Many people try to manage a monthly budget but still overspend because averages rarely match real habits. That’s why learning how to use median for budgeting can give you a clearer, more stable way to plan your spending and avoid distortion from unusual months.

H2T Funding applies this method in real budgeting frameworks to help you build steady, realistic plans. If you want a simple process and examples you can use today, continue reading the full guide below.

Key takeaways:

- If someone asks, “What is median budgeting?”, the short answer is that it uses the middle number from your actual spending history. Not the average, just the middle, the one that usually reflects how you really behave.

- When people wonder how to use median for budgeting, the process is surprisingly simple: collect a few months of expenses, line them up from low to high, and use the center value to guide your next month’s limits.

- The median works because one crazy month, a car repair, a flight, a birthday binge can’t drag your numbers upward. Outliers lose their power.

- In categories that swing a lot (food, fuel, going out), the median tends to settle things down. It gives you a number that doesn’t feel unrealistic or detached from daily life.

- Budgets built this way hold up better over time. People adjust less out of frustration and more out of awareness, because the baseline doesn’t jump around every four weeks.

- This simple idea comes straight from everyday statistics, yet it works surprisingly well when applied to real money decisions. Nothing fancy, just simple tracking done right.

1. What is the median budgeting?

In basic statistics, this middle point helps describe a typical value without being distorted by extreme highs or lows. When applied to budgeting, it represents your typical spending, unaffected by extreme highs or lows.

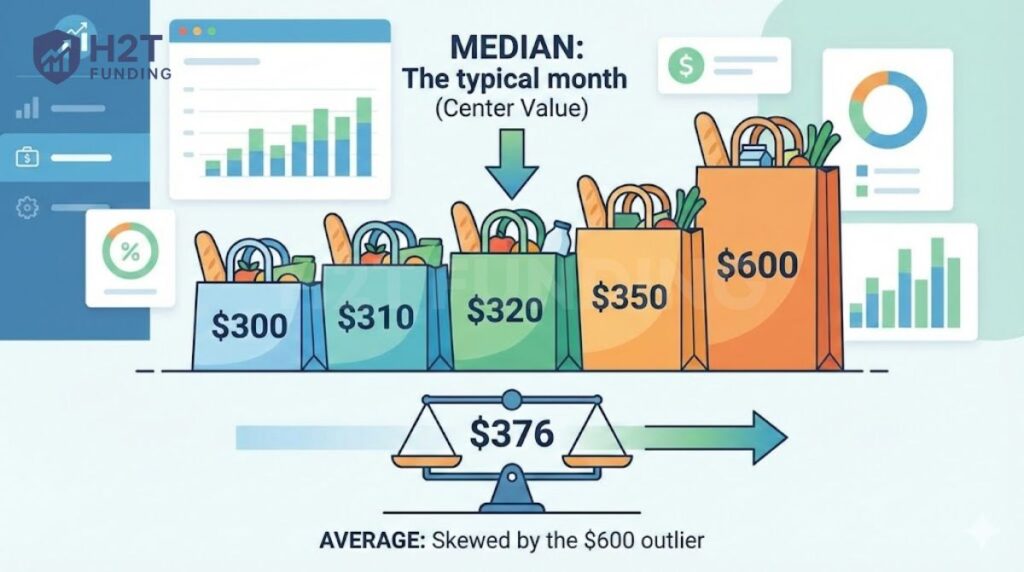

For example, let’s say your grocery bills were $300, $320, $600, $350, and $310. The median is $320. The average jumps to $376 because that $600 a month pulls it up.

Because of this, the median more accurately represents your actual spending patterns, particularly in areas where your costs are irregular. The median also offers a clearer representation of your usual costs, especially when your spending jumps unpredictably.

Unlike averages, which jump around when a one-off expense appears, the median filters out that noise. It helps you set boundaries based on your usual habits, not rare moments.

If you want to prepare for those rare but costly surprises, you can also explore how to start an emergency fund for better protection.

2. Why is median budgeting better for real-life?

The median budgeting method stands out because it mirrors the way people actually spend money day to day. It feels practical, grounded, and far less fragile than a budget built on averages. Here’s why it works so well:

- It reflects your usual spending more clearly: Since the median highlights the middle of your past costs, it shows what a “normal” month actually looks like. You’re not thrown off by odd spikes that would push an average higher than it should be.

- It keeps outliers from taking over: Big bills, holiday trips, repairs, and unexpected events won’t wreck your plan. The median softens their influence so you don’t end up budgeting around rare moments instead of everyday life.

- It helps you notice changes in your habits: When your spending keeps climbing past the median, it’s a sign that something has shifted, maybe routines, maybe prices, maybe a new habit you didn’t realize was forming. And when you fall below the median, it opens room for financial goals. If overspending has been a repeating problem, you can also explore how to stop overspending to regain control.

- It makes your budget easier to follow: Because the numbers reflect how life actually plays out, a median-based plan feels more manageable. You’re not forcing yourself into strict limits; you’re using a steady baseline that fits your rhythm.

- It handles unpredictable categories well: Groceries, dining out, and fuel; these rarely stay the same. The median smooths out the swings, helping you make decisions without reacting to every jump or dip.

This small shift can also improve your broader financial planning because it gives you a stable reference point instead of numbers that swing each month.

I started using the median method last year after watching my grocery spending bounce from $320 one month to nearly $500 the next. Planning with averages made everything feel off. Once I shifted to the median, the whole process settled. My targets made more sense, and I finally stopped second-guessing my numbers.

A close friend of mine applied the same method to her “dining out” budget, which was always inconsistent due to social events and travel. Using the median helped her gain control without cutting out the things she enjoyed.

This small change gave both of us something we hadn’t felt with budgeting in a long time: peace of mind. If you want to strengthen your long-term financial picture, it also helps to learn how to track net worth as part of your routine.

You may also be interested in:

3. How to calculate your spending median

If you’ve ever wondered what your “typical” month really looks like, the spending median gives you a clearer picture than any average ever will. To be honest, I didn’t trust the method at first. But once I tried it with my own numbers, it felt almost embarrassingly simple and surprisingly grounding. Here’s the exact process.

Step-by-step:

- Step 1: Collect at least three to six months of real spending. More data, better accuracy.

- Step 2: Sort your expenses into categories like food, transport, rent, or shopping.

- Step 3: List the amounts in each category from lowest to highest.

- Step 4: Find the middle value. That’s your median. If you have an even number of entries, average the two in the middle.

- Step 5: Compare the median with your average to spot months that pulled the numbers up or down. This quick check shows where overspending tends to hide. This simple comparison gives you a quick analysis of where your budget tends to drift and why certain months feel heavier than others.

Example: Food spending over six months: 350, 370, 380, 390, 400, 600

- Sorted: 350, 370, 380, 390, 400, 600

- Median = (380 + 390) / 2 = 385

- Average = 415

When I saw this in my own budget, it hit me. The average looked “high” only because of one chaotic month. The median, though, felt like the real story.

In simple terms, the median cuts through the noise and shows where your spending usually sits, not where your outliers drag it.

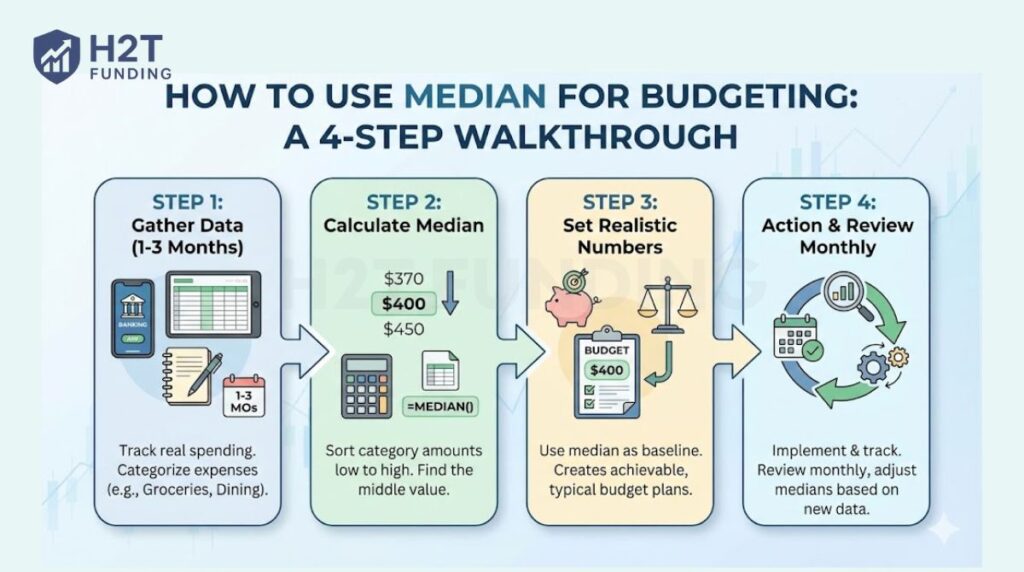

4. How to use median for budgeting: a 4-step walkthrough

Using the median in your budget doesn’t require any complex formulas. You just need a bit of tracking, a quick way to arrange your numbers, and steady habits. This four-step process will help you calculate the middle point for each group and turn those numbers into realistic monthly plans.

4.1. Step 1: Gather your data – track your spending for 1-3 months

To use the median budgeting method, you need a clear picture of your past spending. Start by gathering a few months of real numbers; one to three is enough to begin. A longer window usually gives more reliable results, but even a short snapshot can reveal useful patterns.

You can collect this data from:

- Your banking app or credit card statements

- Spending trackers like YNAB or PocketGuard

- Manual logs if you prefer a spreadsheet, or pen and paper

Make sure to categorize each transaction as you go. This early sorting step matters because it makes the next calculations cleaner and easier to follow. Use clear categories such as:

- Groceries

- Dining out

- Gas and transportation

- Entertainment

- Personal care

- Subscriptions

Don’t worry about being perfect. The goal is to create a dataset that reflects your real-life spending, not an idealized version of it. Once your expenses are sorted and labeled, you’re ready to move on to calculating the median in each category.

If you want a clearer system for following every dollar you spend, you can read this guide on how to track expenses to make the process easier.

4.2. Step 2: Calculate the median for each spending category

Once you’ve tracked and categorized your expenses, it’s time to calculate the median for each category. Don’t worry; it’s easier than it sounds. Here’s how to do it step by step:

- Choose a spending category – for example, groceries.

- List all the spending amounts from your tracking period (e.g., 3 months):

- Month 1: $400

- Month 2: $370

- Month 3: $450

- Sort the numbers in ascending order: $370, $400, $450

- Find the middle number:

- The median is simply the value that sits in the middle when you have an odd count of numbers. In this example, $400 lands right at that midpoint.

- Calculate the average of the two middle numbers if your values are even. -> Example: $370, $400, $420, $450 → Median = ($400 + $420) / 2 = $410

Repeat this for each category where spending tends to fluctuate.

Tip: You can use a median calculator or simple spreadsheet functions like =MEDIAN(A1:A5) in Excel or Google Sheets to speed things up, especially if you’re working with longer data sets.

By isolating the typical amount you spend in each area, you’re now equipped with a reliable number to use in your budget.

4.3. Step 3: Set your new, realistic budget numbers

Now that you’ve calculated the median for each spending category, it’s time to put those numbers to work. Instead of guessing how much to budget or relying on last month’s unusual spending, use the median as your baseline.

For example, if your median spending on groceries over the last three months was $410, that becomes your grocery budget for next month. No more random guesses or wishful thinking. This number reflects your actual habits, making it far more achievable.

The beauty of this approach is that it balances realism with control. You are creating a budget based on your usual pattern rather than your most or least expensive month.

Using these middle values creates a budget you’re more likely to follow and feel confident about.

4.4. Step 4: Put it into action and review monthly

Budgeting is a constant process of reflection and modification rather than a one-time action. Once you’ve set your budget using median values, put it into practice for the upcoming month. Keep track of your expenses in real time and adhere to your spending restrictions.

At the end of the month, check your numbers against your median-based estimates. Ask yourself:

- Did the median number feel realistic?

- Were there any categories where you over- or under-spent?

- Did any new habits appear?

If needed, adjust the next month’s medians based on your updated data. These small adjustments help your numbers stay relevant as your habits naturally change over time. Over time, this approach not only keeps your budget relevant; it also trains you to spot trends, control impulsive spending, and plan for upcoming changes.

Remember: The median method isn’t about perfection. It’s about building a budget that works with your life, not against it.

5. Example: Applying the median method to a real budget

Let’s take a quick, real-world look at how the median works inside an actual budget. I’ll use common categories: Food, Utilities, Rent, Entertainment, and Misc because these are the ones most of us keep an eye on when the month gets tight.

| Category | Month 1 | Month 2 | Month 3 | Average | Median |

|---|---|---|---|---|---|

| Food | 420 | 380 | 600 | 466.7 | 420 |

| Utilities | 110 | 125 | 115 | 116.7 | 115 |

| Rent | 1,200 | 1,200 | 1,200 | 1,200 | 1,200 |

| Entertainment | 90 | 45 | 180 | 105 | 90 |

| Misc | 60 | 200 | 80 | 113.3 | 80 |

When you look at the numbers, you can feel the difference. The average moves up and down with every odd month—like that sudden $600 Food bill or the impulsive night out that pushed Entertainment to $180. The median, meanwhile, stays centered. It reflects what typically happens, not the emotional spikes that sneak into our spending.

I’ve caught myself reacting to those “big” months before and thinking I needed to overhaul everything. But the median reminds me that one unusual moment doesn’t define my habits. It keeps the budget calm and realistic, and honestly, that feels a lot easier to stick with.

In simple terms, the median helps you predict more accurately and avoids the emotional distortion that averages often create.

6. Common mistakes when using the median in budgeting

When people first try the median method, things can feel simple on paper but tricky in real life. I’ve made a few of these mistakes myself, so I know how easily they slip in. And honestly, once you notice them, the whole process becomes smoother.

- Confusing the median with the average, especially when one odd month changes the entire picture. I’ve done this before and wondered why the numbers felt “off.”

- Using too little data. A single month or even two can hide your real patterns, which makes the median misleading.

- Ignoring irregular or annual expenses, like insurance or car maintenance. These don’t show up monthly, but they hit hard when they arrive.

- Treating the median as a strict spending cap instead of a baseline. Life isn’t that tidy, and the method works better when you leave room to breathe.

- Forgetting to update your numbers. Our habits shift over time, and the median should reflect that.

- Not tracking real spending. Without consistent data, the median becomes a guess rather than a guide.

In the end, the median isn’t the problem. The challenge is using it with enough context and flexibility so it reflects how you actually live, not how you wish you lived.

Keep in mind: The median method can also mislead you if the dataset is too small or if your spending patterns change seasonally. Always compare your median with real-life context to avoid drawing the wrong conclusions.

7. Pro-tips for mastering the median budgeting method

Mastering the median budgeting method goes beyond just tracking numbers; it requires a practical approach, some flexibility, and steady habits. It also encourages a healthier money mindset because you stop reacting to unusual spikes and start focusing on long-term patterns.

- Use rolling medians for better accuracy: Instead of recalculating your medians from scratch each month, consider using a rolling 3- or 6-month window. This smooths out short-term fluctuations while keeping your numbers current.

- Track what you earn and what you spend separately: While this method works well for spending categories, it’s also powerful for irregular incomes. Maintain a separate calculation for what you earn to avoid overcommitting based on your best months. If you deal with unpredictable paychecks, you can also read this guide on budgeting for irregular income to build a more stable plan.

- Automate where possible: Use budgeting tools like YNAB, Tiller, or a custom spreadsheet that calculates the median automatically as you update your spending. This reduces friction and improves accuracy. If you want to simplify your money system even further, you can explore how to automate savings to build better habits with less effort.

- Build in buffer categories: Even with median-based planning, life happens. Include a small buffer or contingency category in your budget to absorb one-off surprises without blowing your plan.

- Check in quarterly, not just monthly: A quarterly check helps you zoom out and spot broader shifts, such as seasonal spikes or new spending changes that might not show up in a one-month view.

- Separate needs from wants, even within categories: For example, in a “Dining Out” category, distinguish between quick weekday meals and special-occasion dinners. This helps you tighten spending without cutting out joy entirely. If you want a clearer system for making smarter choices, you can explore how to prioritize expenses to stay focused on what matters most.

The strength of the median technique depends on the habits that support it. With a bit of structure and self-awareness, it can become one of the most powerful tools in your financial toolkit. Over time, consistency matters more than perfection, and the median makes that much easier to maintain.

8. Frequently asked questions (FAQs)

Not necessarily better, just different. The 50/30/20 rule offers a broad framework for allocating income (50% needs, 30% wants, 20% savings), while the median method helps you define more accurate numbers within those categories. In fact, the two methods complement each other: use 50/30/20 for overall balance and the median for precision in specific spending areas.

Yes, and you should. If your income fluctuates monthly, calculating the median income over the last 6 to 12 months gives you a safer estimate to build your budget around. It keeps your expectations grounded, preventing you from overspending in high-income months or panicking during low-income ones.

This is exactly where the median method excels. Unlike averages, the median naturally downplays the impact of extreme values. You don’t need to exclude the month; just include it in your sorted data set, and the median will still reflect your typical behavior without being skewed.

Start with at least three months of data. This provides a solid base to identify patterns. For greater accuracy, especially in categories with seasonal changes, aim for six to twelve months. The longer your tracking period, the more reliable your median calculations will be.

Most people find that three to six months gives a clearer picture. To be honest, one or two months can feel too random, especially if you had a big one-off expense. Using more data smooths out the noise and shows your real patterns.

When your costs rise and fall with the seasons, keep the median but add context. I usually compare my winter and summer numbers separately because they behave differently. In simple terms, treat each season as its own pattern rather than forcing everything into one median.

If your income jumps around, the median often feels more realistic. High-earning months can make the average look better than real life. The median gives you a “typical” month, which helps avoid overcommitting. Still, you can glance at the average for long-term planning.

Yes, and it works surprisingly well. I think of the median as the guide for each category and the zero-based method as the structure that keeps every dollar intentional. One shows what’s typical; the other helps you plan with purpose.

Sort your past spending from low to high, find the middle value, and use that number as your baseline. It’s simple, really. The median tells you what “normal” looks like without being thrown off by extreme months.

9. Conclusion

Learning how to use median for budgeting gives you a clearer view of your real spending habits and removes the noise created by unpredictable months. It replaces guesswork with a steady baseline you can trust. This approach makes your budget easier to follow and easier to adjust as your life changes. It keeps your plan grounded in typical behavior instead of rare outliers. This makes your entire system more sustainable over time without adding extra complexity.

H2T Funding employs this method in many of our practical tools because it enables people to build budgets they can maintain over the long term. If you want more ways to strengthen your money system, explore the Budgeting Strategies section, where we turn complex financial ideas into simple steps you can apply right away.