand out:

- Cost-effective solution: Unlike paid budgeting apps or software, free spreadsheets require no subscription fees, making them accessible to everyone. No matter if you’re a student, a freelancer, or someone working with a limited budget, it’s possible to begin managing your finances without spending extra money.

- Highly customizable: Free spreadsheets allow you to tailor categories, formulas, and layouts to suit your unique financial situation. Whether you need to track specific expenses like travel or childcare, or adjust for irregular income, you can modify a free personal budget spreadsheet template to fit your needs perfectly.

- Accessible anywhere: Many free spreadsheets, especially those on cloud-based platforms like Google Sheets, can be accessed from any device with an internet connection. This ensures you can update your budget on the go, whether you’re using a phone, tablet, or computer.

Personally, I had a real wake-up call when my first spreadsheet showed I was spending nearly $80 a month on coffee and food delivery apps I barely remembered ordering. Seeing that number in black and white was what it took to finally cut back and redirect that cash to my vacation fund. That’s when it really ‘clicked’ for me.

Additionally, spreadsheets make it easy to set and track savings goals with clear visuals and calculations, providing a comprehensive view of your financial health and empowering you to make informed decisions.

Read more related articles:

- How to budget on a low income

- Prop firms with the lowest minimum trading days

- Easiest prop firms to pass

2. Top free personal budget spreadsheet templates

After trying my fair share of budgeting tools, from the overly complicated to the barely useful, I've learned that the right template does more than just track spending; it gives you a genuine sense of clarity and control.

Below is a trusted list of free budgeting templates that I’ve personally tried and found genuinely helpful. Each one offers unique features tailored to different needs, making it easier to stay organized, set realistic goals, and build better money habits over time.

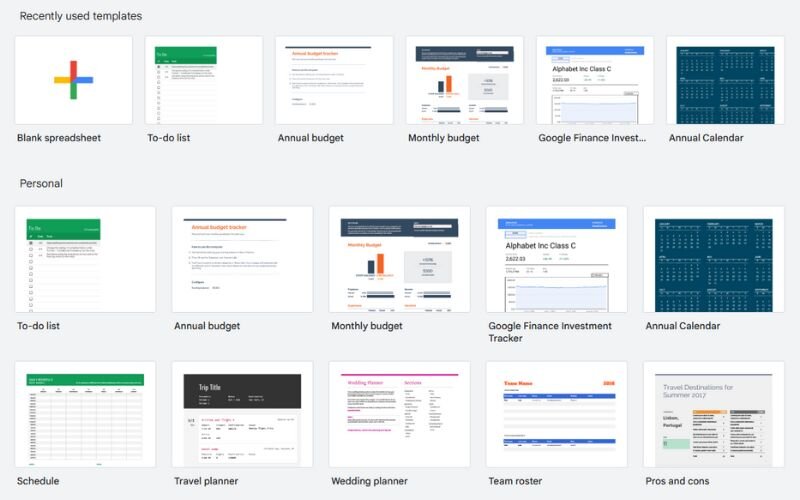

2.1. Google Sheets budget templates

Google Sheets offers a variety of built-in templates that make budgeting straightforward, especially for those who prefer a cloud-based solution. The personal budget spreadsheet free available in Google Sheets, is a popular choice due to its simplicity and accessibility.

Key features:

The monthly budget template includes preset categories for income, expenses, and savings, with a dashboard to visualize your financial progress. It automatically calculates totals and differences, helping you see where your money is going.

How to access:

- Open Google Sheets and go to the Template Gallery.

- Search for Monthly Budget or Annual Budget.

- Select the template and click Use Template to create a copy in your Google Drive.

Customization: You can add or rename categories, such as subscriptions or pet expenses, to reflect your spending habits. You can also share the spreadsheet with family members for collaborative budgeting, making it ideal for household use. With 15GB of free storage, Google Sheets ensures your budget is securely stored and accessible anytime.

2.2. Microsoft 365 Excel budget spreadsheets

Microsoft Excel is a go-to tool for those who prefer robust, offline-capable spreadsheets. Excel offers several free budget templates, including the personal budget, designed to streamline financial tracking.

Key features:

Excel’s templates come with pre-built formulas that automatically calculate totals, differences, and budget variances. The Personal Monthly Budget template includes detailed categories like housing, transportation, and entertainment, allowing you to compare projected and actual expenses. Its structured layout is perfect for users who want a comprehensive yet user-friendly tool.

How to access:

- Visit create.microsoft.com and search for personal budget.

- Choose a template like Personal Monthly Budget or Personal Budget and download it.

- Open the file in Excel (a Microsoft 365 subscription may be required for full functionality, though some templates work in free alternatives like Google Sheets).

Excel’s templates are ideal for users comfortable with spreadsheets, offering advanced features like conditional formatting to highlight overspending. However, ensure you have compatible software to maintain formatting.

2.3. Other trusted free budget spreadsheets

For those seeking variety, reputable sources like NerdWallet and Vertex42 offer free personal budget spreadsheets that cater to different needs. These platforms provide reliable, well-designed templates to help you stay on top of your finances.

- NerdWallet: Offers a 50/30/20 budget spreadsheet that allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This template is available for download in Excel-compatible formats and is ideal for those new to budgeting.

- Vertex42: Known for its extensive collection, Vertex42 provides templates like the Personal Budget Spreadsheet and Money Management Template. These are available for both Excel and Google Sheets, featuring detailed categories and customizable layouts.

Safety tip: Always download from trusted websites to avoid malware or phishing risks. Stick to well-known platforms like NerdWallet or Vertex42 to ensure your data remains secure. These templates are perfect for users who want flexibility and a professional design without the cost.

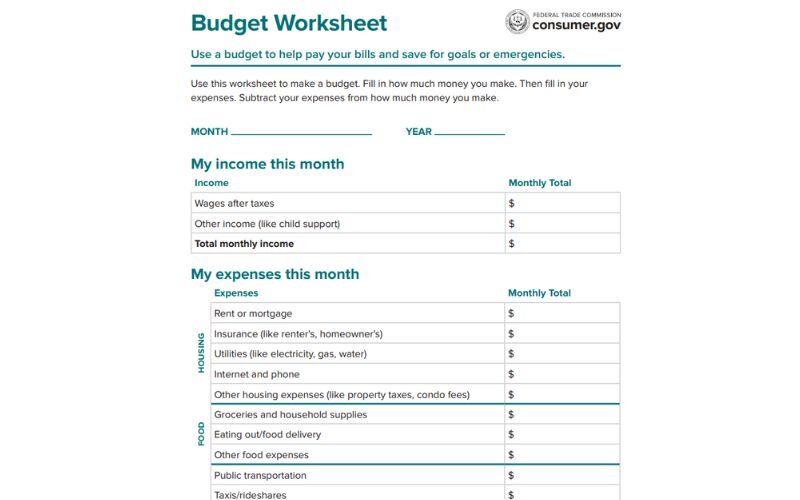

2.4. Government and nonprofit budget worksheets

For beginners or those who prefer simplicity, government and nonprofit organizations offer free budgeting tools that are both reliable and easy to use. The FTC Budget Worksheet, provided by the Federal Trade Commission, is a prime example.

Key features: The FTC’s worksheet is a printable PDF that breaks down income and expenses into broad categories like housing, utilities, and miscellaneous. Its straightforward design makes it accessible for those who find numbers intimidating, serving as an excellent starting point for budgeting novices.

How to access:

- Visit consumer.gov and navigate to the Your Money section.

- Click Making a Budget to download the worksheet.

Benefits: This tool is ideal for tracking expenses over a month to plan for the next, with no complex formulas or software required. Its simplicity ensures reliability, and its government backing guarantees trustworthiness. Other nonprofits, like the Consumer Financial Protection Bureau (CFPB), also offer similar worksheets for basic financial planning.

3. Steps to create your own personal budget spreadsheet

Creating a personal budget spreadsheet gives you hands-on control over your finances. Whether you’re starting from scratch or customizing a free personal monthly budget spreadsheet, this step-by-step guide will help you build a tool that fits your lifestyle and goals.

3.1. Step 1: Select a spreadsheet program or template

Start by choosing the platform you’re most comfortable with.

Google Sheets is a great option if you prefer cloud access and easy sharing. It’s free, works on any device, and autosaves your work.

Microsoft Excel offers more advanced features and is ideal if you already use it regularly. Other options like Numbers (for Mac users) can also work, depending on your preferences.

If you’re new to budgeting, consider starting with a pre-built template. Many free templates are designed for monthly budgeting and include basic formulas. However, if you prefer full customization, you can build your spreadsheet from scratch to suit your specific needs.

3.2. Step 2: Define income and expense categories

Next, outline your financial picture by listing your income sources. This might include your salary, freelance work, side gigs, or passive income like dividends or rental earnings.

Then break down your expenses into categories that reflect your lifestyle. Common examples include rent or mortgage, groceries, utilities, transportation, insurance, subscriptions, and savings. Grouping your expenses this way helps you see where your money is going and where adjustments can be made.

3.3. Step 3: Set your budget period

Decide how often you want to track your budget. A monthly budget period is the most common and aligns well with most billing cycles and paychecks. However, if you’re paid weekly or bi-weekly, you might find it more helpful to set your spreadsheet to match those periods.

Aligning your budget period with your income frequency or financial goals will help you stay consistent and avoid overspending during off-weeks.

3.4. Step 4: Enter data and apply formulas

Now it’s time to fill in your spreadsheet. Input your expected income and planned expenses for the period. Use basic formulas to automate your calculations. For example:

- Use =SUM() to total up income or expenses.

- Subtract total expenses from total income to calculate your balance or surplus.

- Include a running total to track how much you have left for the month.

Even with minimal spreadsheet skills, these simple formulas can provide powerful insights into your financial habits.

Explore more related articles: Budgeting for irregular income: 6 essential steps you need to know

3.5. Step 5: Add visual aids and advanced features

To make your spreadsheet more useful and engaging, add visual elements like charts or graphs. A pie chart can show how your expenses are divided, while a line graph can track your spending trends over time.

You can also use conditional formatting to highlight issues like overspending. For example, set a rule to turn cells red if a category exceeds the budgeted amount. These features not only make your spreadsheet easier to read but also help you take action when needed.

4. Tips for using a personal budget spreadsheet effectively

I still cringe when I remember how I excitedly downloaded a flashy-looking Excel template from some random forum when I first started budgeting. Not only were the formulas a complete mess, but they came with a "free bonus", a virus that made my old laptop crawl to a halt. It was a hard lesson and a complete waste of an afternoon.

From my experience, I’ve outlined practical tips to help you avoid similar pitfalls. By keeping your spreadsheet secure, tailored, and regularly updated, you can confidently take control of your finances and work toward your goals without unnecessary setbacks.

- Download from trusted sources only: Stick to safe websites to avoid viruses or scams. Use platforms like Google Sheets or Vertex42 for free, reliable budget templates. This keeps your data secure and your spreadsheet functional.

- Customize to fit your financial needs: Make it yours by adjusting the spreadsheet to match your goals. Add categories like debt repayment or vacation savings that fit your life. A tailored budget feels easier to follow.

- Review and adjust regularly: Update monthly to track real income and expenses. Check your budget every few months to tweak goals, like saving more or cutting overspending. This keeps your plan relevant and effective.

5. FAQs about personal budget spreadsheets

5.1. How do I create a personal budget spreadsheet?

Follow simple steps to build your own spreadsheet. Choose a tool like Google Sheets, list income and expenses, set a budget period, add formulas for totals, and include charts for visuals. This process, outlined earlier, helps you track finances easily.

5.2. Does Google Sheets have a personal budget template?

Yes, templates are available in Google Sheets. Go to the Template Gallery, search for “Monthly Budget,” and select a template to use instantly. You can customize it to fit your financial needs.

5.3. Is Excel or Google Sheets better for budgeting?

Both are great, but it depends on your needs. Excel offers advanced formulas and offline access, ideal for detailed budgets. Google Sheets is free, cloud-based, and perfect for collaboration or mobile updates.

6. Final thoughts on using a personal budget spreadsheet free

You don’t need high-end tools to manage your money effectively. A personal budget spreadsheet free of charge can offer just as much, if not more, clarity than complex financial apps. Its flexibility allows you to customize categories, track real spending habits, and make data-driven adjustments that align with your goals.

Whether you're new to budgeting or already aiming for long-term financial milestones, a simple spreadsheet can help you visualize income, monitor expenses, and stay focused on smarter financial decisions. Start with a basic template in Google Sheets or Excel to ease into the habit, then gradually tailor it to fit your priorities.

Taking the first step is what counts. Your financial future will thank you for the discipline you begin today.

Looking for more actionable tips? Head over to the Budgeting Strategies of H2T Funding, where you’ll find expert insights and practical tools to strengthen your financial foundation and reach your savings goals faster.

Comments (0)

Leave a Comment