That staggering 82% of small businesses fail over cash flow or budgeting issues isn’t just a statistic; it’s a warning. This is why mastering what are the 7 types of budgets isn’t just a ‘nice-to-have’; it’s a core survival skill.

But how do they actually work together? And which ones matter most for your business stage?

This guide from H2T Funding makes budgeting simple by showing how the seven main types work and which ones to focus on first. Think of it as your framework for smarter planning and stronger growth.

Key takeaways:

- The seven types of business budgets include master, operating, cash flow, financial, capital, static, and flexible, each serving a specific role in planning and managing performance.

- Understanding the seven types of budgets helps businesses plan smarter, allocate resources efficiently, and maintain financial health.

- Small businesses often rely most on operating and cash flow budgets to manage daily operations and liquidity.

- The master budget combines all other budgets, offering a comprehensive view for strategic planning.

- Capital and financial budgets guide long-term investments, funding needs, and balance sheet projections.

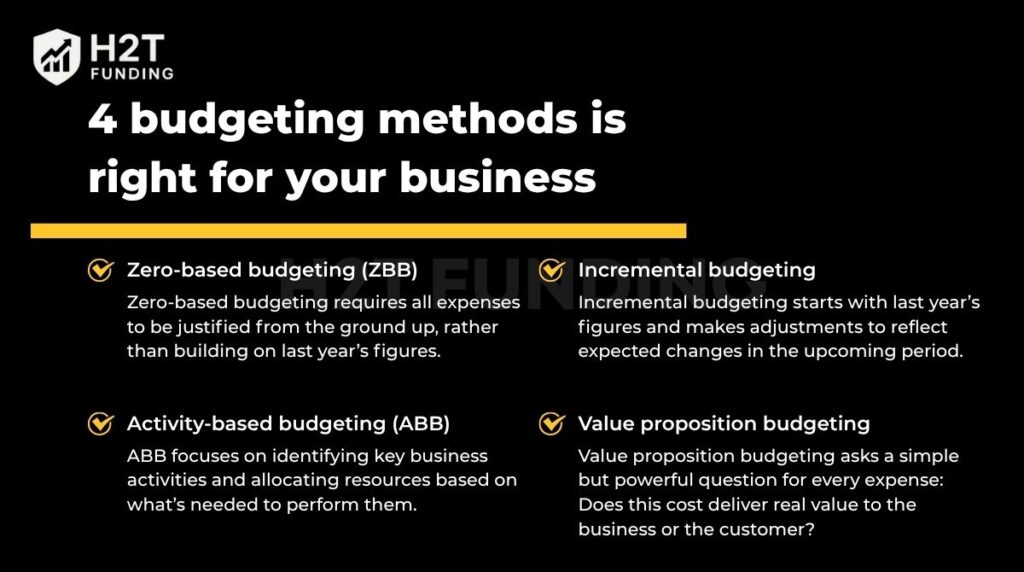

- Budgeting methods like zero-based, incremental, activity-based, and value-proposition serve different business needs and stages.

1. What is a business budget, and why is it crucial?

A business budget is a structured financial plan that outlines a company’s expected income and expenses over a specific period.

Rather than just tracking numbers, it helps businesses forecast performance, set priorities, and manage limited resources wisely.

Here’s why budgeting is essential for every business:

- Supports better decisions by providing a clear picture of financial capacity.

- Helps allocate resources effectively, including cash, labor, and time.

- Sets financial goals and provides a baseline for tracking progress.

- Prevents overspending and improves cash flow stability.

- Strengthens planning and improves communication with investors or lenders.

Creating a well-structured budget is about understanding what a budget can help you do to guide your business toward smarter growth and sustainability. At the same time, it’s equally important to stay aware of common budgeting mistakes to avoid that can derail your financial goals.

Ultimately, a budget transforms financial guesswork into a strategic roadmap, giving you the control and confidence to grow.

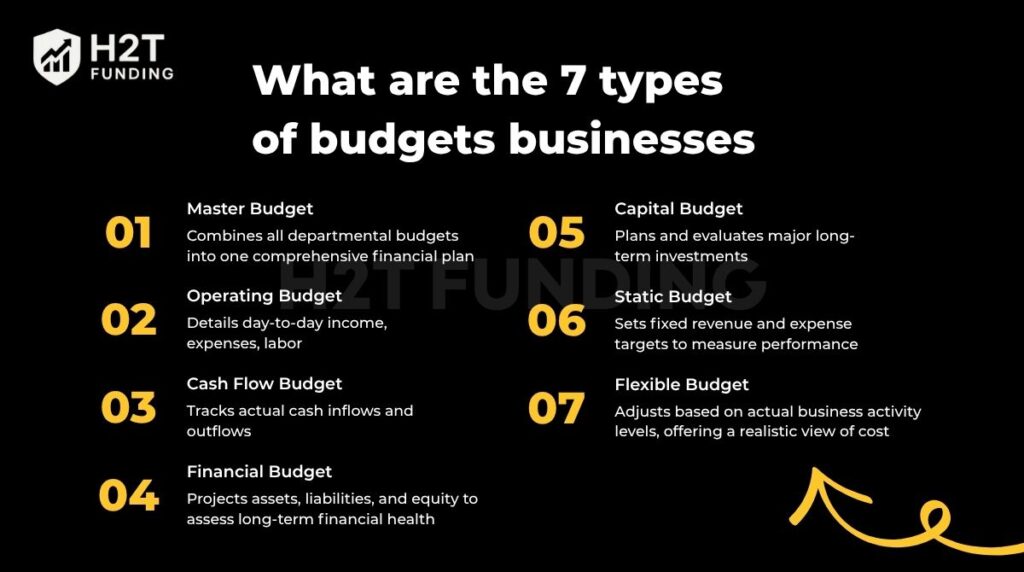

2. What are the 7 types of budgets businesses commonly use?

While there are many ways to manage business finances, what are the 7 types of budgets that companies rely on the most? These are the core budget types widely adopted across industries for their clarity, structure, and strategic value.

Each budget serves a unique role, from planning long-term investments to managing daily expenses. Understanding the distinctions between them will help you build a complete financial system that supports both operations and growth.

Here’s a quick overview of the seven most common business budgets and what they’re used for:

| Budget Type | Main Purpose | Best For |

|---|---|---|

| Master Budget | Combines all departmental budgets into one comprehensive financial plan, giving leaders a complete view of business performance. | Large organizations or companies are preparing for an investor review. |

| Operating Budget | Details day-to-day income, expenses, labor, and overhead to manage ongoing operations effectively. | Small to medium businesses tracking regular revenue and costs. |

| Cash Flow Budget | Tracks actual cash inflows and outflows to ensure liquidity and prevent shortfalls. | Businesses manage short-term cash positions and payment schedules. |

| Financial Budget | Projects assets, liabilities, and equity to assess long-term financial health and stability. | Companies are seeking funding or planning long-term strategies. |

| Capital Budget | Plans and evaluates major long-term investments such as new equipment, facilities, or expansions. | Businesses pursuing growth or infrastructure projects. |

| Static Budget | Sets fixed revenue and expense targets to measure performance against expectations. | Stable industries with predictable costs and revenues. |

| Flexible Budget | Adjusts based on actual business activity levels, offering a realistic view of cost and performance changes. | Dynamic businesses with fluctuating sales or production levels. |

Let’s take a closer look at these seven essential types of budgets and how they work in practice.

Read more:

2.1. The master budget: An overview of your entire financial plan

The master budget is the central hub of a company’s financial planning. It brings together all individual departmental budgets into one comprehensive overview, helping business leaders understand how various functions connect financially.

A master budget typically consists of two key parts:

- Operating budget: Covers day-to-day income and expenses such as sales, production, labor, and overhead.

- Financial budget: Focuses on broader elements like cash flow, capital structure, and projected balance sheets.

Together, these elements form a high-level map of how the business expects to perform over a fiscal period.

This type of budget is especially important for larger organizations or businesses preparing for investor review. Consolidating projections from across departments gives executives the visibility they need to make strategic, company-wide decisions.

Continue reading: 8 Smart Budgeting for Couples to Make Big Goals Together

2.2. The operating budget: Managing day-to-day revenue and expenses

The operating budget is the workhorse of your financial plan, detailing the day-to-day reality of earning revenue and paying your bills. For most small to mid-sized businesses, this is the budget they’ll interact with the most.

It’s built from interconnected parts:

- Sales budget: How much do you expect to sell?

- Production budget: What you need to make or buy to meet those sales.

- Labor budget: The cost of the team needed to do the work.

- Overhead budget: The cost of keeping the lights on, rent, utilities, etc.

- Cash budget: A short-term plan to ensure liquidity while managing operational needs.

Why does this matter? I once worked with a small e-commerce brand that had fantastic sales projections. However, their operating and cash budgets didn’t properly account for rising shipping material costs and a necessary increase in their digital ad spend.

Halfway through the quarter, they had to pause their campaign because labor budget overruns and overhead costs drained available cash, a classic traditional budgeting oversight.

2.3. The cash flow budget: Tracking the movement of cash

Profit is a theory, but cash is king, and it pays the bills. A glowing income statement means nothing if you can’t make payroll. That’s where the cash flow budget becomes your most important tool. It tracks the actual inflows and outflows of cash over a specific period: weekly, monthly, or quarterly.

This type of budget helps businesses:

- Anticipate when cash will be available.

- Ensure there’s enough liquidity to cover short-term expenses like salaries, rent, and supplier payments.

- Identify potential cash shortages before they become critical.

Unlike income statements, which include non-cash items, the cash flow budget shows real-time financial health. Understanding this tool is crucial because even profitable businesses can fail if they run out of cash.

To strengthen your financial resilience, it’s wise to automate your savings and build an emergency buffer using an emergency fund calculator. Both of which can help your business stay ready for unexpected challenges.

2.4. The financial budget: Focusing on financial health and strategy

The financial budget provides a broader view of projected assets, liabilities, and equity. While the operating budget manages revenue and expenses, this section connects with cash budget forecasting to give leaders insights into future performance.

It typically includes:

- Pro forma balance sheet: Shows what the financial position of the company will look like.

- Cash flow statement: Forecasts how cash will move through the business.

- Income statement: Estimates profit or loss based on projected revenues and expenses.

This type of budget is especially important when seeking funding or presenting to investors. It offers a snapshot of long-term financial health and supports big-picture planning.

A well-structured financial budget helps leadership make informed strategic decisions and prepare for future growth or risk.

2.5. The capital budget: Planning for major long-term investments

The capital budget is used to evaluate and plan for significant, long-term investments. These include buying new equipment, expanding facilities, upgrading technology, or launching infrastructure projects.

Unlike other types of budgets in business that focus on short-term operations, this one supports strategic decisions that impact a company’s future competitiveness.

The process involves:

- Identifying potential capital projects.

- Estimating costs and expected returns.

- Performing return-on-investment (ROI) analysis to assess financial viability.

Imagine a successful local bakery wanting to expand. Without a formal capital budget, they might only calculate the cost of the new oven and the lease.

But a proper capital budgeting process forces them to ask tougher questions: What about the costs of training a new team, marketing the launch, and the potential for the new location to run at a loss for the first six months?

I’ve seen businesses put their entire operation at risk by jumping into major investments without this long-term analysis. The capital budget is your safeguard against passionate but poorly planned growth.

2.6. The static budget: A benchmark based on fixed expectations

A static budget is prepared based on a single, fixed level of activity, such as producing 10,000 units. It remains unchanged regardless of actual performance or changes in business conditions.

This budget type serves as a benchmark to compare actual results against planned figures, helping businesses identify variances.

Typically, the static budget is used to:

- Set fixed targets for revenue and expenses.

- Provide a clear baseline for performance evaluation.

- Highlight areas where costs or revenues differ from expectations.

While simple and easy to create, the static budget does not adapt to real-world fluctuations, which can limit its usefulness in dynamic environments. Nevertheless, it remains a valuable tool for variance analysis and accountability.

2.7. The flexible budget: Adapting to your actual business activity

Unlike the static approach, flexible budgeting adjusts with activity levels, providing a fair comparison between planned and actual figures. For example, if your company sells 12,000 units instead of the planned 10,000, the flexible budget recalculates costs and revenues accordingly.

This adaptability is especially useful when paired with rolling budgeting and ongoing forecasting, helping managers respond quickly to real-world changes.

Key benefits include:

- Reflecting changes in sales volume or production levels.

- Helping managers understand cost behavior under different scenarios.

- Improving decision-making by providing realistic financial targets.

By using a flexible budget, businesses can better control costs and respond to market fluctuations, making it an essential tool for dynamic environments.

3. What are the five basic elements of a budget?

After exploring what are the 7 types of budgeting, it’s equally important to understand the five basic elements that make any budget work in real life. These components are the building blocks behind every financial plan, whether you’re running a business or managing your household income.

3.1. Income

Business income includes all sources of revenue: product sales, service fees, interest income, royalties, or licensing deals. It’s not about what you expect to earn but what actually comes in. A budget built on unrealistic revenue projections can lead to overextension and cash flow issues.

3.2. Fixed expenses

These are the predictable, recurring costs necessary to keep your business running: office rent, full-time salaries, insurance, and long-term software subscriptions. Mapping them out early helps prioritize essential spending and avoid late payments or operational disruptions.

3.3. Variable expenses

Variable costs change with the level of business activity. These include utilities, raw materials, temporary staff, commissions, or marketing spending. Monitoring this category closely gives managers more flexibility when revenues dip or when scaling up quickly.

3.4. Savings (or retained earnings)

In a business context, this refers to profits intentionally retained for reinvestment, emergency reserves, or future initiatives. Prioritizing savings, even in small amounts, builds resilience and enables long-term planning.

3.5. Debt repayment

Many businesses rely on credit lines, loans, or equipment financing, but repayment planning must be built into the budget. This includes scheduled loan repayments, interest payments, and early payoff strategies to reduce long-term liabilities.

Once these five elements are clearly defined and tracked, businesses are in a far stronger position to implement structured models, like what are the 7 types of budgeting. The result is a budget that’s not only comprehensive but grounded in real numbers, real priorities, and real financial discipline.

Read more useful articles:

4. 4 budgeting methods: Which one is right for your business?

Now that you know what, let’s talk about how. Choosing the right budgeting method is just as important as knowing the types of budgets you need to create.

While some methods are designed for control and efficiency, others are better for flexibility or strategic alignment. The right fit depends on your company’s goals, structure, and resources.

Let’s explore four widely used types of budgeting strategies, along with their pros and cons, so you can decide which one works best for your business model.

4.1. Zero-based budgeting (ZBB)

Zero-based budgeting requires all expenses to be justified from the ground up, rather than building on last year’s figures. This method questions every cost, promoting a culture of accountability and helping companies redirect resources to where they truly matter.

It’s a powerful strategy for cutting waste and realigning spending with current goals, but it demands time, attention to detail, and disciplined execution.

| Pros | Cons |

|---|---|

| Eliminates outdated or unnecessary spending | Time-consuming and resource-intensive to implement annually |

| Drives transparency and accountability across departments | May overlook foundational costs that aren’t easily quantified |

| Ensures every dollar is tied to a clear business need | Requires experienced financial teams and detailed documentation |

| Helps detect and correct inefficient or bloated budget areas | Can create internal pushback due to constant justification of activities |

| Best for: Startups, companies restructuring, or businesses aiming to reduce overhead | |

ZBB gives you full control over every line item, but it works best when the leadership is ready to challenge the status quo.

4.2. Incremental budgeting

Incremental budgeting is one of the simplest and most widely used budgeting methods. It starts with last year’s figures and makes adjustments, usually small increases or decreases, to reflect expected changes in the upcoming period.

This method is fast, predictable, and easy to manage. However, it can also carry over inefficiencies or outdated assumptions if not reviewed carefully.

| Pros | Cons |

|---|---|

| Easy to implement and understand | May perpetuate past inefficiencies or misallocations |

| Saves time and reduces administrative burden | Can discourage innovation or critical evaluation of spending patterns |

| Useful for stable environments with few operational changes | Not ideal for fast-growing or rapidly changing businesses |

| Provides consistent year-over-year comparisons | Often lacks alignment with strategic goals or performance outcomes |

| Best for: Established businesses with predictable operations, stable cash flow, or limited internal resources for budgeting. | |

For stable businesses, this method is a time-saver. Just be sure to pair it with a deeper review every few years to ensure your budget hasn’t gone stale.

4.3. Activity-based budgeting (ABB)

ABB focuses on identifying key business activities and allocating resources based on what’s needed to perform them. Rather than budgeting by department, ABB asks: What activities drive our goals, and what do they cost?

ABB offers a deeper, more strategic view of spending. It links every dollar to a specific output or operational objective, making it ideal for businesses focused on efficiency and performance.

| Pros | Cons |

|---|---|

| Connects spending directly to operational drivers and outcomes | Complex to set up and maintain, especially for large or diverse organizations |

| Improves cost transparency across the entire value chain | Requires detailed data collection and activity tracking |

| Helps identify non-value-adding activities to eliminate waste | It may be difficult to apply in departments with intangible or variable activities |

| Aligns budget closely with strategy and performance metrics | Time- and resource-intensive, especially for companies without established costing systems |

| Best for: Medium to large businesses looking to link costs to outputs, especially in manufacturing, logistics, or service-oriented operations. | |

ABB takes more effort to implement, but the payoff is a budget that mirrors real business mechanics, enhancing both visibility and accountability.

4.4. Value proposition budgeting

Value proposition budgeting asks a simple but powerful question for every expense: Does this cost deliver real value to the business or the customer? If the answer isn’t clear, the expense is reconsidered or cut.

This method shifts the budgeting conversation from cost control to value creation. It’s especially useful for organizations focused on strategic alignment, innovation, or customer-centric growth.

| Pros | Cons |

|---|---|

| Ensures every dollar spent supports business value or customer benefit | Difficult to quantify “value” objectively, especially across departments |

| Encourages strategic thinking and alignment across the organization | Risk of underfunding long-term initiatives with delayed or intangible returns |

| Helps eliminate spending that doesn’t contribute to outcomes | Requires strong leadership, judgment, and consistent communication |

| Fosters a culture of accountability tied to results | It can become subjective if not grounded in clear performance criteria |

| Best for: Vision-driven businesses, customer-focused teams, or companies undergoing digital transformation or strategic repositioning. | |

Value proposition budgeting promotes smarter, more intentional spending, but it relies on clarity of purpose and shared understanding of what truly matters.

5. Tips for successfully applying budgeting methods in your business

Choosing the right budgeting method is only the first step. To get the most value from your budget, it’s essential to implement it thoughtfully. Here are some practical tips to help you apply budgeting strategies effectively:

- Understand your business needs first: Assess your company size, complexity, and goals before selecting a budgeting method.

- Ensure data accuracy: Reliable financial and operational data is the foundation of any budgeting approach. Invest in good systems and regular updates.

- Engage key stakeholders: Involve department heads and finance teams early to gain buy-in and improve budget realism.

- Communicate clearly: Explain the budgeting process and goals to all involved to reduce resistance and confusion.

- Review and adjust regularly: Budgets should be living documents; periodically revisit and refine them based on actual results and changing conditions.

- Train your team: Provide guidance and resources so employees understand their role in budgeting and can contribute effectively.

- Combine methods if needed: Many businesses benefit from blending approaches, like using incremental budgeting for stable areas and zero-based budgeting for cost control.

By following these tips, your budgeting process will be more accurate, flexible, and aligned with your company’s strategy.

Furthermore: How to choose a prop firm in 2026 – 10 expert tips

6. How to choose the right type of budget

Choosing the right type of budget is about finding what helps you understand your numbers and make better decisions. Each budget serves a different purpose, and the right one depends on your goals, business stage, and the level of control you want.

Start by asking a simple question: What do I need my budget to do right now?

If you want to manage daily income and expenses, an operating budget or cash flow budget is a strong foundation. They help you see where money goes, spot shortfalls early, and stay ahead of bills or payroll.

When you start thinking long-term, move toward a financial budget or capital budget. These give a broader view, showing how today’s choices affect future growth, investment, or debt management.

For businesses in fast-changing markets, a flexible budget can make a real difference. Designed to shift with your activity level, this approach helps you react quickly without losing control. A flexible plan is also one of the most practical ways to maintain stability when conditions change.

Or if you prefer an all-in-one overview, the master budget ties everything together. This framework connects income, expenses, and forecasts into one clear picture, ideal for long-term planning and keeping departments aligned under a shared goal.

There’s no single “best” approach. The key is to start with the budget that matches your needs today, then refine it as you grow. A well-chosen budget is a system that helps you think clearly, plan confidently, and move with purpose.

7. Frequently asked questions (FAQs)

The term 7 categories of a budget typically includes master budget, operating budget, cash flow budget, financial budget, capital budget, static budget, and flexible budget. The phrase is just another way of describing the main budget classifications used in business financial management.

For smaller firms, two budgets stand out as essential. The operations plan manages sales and expenses, while the cash plan keeps enough funds available to meet obligations and sustain operations.

These budgets don’t operate in isolation; they form an interconnected system. For example, the sales budgeting within the operating budget feeds into the production budget and the cash flow budget by projecting expected revenues. All detailed budgets roll up into the master budget, providing a comprehensive financial overview for strategic decisions.

The three main types of budgets are operating, capital, and cash flow. An operating budget handles daily income and expenses, a capital budget focuses on long-term investments, and a cash budget tracks how money moves in and out. Together, they provide a clear view of overall financial health and stability.

The 3 P’s of budgeting are Paycheck, Prioritize, and Plan. This method helps manage personal finances effectively: start with your Paycheck to understand your income, prioritize where your money should go, and plan a budget that supports your financial goals and spending limits.

In budgeting and accounting, the Big 3 usually refers to the three main financial statements: the income statement, balance sheet, and cash flow statement. Which together reflect a company’s financial health. The Big 4 refers to the world’s four largest accounting firms: Deloitte, PwC, Ernst & Young (EY), and KPMG.

There’s no single fixed number, as budgets can be classified in different ways, by purpose or by method. Common examples include the operating, capital, cash flow, master, financial, static, and flexible budgets. Some organizations also use zero-based or performance budgets, depending on their goals and structure.

A fixed (static) budget stays the same regardless of actual business activity, making it useful for setting performance benchmarks. A flexible budget adjusts based on real results, offering a more accurate view of costs and revenue in changing conditions.

Yes. Most companies use several types of budgets at the same time. For instance, a master budget provides an overall plan, while operating and cash flow budgets handle daily operations and liquidity. Using multiple budgets helps align short-term activities with long-term goals.

The best budget for personal finance is the one you can consistently follow and that fits your lifestyle. No single method fits everyone. A cash flow budget, 50/30/20 rule, or zero-based plan can each help you manage money and meet your goals.

8. Conclusion

Moving beyond simply knowing what are the 7 types of budgets are is the first step toward true financial mastery. Applying them effectively is what gives your business a powerful framework to control costs, seize opportunities, and grow with confidence.

Budgeting is an ongoing process that evolves alongside your business needs and market changes. To dive deeper into strategies that optimize your capital, explore more expert insights in with Budgeting Strategies section of H2T Funding.