Talking about money can be one of the toughest conversations for couples. According to a 2023 survey by Zola and NerdWallet, 54% of engaged couples disagree on financial goals, and 70% have faced money challenges while planning their wedding. This highlights how important clear budgeting is for a healthy relationship.

At H2T Funding, I understand that budgeting for couples or even budgeting for two is about teamwork and communication. In this article, we’ll share 8 smart budgets for couples to manage money together, helping you align your financial goals and reduce stress.

Let’s get started on building a strong financial foundation as a team.

Key takeaways:

- Budgeting for couples is teamwork. It’s about communication, trust, and shared goals, not just numbers on a spreadsheet.

- Understand your money habits first. Identify how each partner spends and saves to prevent future conflicts.

- Set shared short-, medium-, and long-term goals. These align your dreams, from vacations to retirement.

- Track income and expenses transparently. Use apps or templates to manage joint finances clearly.

- Choose a budgeting method that fits. Try the 50/30/20 rule, 80/20 rule, or a balanced approach for flexibility.

- Split expenses fairly. Divide by income percentage or merge funds depending on comfort and trust.

- Review regularly. Schedule weekly or monthly financial check-ins to stay aligned and motivated.

- Use digital tools. The best budgeting apps for couples or shared spreadsheets make tracking simple and stress-free.

- Focus on teamwork, not perfection. Budgeting strengthens relationships and builds long-term financial satisfaction.

1. Why couples need to create a budget together

Building a budget for couples living together isn’t just about spreadsheets or numbers; it’s about creating harmony, trust, and a shared vision for your future. When two people merge their lives, they also merge their financial habits, goals, and expectations. A clear budgeting plan for couples or a detailed budgeting template for couples turns potential conflicts into cooperation, helping both partners build long-term financial health and financial satisfaction.

Below are the key reasons why budgeting as a couple is essential and how it brings clarity, balance, and teamwork to your financial life.

1.1. Different money habits need a common ground

Every couple comes with unique money habits. One partner may save diligently, while the other prefers spontaneous spending. Without alignment, these differences can cause tension over everyday expenses or discretionary spending.

A joint budgeting plan for couples helps transform these habits into strengths, creating room for both freedom and responsibility. By discussing your financial tendencies openly, you can compromise, find balance, and design a system that supports both partners’ priorities.

1.2. Shared budgets build a common financial language

Money talks can easily turn emotional unless you have a shared framework. A budget for couples living together or shared budget plans for couples serves as that neutral guide, giving both partners an objective view of income, spending, and savings.

When couples see the same numbers, they can communicate without blame, make data-driven decisions, and evaluate their financial review together. This common language minimizes misunderstandings and strengthens teamwork.

1.3. Budgeting aligns priorities and individual goals

One of the biggest benefits of budgeting for a couple is learning how to align personal dreams with shared ambitions. Whether it’s saving for a trip, a new home, or retirement, a joint budget helps couples set priorities transparently.

Each partner can still maintain autonomy in allocating personal spending money while working toward long-term financial satisfaction as a team.

1.4. Reduces financial stress and strengthens trust

Open financial communication is key to a healthy relationship. When you both know exactly where your money goes, it reduces anxiety and prevents conflicts about hidden spending or unspoken debts.

Couples who budget together develop stronger trust and accountability, ensuring that both partners feel equally valued in decision-making and financial planning.

1.5. Builds a strong foundation for the future

Collaborative budgeting sets the stage for long-term stability. Whether you’re planning to buy a home, start a family, or retire early, a clear budgeting plan for couples keeps you on track.

It encourages consistent saving, smarter investments, and preparedness for unexpected expenses. In short, budgeting transforms uncertainty into confidence, helping you create the life you both envision.

1.6. Encourages independence within partnership

Contrary to common belief, budgeting together doesn’t mean losing independence. Many couples, like those who use a budgeting spreadsheet for couples or split expenses proportionally, find that shared planning actually supports individuality.

You can still manage personal spending while maintaining joint goals. This approach promotes both autonomy and teamwork, ensuring financial harmony at home.

2. 8 steps to budgeting for couples

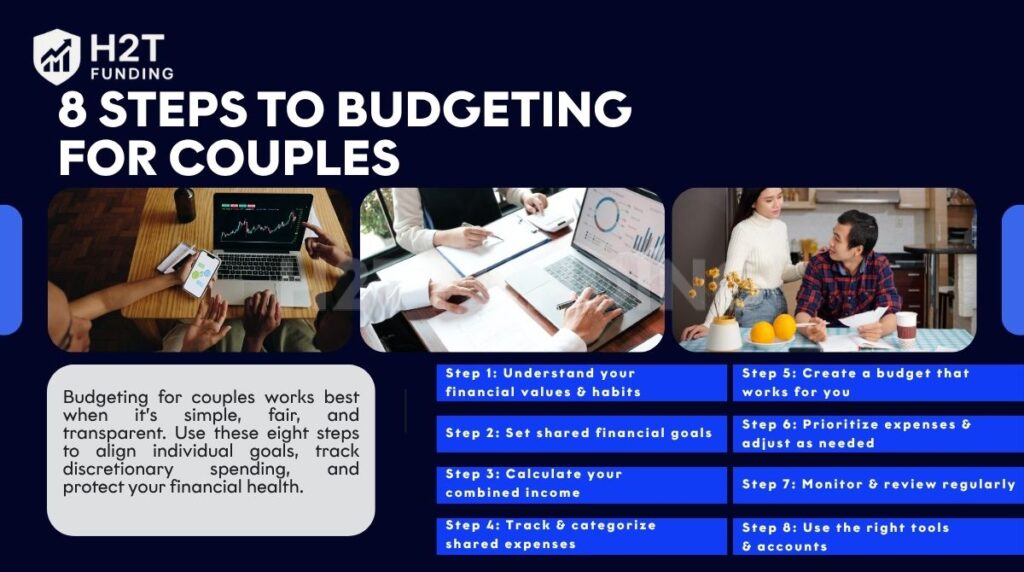

Budgeting for couples works best when it’s simple, fair, and transparent. Use these eight steps to align individual goals, track discretionary spending, and protect your financial health. Start with honest conversations, build a budgeting plan for couples you both agree on, and schedule regular financial reviews so you can adjust as life changes.

2.1. Step 1: Understand your financial values & habits

To budget effectively as a couple, start by exploring each other’s financial values and habits through open, honest conversations. Discuss how you each approach money, whether you lean toward saving for the future or spending on present experiences.

For instance, one partner might carefully track every expense, while the other spends more freely. Understanding these differences early prevents conflicts and helps create a budget you both support.

To budget effectively as a couple, start by exploring each other’s financial values and habits

Examine your spending patterns by reviewing recent expenses, like bank or credit card statements, to spot similarities and differences. If one of you loves dining out while the other prioritizes saving for a big purchase, acknowledge these habits without judgment. Similar money management styles make budgeting smoother, but contrasting approaches.

2.2. Step 2: Set shared financial goals (short, medium, long term)

Dreaming together is the heartbeat of budgeting for couples; it’s where your shared vision comes to life! Setting financial goals as a team not only fuels your motivation but also transforms budgeting from a chore into an exciting journey toward your dream life.

Picture this: you and your partner curled up on the couch, imagining your future together. Maybe it’s buying your first home or jetting off to Paris. Setting shared goals turns these dreams into reality by giving your budget purpose. It’s not just about numbers, it’s about building a life you both love.

Studies show couples who plan together are 80% more likely to feel confident about their finances. Plus, it cuts down on money fights, leaving more time for date nights!

Tip: Kick off your goal-setting with a fun “money date.” Grab coffee or wine and talk about what excites you both, whether it’s a new car or early retirement. Write down your top three dreams to keep the vibe positive and focused.

Break your dreams into bite-sized pieces by setting short-term, medium-term, and long-term goals. This mix keeps you motivated with quick wins while building toward your big-picture future, and for more context on how to balance saving and growing your money, check out our saving vs investing: Pros and cons guide.

- Short-term goals (1-3 years): These are your “let’s make it happen soon” goals. Think saving $2,000 for a weekend getaway to Napa Valley, paying off a $1,500 credit card balance, or stashing $1,000 for car repairs. These wins feel amazing and keep your budgeting momentum going strong.

- Medium-term goals (3-5 years): These goals are your bridge to bigger dreams. Maybe you’re eyeing a $20,000 down payment for a starter home or $10,000 for a used SUV. Or perhaps it’s taking a career course to boost your income. These require planning, but feel totally doable with teamwork.

- Long-term goals (5+ years): This is where you dream big for your future selves. Think of maxing out your Roth IRA contributions ($7,000 per person in 2026) or investing in a rental property to grow wealth. These goals secure your financial freedom down the road, and understanding how compound interest works can help you accelerate that growth over time.

Tip: Use a vision board app like Canva to visualize your goals. Pin pictures of your dream home or vacation spot to keep your “why” front and center.

2.3. Step 3: Calculate your combined income (incl. irregular)

Knowing your total income is like fueling up for your budgeting adventure. It’s the key to a plan that works for both of you, built on trust and clarity.

- Add up every dollar: List all income, salaries, side hustles, even $100 from selling old gear. Check pay stubs or bank statements for accuracy. This total shows what you can spend, save, or splurge on.

- Tip: Use a free Google Sheet to track it together. Alternatively, you can use a couple, monthly budget templates to streamline tracking and planning. Example: Lily’s $2,800 salary plus Tom’s $1,200 gig income gave them $4,000 monthly.

- Tackle irregular income like pros: If one of you freelances, works commissions, or has seasonal gigs, income can feel like a rollercoaster. Smooth it out by averaging your earnings over the past 6-12 months. For extra caution, base your budget on your lowest-earning month to stay safe.

- Be open about every dollar for trust: Honesty is the secret sauce of budgeting as a couple. Share all income details, even if one of you earns more or has a side hustle. This openness builds trust and ensures you’re both on the same page when deciding how to split finances as a couple.

Continue reading related content:

2.4. Step 4: Track & categorize shared expenses

Keeping tabs on your shared expenses is the backbone of budgeting for couples; it’s like having a GPS for your money! You can explore grocery budget tips to make this process easier and more effective. By tracking where every dollar goes, you and your partner can make smarter decisions, avoid surprises, and stay aligned on your financial journey..

- How to track spending: Check bank statements or receipts for a month. Log shared costs like rent or groceries. Review together weekly.

- Tools to use: Try apps like YNAB to auto-track expenses. Or use a free Google Sheet for custom categories.

- Sort expenses: Split into needs (rent, bills), wants (movies, dining out), and savings (emergency fund, debt payoff). These are some of the most common budget categories for couples to consider when creating their plan.

- Options for dividing shared expenses: Deciding how to split finances as a couple depends on your incomes, goals, and comfort levels.

- Splitting bills equally: Each partner pays half of shared expenses, like $500 each for $1,000 rent. This works well if incomes are similar, but can strain the lower earner.

- Proportional splitting based on income: Contribute to shared expenses based on income percentage. If one earns $3,000 and the other $2,000, split bills 60/40. This feels equitable for unequal incomes.

- Fully combined finances with joint accounts: Pool all income into a joint account to cover all expenses. This simplifies tracking but requires trust and agreement.

When my partner and I started living together, we thought splitting everything 50/50 was fair and easy. But reality hit hard; my lower income made the arrangement stressful and unsustainable. That’s when we learned the importance of tracking, discussing, and customizing our shared budget.

We began reviewing our bank statements together each Sunday, noting down all shared expenses in a simple Google Sheet with categories for needs, wants, and savings. Eventually, we transitioned to a proportional split based on income, which felt much more equitable.

These methods not only helped us avoid misunderstandings but also built trust and accountability in our relationship. Based on this personal journey, I can confidently say that taking the time to track and fairly divide expenses is essential for any couple aiming for long-term financial harmony.

2.5. Step 5: Create a budget that works for you

Several budgeting methods can work for couples, each with unique strengths. The key is choosing one you both can stick to, whether you prefer simplicity or detailed planning.

2.5.1. The 50 30 20 rule for couples

The 50 30 20 rule is a popular method rooted in Elizabeth Warren’s book All Your Worth, splits after-tax income into three buckets: 50% for needs (rent, groceries, utilities), 30% for wants (dining out, hobbies), and 20% for savings or debt repayment (emergency fund, retirement, extra loan payments). It’s simple and flexible, ideal for couples new to budgeting.

Another helpful resource is a budgeting for couples, which provides practical exercises and real-life examples to strengthen financial teamwork.

How to adapt this rule for a couple’s budget: Calculate your combined after-tax income, then allocate 50% to shared essentials, 30% to fun shared or individual wants, and 20% to joint goals like a vacation fund. Adjust percentages if needs exceed 50% (e.g., 60/20/20 in high-cost areas).

2.5.2. The 80/20 rule

The 80/20 rule is a breeze for couples who want a no-fuss budget. Just save 20% of your combined income and use the remaining 80% for all expenses, needs like rent and groceries, plus wants like date nights or new gadgets. It’s perfect for those who dread detailed tracking, offering freedom while ensuring savings.

- Tip: Set up an automatic transfer to a high-yield savings account (4-5% interest in 2026) to lock in the 20% before spending starts.

- Example: Jake and Sophie, with a combined $6,000 monthly income, save $1,200 (20%) in a joint savings account for a future home deposit. They freely spend the remaining $4,800 on rent ($2,000), groceries ($600), dining out ($400), and other expenses, without stressing over categories. After six months, they’ve saved $7,200 while enjoying their lifestyle.

2.5.3. The balanced approach

Every couple’s financial situation is different, and sometimes standard rules don’t fit. The balanced approach lets you create custom percentages based on your specific circumstances, goals, and priorities.

How it works: Start with your combined monthly income and identify your fixed expenses (rent, insurance, loan payments). Then allocate remaining funds based on your priorities – whether that’s aggressive debt payoff, building an emergency fund, or saving for a wedding.

Perfect for couples who:

- Have irregular income (freelancers, commission-based jobs).

- Are you paying off significant debt?

- Have specific short-term goals (wedding, home purchase, starting a family).

- Live in areas with unusual cost structures.

Example scenario: Alex and Sam earn $7,500 combined but have $2,000 in student loan payments. Their balanced approach: 65% for needs and debt payments, 15% for wants, and 20% for savings. Once loans are paid off in two years, they’ll shift to a 50/30/20 split.

2.5.4. Other budget options

Zero-based budgeting for couples:

This method assigns every dollar a purpose before the month begins. Your income minus all planned expenses and savings should equal zero. It’s perfect for couples who want complete control over their money and prefer detailed planning.

Steps to implement:

- List your combined monthly income

- List all fixed expenses (rent, insurance, minimums on debt)

- Assign amounts to variable categories (groceries, entertainment, personal spending)

- Allocate remaining funds to savings goals

- Adjust until income minus expenses equals zero

Best for: Detail-oriented couples, those with debt payoff goals, or couples preparing for major life changes.

The envelope system (digital or physical):

Allocate cash or digital “envelopes” for each spending category. When an envelope is empty, you’re done spending in that category for the month. This method prevents overspending and helps couples stay accountable to each other.

Modern approach: Use apps like YNAB (You Need A Budget) or EveryDollar to create digital envelopes you both can access and track in real-time.

The percentage-based flexible method:

Similar to 50/30/20 but with customizable percentages:

- Essentials: 45-65% (housing, food, transportation, insurance)

- Financial goals: 15-25% (savings, debt repayment, investments)

- Lifestyle: 15-35% (entertainment, hobbies, dining out)

- Personal spending: 5-10% (individual fun money, no questions asked)

2.6. Step 6: Prioritize expenses & adjust as needed

Sticking to a budget is much easier when you focus on what truly matters. My partner and I learned this the hard way during our first year of living together. We thought we were being smart with our money until we realized how much we were spending on takeout and unnecessary subscriptions.

- Essential vs. non-essential spending: Needs are must-haves (rent, utilities, groceries). Wants are extras (streaming, dining out). Check your spending to sort them.

- Cut back smartly: Shop smarter by buying groceries in bulk or choosing store brands, saving $50-$100 monthly. For more practical ideas, read our guides on how to save money on groceries and meal planning to save money. Limit impulse buys with a 24-hour “cool-off” rule before purchasing.

- Balance individual and shared priorities: Agree on big goals (e.g., saving for a house) but allow personal spending (e.g., $50 for hobbies). Check in monthly.

From personal experience, my partner and I struggled early on with distinguishing wants from needs, especially when it came to dining out and subscriptions. We eventually created a shared spreadsheet and began reviewing our expenses together each month. One major shift was buying in bulk and meal prepping, which helped us save around $80 monthly.

We also gave ourselves a “fun allowance” to spend however we like, guilt-free. This not only kept our finances in check but also strengthened our communication and trust. Budgeting became less about restriction and more about teamwork and shared goals.

2.7. Step 7: Monitor & review regularly

Consistent budget reviews help couples stay aligned on financial goals, identify overspending, and adjust to changing circumstances. To improve your financial health, check out our guide on how to stop living paycheck to paycheck.

You can also explore fun budget challenge ideas to keep couples motivated and engaged. Regular discussions foster transparency and trust, ensuring both partners are on the same page financially.

Recommended review frequency

- Weekly: Ideal for tracking daily expenses and making minor adjustments.

- Monthly: Suitable for assessing overall budget performance and planning for upcoming expenses.

- Quarterly: Useful for evaluating progress toward long-term goals and making significant budget changes.

The frequency can vary based on individual preferences and financial complexity. Some couples find monthly reviews effective, while others prefer weekly check-ins to stay more engaged.

Consider the case of Sara and her husband, who, despite a household income exceeding $200,000, struggled with debt and financial disagreements. They began holding weekly money talks and learning each other’s spending habits. These open discussions turned financial conflicts into teamwork.

2.8. Step 8: Use the right tools & accounts

Using the right tools makes budgeting for couples as easy as streaming your favorite show. They help track money and grow savings, so you can focus on your shared goals.

- Best budgeting apps for couples can make managing money simple and transparent. Top picks include YNAB, which assigns every dollar a purpose, and Honeydue (free), which tracks joint expenses and lets you chat about money in-app. If you’re looking for a simple budgeting app for couples, these tools provide both convenience and transparency.

- Spreadsheets for manual budgeting: For those preferring a hands-on approach, spreadsheets or a ready-made budgeting template for couples offer customizable budgeting solutions. Couples can tailor categories, track expenses, and analyze spending patterns to suit their unique financial situation. You can also download a free budgeting for couples worksheet to simplify manual tracking and keep both partners accountable.

- High-yield savings accounts: Utilizing high-yield savings accounts can accelerate savings for joint objectives like vacations, home purchases, or emergency funds. These accounts offer higher interest rates compared to traditional savings accounts, maximizing the growth of your funds.

3. Common challenges and how to overcome them

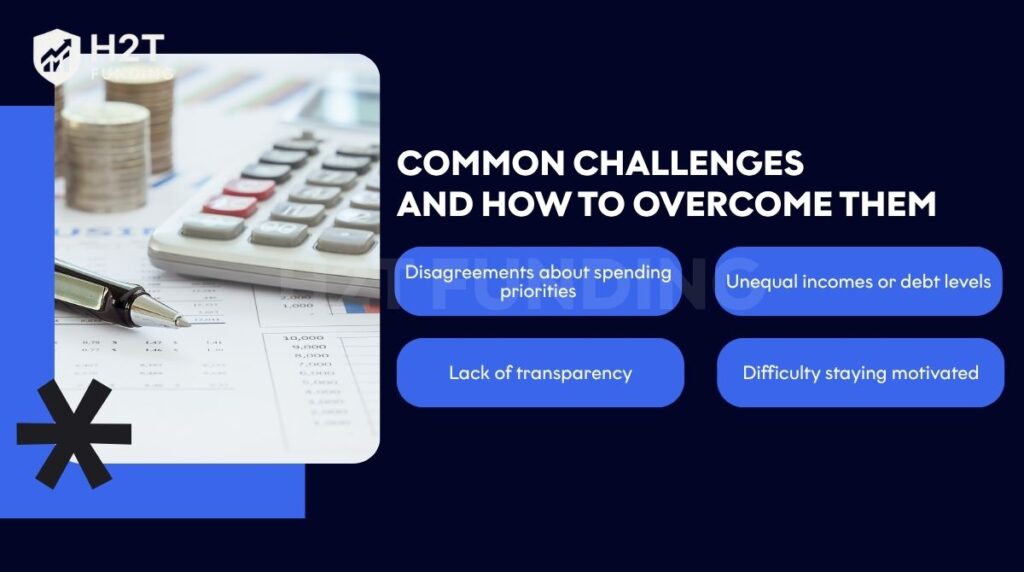

Like many couples starting out, my partner and I faced our fair share of challenges when managing our finances together. From disagreements over spending priorities to unexpected expenses throwing off our budget, the learning curve was steep.

Over time, we discovered effective strategies to overcome these hurdles, which not only strengthened our financial plan but also our relationship. So, I will share these insights to help you save time and avoid common pitfalls that we personally experienced.

For a deeper look at budgeting for couples, you can also read our guide on budgeting mistakes to avoid and explore creative save money challenge ideas to stay consistent.

- Disagreements about spending priorities: One partner may prefer saving, while the other enjoys spontaneous purchases. These different money habits can easily lead to tension.

- Unequal incomes or debt levels: When one person earns significantly more or carries more debt, it can create feelings of imbalance, guilt, or resentment.

- Lack of transparency: Hiding purchases, not sharing debts, or avoiding financial discussions can damage trust in the relationship.

- Difficulty staying motivated: Couples often start budgeting with enthusiasm, but old habits and temptations can make it hard to stick to the plan.

How can we overcome it?

- Schedule regular money check-ins to discuss upcoming expenses, shared goals, and spending limits. Clear communication reduces misunderstandings.

- Instead of splitting everything 50/50, consider sharing expenses based on income percentage. Discuss debt openly and plan repayment strategies together.

- Commit to full honesty about income, debt, and spending. Use a shared budgeting app to increase visibility and reduce the risk of surprises.

- Set short-term goals, like saving for a weekend trip. Celebrate small wins together to keep morale high and progress visible.

4. FAQs about budgeting for couples

A reasonable monthly budget for a couple depends on income, location, and lifestyle. On average, a two-person household in the U.S. spends around $5,500 per month. Budgeting for couples starts with listing fixed costs (rent, utilities), variable expenses (food, transportation), and savings goals to build a realistic and flexible plan.

The 50/30/20 rule divides after-tax income into three parts: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Couples can adapt this method by combining incomes and allocating expenses accordingly. It’s a simple way to start budgeting for couples who want structure without complexity.

Start by tracking all income sources and expenses for at least one month. Categorize spending, prioritize essentials, set savings targets, and assign responsibility for bill payments. Successful budgeting for couples also means scheduling regular budget check-ins to adjust as needed.

The best way depends on your communication style and financial habits. Many couples succeed by using a joint budget for shared expenses while keeping separate accounts for personal spending. Budgeting for couples works best when both partners feel involved and empowered.

Couples can split bills equally or proportionally based on income. For example, if one partner earns 60% of the combined income, they may cover 60% of shared expenses. Clear discussions are essential to ensure fairness and support successful budgeting for couples.

Experts recommend saving at least 20% of your combined after-tax income. For a couple earning $6,000 monthly, this would be $1,200. Budgeting for couples should include both emergency savings and long-term goals like vacations, home ownership, or retirement.

Top budgeting apps for couples include YNAB (You Need A Budget), Honeydue, and Goodbudget. These tools support shared expense tracking, goal setting, and transparency. Choosing the right app can make budgeting for couples easier and more collaborative.

A typical monthly grocery budget for a couple in the U.S. ranges from $500 to $800, depending on diet, location, and cooking habits. Budgeting for couples can benefit from meal planning, shopping with a list, and using cashback or discount apps to reduce food costs.

The 70/20/10 rule suggests dividing your income into 70% for living expenses, 20% for savings or debt repayment, and 10% for charitable giving or investments. It’s a simple budgeting framework that balances financial stability with long-term goals.

Couples should start by discussing financial goals, listing all income sources, and tracking shared expenses. Choose a budgeting method like the 50/30/20 or zero-based plan and review spending together each month to stay aligned and accountable.

The 70% rule for budgeting means limiting everyday spending, such as housing, food, and utilities, to no more than 70% of your income. The remaining 30% should go toward savings, debt repayment, or discretionary spending to maintain a healthy financial balance.

5. Conclusion

Budgeting for couples isn’t just about crunching numbers; it’s about building trust, strengthening communication, and working toward shared financial goals. Whether you’re moving in together or managing long-term goals, a clear budget strengthens your relationship. It also keeps your finances secure.

If you found these tips helpful, try using our free budgeting template for couples or explore the best app for budgeting for couples in the Strategies section at H2T Funding for more practical money-saving insights.

From smart spending to long-term planning, you’ll find resources tailored to help couples make confident financial decisions together.