Are you planning to buy a big car, a house, or to go on a dream holiday? Saving effectively requires strategy and discipline, but it’s achievable with the right approach. As a financial enthusiast, I’ve helped many friends save for their big goals. Through that experience, I’ve seen how small, consistent steps lead to lasting success and financial wellness, especially during times of rising inflation.

This guide, using expert tips and tools like high-yield and high-interest savings account options, outlines proven methods that will help you achieve your goal without stressing out. Let’s have H2T Funding explore how to save for a big purchase and make that dream a reality.

Key takeaways:

- A large purchase is anything that strains one month’s income, disrupts your budget, or delays other goals (always factor in estimated costs).

- Saving for large purchases helps you avoid debt, reduce stress, and stay in control of your finances.

- The best way to save for a big purchase is to set a clear goal, create a realistic budget, and automate your savings.

- Automate your savings into a high-yield account and track progress regularly.

- Save when you’ll need the money within 1–3 years or want financial safety.

- Invest when your goals are 5+ years away and you’re ready for long-term growth.

- Stay flexible, adjust your plan, but never stop saving toward your goal.

1. Large purchase definition

A large purchase is one in which the user tends to plan and stop before making the expenditure. Big purchases in life are usually tied to major milestones or needs: buying a car, upgrading one’s home, or paying college tuition.

It’s subjective; what feels like a big expense for one person may be manageable for another. Still, it usually meets one or more of the following conditions:

- It costs more than one month’s income.

- It forces noticeable changes to your monthly budget or cash flow.

- It affects your ability to meet other financial goals.

- It may require financing, borrowing, or dipping into long-term savings.

In short, a large purchase is about how much it impacts your financial stability and peace of mind.

While “big” can mean different things to different people, here are big purchases:

- Vehicles: Cars, motorbikes, boats, or RVs.

- Property: Homes, investment properties, or parcels of land.

- Home essentials: Appliances, major renovations, or furniture upgrades.

- Education and experiences: College tuition, weddings, dream vacations, or advanced technology.

These are the types of purchases that people usually make only a few times in their lives, and often after careful thought and saving.

2. Why should you save for large purchases?

For big purchases, there are big emotions: excitement, anxiety, or even panic when they’re unexpected. But save up in advance, and everything changes. It turns financial pressure into confidence, lets you make informed purchases, and keeps your money decisions aligned with what truly matters to you.

Here’s why saving for large purchases is worth it:

- Avoid debt and interest stress: Paying in cash or from savings means you don’t owe anyone later. No credit card bills, no loan interest, no hidden fees eating into your paycheck.

- Get better deals: When you already have money set aside, you can negotiate, shop around, or wait for the perfect sale instead of rushing into a purchase.

- Stay calm in emergencies: If your fridge breaks or your car dies, having savings turns a potential crisis into a simple replacement. No panic, no last-minute borrowing.

- Build stronger habits: Saving regularly teaches patience, planning, and consistency, habits that make every financial goal easier to reach.

- Feel secure and in control: Knowing you’re prepared brings real peace of mind. You’re no longer reacting to life; you’re steering it.

Ultimately, saving for large purchases is about gaining financial freedom. You get to choose when and how you spend, without guilt or pressure. And that kind of control is worth far more than any discount or deal.

3. How to save for a big purchase

Learning how to save for big purchases is all about planning smart, staying consistent, and managing discretionary spending. Whether it’s a new car, home renovation, or dream vacation, a clear savings strategy gets you to your goal sooner. You’ll avoid debt and feel less financial pressure.

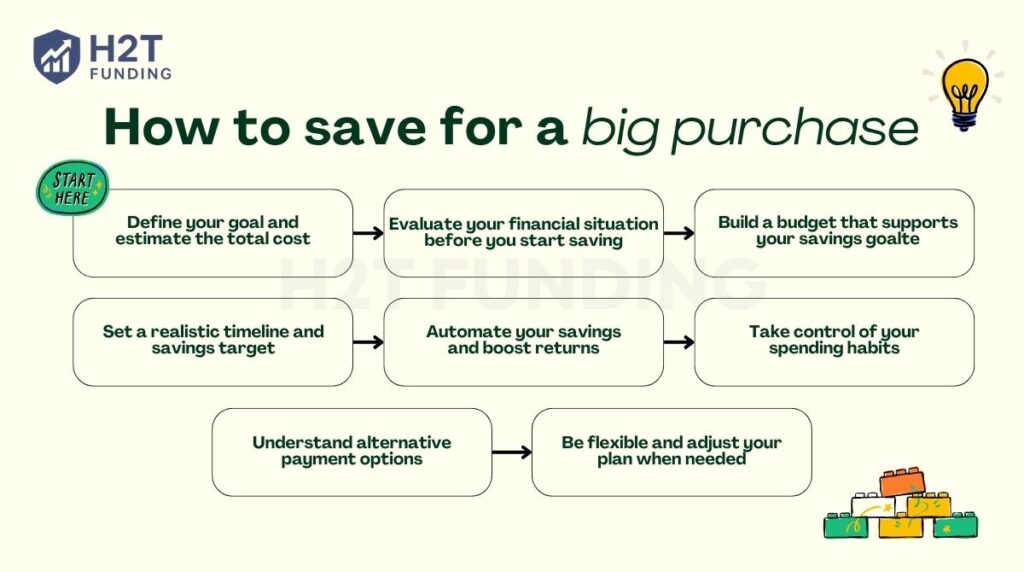

Here’s your simple step-by-step roadmap to build a solid savings plan:

- Define your goal and estimate the total cost

- Evaluate your financial situation before you start saving

- Build a budget that supports your savings goal

- Set a realistic timeline and savings target

- Automate your savings and boost returns

- Take control of your spending habits

- Understand alternative payment options

- Be flexible and adjust your plan when needed

Follow these steps to save smarter, manage money better, and make confident decisions for your future. Take the first step now.

3.1. Define your goal and estimate the total cost

When learning how to save for a big purchase, the first crucial step is to clearly define your goal and estimate its total cost. Whether you’re dreaming of a new car, a down payment on a house, or an unforgettable vacation, having a specific target in mind sets the foundation for success. By understanding exactly what you’re saving for and how much it will realistically cost, you can create a focused plan to turn your goal into reality.

Start by identifying the item or experience you’re aiming for. Be specific. Instead of saying “a car,” write down “a 2023 Honda CR-V, used, under 30,000 miles”. The more specific you are, the easier it becomes to stay motivated and track your progress.

The listed price often doesn’t reflect the total amount you’ll spend. Additional expenses can accumulate, impacting your budget. Consider the following:

- Taxes and fees: Sales tax, registration fees, and licensing can add a significant amount.

- Maintenance and repairs: Regular upkeep, unexpected repairs, and service charges.

- Insurance: Premiums can vary based on the item’s value and usage.

- Financing costs: Interest rates and loan origination fees if you’re not paying in full up front.

For example:

- Buying a home? Factor in closing costs, inspection fees, moving expenses, and property taxes.

- Planning a vacation? Don’t forget travel insurance, currency exchange, baggage fees, or tips.

- Getting a new car? Include registration, insurance, and future maintenance.

By considering these hidden costs upfront, you avoid budget shortfalls down the line.

3.2. Evaluate your financial situation before you start saving

Before setting your sights on a big purchase, take a step back and look at your current financial picture. This ensures your savings plan is realistic and doesn’t derail other important financial goals.

Start by calculating your monthly net income (after taxes) and tracking your current spending. A basic breakdown helps you identify:

- How much money do you have left over each month

- Which expenses could be reduced or adjusted

- Any outstanding debts, such as student loans, credit cards, or car payments

For example, if you’re carrying high-interest debt, it might make sense to prioritize paying that down first, before diverting funds toward a large purchase.

Saving for a big-ticket item shouldn’t come at the expense of your financial safety net. Make sure you’re also working toward:

- A fully funded emergency fund (3–6 months of living expenses)

- Retirement contributions or long-term investing goals

- Essential insurance coverage for health, home, or life

Having these pillars in place gives you the flexibility to save with confidence, without compromising your financial security.

Any savings goal should be set within a broader context. If you’re already juggling other priorities like paying down debt or saving for a home, you may need to adjust your timeline or reduce the scale of your purchase.

Discover more similar articles:

3.3. Build a budget that supports your savings goal

Once you’ve set a savings target, the key is to create a budget that keeps you disciplined and consistent. One of the most effective approaches is combining the 50/30/20 budgeting (or 50/20/30 rule) with the Pay Yourself First method. It’s a strategy used by financial planners to help people save automatically before they spend.

The Pay Yourself First method means you treat savings like a non-negotiable bill. As soon as your paycheck arrives, transfer a fixed amount into your savings or investment account before paying for anything else. By doing this, saving becomes automatic, not an afterthought.

Then, structure the rest of your budget using the 50/30/20 rule:

- 50% for needs: rent or mortgage, groceries, utilities, transportation.

- 30% for wants: dining out, subscriptions, entertainment, leisure.

- 20% for savings or debt repayment: this is your pay-yourself-first portion (ideally into a high-interest savings account or high-yield account).

Example – Applying the 50/30/20 Rule

| Monthly Income | Needs (50%) | Wants (30%) | Savings/Debt (20%) |

|---|---|---|---|

| $4,000 | $2,000 | $1,200 | $800 |

| $5,000 | $2,500 | $1,500 | $1,000 |

| $6,000 | $3,000 | $1,800 | $1,200 |

To make this work seamlessly:

- Set up automatic transfers to your savings account right after payday.

- Use a separate high-yield savings account for big goals.

- Gradually increase your savings rate if your income grows or expenses drop.

According to a 2023 NerdWallet report, people who follow structured budgets and save first tend to accumulate nearly twice as much annually as those who save “what’s left”. It’s about prioritizing your future every single month.

From personal experience: When saving for a trip to Japan, I shifted from the “spend-what’s-left” method to a 50/20/30 model. By clearly capping my wants at 20%, I was able to save $2,400 in 6 months, something I’d struggled to do for over a year without a clear framework.

3.4. Set a realistic timeline and savings target

Setting a clear timeline and target amount is crucial when saving for a big purchase. First, decide the total amount you need, not just the price tag, but also extra costs like taxes, fees, or maintenance. Then, figure out how long you want to save before making the purchase.

Why realistic matters: If you want to save $5,000 but only give yourself 3 months, it means saving over $1,600 monthly, a tough goal for most. Instead, extend the timeline to 12 months, which lowers the monthly target to about $420, making it more achievable.

Use goal-setting frameworks like SMART goals

SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) help structure your savings plan. For example:

- Specific: Save $15,000 for a home down payment.

- Measurable: Track $625 saved monthly for 24 months.

- Achievable: Based on your income of $4,000/month, allocate 15% ($600) to savings after expenses.

- Relevant: Aligns with your goal of homeownership.

- Time-bound: Achieve the goal by December 2027.

This framework ensures clarity and keeps your efforts focused. Write down your SMART goal and review it monthly to stay on track.

Pro tip: Track your progress regularly. I used a simple spreadsheet and a calendar reminder to check savings every two weeks. Watching my balance grow kept me excited and committed.

3.5. Automate your savings and boost returns

Automation savings removes the guesswork and discipline needed to consistently. Schedule transfers right after payday into a dedicated high-interest savings account (or high-yield option), so saving happens without you thinking about it.

- Boost returns with better accounts: High-yield savings accounts offer significantly better interest rates. For example, in 2026, some online banks provide APYs around 4.25%, compared to the national average of 0.4% for traditional banks. That means your money grows faster without extra effort.

- Additional tools: Apps offering round-up savings automatically save spare change from purchases, small amounts that add up. Also, savings challenges encourage incremental saving over weeks or months, making the process fun and engaging.

For example, if you get paid biweekly, setting up a $250 automatic transfer every two weeks adds up to $6,500 a year without you lifting a finger.

Also, placing this money in a high-yield savings account is smart. Last year, I switched from a traditional bank paying 0.1% interest to an online bank offering 4.25% APY. The difference was surprising; I earned $425 interest on $10,000 compared to just $10 before.

This strategy helps you save money on a massive amount over time, thanks to compound interest and consistent deposits.

3.6. Take control of your spending habits

Mastering how to save for a big purchase starts with smarter spending, not just higher earnings. Begin by analyzing your monthly expenses to identify and cut non-essential costs, paving the way for significant savings.

- Easy wins: Cancel unused subscriptions (streaming services, gym memberships), reduce dining out, and limit impulse purchases by waiting 24 hours before buying non-essential items.

- Consistency is key: Small daily savings accumulate. For example, skipping a $5 coffee five days a week saves about $260 a year.

Real-life insight: A colleague tracked her spending for a month and discovered she spent $100 on impulse buys. By setting a rule to pause and review purchases for 24 hours, she cut this in half within two months, freeing up money for her savings goal.

There are many approaches if you want me to write about different ways to save money. You can start by cutting down on unnecessary expenses, setting up automatic transfers to savings, participating in money-saving challenges, or using cashback apps.

Each small action builds momentum, and when combined, they make a significant impact on reaching your savings goals.

3.7. Understand alternative payment options

Not all big purchases require a full upfront payment. Alternative payment plans can be smart if managed well.

- Pay-over-time plans: Many retailers offer installment financing, letting you pay in monthly chunks, sometimes interest-free. This helps manage cash flow, but beware of high-interest rates if payments are missed.

- Credit cards: Can be convenient with rewards, but risky if balances aren’t paid monthly due to interest charges.

- Layaway plans: Some stores let you reserve an item by paying a portion over time before taking it home, often without interest.

Which is best? Generally, saving and paying upfront avoids interest and fees, making it cheaper overall. But if a financing plan has low or zero interest and fits your budget, it can be a useful tool.

Example: A family I know used a 12-month 0% interest plan to buy appliances. They stuck strictly to monthly payments, so it was like using their savings spread out without extra cost.

When you build strong savings habits, you will be less likely to take out loans for larger purchases in the future, reducing financial stress.

3.8. Be flexible and adjust your plan when needed

Life is unpredictable, and when planning how to save for a big purchase, unexpected expenses, income changes, or shifting priorities can throw your savings plan off track. Staying adaptable ensures you can tweak your strategy to stay on course without losing sight of your goal.

- Don’t be rigid: If your monthly target becomes too hard, adjust your timeline or amount. It’s better to save something consistently than to give up entirely.

- Avoid burnout: Strict budgets can feel overwhelming. Allow some breathing room for occasional treats to keep morale high. That’s also why budgeting for fun is a good idea. Allowing a portion for entertainment keeps you motivated while still reaching your goal.

- Tracking progress: Use apps or spreadsheets to review your goals regularly. If you get a raise or bonus, consider increasing your monthly savings. Conversely, if you lose income, pause or reduce contributions temporarily.

4. Leverage technology to make saving easier

In today’s digital age, managing money no longer means juggling spreadsheets or paper notes. With the right tools, you can automate saving, track expenses, and plan financial goals, all in one place. Technology helps you stay consistent, organized, and motivated throughout your saving journey.

Here’s how you can make tech work for you:

- Budgeting apps: Tools like YNAB (You Need A Budget), PocketGuard, or Goodbudget automatically categorize expenses and show where your money goes each month, helping you adjust before overspending.

- Automatic saving apps: Platforms such as Acorns, Qapital, or Digit can round up purchases to the nearest dollar and save the difference, turning spare change into steady progress toward your goal.

- Goal-tracking dashboards: Many online banking tools let you set specific savings goals and track your progress in real time, adding a visual layer of motivation.

- Online financial planners: Digital platforms now connect you directly with certified experts who can guide your financial planning remotely. If you’re new to this, explore our detailed guide on the best financial planners for beginners to find reliable, beginner-friendly options.

Embracing technology, you take the guesswork out of saving. Automation ensures you never forget to set money aside, while insights from budgeting apps keep you in control, helping you save smarter, not harder.

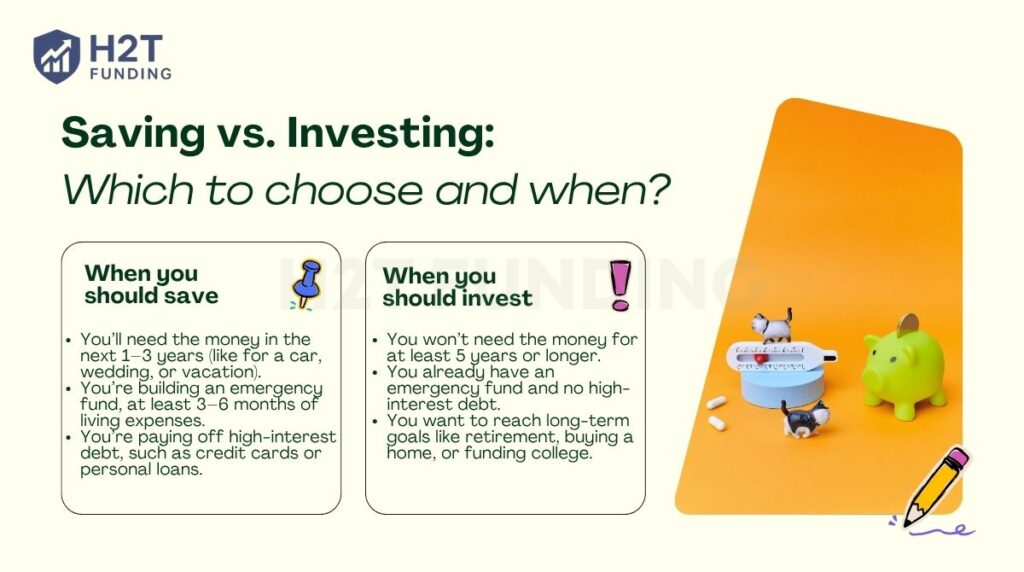

5. Saving vs. Investing: Which to choose and when?

We’ve all heard that one before: Should I save this money, or should I invest it? The answer depends on what you need the money for and when you are going to need it. Both saving and investing are ways of reaching financial goals, but for very different roles: saving protects your money, while investing grows it.

The following are a few simple ways to determine which will best suit your situation.

5.1. When you should save

Saving makes sense when you’ll need the money soon or when safety matters more than growth. It keeps your money easy to access and safe from market swings.

Save when:

- You’ll need the money in the next 1–3 years (like for a car, wedding, or vacation).

- You’re building an emergency fund, at least 3–6 months of living expenses.

- You’re paying off high-interest debt, such as credit cards or personal loans.

Example: When my old laptop died suddenly, I was thankful I had a small “replacement fund.” It wasn’t much, but enough to buy a new one without swiping my credit card. That’s the power of saving, it keeps life’s surprises from turning into financial stress.

Use a high-yield savings account or a money market account for this purpose. You won’t earn huge returns, but you’ll have peace of mind knowing your money is safe and ready when needed.

5.2. When you should invest

Investing is for money you don’t need right away; it’s how you grow wealth over the long term. It carries more risk, but the rewards can be much higher than a savings account.

Invest when:

- You won’t need the money for at least 5 years or longer.

- You already have an emergency fund and no high-interest debt.

- You want to reach long-term goals like retirement, buying a home, or funding college.

Investing rewards patience. For example, if you invest $5,000 annually with an average return of 7%, you could grow roughly $70,000 in 10 years. Saving that same amount in a traditional account would yield far less due to lower interest rates.

5.3. When you need both

In many cases, the best answer isn’t choosing one; it’s doing both. Save for short-term needs, invest for long-term goals.

Example: Let’s say you earn $4,000 a month. You could:

- Save $500 in a high-yield account for emergencies or near-term plans.

- Invest $300 in your retirement account or an index fund for the future.

This balance keeps you protected today while letting your money grow for tomorrow.

In short, saving and investing work best together. Saving gives you stability for what’s near, while investing builds your future wealth. Start by saving for safety, then invest once you’re ready for growth. With both in balance, you’ll have peace of mind today and financial freedom tomorrow.

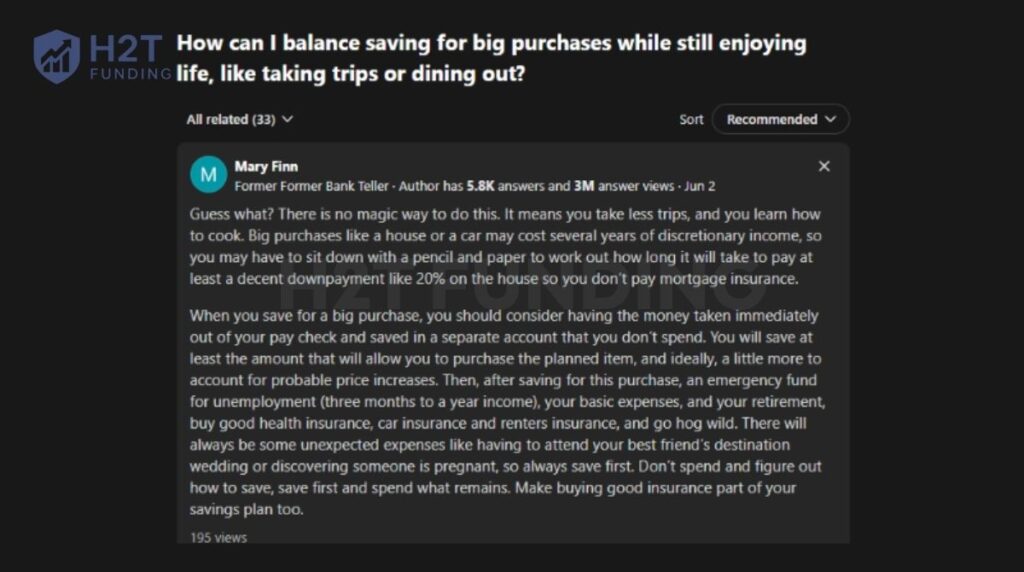

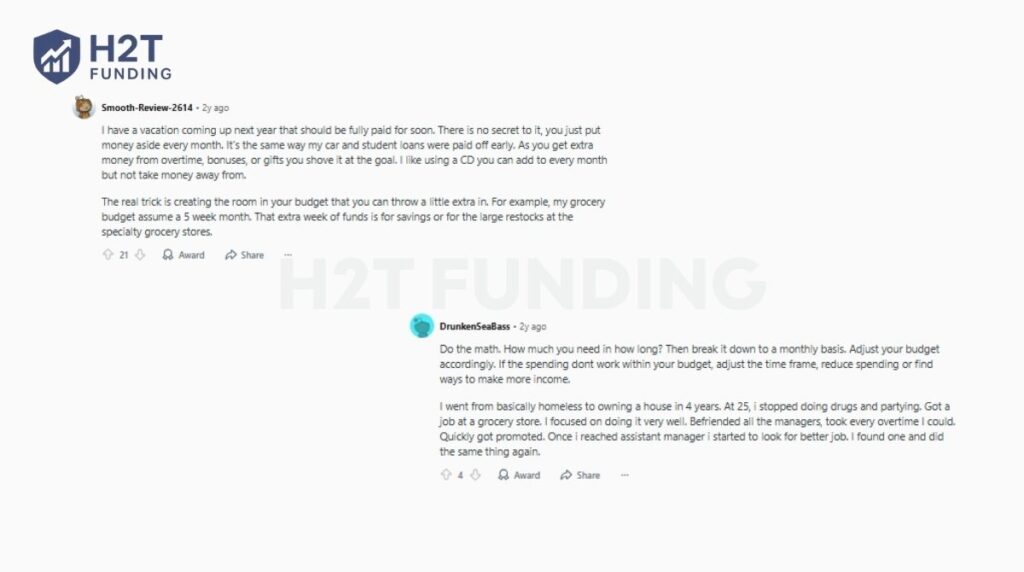

6. What the forum says about how to save for a big purchase

Sometimes the most practical saving lessons come from those who have done it themselves, not necessarily from experts in a book or so. Many users across various online forums attest to the same fact that saving for a big purchase does take discipline, small sacrifices, and a clear plan that fits your life.

Most of them agree that there is no magic shortcut; it simply involves cutting down on a few luxuries, planning, and consistency. For big goals like buying a house or a car, experts often recommend automating your savings. Have a portion of your paycheck sent directly to a separate savings account, so you’re not tempted to spend it on other things.

The key is, save first and spend what remains, not the other way around.

Others like to keep it basic: save a little money each month for things like vacations or big purchases. One client had a great suggestion: plan a “bonus week” into the budget.

For instance, plan your groceries as though every month has five weeks; that extra week’s amount automatically goes into savings for your next trip or a major expense.

Others focused more on a shift in mindset: Do the math. Break it down. Adjust. First, figure out how much you need, then divide it by months. If your current budget doesn’t fit, reduce spending or find little ways to make extra. Over time, these adjustments build up, and that’s how major goals such as homeownership or debt-free living are reached.

The overall message from the community is clear:

- Stay consistent, even if progress feels slow.

- Automate your savings to avoid temptation.

- Be flexible; if life changes, adapt your plan, not your goal.

Success hasn’t got any one formula, but each of these stories has its roots in the same thing: steady saving, honest budgeting, and an ideology that small steps build big milestones.

7. FAQs on how to save for a big purchase

Start by clearly defining what you want to buy and why. Then, calculate the total cost including taxes, fees, and any extra expenses. This helps you set a realistic savings goal.

Begin by saving small amounts regularly, even if it’s just a little. Prioritize your spending and cut unnecessary expenses. Over time, consistent saving adds up and can cover big purchases.

The best way is to save up and pay in full to avoid interest and debt. If that’s not possible, look for interest-free or low-interest financing options, but read the terms carefully before committing.

Saving first means you avoid debt and the stress of paying interest. It also teaches discipline and helps build a stronger financial foundation for the future.

Common barriers include impulsive spending, inconsistent income, and a lack of a clear budget or savings plan. Overcoming these requires discipline and sometimes adjusting lifestyle habits.

Yes, as long as the purchase fits your long-term financial goals and is planned carefully. Avoid impulse buys and ensure you have enough saved to handle it without financial strain.

Identify your personal goal clearly, whether it’s a car, a home appliance, or a vacation. Then, set a timeline and monthly savings target that fits your budget, and track your progress regularly.

The 70-10-10-10 rule is a simple budgeting method that helps you manage every dollar you earn. You divide your income into four parts: 70% for living expenses, 10% for saving, 10% for investing, and 10% for giving or charity. It encourages balance, covering your needs while still building wealth and giving back.

The best way to save for a big purchase is to set a clear goal and timeline, then automate your savings. Open a separate high-yield savings account just for that goal so you don’t mix it with everyday spending. Break your target into monthly or biweekly amounts, transfer the money automatically after payday, and track your progress regularly. This keeps saving consistently and stress-free.

The $27.40 rule is a simple savings challenge based on daily consistency. If you save $27.40 every day for a year, you’ll have $10,000 by the end of 12 months. It’s a great way to visualize how small daily actions can lead to big results, perfect for anyone who wants to stay motivated while saving for a major goal.

Saving $10,000 in 3 months requires focus, structure, and short-term sacrifice. First, divide your goal; that’s about $3,333 per month or $111 per day. Cut unnecessary spending, delay non-essential purchases, and boost income with overtime or side work. Automate transfers into a dedicated savings account each week. This plan demands discipline, but with a strict budget and clear motivation, it’s achievable.

8. Conclusion

Saving for a big purchase may seem challenging at first, but with clear goals, a realistic plan, and disciplined habits, it becomes much more achievable. By breaking down your target, automating your savings, and staying flexible when life changes, you set yourself up for financial success without unnecessary stress or debt.

Remember, the key is consistency and smart money management. Whether you’re saving for a new car, a home renovation, or a special trip, following these steps will help you reach your goal faster and with confidence.

If you want to deepen your understanding and explore more practical tips on how to save for a big purchase, don’t miss the other insightful articles in the Strategies section and Cash Flow & Saving Strategies at H2T Funding. These resources provide expert advice on budgeting, investing, and managing your finances to support your biggest goals.

Start your savings journey today with H2T Funding’s expert strategies, your path to smarter financial decisions, and big purchase success.