Have you ever asked yourself: Am I saving enough by the time I turn 25? It’s a common worry when being 25 years old, especially when you see friends posting about new apartments, cars, or investment wins. At this age, comparing yourself can feel discouraging, but the truth is, there’s no single perfect number.

So, how much money should I have saved by 25? Experts suggest aiming for about 0.5x to 1x your annual income by this age. That means if you earn $40,000 a year, you might target $20,000–$40,000 in savings (American Century, 2025). Still, this is only a guideline. Your real goal depends on income, lifestyle, debts, and personal ambitions.

This guide from H2T Funding will help you set realistic savings benchmarks. It will also help you understand the factors that shape your finances. Finally, it shows you how to start building wealth, even if you’re beginning from zero.

Key takeaways

- Age 25 is the right time to build financial independence by saving at least 10% of your income and setting clear money goals.

- A reasonable target by 25 is 0.5x–1x your annual salary.

- Factors like income, living costs, debt, family support, and personal goals strongly affect how much you can save.

- Catching up in your mid-20s is possible by focusing on an emergency fund, automating savings, investing early, and finding ways to boost income through side hustles or skill-building.

1. Why is 25 a financial milestone? Financial goals to make saving easier

At 25, you’re stepping into a stage where financial independence becomes real. It’s also a financially tricky age, since many young adults start earning a stable income, managing bills, and considering long-term goals for the first time.

This makes it the perfect time to set clear financial goals and start saving consistently, even if the amount feels small at first. Experts often recommend saving at least 10% of your income in your early 20s.

For example, if you make $40,000 a year, setting aside $4,000 annually is a healthy starting point. As your salary grows, increasing that percentage to 15–20% will help accelerate progress and give you a head start toward retirement savings.

To make saving easier, consider setting practical financial goals:

- Pay off high-interest debt early, such as credit cards or auto loans. Clearing these balances frees up more income for savings.

- Build an emergency fund with at least three months of living expenses. This acts as a safety net for job loss or unexpected costs.

- Start investing through a retirement account, ETF, or index fund. If your employer offers a 401(k) match, take full advantage; it’s essentially free money helping your savings grow faster.

By forming these habits at 25, you’re not only putting money aside but also shaping a disciplined financial mindset that will serve you for decades.

Explore more: Should I take my tax-free lump sum before the budget?

2. How much money should I have saved by 25?

By age 25, financial experts generally suggest aiming for about 0.5x to 1x your annual salary in savings. In practice, if you earn $40,000 a year, you might target between $20,000 and $40,000 set aside. This range is seen by many finance experts as a realistic ideal savings goal.

Based on median earnings reported by the Bureau of Labor Statistics in the 2nd quarter of 2025, workers aged 20–24 earn around $37,024 annually. While those aged 25–34 average $54,184. If you’ve been saving even 15–20% of income over a few years, reaching roughly $20,000 by 25 is realistic.

Still, it’s important to remember that your career path and background matter. Some people delay savings due to student loans, graduate school, or starting salaries in lower-paying fields.

Others may save more if they live with family or have lower expenses. To stay on track, focus on building habits and tracking your expenses regularly. Your journey doesn’t need to match an average; what matters is consistency and progress.

3. Factors that influence how much you should save by 25

How much you’ve saved by 25 can vary widely because everyone’s financial journey looks different. Some people may already have a cushion thanks to stable jobs or family support, while others are just starting out. The most important thing is understanding what shapes your situation:

- Income level: If you’re making $35,000 a year, saving even $3,500–$5,000 can be a strong start. Higher salaries give more room to save, but percentages matter more than absolute numbers.

- Cost of living: Rent, food, and transportation costs differ greatly between living in a major city and staying in a smaller town. Adjusting your budget and saving on groceries can help free up extra cash.

- Inflation: Rising prices over time reduce purchasing power, making it essential to save and invest strategically to protect your wealth.

- Debt obligations: Student loans, car payments, or credit card debt often take priority. Paying off high-interest debt first frees up money for savings later.

- Family support: Living with parents or receiving some financial help can boost savings faster. On the other hand, supporting family members may slow it down.

- Personal goals: Plans like buying a house, studying abroad, or traveling may shift how aggressively you save in your early 20s.

So, what if you haven’t saved anything yet?

The answer is that the past is irrelevant. Your focus now is on building the right system for the future. Don’t worry about the 10–20% rule yet; start by automating just 5% of your income. Building systems to improve your personal cash flow is the most critical first step to building wealth.

Continue reading:

4. How to catch up financially in your mid-20s

Falling behind on savings at 25 can feel discouraging, but it doesn’t mean you’ve failed. Your mid-20s are still the perfect time to reset and move forward. With the right habits, progress can come faster than you expect.

- Emergency fund first: Having three months of living expenses in a separate account brings peace of mind and prevents you from relying on debt during tough times. Consider building a sinking fund to prepare for large or irregular expenses.

- Automated savings: Setting up automatic transfers ensures you save consistently without relying on willpower, leaving less room for excuses.

- Early investments: Even if it’s just $50 or $100 a month, putting money into ETFs or index funds helps you take advantage of compounding while you’re still young. Learn the pros and cons of saving vs. investing to create a balanced strategy.

- Income growth mindset: Taking on freelance projects, side hustles, or learning new skills can open doors to higher pay and faster wealth-building opportunities.

Each step you take is a personal choice that strengthens your future. What matters most is not catching up overnight but building steady momentum that keeps you moving forward.

5. Tips to build better saving habits at 25

Saving money becomes much easier when you turn it into a habit rather than a stressful task. At 25, the goal is to create routines that feel natural and sustainable over time.

- Use a simple rule of thumb: Frameworks like the 50/30/20 or 70/20/10 rule help you divide income into needs, wants, and savings. This gives structure without overcomplicating budgeting.

- Set clear financial goals: Whether it’s $5,000 for travel, $10,000 for an emergency fund, or saving for a down payment, having specific targets keeps you motivated.

- Leverage financial apps: A good budgeting app can track your spending and even automate transfers into savings accounts. Pairing this with cashback tools on everyday purchases adds extra money without extra effort. When saving feels effortless, it becomes a lifestyle instead of a chore.

- Avoid comparisons: Watching peers buy cars or houses can create unnecessary pressure. Focus on your own progress; every dollar saved is a step toward independence, not a race with others.

Strong habits built now won’t just improve your savings at 25 but will carry over into your 30s and beyond. They also give you a sense of financial confidence that keeps growing with time. Starting small today can make a surprisingly big difference in the years ahead.

Read more helpful articles:

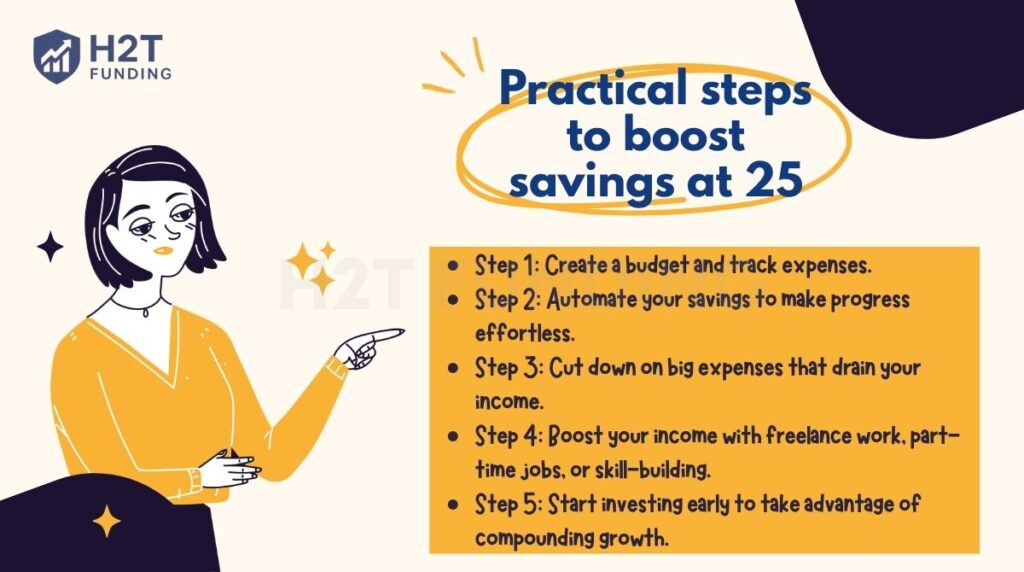

6. Practical steps to boost savings at 25

Knowing how much money should I have saved by 25 is only part of the journey. The real difference comes from taking small, consistent actions that strengthen your financial foundation.

Here’s a quick overview of the steps you can start today:

- Step 1: Create a budget and track expenses.

- Step 2: Automate your savings to make progress effortless.

- Step 3: Cut down on big expenses that drain your income.

- Step 4: Boost your income with freelance work, part-time jobs, or skill-building.

- Step 5: Start investing early to take advantage of compounding growth.

Each step is designed to be actionable and simple to implement. Let’s dive deeper into each one:

6.1. Step 1: Create a budget and track expenses

A budget is like a mirror that shows where your money truly goes. Use a simple spreadsheet or a budgeting app to monitor daily spending. Identifying small leaks, like $5 coffees or forgotten subscriptions, can free up money you didn’t realize you were wasting.

Personal tip: I once cut two unused streaming services, saving $20 a month, which turned into $240 a year, and added it to my emergency fund.

6.2. Step 2: Automate your savings

Setting up an automatic transfer to savings ensures you always put money aside before spending it. Treat it like paying yourself first. This method works because it removes the need for constant self-control.

6.3. Step 3: Cut down on big expenses

Housing, transportation, and food often eat the largest part of your income. Sharing rent with roommates, biking instead of driving, or cooking at home can make a big difference.

Personal tip: I started meal-prepping on Sundays. Spending $40 on groceries saved me from $100 worth of takeout each week.

6.4. Step 4: Boost your income

Sometimes the fastest way to save more is to earn more. Freelancing, part-time jobs, or negotiating a raise can accelerate your progress. Building skills that lead to better pay is also an investment in yourself.

For me, the fastest path forward was boosting my income. I dedicated my Saturday mornings to freelance writing; it wasn’t always glamorous, but that extra $400 a month wasn’t just “play money”. It is what allowed me to open my first real investment account without touching my primary salary.

6.5. Step 5: Start Investing Early

Even small investments today can grow into something much bigger over time. Index funds, ETFs, or retirement accounts are great starting points. Diversification protects you from putting all your eggs in one basket.

Strong savings habits don’t need to start perfectly. What matters is finding systems that work for you and sticking with them. Each small action, whether it involves cutting costs, automating processes, or investing, adds up to a stronger financial foundation.

7. What if you haven’t achieved your goals by age 25?

Feeling behind at 25 is a common data point, not a personal failure. Many young adults feel pressure from today’s economic climate and rising inflation, which makes early savings harder than ever.

My own progress accelerated when I stopped focusing on the large savings goal, which felt paralyzing, and focused on perfecting my system instead.

The most effective strategy was simple: I set up a non-negotiable, automated transfer into my investment account for the day after I got paid. The amount was small at first, but the consistency was what mattered.

This is the tactical shift you should make: Stop managing your motivation and start managing your automation. A reliable system is far more powerful than feelings of encouragement or guilt. Focus on building that system, and the results will eventually follow.

Here are strategies that worked for me and many others:

- Stay encouraged: Many people don’t reach major savings milestones until their late 20s or 30s. Falling short at 25 doesn’t define your financial future.

- Start where you are: Even if your balance is zero, beginning now sets you ahead of the many who delay saving further. Every dollar you put away builds momentum.

- Focus on progress, not perfection: Small, consistent contributions—like saving $100 a month matter. Over time, these add up and teach discipline.

- Adjust your plan: Life changes quickly in your 20s. If your goals feel too ambitious, revise them to fit your current reality. It’s better to save something sustainable than to give up entirely.

- Seek guidance: If you feel lost, talking with a financial advisor or mentor can give clarity and help you avoid common mistakes.

Falling short at 25 is not the end of the story; it’s just the starting point for building smarter habits. What matters most is moving forward, one step at a time.

8. Community discussion

When it comes to the question how much money should I have saved by 25 Reddit?, the answers from real people show how diverse the experiences can be. Not everyone follows the same path, and that’s completely normal.

One perspective comes from Quora, where a former pilot shared advice passed down from his father. Instead of focusing only on saving, he emphasized the importance of investing in relationships and opportunities during your 20s.

Building connections, gaining experiences, and staying flexible with renting rather than rushing to buy a house can provide long-term financial benefits. His message was clear: saving matters, but so does investing in yourself and your network.

On Reddit, a 25-year-old user admitted to just starting their savings journey, with only about $500 put aside so far. Despite feeling behind, they opened a Roth IRA and began learning about personal finance. Their story highlights that it’s never too late to begin, and small, consistent steps can lead to bigger wins over time.

Meanwhile, also on Reddit, discussions show that many 25-year-olds are still figuring things out. Some are in school, others are just starting careers, and a few are already ahead.

The takeaway is that everyone’s timeline looks different, and comparing yourself too harshly can create unnecessary stress. What matters most is finding a system that works for your own circumstances.

These community voices remind us that saving by 25 doesn’t follow a single formula. Some people save early, others start late, but progress is possible at any stage if you take consistent action.

9. FAQs

Yes, $10,000 is a solid start at 25, even if it’s below the expert guideline of 0.5x–1x annual income. The important part is consistency; if you keep building from there, you’re on track.

Both matter, but the balance depends on your situation. Prioritize an emergency fund first, then split extra money between savings and low-risk investments like index funds.

A good net worth often ranges from 0.25x to 1x your annual salary, depending on debt and assets. What matters most is avoiding high-interest debt and growing steadily each year.

Not at all; it’s never too late. Start with a realistic percentage, like 10% of your income, and focus on building habits. Many people don’t begin saving until later.

Aim for at least three months of essential living expenses. If your costs are $2,000 a month, that means about $6,000 in a separate, easily accessible account.

Most experts recommend saving 15–20% of income. If that feels impossible, start with 5–10% and increase gradually as your earnings grow.

Focus on clearing high-interest debt first, such as credit cards. At the same time, keep a small emergency fund so you don’t fall back into debt during unexpected expenses.

By 26, try to reach at least 0.75x–1x your annual salary. For someone earning $50,000, that’s $37,500–$50,000. It’s a guideline, not a strict rule.

At 24, having 0.25x–0.5x your salary is a healthy range. For example, with $40,000 income, that’s $10,000–$20,000. Even less is fine if you’re just starting.

According to Federal Reserve data, the average American under 35 has about $20,540 saved. Keep in mind this includes a wide range of incomes, so your number may differ.

10. Conclusion

There is no perfect number you must hit by age 25. What truly matters is that you start saving, stay consistent, and build habits that support your future. Everyone’s path looks different, and that’s okay. Progress always counts more than comparison.

No matter where you are right now, it’s never too late to build smart financial habits. Begin with small, realistic goals and keep adjusting as your income and priorities change.

So if you’re wondering how much money should I have saved by 25, the best answer is to start where you are. Set achievable milestones. Keep moving forward one step at a time.

Want more practical tips to take control of your money? Explore the Cash Flow & Saving Strategies section at H2T Funding and learn how to create a plan that works for your lifestyle.