Let’s be honest. In the world of trading, we love to talk about our wins. A high win rate feels good, it looks good on a spreadsheet, and it’s a great boost to the ego. But it’s a vanity metric. It doesn’t tell the real story of risk, and it certainly doesn’t determine your long-term success.

The real story is told in the moments of struggle. These are the painful, gut-wrenching periods when your account balance goes down, not up. Your ability to survive and thrive is defined by how you handle these periods. This is why you must understand what is drawdown in trading, as it is the most critical concept in risk management.

1. What is drawdown in trading? A simple definition

So, let’s get right to the core question: what is drawdown in trading?

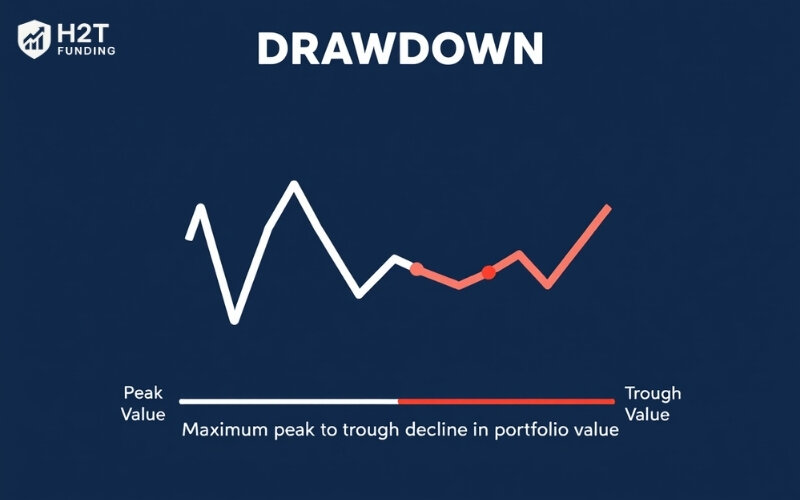

Simply put, drawdown is the measurement of your account’s decline from its highest point (a peak) to its lowest point (a trough) within a specific period.

Think of your account balance like a mountain climber. The peak is the highest altitude they have ever reached. The drawdown is the necessary descent into a valley before they can begin climbing the next, hopefully even higher, mountain. It measures the depth of that valley.

This concept is universal across all markets. The drawdown forex meaning is exactly the same as it is for stocks or futures. It is the truest measure of a strategy’s volatility and historical risk.

2. Why does drawdown matter in your trading?

So why are we so obsessed with this one metric? It’s because drawdown tells you more about your trading than almost any other number. In my experience, it’s the true dividing line between someone who just gets lucky and someone who has a professional, sustainable strategy.

Here’s why it matters so much:

2.1. It measures your emotional resilience

Let’s be real: anyone can handle winning. The real question is, can you handle losing? A drawdown is a direct measure of the psychological pressure you will face. Knowing your strategy has a historical 15% maximum drawdown prepares you mentally for that difficult period.

Without that knowledge, a 10% dip can feel like the end of the world, leading to panic and bad decisions.

2.2. It defines your strategy’s true character

A high win rate with a massive drawdown is the sign of a fragile, high-risk strategy. It might look good for a while, but it’s a ticking time bomb. On the other hand, a strategy with modest returns but a very small drawdown is robust, stable, and built to last. It shows you can generate profit without risking a catastrophic failure.

2.3. It’s the language of professional capital

When you want to trade for a prop firm, manage investor capital, or even just prove your skill, no one will be impressed by a few lucky wins. They will immediately ask about your maximum drawdown. A low, controlled drawdown is the ultimate proof that you are not a gambler, but a disciplined risk manager. It’s the key that unlocks the door to trading with serious capital.

3. Types of drawdowns

Once you understand the basic concept of drawdown, it’s time to look at it the way professionals do. In my experience, not all drawdowns are created equal. Here are the different types and what they really tell you about a trading strategy.

3.1. Maximum Drawdown (MDD)

This is the most important one. It measures the single largest drop your account has ever experienced from its highest point to its lowest point, representing the worst-case scenario your strategy has survived.

A tale of two traders: Who is the better trader?

Consider two traders, Alex and Ben, both starting with $100,000. Alex, a cautious trader, finished the year with $115,000. His maximum drawdown (MDD) was a mere 5%, falling from $110,000 to $104,500. His trading journey was smooth and stable.

Ben, an “all-in” trader, ended the year with $118,000, slightly more than Alex. However, his account surged to $150,000 before a losing streak dropped it to $105,000. Ben’s MDD was a significant 30%, indicating a highly volatile and risky trading style.

Despite Ben’s slightly higher final balance, Alex is considered the better trader. Professional fund managers prioritize lower drawdown, as a 30% MDD suggests an unsustainable and high-risk strategy. Alex’s returns are more predictable and stable, allowing for peace of mind and long-term viability.

3.2. Average drawdown

This gives you a feel for the typical, or “normal,” dip your strategy experiences on a more regular basis. It helps you understand how volatile the trading journey will be day-to-day.

3.3. Calmar ratio (A related metric)

While not a type of drawdown itself, this performance ratio is directly related. It compares your annual return to your maximum drawdown to measure how much profit you’re getting for the amount of risk you take.

4. Risks of drawdown in trading

Understanding drawdown is critical because it reveals three hidden dangers that go beyond just the financial loss:

- It’s a test of your strategy. Analyzing your drawdown history gives you an honest look at your system’s true risk. This insight allows you to make informed decisions to improve your strategy and reduce future losses.

- It’s a test of your personality. A drawdown forces you to confront your personal risk tolerance. Choosing a strategy with a drawdown profile that matches your comfort level is key to avoiding emotional decisions and sticking with your plan.

- It highlights the cost of time. A major, often overlooked risk is the recovery time. The longer it takes for your strategy to get back to its previous peak after a dip, the more opportunity cost you lose where your capital isn’t growing.

Read more related articles:

5. The critical difference: Drawdown vs Loss

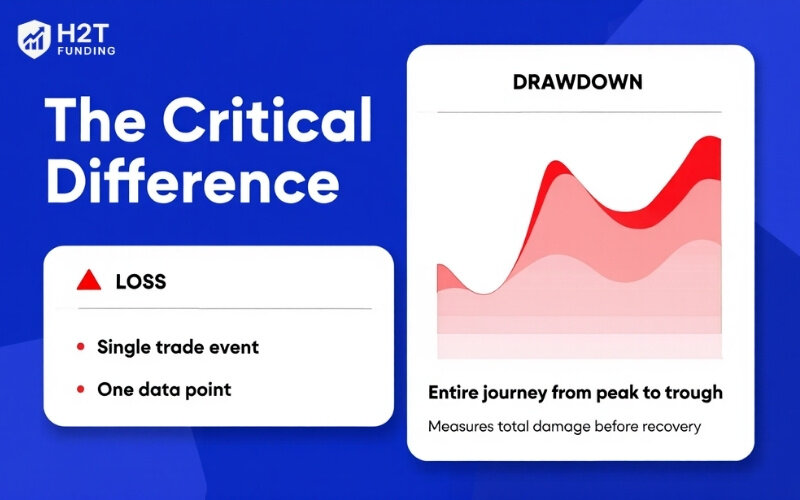

Now that we have a clear definition, it’s vital to distinguish it from a simple loss. Although the two concepts are connected, they each reveal a vastly different aspect of performance. To truly understand your risk as a trader, you must first clearly distinguish between a drawdown and a simple loss.

- A loss is a single event. You close one trade for less than you entered it for. It’s one data point.

- A drawdown is the entire journey. It is the full peak-to-trough decline of your account’s value and can be made up of many losses. It measures the total damage done before a recovery begins.

6. How to calculate drawdown (with a practical example)

To properly manage something, you first have to measure it. The good news is that learning how to calculate drawdown in trading is straightforward.

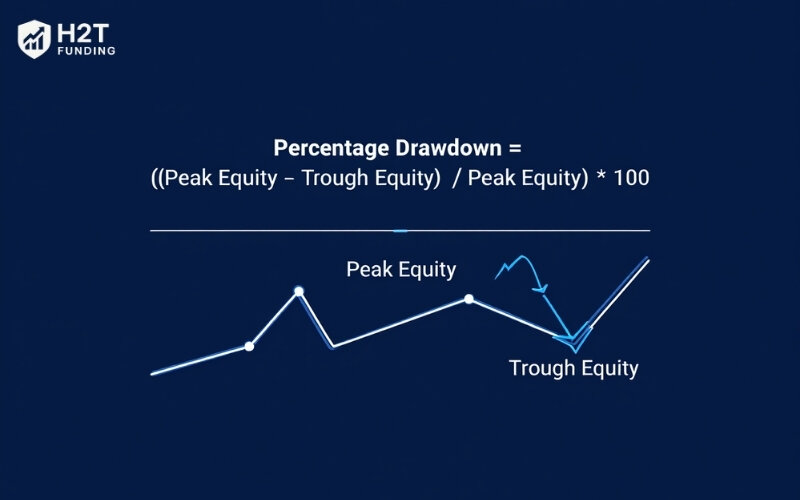

The formula is: Percentage Drawdown = ((Peak Equity – Trough Equity) / Peak Equity) * 100

Let’s walk through a real-world scenario:

- You start with a $25,000 account.

- After a good run, your account equity hits a new high of $27,500. This is your new Peak.

- You hit a rough patch. A series of losing trades brings your account down to $25,900. This is your current Trough.

- Your drawdown for this period is now calculated from the most recent peak:

- Dollar drawdown: $27,500 (Peak) – $25,900 (Trough) = $1,600

- Percentage drawdown: ($1,600 / $27,500) * 100 = 5.82%

7. The rules of the game: Prop firms and drawdown

For anyone looking to get funded, you must live and breathe drawdown trading rules. Prop firms are obsessed with drawdown because they are managing their capital, not yours.

These firms enforce a Maximum Drawdown, which is a hard floor your account cannot fall below. They also use a Daily Loss Limit to prevent a single bad day of emotional trading. Crucially, they watch your equity drawdown vs balance drawdown. They don’t care about your closed balance; they watch your real-time equity, including open trades, as this shows their true risk exposure.

8. How to manage drawdown in trading: A survival guide

You cannot avoid drawdowns, but you can control them. This is where amateurs fail and professionals thrive.

- Embrace the stop-loss: This is your most fundamental tool. It removes emotion and ensures no single trade can cause a catastrophic loss.

- Respect the 1-2% rule: Never risk more than 1-2% of your account on a single trade. This mathematical discipline is the core of professional survival.

- Know your history: Backtest your strategy. Knowing your historical MDD gives you the confidence to stick to your plan during a losing streak.

- Reduce size in a slump: When you’re in a drawdown, get defensive. Reduce your position sizes to minimize further losses and trade with less emotional pressure.

- Take a break and review: After a string of losses, step away from the charts. Review your journal. Prevent “revenge trading” and ensure you only trade with a clear mind.

9. Frequently asked questions (FAQs) about trading drawdown

There’s no single number. It depends on your strategy’s risk level. For prop firm traders, a “good” percentage is simply one that stays safely within their rules.

Not always, but it’s a critical warning. If your current drawdown is much larger than your strategy’s historical MDD, you must stop and find out why.

Balance drawdown tracks your closed trades (the past). Equity drawdown tracks your real-time account value, including open trades (the now). Prop firms only care about equity drawdown.

No, it’s impossible. Drawdowns are a normal, expected part of trading. The goal is to manage them, not to avoid them.

There’s no set time. The biggest danger is trying to rush the recovery, which often leads to bigger losses. Discipline, not speed, is the key to getting back to a new peak.

10% drawdown means your account’s equity has dropped by 10% from its highest point. If your account peaked at $120,000, a 10% drawdown means it fell by $12,000. In prop trading, this is often the maximum drawdown allowed, so my personal goal is to always keep my strategy’s risk well below this critical limit.

Imagine your account grows to a new peak of $11,500. After a few losing trades, it drops to $10,800 before starting to recover. That $700 dip from the peak is your drawdown. It’s not just one loss; it’s the total decline from the highest point.

In my world, this almost always refers to the Daily Loss Limit used by prop firms. It means your account can’t lose more than 5% in a single day. I see it as a crucial discipline tool that prevents one bad day of emotional “revenge” trading from ruining your entire evaluation.

10. Conclusion: Become a risk manager, not a return chaser

So, what is drawdown in trading? Drawdown is more than a number on a performance report. It’s the ultimate test of a trader. It’s the crucible where discipline is forged, and strategies are proven. Anyone can get lucky on a few trades; only a true professional can navigate a deep drawdown and live to trade another day.

The journey to becoming a consistently profitable trader is a journey of mindset shift. You must evolve from being a “return-chaser,” focused only on the upside, to becoming a dedicated “risk manager,” whose primary job is capital preservation. Profit is not something you hunt; it is the natural byproduct of excellent risk management.

So, don’t fear drawdown. Embrace it. Study it. Respect its power. By learning to control it, you are not just protecting your account; you are building the foundation of a long and successful trading career. Master your risk, and the returns will take care of themselves.

Understanding drawdown is a huge step forward. If you’re ready to explore other essential topics that will help you on your path to getting funded, I highly recommend diving into H2T Funding‘s other guides in our Strategies: Prop Firm & Trading Strategies.