In 2026, 57 % of Americans said they were living paycheck to paycheck, and lower‑income households felt the squeeze the most. With housing, groceries, and childcare costs outpacing wages, one unexpected expense can derail an entire month’s finances.

Worse, nearly half of adults lack a three‑month emergency cushion, leaving families just one crisis away from debt.

This comprehensive step-by-step guide is designed to help families allocate every dollar efficiently, prioritize essential expenses, and gradually build financial resilience.

Whether you’re struggling to cover monthly bills or aiming to save for emergencies, adopting a clear low income family budget plan is the first critical step toward lasting financial security.

1. Understanding your financial situation

To create a low income family budget plan, you need a clear picture of your finances. This step helps you track income, expenses, and gaps, empowering you to manage money better. In 2026, a family of four earning $32,150 or less annually is considered low-income, per federal guidelines. Let’s dive into how to assess your situation.

1.1. First, total up your income

Include your paycheck, side gigs, government benefits, or even occasional cash from family. If your income varies, like for freelancers or seasonal workers, use your lowest monthly take-home pay as a baseline. For example, if you earn between $1,000 and $1,500, plan around $1,000 to stay safe.

1.2. Next, track every expense

Jot down every expense: rent, utilities, groceries, gas, insurance, debt payments, and even small treats like a $3 coffee. Pull out bank statements or receipts from the last couple of months to spot patterns. You might notice you’re spending $40 on snacks or that your phone bill is higher than expected. No detail is too small; every penny shapes your basic budget plan for a low-income family.

1.3. Finally, find financial gaps

If you have a surplus, even a small one, it’s a chance to save or tackle debt. Look for surprises, like high grocery costs or impulse buys, and flag areas to cut back. Try tracking every purchase for a month using a notebook or a free app to confirm your habits. This clarity is key to how to budget money on a low income and sets you up to build a budget that works for your family.

2. How to create a low-income family budget plan

Building a spending plan when every dollar matters demands clarity, discipline, and an unflinching focus on needs over wants. Follow the five steps in order: you will know exactly where your money is going, see how much is left, and decide, without guesswork, what to do next.

2.1. Step 1: Calculate monthly income

Start by listing all the money coming into your household. Include wages, side gigs, government assistance, or child support.

For bi‑weekly pay, multiply one paycheck by 26 and divide by 12 to find an accurate monthly figure. If your income fluctuates, average the last three to six months to set a conservative baseline; it is better to budget with the lower number and be pleasantly surprised by extra cash.

2.2. Step 2: Setting realistic financial goals

Setting clear goals keeps your low-income family budget plan focused and motivating. Break them into immediate, short-term, and long-term priorities to balance needs and dreams.

- Prioritize essential needs:

The first goal must always be to cover your family’s core needs, often called the four walls; nothing else moves forward until these are secure:

- Housing (rent, mortgage)

- Utilities (electricity, water, internet for work/school)

- Food (groceries only, no takeout)

- Transportation (gas, public transit, basic car upkeep)

I’ve worked with hundreds of families, and I can tell you that the most common and most dangerous trap is letting guilt or wants get ahead of core needs. It’s a completely understandable impulse.

For instance, I once worked with a mother who, wanting the best for her kids, bought new school clothes before securing the rent payment. The stress that followed nearly cost them their home. Securing your four walls first isn’t about being restrictive; it’s about creating a foundation of safety so you can handle everything else.

Other essential costs:

- Minimum debt repayments (credit cards, loans)

- Childcare (if required to work)

- Medication, basic health needs

- Work-related costs (uniforms, transport, tools)

- Plan for short-term savings:

Build a starter emergency fund of roughly $500‑$1,000; households with even a small buffer recover faster from shocks like car repairs or medical co‑pays.

- Set long-term financial objectives:

Once basic needs and emergencies are handled, define long-term goals:

- Pay off high-interest debt

- Save for retirement (even $25/month counts)

- Fund future needs like a used car, education, or a home deposit

2.3. Step 3: Subtract expenses from income

Now subtract your essential expenses from your income using this formula:

Income – Expenses = Balance

There are two possible outcomes:

- Positive balance: You’re spending less than you earn, great! Assign every extra dollar to a goal.

- Negative balance: You’re spending more than you earn, don’t panic. You now have the clarity to fix it.

2.4. Step 4: Adjust for surplus or deficit

If you have a surplus:

- Top up your emergency fund.

- Pay down debt (start with the smallest or highest interest).

- Add to long-term goals (retirement, education, savings).

Tip: Use a flexible version of the 50/30/20 rule, although many low-income families lean closer to 70% for needs, any progress on the 20% for savings/ debt is worth celebrating.

Your budget isn’t set in stone. Life changes, and your budget should change with it. Take ten minutes each week to review your spending. This helps you catch problems before they grow. Use a free app like EveryDollar or a simple notebook to see where your money is going.

When your income goes up, or a bill goes down, immediately decide where that extra money will go. This prevents “lifestyle creep” and keeps you moving toward your goals.

If you have a deficit:

- Reduce variable costs: Cut subscriptions, cook meals at home, switch to prepaid phone plans.

- Access support programs: Look into local utility assistance (LIHEAP), food pantries, and free school meal programs.

- Increase income: Take on short-term gigs, sell unused items, or negotiate more work hours.

- Reorder goals: Temporarily pause non-essential savings, but never stop covering your essentials or minimum debt payments.

Budgeting on a low income isn’t about cutting joy; it’s about creating peace of mind. When you know exactly where your money is going and why, stress levels drop, and confidence rises.

It’s easy to hear this advice and think, “Easy for you to say. You don’t know my situation.” And it’s true, budgeting on an income under $1,500 a month can feel impossible. But I have personally seen families in that exact situation use a clear plan to slowly dig out of debt and build a small savings.

The goal isn’t to become wealthy overnight. It’s about gaining control. It’s about knowing exactly where your money is going so you can make intentional choices, even when those choices are incredibly tough. That control is where the power lies, not in the size of your paycheck.

Read more related articles:

3. Budgeting tips for low income families

Budgeting on a tight income isn’t just about cutting back; it’s about making intentional, informed decisions that protect your financial stability in the long term.

For families living paycheck to paycheck, every dollar must work harder. But with the right strategies, even low-income households can build resilience, reduce stress, and move toward financial security.

3.1. Cutting unnecessary expenses

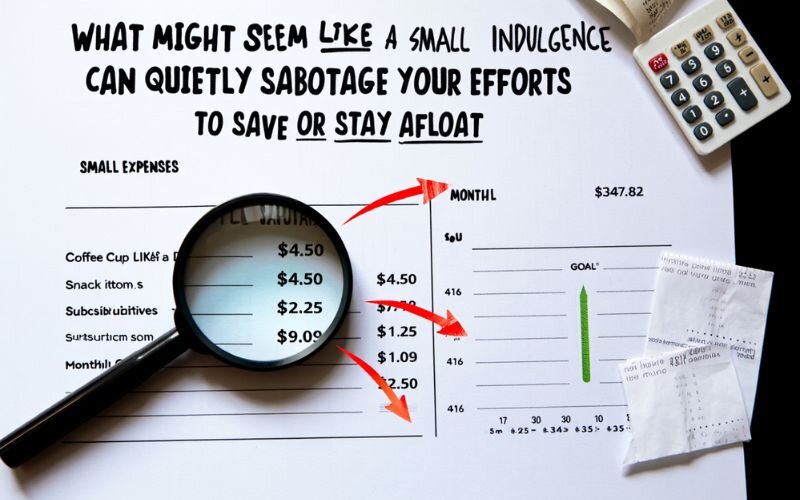

When funds are limited, distinguishing between wants and needs becomes the foundation of financial survival. What might seem like a small indulgence can quietly sabotage your efforts to save or stay afloat.

Start by asking: “Is this essential to my well-being or my family’s?”

If not, it may be time to eliminate or downgrade the expense.

- Replace dining out with home-cooked meals. A home-prepared $10 meal can feed an entire family, compared to one fast-food combo meal.

- Switch from premium subscriptions. Cancel ad-free streaming services and try free alternatives like Tubi, Freevee, or YouTube.

- Buy less, not more. Delay online purchases for 48 hours to avoid impulse buys; many lose their appeal over time.

- Find cheaper options. Shop secondhand, borrow instead of buy, or trade services and goods through community exchanges.

- Reduce recurring bills. Call your insurance or internet provider to negotiate a better deal or switch to a more affordable plan.

- Lower utility costs. Turn off unused electronics, switch to energy-efficient bulbs, and unplug vampire devices.

3.2. Maximizing your income

You can’t always cut your way to stability. Increasing your income, even modestly, can change your financial trajectory.

Explore realistic opportunities that fit your skills, schedule, and situation:

- Sell unused items: Old electronics, clothes, toys, and collectibles can be resold for cash via eBay, Mercari, or garage sales.

- Explore side hustles: Roughly one in four U.S. adults now earns from freelance or gig work; consider weekend deliveries, virtual tutoring, or selling crafts online.

- Work overtime or freelance: Track your true hourly wage; even five extra hours a week at $15 nets $300 a month before taxes, enough to erase many budget deficits.

- Request a salary increase: Time the ask after strong performance and prepare concrete results; structured scripts raise success odds.

- Consider switching jobs: If raises stall, benchmarking your skills on the open market can lead to 10 percent, plus pay bumps, especially in high‑turnover service sectors.

Consider the case of Maria, a receptionist in Phoenix. After paying for rent and childcare, her paycheck was stretched so thin that any unexpected bill felt like a crisis. Feeling helpless, she started tackling the one thing she could control: the mountains of outgrown baby clothes and old kitchen gadgets cluttering her closets.

She began listing them on Facebook Marketplace and Mercari on weekends. It wasn’t a windfall, a few dollars here, twenty there. But she was consistent. A year later, when her son needed an unexpected dental procedure costing over $1,800, she felt that familiar panic. Then she remembered her savings.

The ability to pay that bill in cash, without resorting to a high-interest credit card, was the first time in years she felt she had breathing room. It proved that small, consistent efforts can build a real financial shield.

3.3. Building an emergency fund

An emergency fund isn’t a luxury; it’s a financial lifeline. Without one, even a minor crisis (like a car breakdown or medical co-pay) can spiral into debt.

Start small and stay consistent:

- Aim for at least $500 to start: Then work toward covering 1-3 months of essential expenses.

- Automate your savings: Direct a portion of your paycheck, no matter how small, into a separate savings account.

- Use round-up apps: Tools like Qapital or Acorns round up everyday purchases and stash the spare change.

- Reallocate windfalls: Tax refunds, holiday bonuses, or cash gifts should go directly into your emergency savings.

- Create savings challenges: Set weekly no-spend goals or meal plan challenges, and transfer the unspent money to your emergency fund.

Then there’s the story of David’s family in Des Moines. Living on a single income with two kids, an emergency fund felt like an impossible luxury. They were managing, but just barely. That changed on a Tuesday afternoon when their old, reliable sedan made a terrible noise and died on the way to daycare.

The repair bill was $1,200. David described the sinking feeling in his stomach as he handed over his credit card, knowing it was nearly maxed out. That one repair, charged at 24% APR, began a debt spiral. For years, the monthly payment on that card served as a painful reminder of that single emergency.

His story is a stark illustration of a hard truth: we don’t build an emergency fund for the days when things go right; we build it for the one day everything goes wrong.

Maybe you should know: What can a budget help you do? 12 powerful benefits

3.4. Managing debt effectively

Debt management is about cost control, not just repayment speed.

- Prioritize high‑interest debt: The avalanche method targets the most expensive balance first, saving more on interest than the snowball approach.

- Avoid new debt: Freeze credit‑card spending until balances fall below 30 percent of limits, protecting your credit score.

- Seek debt relief options: Free nonprofit counseling agencies can consolidate payments or negotiate lower rates without harming credit.

After years of juggling five credit cards, James, a warehouse worker in Ohio, finally sought help from a nonprofit credit counseling agency. They helped him consolidate his $9,000 debt into one structured payment plan with a lower interest rate.

By cutting up his cards and sticking to a fixed budget, James paid off the full amount in under three years, saving over $2,000 in interest alone. His story highlights that debt management isn’t just about urgency, but about using the right strategy and getting support when needed.

3.5. Leveraging community and government resources

You’re not alone; federal, state, and local programs exist to support low-income households. These resources can free up room in your budget and give you breathing space to focus on long-term goals.

Explore support systems you may qualify for:

- Food assistance: SNAP (food stamps), WIC, and local food banks.

- Healthcare: Medicaid, CHIP (for children), and community health clinics.

- Utilities support: LIHEAP (Low Income Home Energy Assistance Program) and weatherization grants.

- Housing assistance: Section 8 vouchers, emergency rental aid, and local housing nonprofits.

- Childcare & family support: Head Start, TANF (Temporary Assistance for Needy Families).

- Technology and connectivity: Lifeline (discounted phone and internet service).

- Job training and education: Workforce Innovation & Opportunity Act (WIOA), community college grants, and local career centers.

3.6. Tracking and adjusting your budget

A budget isn’t a static document; it’s a living reflection of your reality. Regularly updating it ensures that you stay aligned with your financial goals.

- Monitor spending regularly: Review transactions weekly; ten minutes prevents end‑of‑month shocks.

- Use budgeting tools or apps: Free or low‑cost apps such as EveryDollar, Rocket Money, and Monarch categorize spending and flag trends automatically.

- Adjust the budget as needed: Life changes fast; when income rises or bills fall, re‑allocate funds to goals immediately to avoid lifestyle creep.

4. FAQs

Prioritize essential expenses like housing, food, utilities, and transportation, using the “Four Walls” approach. Cut non-essential spending, such as dining out or subscriptions, and explore government assistance like SNAP or Medicaid to stretch your budget.

Track expenses to identify and reduce non-essential spending, such as entertainment or impulse purchases, and shop smart by using coupons or buying secondhand. Set aside small, consistent amounts for an emergency fund, even if just $25 a week, to build savings over time.

Implement a “no-spend” challenge for a month, avoiding all non-essential purchases, and sell unused items for quick cash. Negotiate bills, switch to cheaper service plans, and redirect savings to a high-yield savings account for faster growth.

Low-income families typically allocate about 75% of their budget to core needs like food, rent, utilities, transportation, and cellphone services. Additional spending may include childcare, healthcare, and small amounts on education or children’s items like diapers, with minimal expenditure on non-essentials like alcohol or tobacco.

A basic budget plan for a low-income family prioritizes essentials (housing, food, utilities, transportation), allocating 50% of income to needs, 30% to wants, and 20% to savings or debt repayment using the 50/30/20 rule. It involves tracking income and expenses, cutting non-essentials, and adjusting monthly based on financial changes.

Free budget templates are available on websites like NerdWallet, Ramsey Solutions (EveryDollar app), or MoneyHelper, which offer customizable spreadsheets or apps tailored for low-income budgeting. Local nonprofit credit counseling organizations, like those listed on mymoneycoach.ca, also provide free budget planners.

For a family of 4 with a monthly income of $2,500: allocate $1,250 (50%) to needs (rent: $800, groceries: $300, utilities: $100, transportation: $50), $750 (30%) to wants (entertainment: $100, clothing: $50, miscellaneous: $600), and $500 (20%) to savings/debt (emergency fund: $100, debt repayment: $400). Adjust based on actual income and expenses, using a budgeting app like Rocket Money for tracking.

5. Conclusion

Creating a budget isn’t about being perfect. It’s about being consistent and making progress, no matter how small.

While having limited money is hard, a smart low income family budget plan gives you the power to stay in control, reduce your debt, and slowly build a safety net for your family’s future.

By prioritizing essential needs, seeking out realistic ways to increase income, and taking advantage of community and government support, low-income households can regain control and set attainable financial goals, even in uncertain times.

For more insights tailored to real-life financial challenges, explore the Strategies section and Budgeting Strategies at H2T Funding. From mastering debt repayment techniques to boosting your income with flexible side gigs, our curated resources are designed to help you make smarter money moves, regardless of where you’re starting.