In the dynamic world of trading, mastering grid trading can be your secret weapon for consistent profits. This innovative strategy leverages market fluctuations by placing buy and sell orders at predetermined intervals, creating a grid-like structure that capitalizes on price movements.

Whether you’re a seasoned trader or just starting out, understanding the nuances of grid trading can unlock your potential to navigate volatile markets effectively.

In this article, we’ll delve into proven strategies that will help you maximize your profits with grid trading. From identifying the right market conditions to optimizing your grid setup, we’ll provide you with actionable insights to refine your trading approach. Equip yourself with the tools and techniques needed to turn market volatility into your advantage.

Ready to elevate your trading game? Let’s explore the methods that can transform your grid trading experience into a lucrative venture.

1. Understanding the Grid Trading Concept

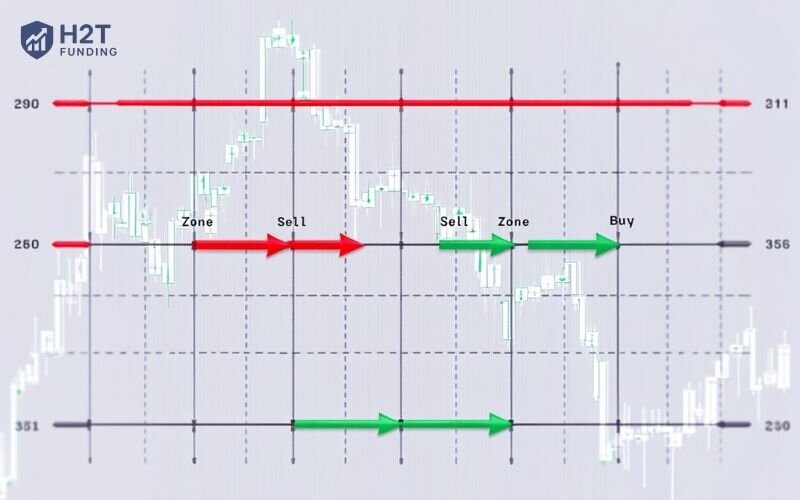

Grid trading is a systematic trading strategy that capitalizes on market volatility. The essence of grid trading lies in placing buy and sell orders at predetermined intervals above and below a set price point, forming a grid-like structure.

This method allows traders to profit from market fluctuations without needing to predict price direction. By setting these orders at various levels, traders can capture profits from both upward and downward movements in the market.

The foundation of grid trading is its non-directional nature, meaning it doesn’t rely on the market moving in a specific direction to generate profits. Instead, it leverages the natural ebb and flow of market prices. This characteristic makes grid trading particularly appealing in markets that exhibit sideways or ranging behavior.

It provides a structured approach to capturing small, frequent profits, which can accumulate significantly over time.

To implement grid trading effectively, traders need to determine the grid size, which is the distance between the buy and sell orders. This spacing is crucial as it influences the frequency of trades and the overall profitability of the strategy.

A smaller grid size leads to more frequent trades and potentially higher profits, but also increases transaction costs and the risk of overtrading. Conversely, a larger grid size reduces the number of trades but may miss out on smaller price movements. Finding the optimal balance is key to successful grid trading.

2. Key benefits of Grid Trading

One of the primary benefits of grid trading is its ability to generate consistent profits in volatile markets.

By placing buy and sell orders at regular intervals, traders can capture gains from both upward and downward price movements. This strategy effectively turns market volatility into an advantage, allowing traders to benefit from the inherent unpredictability of financial markets.

Another significant advantage of grid trading is its simplicity and automation potential.

Once the grid parameters are set, the trading strategy can be largely automated, reducing the need for constant monitoring and manual intervention. This makes grid trading an attractive option for traders who prefer a more hands-off approach or who may not have the time to actively manage their trades throughout the day.

Additionally, grid trading offers a level of risk management that can be appealing to many traders. By spreading out buy and sell orders across a range of price levels, the strategy helps to diversify risk and avoid large, concentrated losses. This structured approach can provide a more stable and predictable trading experience, particularly in uncertain or choppy market conditions.

Read more related articles:

3. Essential tools and platforms for Grid Trading

To successfully implement grid trading, having the right tools and platforms is essential. One of the most critical tools is a reliable and feature-rich trading platform that supports automated trading strategies.

Platforms like MetaTrader 4, MetaTrader 5, and TradingView offer robust support for grid trading, providing the necessary tools to set up and manage your grid orders efficiently.

In addition to a solid trading platform, access to real-time market data and analytics is crucial. Accurate and timely market information allows traders to make informed decisions about grid placement and adjustments. Services like Bloomberg Terminal, Reuters Eikon, and various online brokerage platforms provide comprehensive market data and analysis tools that can enhance your grid trading strategy.

Another valuable tool for grid trading is a backtesting and simulation environment.

Before deploying a grid trading strategy in live markets, it’s essential to test it thoroughly using historical data. This helps to identify potential weaknesses and refine the strategy for optimal performance. Tools like MetaTrader’s Strategy Tester, TradingView’s Pine Script backtester, and specialized backtesting software like Amibroker can be invaluable in this process.

4. Proven strategies for effective Grid Trading

One of the most effective grid trading strategies involves setting up a grid with a fixed grid size based on historical price volatility. By analyzing past price movements, traders can determine an appropriate interval for their buy and sell orders, ensuring they capture the majority of significant price swings.

This approach helps to maximize the profitability of the grid trading strategy while minimizing the risk of overtrading or missing out on important price movements.

Another proven strategy is to use a dynamic grid size that adjusts based on current market conditions. This involves monitoring market volatility and adjusting the grid size accordingly. In highly volatile markets, a larger grid size can help to avoid excessive trading and reduce transaction costs.

In more stable markets, a smaller grid size can capture more frequent profits. This adaptive approach allows traders to optimize their grid trading strategy for different market environments.

Incorporating technical indicators into the grid trading strategy can also enhance its effectiveness. Indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can provide valuable insights into market trends and potential reversal points.

By combining these indicators with a grid trading framework, traders can improve their decision-making process and increase the likelihood of successful trades.

5. Risk management techniques in Grid Trading

Effective risk management is crucial for long-term success in grid trading. One of the key techniques is to set a maximum allowable drawdown, which limits the total amount of loss a trader is willing to accept. By defining this threshold, traders can prevent catastrophic losses and preserve their trading capital. This can be achieved by using stop-loss orders or by closely monitoring the overall performance of the grid trading strategy.

Another important risk management technique is to diversify the grid trading strategy across different assets or markets. By spreading the risk across multiple trading instruments, traders can reduce the impact of adverse price movements in any single market. This diversification can help to stabilize overall returns and mitigate the risks associated with individual market fluctuations.

Position sizing is also a critical aspect of risk management in grid trading. Traders should carefully determine the size of each trade based on their overall trading capital and risk tolerance. By keeping individual trade sizes relatively small, traders can limit their exposure to any single trade and reduce the potential for large losses.

This disciplined approach to position sizing can help to ensure the long-term viability of the grid trading strategy.

6. Common mistakes to avoid in Grid Trading

One of the most common mistakes in grid trading is setting the grid size too small. While a smaller grid size can capture more frequent price movements, it also increases the risk of overtrading and incurring excessive transaction costs.

Traders should carefully analyze historical price data and consider market volatility when determining the optimal grid size to avoid this pitfall.

Another frequent mistake is neglecting to adjust the grid trading strategy based on changing market conditions. Markets are dynamic, and what works well in one environment may not be effective in another. Traders should regularly review and adjust their grid trading parameters to ensure they remain aligned with current market conditions.

Failing to do so can result in suboptimal performance and increased risk.

Over-leveraging is another common error that can be detrimental to grid trading success. Using excessive leverage can amplify both profits and losses, increasing the risk of significant drawdowns. Traders should use leverage cautiously and ensure they have sufficient margin to withstand adverse price movements.

Maintaining a conservative leverage ratio can help to protect trading capital and reduce the risk of margin calls.

7. Case studies: Successful mastering Grid Trading examples

One notable example of successful grid trading is the case of a trader who implemented a grid strategy in the foreign exchange market. By analyzing historical volatility and setting a grid size that captured significant price movements, the trader was able to generate consistent profits over several months.

The key to their success was the disciplined execution of the strategy and regular adjustments based on market conditions.

Another case study involves a trader who applied grid trading to the cryptocurrency market. Given the high volatility of cryptocurrencies, the trader used a dynamic grid size that adjusted based on real-time market data. This adaptive approach allowed them to capture frequent price swings and achieve impressive returns.

The trader also incorporated technical indicators to enhance their decision-making process and optimize trade execution.

A third example highlights a trader who diversified their grid trading strategy across multiple asset classes, including stocks, commodities, and currencies. By spreading the risk across different markets, the trader was able to achieve a more stable and predictable return profile.

This diversified approach helped to mitigate the impact of adverse price movements in any single market and contributed to the overall success of the grid trading strategy.

8. Advanced Grid Trading techniques

For traders looking to take their grid trading to the next level, advanced techniques can provide additional opportunities for profit. One such technique involves incorporating mean reversion strategies into the grid trading framework. Mean reversion is based on the idea that prices will eventually return to their average or mean value.

By combining grid trading with mean reversion analysis, traders can enhance their ability to capture profitable price movements.

Another advanced technique is to use machine learning algorithms to optimize the grid trading strategy. Machine learning can analyze vast amounts of historical data and identify patterns that may not be apparent to human traders.

By leveraging these insights, traders can fine-tune their grid parameters and improve the overall performance of their strategy. This approach requires a solid understanding of both machine learning and trading principles.

Implementing a hybrid grid trading strategy that combines multiple trading systems can also be highly effective. For example, traders can integrate grid trading with trend-following or momentum strategies to capture profits from different market conditions.

This multi-faceted approach allows traders to diversify their trading tactics and increase the resilience of their overall strategy. By combining the strengths of different trading systems, traders can enhance their ability to navigate volatile markets.

9. Conclusion and next steps for aspiring traders

Mastering grid trading requires a thorough understanding of its principles and a disciplined approach to implementation. By leveraging the strategies and techniques outlined in this article, traders can maximize their profits and turn market volatility into an advantage.

Whether you’re a seasoned trader or just starting out, grid trading offers a structured and systematic way to navigate the complexities of financial markets.

Aspiring traders should begin by familiarizing themselves with the basic concepts of grid trading and experimenting with different grid sizes and parameters. Utilizing back-testing tools and simulation environments can help to refine the strategy and identify the most effective setups.

It’s also important to stay informed about market conditions and be prepared to adjust the grid trading strategy as needed.

Finally, traders should focus on continuous learning and improvement. The financial markets are constantly evolving, and staying ahead of the curve requires ongoing education and adaptation. By dedicating time to study market trends, technical analysis, and advanced trading techniques, traders can enhance their skills and increase their chances of long-term success in grid trading.

Want to sharpen your edge even further? Visit H2T Funding to explore top-rated prop firms and trading resources, and don’t forget to check out our blog for more expert articles in the Prop Firm & Trading Strategies category.