Imagine your car breaks down or you suddenly lose your job. Instead of panicking, you stay calm because you’ve built an emergency fund. Learning how to start an emergency fund is one of the smartest financial moves you can make. It’s your safety net that protects you from unexpected expenses and keeps your finances stable.

Even if you’re living paycheck to paycheck, starting an emergency fund is possible. This guide will show you how to build your emergency fund from zero, why it matters, and how to stay consistent along the way.

Let’s get started and take your first step toward financial security.

Key takeaways:

- Building an emergency fund gives you a financial safety net when life throws surprises like job loss, car repairs, or medical bills.

- Start small; even $20 a week can grow into real protection over time.

- Learn practical steps to set up your fund: open a separate account, automate small deposits, and cut back on non-essential spending.

- Stay consistent with your savings habit and review your goals regularly to keep your financial health strong.

- Use one-time opportunities like bonuses, refunds, or gifts to boost your savings faster without straining your budget.

- Aiming for a balance of about three to six months of living costs is ideal, but every dollar saved adds peace of mind.

- Your emergency fund should be safe, easy to access, and reserved only for real financial emergencies.

1. What is an emergency fund?

An emergency fund is your personal cash reserve. It’s the money you set aside for real financial emergencies, the kind that appear when you least expect them. Maybe your car stops working, a medical bill comes out of nowhere, or your paycheck is delayed. These unplanned expenses always seem to show up at the worst time, right?

I’ve been through that myself. One month, my refrigerator broke just a week after I’d paid all my bills. I remember standing there, wondering how I’d pay for the repair. That was the moment I understood why an emergency fund matters so much. Without it, even a small financial shock can spiral into debt or force you to rely on credit cards or loans.

So, what exactly is an emergency fund? It’s a small pool of money kept separate from your daily budgeting and spending. You only touch it when something urgent happens, like a job loss, medical emergency, or essential home repair. It’s not a “fun money” account. It’s a shield that keeps your financial security intact.

Most people keep their emergency fund in a high-yield savings or money market account. These accounts help your money grow a little while staying safe and easy to access when you need it. The goal is accessibility, not temptation. You want it available for real emergencies, but not so easy to dip into for impulse spending.

If you’re wondering how much to save, start with what feels realistic. Even $20 a week makes a difference. After six months, you could have $500. That small cushion can stop a single emergency from wrecking your entire cash flow. Once you get into a simple savings habit, you’ll start noticing how it improves your financial well-being over time.

Saving doesn’t have to be complicated. Think of it as one step toward control and confidence. With an emergency fund, you don’t panic when something breaks; you handle it, recover faster, and move on with peace of mind.

2. Why do I need an emergency fund?

Let’s be real. Most of us don’t think about saving for emergencies until life proves why we should. A flat tire, a broken phone, or an unexpected bill can throw off your whole plan. Having an emergency fund gives you something steady to lean on when things get rough.

Here’s why it matters:

- It keeps you from falling into debt: Without backup money, it’s easy to swipe credit cards or take small loans just to get through the week. I’ve done that before, and the stress of paying it off later wasn’t worth it.

- It protects your goals: When a financial shock hits, you don’t want to touch your long-term savings. A separate cash reserve lets you handle small surprises without derailing your bigger plans.

- It keeps your budget stable: With even a small cushion, your cash flow feels smoother. You don’t have to delay bills or panic when unplanned expenses appear.

- It brings peace of mind: Knowing you’re ready for financial emergencies helps you stay calm and confident. That sense of control is part of real financial well-being.

If you ever get unexpected income like a bonus or a gift, save a part of it instead of spending everything. That one simple choice can strengthen your savings habit more than you think.

Keep your funds in a safe place, such as a high-yield savings or money market account. These options let your money grow a little while staying easy to access when needed. You can also set up automatic savings from your bank account so you don’t forget to add to it.

When you need to use the money, rebuild it slowly. Even small contributions make a difference over time. Check your progress once a month and adjust your budgeting if needed. Consistency, not perfection, is what protects your financial security.

Key points:

- An emergency fund helps you handle unexpected costs without new debt.

- It protects your savings and keeps your cash flow stable.

- Store it in a safe, accessible account and rebuild it after use.

- Saving regularly builds long-term confidence and financial stability.

3. How much should an emergency fund be?

The truth is, there isn’t one perfect number for everyone. It really depends on your lifestyle, your income, and how steady your job is. But most experts agree that your emergency fund should cover at least three to six months of living costs. That might sound big at first, but you can get there one step at a time.

Start small. Think about how much you spend in a single month on rent, food, bills, and transportation. Then multiply that by three. That’s your first milestone. If you’re self-employed or supporting a family, you may want to aim for six months instead.

When I started, my goal was just $500. It wasn’t much, but it helped me avoid using credit when my car needed repairs. That experience changed how I looked at savings. It wasn’t about perfection; it was about protection.

A clear goal-setting process helps you stay focused. Write down a number that feels realistic and commit to adding small contributions every week or month. Even $20 at a time builds momentum. You can use automatic transfers or employer contributions if your job allows split deposits between checking and savings.

If you ever need to use the money, rebuild it gradually. These small steps are part of good personal guidelines for financial health. Once you withdraw, make replenishing savings your next short-term goal. Checking your progress regularly, maybe once a month, can help with tracking progress and keeping your motivation alive.

Sometimes, reaching your target might require small lifestyle changes. Maybe cooking at home more often or skipping one subscription. Those changes don’t just help your balance grow; they shift how you think about money.

At the end of the day, the amount isn’t as important as the habit. What matters is that you’re preparing yourself to handle anything life throws at you.

Key points:

- Aim for an emergency fund that covers three to six months of living expenses.

- Start small, set realistic goals, and make consistent contributions.

- Use clear guidelines and review your tracking progress regularly.

- Focus on replenishing savings whenever you use the fund.

- Small lifestyle changes can make building your savings much easier.

4. What you need to learn how to start an emergency fund

If you’re wondering how to start an emergency fund or how to create an emergency fund from the ground up, here’s what you’ll need to get started:

- A dedicated savings account (preferably high yield and separate from your checking account)

- A realistic initial goal (e.g., $500 or $1000)

- Consistent income or side income to support regular deposits

- Auto-transfer tools from your bank or app

- Willingness to cut non-essential spending temporarily

If you’re just beginning and unsure how to set up an emergency fund, don’t worry; this guide covers every step.

You can also use budgeting apps like YNAB or Mint, but a digital savings account is still the most secure and trackable way to start. If you’re planning long-term, thinking about an emergency fund retirement strategy early on can help protect your retirement savings from being tapped during unexpected events.

View more: How does Apex Trader funding work

5. How to start an emergency fund, one step at a time

Tiny steps done regularly can make a big difference. Ready? Let’s take this journey one step at a time.

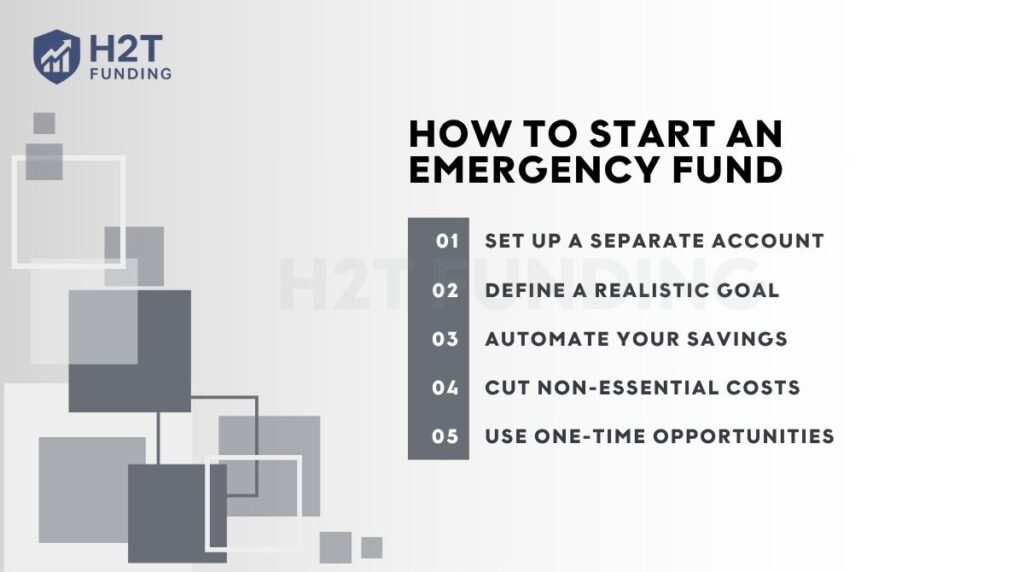

Quick checklist: The 5 steps to build your emergency fund

- Step 1: Set up a separate account: Open a savings account only for emergencies so you don’t mix it with daily spending.

- Step 2: Define a realistic goal: Start small, like $500 or $1,000, and increase gradually as your confidence grows.

- Step 3: Automate your savings: Schedule regular transfers from your paycheck so saving becomes effortless.

- Step 4: Cut non-essential costs: Trim small expenses such as unused subscriptions or daily coffee runs.

- Step 5: Use one-time opportunities: Direct part of any bonus, refund, or gift into your fund to grow it faster.

5.1. Step 1: Set up a savings account just for emergencies

When you’re learning how to start an emergency fund, having a specific account just for emergencies helps you stay disciplined and avoid temptation. Here’s what to look for and how to get started:

- This account should be completely separate from your everyday spending.

- Choose a high-yield savings account with no monthly fees

Example: I opened my first emergency savings account with $50 in a local credit union. Within six months, it grew to $600 thanks to automation and cutting a few expenses.

5.2. Step 2: Define a Realistic Goal

You’ll stay more motivated when your targets are within reach. Instead of aiming too high, focus on manageable milestones:

- Start with $500 to $1000, enough for minor emergencies

- Break your goal into smaller targets: $100 → $250 → $500

- Use apps like Mint or EveryDollar to know your monthly expenses

You can also try an emergency fund calculator to estimate exactly how much you should save based on your lifestyle and fixed expenses.

For instance, you can commit to saving $25 each week. After one month, you’ll have $100. Maintain that habit, and you’ll hit $250 by the tenth week, making your first big milestone feel totally doable.

5.3. Step 3: Set up automatic deposits into your fund

Life gets busy, and it’s easy to forget or skip saving when other priorities get in the way. That’s where automation becomes your best ally; it turns saving into a background habit that happens without extra thought.

- Schedule automatic transfers from your checking to your savings account on each payday. Treat this like any other fixed bill, and check out our full guide on automating savings to make the process even easier.

- Start small: $10 per week becomes $520 a year without you lifting a finger.

- Many banks and budgeting apps offer automation tools; use them to your advantage.

5.4. Step 4: Reduce or eliminate non-essential spending

Cutting back on non-essentials gives you room to save. Here’s where you can start:

- Audit and cancel subscriptions you don’t use

- Make coffee at home, and pack lunch twice a week

- Redirect savings directly into your emergency fund

Personal tip: I saved $80/month by switching from cafe coffee to home-brewed. That added almost $1000 in a year.

“Start cutting discretionary spending now, before the world forces you to. That’s how you protect yourself and position yourself to be ahead when things stabilize.” Ramit Sethi, personal finance expert

5.5. Step 5: Save unexpected income

Windfalls are a golden opportunity to fast-track your emergency fund. Make the most of them:

- Redirect at least 50% of tax refunds, bonuses, or gifts

- Split: 50% to fund, 50% to enjoy

Real story: From a $600 tax refund, I saved $400 and used $200 for a guilt-free treat. There are plenty of emergency fund examples where small, consistent actions add up to significant safety nets over time. A balanced approach helps you stick to the habit.

See more related articles:

6. Tips to stay on track

Staying consistent with your emergency fund isn’t always easy, especially when life gets busy or new expenses pop up. The good news is that a few simple habits can help you stay motivated and keep your savings on track. These quick tips will help you check your progress, celebrate your wins, and use your fund wisely.

6.1. Review your goals regularly

Check your progress monthly. How close are you to your goal? If not, identify blockers and make small tweaks, like adjusting your transfer amount or reducing another expense.

6.2. Celebrate milestones

Hit your $500 goal? Celebrate with a small reward. Hit $1000? Reward yourself with something fun, like a movie. Small rewards help build momentum and motivation.

6.3. Avoid over-saving or misusing the fund

Your emergency fund is not a vacation fund or a shopping spree backup. Only use it for true emergencies such as job loss, medical expenses, or urgent repairs. Also, don’t go overboard and hoard all the cash here.

Once you hit 6 months of expenses, consider diverting extra funds to investments. Some people explore low-risk options like an emergency fund investment, though it’s important to keep accessibility and safety in mind.

7. FAQs

Start with a short-term target of $500 to $1000 to cover basic unexpected costs like a car repair or urgent medical visit. Once you reach that, gradually build up to a fund that can cover 3 to 6 months of your essential living expenses, including rent, food, and utilities.

High-yield savings accounts or money market accounts are often recommended when considering where to keep an emergency fund safely and with some interest growth.

True emergencies include events like sudden job loss, medical emergencies, major car or home repairs, or urgent travel needs due to family crises. Wants like vacations or tech upgrades don’t count.

Definitely. Start with very small amounts, $5 to $10 a week, set up automatic transfers, and look for ways to reduce unnecessary spending. Progress might be slow, but consistency builds results over time.

Credit cards can lead to high-interest debt and financial stress. An emergency fund gives you peace of mind and avoids long-term repayment burdens.

The answer depends on your income and savings habits. With $20 per week, you can build $1000 in less than a year. Regular saving is better than trying to do it all at once.

While your emergency savings should remain liquid and safe, many people still wonder: Should I invest my emergency fund? The general advice is no, unless you’ve already secured 6 months of expenses and want to explore low-risk options.

A small cash stash at home ($100–$200) is okay for true emergencies, but keep the majority in a savings account where it’s safer and earns interest.

Yes. Set a small emergency fund goal, like $500, while making minimum debt payments. This protects you from needing to borrow more when unexpected costs arise.

Start with the same strategy you used to build it: resume small automatic contributions, use windfalls like bonuses or refunds, and temporarily trim non-essential expenses to replenish faster.

Follow a few simple steps: open a high-yield savings account, set a small target like $500, and automate your savings. Our guide on how to start an emergency fund has all the details.

A good place to start is around $500 to $1,000. It’s enough to handle small unplanned expenses like a car repair or medical bill. Once you reach that goal, keep adding until you have at least three months of basic living costs. The key is to build consistency, not perfection.

Open a separate savings account, decide on a small first goal, and set up automatic transfers from your paycheck. Saving a little at a time helps you build consistency and confidence.

It’s a simple savings strategy that helps you plan your fund size. Save three months of expenses if your job is stable, six if your income changes, and nine if you’re self-employed or supporting a family.

You can start with as little as $20 or $50. The point isn’t the amount; it’s creating the habit and staying consistent until it grows.

A beginner emergency fund is your first safety cushion. Start with $500 to $1,000 to handle minor surprises such as car repairs or medical costs.

8. Conclusion: Why It Matters

Before I had an emergency fund, I lived in constant anxiety. One unexpected expense could ruin my month. Now, with a 3-month cushion in place, I sleep better. My goal is for you to enjoy that same sense of control.

If you follow the steps above, you’ll understand clearly how to start an emergency fund, and you can build an emergency fund that gives you freedom and confidence. Share this guide with a friend, and take the first step today.

Financial experts underscore the significance of having an emergency fund. Jean Chatzky, financial editor of NBC’s Today, advises:

Do you have an emergency fund? If not, build one – aim for three months of expenses to start, then boost it to six. It will ease your anxiety and get you out of a potential jam.

A little effort now means a big thank-you later.

You can read more practical tips and personal finance guides like this in the Strategy Section and Cash Flow & Saving Strategies of H2T Funding.