A few years ago, I realized my fixed salary wasn’t enough. Rent, bills, and groceries kept rising, while my paycheck stayed the same. Like many office workers, I began searching for how to earn extra income while working full-time without giving up the stability of my main job.

My first attempts were a total scramble. I stayed up until 2 AM writing marketing articles, and tried selling custom phone cases for a month, but no sales came. Even on weekends, I took shifts at a local cafe.

The only thing I got out of it was complete exhaustion. I was running on fumes, and that’s when it hit me: the goal isn’t just to work more, it’s to work smarter with the limited time you actually have.

Through trial and error, I learned how to align side hustles with my skills, schedule, and energy. In this guide, I’ll share strategies and real examples to help you earn extra income while working full-time and keep a healthy work-life balance.

Key takeaways

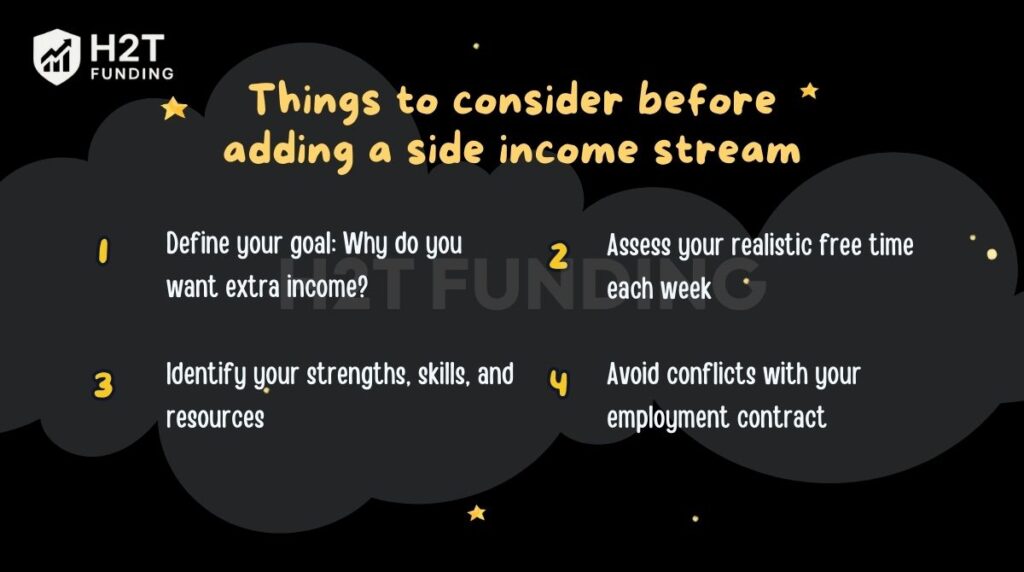

- Extra income requires clear intention; define your goal, assess available time, use existing strengths, and check for contract conflicts before starting.

- Freelancing, e-commerce, tutoring, and selling digital products are among the most practical ways to earn extra income outside a 9–5.

- Smart time management is essential: set a consistent schedule, focus on high-return activities, leverage tools to save hours, and guard against burnout.

- Common mistakes include overworking, overlooking legal restrictions, chasing hustles that don’t fit your skills, and quitting before results have time to show.

- Building extra income is less about working longer hours and more about persistence, discipline, and aligning side hustles with your lifestyle and energy.

1. Things to consider before adding a side income stream

Before diving into a side hustle, it’s important to slow down and plan. Many people rush in, take on too much, and end up drained with little progress, as I did. A thoughtful start helps you avoid wasted effort and protects your energy.

If you’re looking for how to earn extra income while working full-time, this guide lays out practical, low-risk paths you can start today.

1.1. Define your goal: Why do you want extra income?

Every successful side hustle starts with a clear purpose. Whether it’s paying off debt, saving for a big purchase, or investing for the future, knowing why you’re doing it keeps you focused.

A defined goal, like building an emergency fund or adding to savings, will give you the motivation to push through on difficult weeks. For deeper guidance, check out this guide on how to set financial goals to create a solid roadmap.

1.2. Assess your realistic free time each week

It’s tempting to assume you have more time than you really do. In reality, most full-time workers only manage 5–10 hours per week without burning out. Take an honest look at your schedule, mornings, evenings, or weekends, and commit to a timeframe you can actually sustain.

1.3. Identify your strengths, skills, and resources

The most successful side hustles are built around what you already know or enjoy. If you’re skilled at writing, design, or teaching, those talents can be turned into income faster than starting from scratch. Leveraging existing skills also keeps the work more enjoyable and less like a second job.

1.4. Avoid conflicts with your employment contract

Some companies include strict “conflict of interest” clauses. Taking on work too close to your employer’s business could land you in trouble. Always review your contract and, when in doubt, choose opportunities that are clearly outside your primary role.

Adding a side income stream is about intention and balance. Define your purpose, be realistic about your time, play to your strengths, and make sure you stay clear of conflicts. With this foundation, your extra income journey will be smoother and far more rewarding.

And as you plan, don’t forget to use an emergency fund calculator to ensure your financial safety net is strong enough to support your goals.

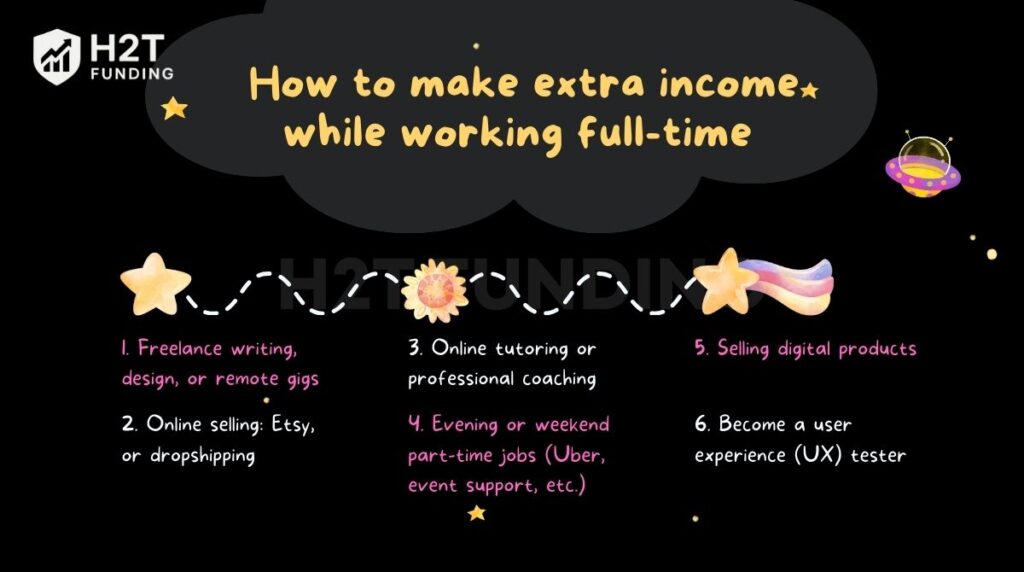

2. How to make earn income while working full-time

Finding ways to make extra money alongside a nine-to-five doesn’t have to mean burning the candle at both ends. With the right approach, you can create reliable income streams that fit around your schedule and even align with your skills.

By the end of this section, you will:

- Understand the most practical side hustle options available today.

- See real-world examples of how each job can generate income.

- Learn the pros and cons of each option to make informed choices.

- Identify which paths align best with your skills, lifestyle, and resources.

⚠️ Reminder: Not every side hustle will be right for you. Carefully evaluate your existing skills and resources before committing, especially if the work demands long-term dedication.

Ready to explore the first option? Let’s start with freelance writing, design, or remote gigs.

2.1. Freelance writing, design, or remote gigs

If you already have marketable skills: writing, graphic design, video editing, or coding, freelancing is one of the fastest ways to start earning extra income. Platforms like Upwork, Fiverr, and Freelancer connect you with clients worldwide. You can take projects that fit your free hours, whether evenings or weekends.

For me personally, freelance writing has been a game-changer. I started small back in 2021, mostly editing blog posts for a few clients. It’s now my most reliable side hustle.

That extra 400–500 a month doesn’t sound like a fortune, but it’s enough to cover my car payment or a weekend trip without touching my main salary. What I love is that you can start small and build from there.

| Pros | Cons |

|---|---|

| Freelancing allows you to work flexible hours that fit your schedule. | The competition on freelance platforms is very high. |

| You can reach clients from all over the world. | You need to constantly promote yourself to attract clients. |

| The income potential increases as you build a portfolio. | Income may be inconsistent, especially in the beginning. |

Since freelancing income can fluctuate, learning essential budgeting tips for freelancers is key to managing your finances effectively. And if you’re still studying, check out these budgeting tips for college students to balance side income with academic life.

2.2. Online selling: Etsy, or dropshipping

E-commerce is a proven path for side income. If you’re creative, platforms like Etsy are perfect for selling handmade or digital products. If you prefer not to manage stock, dropshipping allows you to sell items online without holding inventory.

Shopify and WooCommerce make the setup manageable even for beginners. Success requires patience; you’ll need to learn product research and basic marketing, but once a system is in place, sales can become semi-passive.

| Pros | Cons |

|---|---|

| Online stores can scale and generate significant revenue. | It usually takes time before you make your first sales. |

| Once set up, the system can run semi-passively. | Success requires learning product research and marketing skills. |

| Beginners have many accessible platforms to choose from. | The startup phase involves a steep learning curve. |

Continue reading: 4 walls of budgeting that will change how you spend

2.3. Online tutoring or professional coaching

Tutoring has evolved beyond math and science. Today, you can coach in Excel, languages, music, or even career development. Platforms like Tutor.com or Preply let you teach globally.

If you’re bilingual, teaching English online is consistently in demand and often pays above average for part-time hours. Coaching in your professional expertise can be even more rewarding; you might charge higher rates because of your unique background.

I saw this work brilliantly for a guy in the finance department at my old job. He was the office’s unofficial Excel guru and got so tired of answering the same questions that he joked about charging for his time, and then he actually did it.

He started offering small-group Zoom workshops on weekends. After a few months of word getting around, he was pulling in an extra $600 a month just from that.

| Pros | Cons |

|---|---|

| Tutoring or coaching often pays a high hourly rate. | Demand for lessons can be irregular. |

| Helping others can feel rewarding and meaningful. | Not everyone can teach effectively. |

| Teaching builds your authority in the field. | It can be exhausting after a full workday. |

2.4. Evening or weekend part-time jobs (Uber, event support, etc.)

Driving for Uber or Lyft, delivering food with DoorDash, or working at weekend events are straightforward ways to bring in extra money without special skills. The flexibility is the biggest advantage; you decide when and how long to work. While the hourly pay may not match freelancing or coaching, it’s reliable.

I even gave driving for Uber a shot one summer. After my day job, I’d hop in the car for a couple of hours. It wasn’t the most glamorous work, but that extra 300 – 400 a month, honestly, made a huge difference; it meant my entire grocery bill was taken care of. It was a straightforward way to ease some financial pressure.

| Pros | Cons |

|---|---|

| You can choose when and how long you want to work. | The work can be physically tiring. |

| Payment is usually quick and straightforward. | The hourly pay is often lower compared to freelancing or coaching. |

| These jobs do not require special qualifications. | Driving jobs can cause extra wear on your vehicle. |

2.5. Selling digital products (eBooks, online courses, Notion templates)

If you want leverage, work once, get paid repeatedly, digital products are the answer. You can create an eBook, an online course, or productivity templates and sell them on Gumroad, Udemy, or Etsy.

The upfront effort is heavy: you’ll spend weeks preparing and refining. But once published, these products can generate income with minimal ongoing effort. Many side hustlers report earning $100–1,000 a month after a few months of consistent promotion.

| Pros | Cons |

|---|---|

| Digital products can generate passive income once published. | You need to put in a lot of upfront effort to create the product. |

| They can reach a global audience instantly. | Marketing is essential to attract buyers. |

| The income potential grows with consistent promotion. | It may take months before you see results. |

2.6. Become a user experience (UX) tester

Companies constantly need feedback on their websites and apps. Platforms like UserTesting and TryMyUI pay you to record your thoughts while navigating a site. Most short tests pay around $10, while live interviews can reach $100 or more.

| Pros | Cons |

|---|---|

| The tasks are simple and easy to understand. | Tests are not always available when you need them. |

| Short tests can pay a reasonable rate for the time spent. | Monthly earnings are usually very limited. |

| It requires no special skills to get started. | It is not a scalable long-term option. |

2.7. Take surveys or join focus groups

Survey platforms like Survey Junkie, Swagbucks, or MyPoints pay for your opinions. While the payouts are small, maybe $1–3 per survey, doing them while watching TV can bring in $30–50 monthly.

A better option is focus groups, where companies pay $50–200 for a 1–2 hour session testing a product or sharing feedback. This is hit or miss based on availability, but it’s worth checking if you enjoy giving opinions.

| Pros | Cons |

|---|---|

| You can multitask and take surveys while doing other activities. | Most surveys pay very little per completion. |

| No skills are required to participate. | Spending time on surveys often brings low returns. |

| Focus groups can pay significantly more than surveys. | Focus group opportunities are inconsistent and limited. |

2.8. Offer services as a virtual assistant

If you’re organized and like variety, becoming a virtual assistant can be a rewarding side hustle. Tasks include managing calendars, booking travel, and handling customer emails.

Websites like Belay and Zirtual connect VAs with small businesses. Many earn $15–25 per hour starting. Once you prove reliability, clients often expand your tasks, turning this into a long-term income stream.

| Pros | Cons |

|---|---|

| Virtual assistants can earn solid hourly rates. | You need to be very organized to succeed. |

| The work involves varied tasks, so it is rarely boring. | The workload can feel overwhelming at times. |

| Reliable VAs often gain long-term clients. | Projects may be irregular at the beginning. |

2.9. Social media management or content creation

If you enjoy social media but don’t want to be in front of the camera, managing accounts for businesses is an option. Many small companies can’t keep up with posting and engagement, so they outsource.

Rates start around $300–400 per month per client. On the flip side, if you have your own following, affiliate marketing and brand collaborations can turn your content into income. This route suits you if your creative skills are stronger than your desire to be on camera.

| Pros | Cons |

|---|---|

| Social media management is in high demand. | Managing accounts requires a lot of time and consistency. |

| The work allows you to be creative and expressive. | Results depend heavily on unpredictable algorithms. |

| Income can scale as you handle more clients. | Working with clients requires good communication skills. |

2.10. Pet sitting or babysitting

These traditional side hustles still work, and often pay better than you’d expect. Services like Rover or Care.com make it easy to find clients. Pet sitting can bring in $20–40 a night, while babysitting rates often hit $15–25 an hour, depending on your city. If you genuinely enjoy kids or animals, this income won’t even feel like work.

| Pros | Cons |

|---|---|

| Babysitting and pet sitting can pay surprisingly well. | You carry a high responsibility for safety and care. |

| It is enjoyable if you like animals or children. | Opportunities are limited by time and availability. |

| Clients often return if you build trust. | Building trust takes effort and reliability. |

2.11. Become a photographer or videographer

If you own a decent camera and have an eye for detail, weekend photography gigs can pay well. Family shoots, birthdays, or small business content often bring $75–150 per session. Add editing time, and you can easily clear a few hundred dollars a month with just a couple of jobs.

| Pros | Cons |

|---|---|

| Creative projects can be fulfilling. | Cameras and equipment require large investments. |

| Photography gigs usually pay well per session. | Editing work can be very time-consuming. |

| You can work part-time and still earn extra income. | Client demand may fluctuate with the seasons. |

2.12. Rent your space, car, or belongings

If you own assets you don’t use daily, renting them out can turn idle things into income. Airbnb lets you rent a spare room, potentially bringing in $500–1,000 a month depending on your city. Platforms like Turo allow you to rent out your car, often earning $300–600 per month for occasional rentals.

Even smaller items, like cameras, projectors, or baby gear, can be rented through platforms like Fat Llama or BabyQuip. It’s one of the most “set and forget” ways to add income.

| Pros | Cons |

|---|---|

| Renting provides a relatively passive income. | There is always a risk of damage or loss. |

| You can monetize things you already own. | You may be liable for accidents or misuse. |

| The income can scale if demand is high. | Platforms usually charge service fees. |

2.13. Start a blog or YouTube channel

Content creation is a slower build, but it can turn into a strong side business. Blogging about cooking, travel, or personal finance can generate advertising, affiliate, or sponsorship income. YouTube offers similar monetization paths once you hit their thresholds.

Many creators start with zero and, after a year of consistent posting, see $200–500 monthly. While not instant, this path leverages creativity into long-term passive income.

| Pros | Cons |

|---|---|

| Blogs and channels can eventually generate passive income. | It takes a long time before you see financial results. |

| Content creation builds your authority online. | Success requires consistent effort over months or years. |

| Multiple income streams become possible as you grow. | There is no guarantee of stable earnings. |

2.14. Financial coaching or consulting

If you’re passionate about money management, financial coaching can be both impactful and profitable. Unlike tutoring, this doesn’t require certifications to start; you simply help clients with budgeting, debt payoff, or saving strategies. Rates often start at $50 an hour.

You can explore resources like the best trading strategy for beginners or learn how to get into prop trading to expand into advanced coaching.

| Pros | Cons |

|---|---|

| Coaching has a strong earning potential. | You need credibility to attract clients. |

| It offers a flexible schedule for sessions. | Coaching can be emotionally demanding. |

| Helping clients improve financially is impactful. | Specialized knowledge may be required to stand out. |

2.15. Task-based or handyman services

Platforms like TaskRabbit let you earn by assembling furniture, fixing small household issues, or running errands. Hourly rates vary from $20 to $40, depending on the task and location.

For those handy with tools or who enjoy physical work, this is a straightforward way to make a side income. Even small “odd jobs” a few times a month can fund your utilities or weekend leisure.

| Pros | Cons |

|---|---|

| You see immediate results after each job. | The work can be physically demanding. |

| The hourly pay can be attractive. | Opportunities depend on your location. |

| The work is usually simple and straightforward. | Jobs are not always consistent. |

2.16. Car advertising or delivery services

Apps like Wrapify will pay you to wrap your car with ads, averaging $250–400 per month, depending on mileage. Combined with delivery services like Amazon Flex or Instacart, your car can become an asset that pays for itself.

| Pros | Cons |

|---|---|

| Car advertising provides easy side income. | The overall earning potential is limited. |

| Delivery services offer flexible hours. | Your car will experience additional wear and tear. |

| Wrapping your car can generate passive earnings. | Some services require a minimum level of mileage. |

There’s no single best way to make extra income while working full-time. The right choice depends on your schedule, skills, and how much energy you want to commit.

3. How to manage your time to make extra income while working full-time

Earning extra income while keeping a nine-to-five requires more than just motivation; it requires smart time management. Without structure, side hustles can spill into your main job or personal life, leading to exhaustion. Here are proven strategies to balance both effectively.

3.1. Create a schedule: mornings, evenings, and weekends

The first step is to map out when you realistically have time. Some people thrive in the early hours, dedicating an hour to freelancing before work. Others prefer evenings or weekends for tutoring, deliveries, or creative projects.

By blocking out these slots, you avoid the trap of “fitting it in whenever.” A consistent schedule turns your side hustle into a habit, not a stressor. To make sure your schedule supports your financial goals, consider pairing it with smart money habits like tracking your expenses.

3.2. Apply the 80/20 rule – focus on what works best

Not every task produces equal results. The Pareto Principle (80/20 rule) suggests that 80% of outcomes come from 20% of actions. In side hustles, that might mean a few high-paying freelance clients instead of many low-paying gigs, or one strong digital product instead of juggling multiple small ones.

Focus on the income streams that give you the highest return for your time, and trim the rest.

Discover more budgeting methods:

3.3. Use tools to manage tasks and time

Technology can save hours of manual work. Tools like Trello, Asana, or Notion help you organize tasks and deadlines. Time trackers like Toggl show you exactly where your hours go.

Even automation tools (Buffer, Hootsuite, Zapier) can handle repetitive actions like posting on social media or sending invoices. Leveraging these systems means you spend more time earning, less time managing.

Personally, I use Notion to organize weekly priorities and client projects, and Buffer to schedule social posts, which saves at least five hours each week.

3.4. Set boundaries to protect health and your main job

The biggest risk of side hustling isn’t failure, it’s burnout. To avoid it, set clear limits. Decide how many hours per week you’ll dedicate to extra income and stick to them. Communicate availability to clients upfront so they don’t expect 24/7 responses.

And most importantly, don’t let side work bleed into your main job’s hours; protecting that paycheck comes first. Healthy boundaries also mean knowing how to prioritize expenses, so the income you earn actually strengthens your financial life instead of creating more stress.

Managing time isn’t about squeezing more hours; it’s about smarter choices. Build a schedule, prioritize high-value work, use tools to stay organized, and set boundaries. That’s how you earn extra income without burning out.

4. Common mistakes to avoid when trying to make extra income while working full-time

Earning extra income sounds exciting, but it’s easy to fall into traps that drain your energy or stall progress. These are the mistakes I’ve seen most often, and in some cases, learned the hard way myself. Avoiding these pitfalls is just as important as knowing how to earn extra income while working full-time.

4.1. Overworking and burning out

One of the fastest ways to fail is to pile on too much. I once pushed past 60 hours a week, combining my job and side hustles. The result? Zero energy and slipping performance at work.

Remember: your health and main salary are your foundation, so set limits early.

Also, be mindful of how you use the extra money. If you fall into lifestyle inflation, all your hard work can disappear without improving your financial stability.

4.2. Ignoring your employment contract (conflict of interest)

Your company may restrict outside work, especially if it overlaps with the industry you’re in. One colleague of mine accepted freelance gigs that directly competed with their employer, only to face disciplinary action later. It’s not worth the risk; always check your contract before committing.

4.3. Choosing the wrong side hustle for your skills or time

Not every hustle suits your lifestyle. I once tried online reselling because it seemed trendy, but the endless customer messages and returns drained me. I eventually realized freelancing aligned better with my skills and available time. Picking the wrong model wastes effort and often leads to frustration.

4.4. Lacking consistency and quitting too soon

Side hustles usually grow slowly. Many people quit after a month when earnings seem small. The truth is, momentum builds over time. Treat it like a marathon: commit for at least three to six months before judging success.

At the same time, avoid bad spending habits. Knowing how to stop overspending ensures the extra income you earn actually strengthens your finances instead of slipping away.

Avoid the temptation to overwork, protect yourself legally, choose hustles that fit who you are, and stay patient. Extra income grows slowly at first, but with discipline and persistence, it can become a meaningful financial cushion.

5. Best extra income ideas by country

While the sections above cover general side hustle ideas, this part breaks them down by country-specific opportunities and platforms. Finding ways to make extra money while working a full-time job is possible no matter where you live, but the best approach often depends on your country’s opportunities.

In the UK, gig apps like Deliveroo or Uber are common, while in the Philippines, freelancing and e-commerce platforms dominate.

5.1. How to make extra income while working full-time in the UK

Extra income opportunities exist everywhere, but the options differ by country. Gig work and rentals are popular in the UK and Canada, while freelancing and e-commerce thrive in the Philippines and India. Let’s explore the most practical ideas you can start today.

Online and digital hustles

- Freelancing: Offer services such as copywriting, design, or virtual assistance through platforms like Upwork or Fiverr.

- Digital products: Build and sell ebooks, templates, or online courses to generate semi-passive income.

- Content creation: Start a blog, YouTube channel, or podcast and earn from ads, affiliates, or sponsorships.

- Online tutoring: Teaching English or other subjects to students both in the UK and abroad.

- Cash-back apps: Use apps to earn rebates on groceries and essentials, stacking savings with other side hustles.

- E-commerce: Launch a small online shop or print-on-demand store using Shopify or Etsy.

Gig economy and local services

- Food and grocery delivery: Work with apps like Deliveroo, Uber Eats, or Just Eat during evenings or weekends.

- Ridesharing: Drive with Uber or Bolt for flexible additional earnings.

- Pet care: Offer dog walking, pet sitting, or boarding services in your local community.

- Event support: Pick up part-time event staff roles on weekends for quick extra pay.

Renting out assets

- Spare room rental: List extra space in your home on Airbnb for a steady side income.

- Car sharing: Use Turo or Karshare to rent your car when not in use.

Selling products

- Reselling: Buy and flip second-hand goods through eBay, Gumtree, or Facebook Marketplace.

- Handmade crafts: Sell unique crafts or art pieces on Etsy or at local markets.

Other income ideas

- Market research: Earn cash or vouchers by joining paid focus groups and survey panels.

- Competitions: Participate in prize draws or giveaways, which can occasionally bring valuable rewards.

5.2. How to make extra income while working full-time Philippines

In the Philippines, extra income opportunities are shaped by strong demand for online services, growing e-commerce platforms, and the fast-rising gig economy.

Leveraging your skills

- Freelancing and consulting: Use platforms like OnlineJobs.ph, Fiverr, or Upwork to offer writing, social media management, or virtual assistance.

- Online tutoring and teaching: Teach English or academic subjects to international students through platforms like 51Talk or Preply.

- Web and multimedia design: Build websites, apps, or creative assets for businesses looking to strengthen their online presence.

- Transcription services: Convert audio and video recordings into written form, with specialized opportunities in medical or legal transcription.

- Photography and videography: Sell stock images online or provide event photography for weddings and birthdays.

Online ventures

- E-commerce selling: Open a shop on Shopee, Lazada, or use Facebook Marketplace to sell products directly to local buyers.

- Dropshipping: Launch an online store without managing inventory by partnering with suppliers.

- Affiliate marketing: Promote products via blogs, TikTok, or Facebook and earn commission from each sale.

- Blogging and content creation: Build a YouTube channel, podcast, or niche blog to generate advertising and sponsorship revenue.

- Digital products: Create and sell e-books, templates, or online courses tailored to Filipino audiences.

Participating in the sharing economy

- Rideshare and delivery: Drive for Grab, Lalamove, or Foodpanda to earn during evenings or weekends.

- Renting out assets: List a spare room on Airbnb or rent out personal equipment like cameras and tools.

Other income streams

- Online surveys and microtasks: Join platforms like Swagbucks or Clickworker for small, quick tasks.

- Pet care: Offer dog walking or pet sitting services within your neighborhood.

- Handmade crafts: Sell custom-made jewelry, accessories, or décor online or at local markets.

5.3. How to make extra income while working full-time in India

India offers a wide variety of side hustle opportunities, from online freelancing to local gigs and even passive investing. With the country’s fast-growing digital economy, many full-time workers are turning to flexible online platforms, small businesses, and creative ventures to supplement their income.

Online and digital income

- Freelancing: Use Upwork, Fiverr, or WorknHire to provide services in writing, design, development, or social media.

- Virtual assistant: Offer admin or creative support to global clients from home.

- Blogging or YouTube: Build content in niches like tech, education, or lifestyle and monetize through ads and sponsorships.

- Online tutoring: Teach math, coding, or English to local and international students.

- Digital products: Sell ebooks, templates, or online courses on platforms like Gumroad.

- Affiliate marketing: Promote products via websites or social media and earn commissions.

- Online surveys and microtasks: Join sites like Swagbucks or Amazon Mechanical Turk for small, quick payouts.

Creative and product-based income

- Handmade crafts: Sell handmade jewelry, textiles, or art through Amazon India or Instagram shops.

- Dropshipping: Start an online store without managing inventory by using suppliers.

- Reselling: Flip second-hand goods or refurbished electronics for profit online.

Local and gig-based opportunities

- Delivery services: Partner with Zomato, Swiggy, or Dunzo to earn through food or grocery delivery.

- Ridesharing: Drive with Ola or Uber during evenings or weekends for flexible income.

- Local services: Offer house cleaning, lawn care, or errands in your neighborhood.

- Pet care: Provide dog walking or pet sitting for urban pet owners.

Investment and consulting

- Investing: Build long-term passive income by investing in stocks, mutual funds, or SIPs.

- Consulting: Share your professional expertise, such as business strategy, marketing, or IT, to help small businesses grow.

5.4. How to make extra income while working full-time in Ireland

In Ireland, earning extra income alongside a full-time job is very accessible thanks to flexible gig platforms, online freelancing, and local demand for services. From digital opportunities to renting out assets, workers have multiple ways to supplement their salaries while keeping their main role secure.

Online and digital opportunities

- Freelancing: Provide services in writing, editing, graphic design, or web development through sites like Upwork or PeoplePerHour.

- Virtual assistant: Support small businesses remotely with admin, scheduling, or creative tasks.

- Online courses: Package your expertise into courses and sell on platforms like Teachable or Udemy.

- Affiliate marketing: Earn commissions by promoting products via blogs or social media.

- Digital products: Sell e-books, templates, or other downloadable resources.

- Content creation: Launch a blog, YouTube channel, or podcast and monetize through ads or sponsorships.

Selling goods and services

- Handmade crafts and art: Create unique items and sell through Etsy or local craft fairs.

- Decluttering sales: Sell used clothing, electronics, or furniture on DoneDeal or Adverts.ie.

- Mystery shopping: Get paid to evaluate customer experiences for retail and hospitality brands.

- Tutoring: Teach school subjects or language lessons either online or in person.

Gig economy and local services

- Food and rideshare driving: Drive with Uber, Bolt, or deliver food for Deliveroo and Just Eat.

- Pet care: Offer dog walking or pet sitting for busy households.

- House sitting: Look after homes while owners are away, often with added pay for extra duties.

Renting assets

- Property rental: List a spare room or entire home on Airbnb for steady side earnings.

- Car rental: Rent your vehicle on platforms like GoCar or Yuko when not in use.

Things to consider

- Time management: Balance your full-time job with side hustles by setting a clear schedule.

- Tax compliance: Report all additional earnings to the Revenue Commissioners to avoid penalties.

- Skill alignment: Choose hustles that match your strengths to maximize efficiency and results.

5.5. How to make extra income while working full-time in Australia

In Australia, side hustles are widely accessible through both digital platforms and local service-based opportunities. Whether you want to earn online, provide community services, or rent out assets, there are flexible options that can fit around a full-time schedule.

Offer your skills

- Freelancing: Use writing, editing, design, or web development skills to find projects on platforms like Upwork or Freelancer.

- Online tutoring: Teach school subjects, languages, or music lessons via Zoom or local tutoring platforms.

- Virtual assistant: Provide remote admin support such as managing emails, scheduling, or handling social media tasks.

Service-based gigs

- Pet sitting and dog walking: Look after pets for owners using sites like MadPaws or Pawshake.

- Delivery and driving: Earn a flexible income by delivering food with Uber Eats or Menulog, or driving passengers with Uber or DiDi.

- Cleaning and handyman services: Offer cleaning, gardening, or small repair work to households in your area.

Sell products and assets

- Sell handmade items: Create and sell crafts or art on Etsy or at local weekend markets.

- Resell used items: Declutter your home and list unwanted goods on Gumtree or Facebook Marketplace.

- Rent your assets: List spare rooms on Airbnb, rent out your car via Car Next Door, or even sublet parking spaces.

Online opportunities

- Online surveys and market research: Earn small payments by sharing feedback through survey panels.

- Blogging and content creation: Launch a blog or YouTube channel to generate ad and sponsorship revenue.

- Digital products: Sell e-books, printables, or digital templates on Gumroad or similar platforms.

5.6. How to make extra income while working full-time in Canada

In Canada, there are plenty of flexible ways to earn extra income alongside your regular job. From online freelancing and content creation to gig economy roles and asset rentals, side hustles can be tailored to your skills and lifestyle. Choosing the right option allows you to supplement your salary without overloading your schedule.

Online and digital side hustles

- Freelancing: Use platforms like Upwork or Fiverr to offer services in writing, translation, graphic design, or web development.

- Virtual assistant: Provide remote admin or creative support, including scheduling, data entry, or social media tasks.

- Content creation: Launch a YouTube channel, blog, or podcast and earn through ads, affiliates, or sponsorships.

- Online tutoring: Teach subjects like math, science, or English to students locally or abroad.

- Online courses: Package your expertise into structured digital courses and sell them on Teachable or Udemy.

- Surveys and user testing: Join sites like UserTesting or Survey Junkie to earn small payments for feedback.

Gig economy and service-based hustles

- Rideshare and delivery: Drive with Uber or Lyft, or deliver food and groceries via SkipTheDishes, DoorDash, or Instacart.

- Pet sitting and dog walking: Provide pet care services for busy owners using sites like Rover.

- Babysitting: Offer childcare services through Care.com or within your community.

- House sitting: Look after homes while owners travel, often with added pay for tasks like plant or pet care.

- Event and personal services: Offer event planning, personal shopping, or local errand-running for clients.

Selling and renting

- Sell products: Use Etsy, eBay, or Facebook Marketplace to sell handmade crafts, second-hand goods, or vintage items.

- Rent assets: Rent out spare rooms through Airbnb, your car through Turo, or unused parking spaces.

- Flipping goods: Buy undervalued items from thrift stores or garage sales, refurbish them, and resell at a profit online.

Every country offers its own unique mix of side hustle opportunities, shaped by local platforms, legal requirements, and cultural habits. What works best in the UK or Canada may differ from options in India or the Philippines

But the principle remains the same: focus on opportunities that match your skills, comply with regulations, and fit within the time you can realistically commit.

6. Real-life examples of people who made extra income while working full-time

Sometimes the most powerful lessons come from seeing how ordinary people turn their skills into extra income. Below are real cases I’ve come across that show both the potential and the challenges of side hustles.

6.1. A full-time accountant teaching Excel on weekends

Ravi worked full-time at an accounting firm in Manchester. He noticed many colleagues struggled with Excel shortcuts and formulas, so he decided to turn his knowledge into an online course.

Every Saturday morning, he ran 2-hour Zoom classes for small groups of 8–10 students. Within six months, Ravi was earning £400–£500 per month.

Getting the word out was way harder than he expected. His first announcement on LinkedIn got two likes, one from his mom. His first actual class had only three people show up, and one of them was his cousin.

He realized he needed to show people what he could do, so he started posting short, genuinely useful “Excel Tip of the Day” videos. Slowly, people started to notice, and his classes began to fill up.

6.2. An office worker selling handmade crafts on Etsy

Mei, an administrative assistant in Singapore, had always loved making scented candles. After encouragement from friends, she opened an Etsy store in 2021. She worked on new designs during weeknights and handled packaging on Sundays.

During the Christmas season, her shop sometimes brought in $700–800 in extra income, while in quieter months she still made around $300–400.

The biggest challenge was keeping up with orders during peak periods while working 9–5. Mei solved this by preparing batches of candles in advance and outsourcing packaging help to a cousin when demand spiked.

6.3. A software developer creating small apps for the App Store

Arjun was a full-time software engineer in Bangalore. In his spare evenings, he created a simple productivity app to help users organize daily tasks. He launched it on the App Store for $1.99 with optional in-app purchases.

The app steadily earned ₹15,000–25,000 per month ($200–300) in passive income. His main difficulty was maintaining updates; bug reports piled up faster than he expected.

To manage this, he dedicated one fixed evening per week to debugging and pushed minor updates monthly. Over time, his app developed a small but loyal user base.

These stories show that earning extra income doesn’t mean leaving your full-time job. With patience and consistency, even small side hustles can become reliable financial support, clear examples of how to make extra income with a full-time job in practical ways.

7. Which side hustle is best for you?

Alright, let’s get real. Forget the endless lists of the 50 best side hustles. The best one for you isn’t the trendy one; it’s the one you’ll actually stick with after a long day at your main job.

To figure that out, think about what kind of person you are.

7.1. If you’re creative and tech-savvy

If you enjoy working independently on a computer and want to build something scalable, these digital hustles are a great fit.

- Content creation: Start a blog, YouTube channel, or podcast focusing on a topic you’re passionate about (e.g., cooking, personal finance, gaming). You can monetize through ads, sponsorships, or affiliate marketing.

- Digital products: Design and sell digital goods like e-books, online courses, or productivity templates on platforms like Gumroad or Etsy. This model offers the potential for passive income, create it once and sell it repeatedly.

- Freelancing: Offer your skills in writing, graphic design, web development, or video editing on platforms like Upwork and Fiverr. This is one of the fastest ways to turn your existing expertise into cash.

This path is best for you if: You are a self-starter, enjoy creative challenges, and want an income stream with long-term growth potential.

7.2. If you prefer hands-on work and local services

If you’re more of a people person or enjoy tasks that get you out and about, the gig economy and local services offer immediate and flexible earning opportunities.

- Gig economy: Drive for rideshare services like Uber, deliver food with apps like Deliveroo, or offer pet sitting through platforms like Rover. The biggest advantage is the flexibility to work whenever you have free time.

- Tutoring or coaching: Share your knowledge by tutoring students online in subjects you excel at or offering professional coaching in your field of expertise. This can be both financially and personally rewarding.

- Specialized services: Offer practical services like event photography, furniture assembly (via TaskRabbit), or handyman repairs in your local community. These jobs often pay well per hour.

This path is best for you if: You want a flexible schedule, prefer straightforward tasks with quick payouts, and enjoy interacting with people or working in your local area.

7.3. If you have niche expertise or existing assets

If you have deep knowledge in a specific field or own assets you’re not using full-time, you can monetize them for a high return on your time and investment.

- Consulting and coaching: Leverage your professional experience to offer financial coaching, digital marketing consulting, or business strategy advice to small businesses or individuals. This allows you to charge premium rates for your expertise.

- Renting your assets: Generate passive income by renting out a spare room on Airbnb, your car on Turo, or even a parking space. This is an excellent way to make your assets work for you with minimal ongoing effort.

- Reselling or flipping: Use your eye for value to buy undervalued items from thrift stores or online marketplaces and resell them for a profit. This is ideal for those who enjoy the thrill of finding a good deal.

This path is best for you if: You want to leverage existing knowledge or resources, aim for higher hourly earnings, and are interested in building more passive or strategic income streams.

At the end of the day, figuring out how to make extra income with a full time job isn’t a secret formula. It’s about knowing yourself. Are you a computer person, a hands-on helper, or a savvy owner? Just pick one thing that sounds remotely interesting and give it a try. Starting is the hardest part.

8. FAQs

Begin with simple side hustles that don’t require expertise, such as online surveys, delivery apps, or selling second-hand items. As you gain experience, you can develop marketable skills like writing, design, or tutoring to move into higher-paying opportunities.

Yes, many options need little or no upfront cost: freelancing with existing skills, virtual assistance, online tutoring, or offering pet sitting. Even starting a blog or YouTube channel is low-cost, though it takes time before generating income.

Focus on side hustles that fit small time slots, such as freelancing on short projects, teaching one or two tutoring sessions, or doing food delivery on weekends. The key is consistency; even with limited hours, you can still explore how to make extra income with a full-time job by choosing flexible and realistic options.

Yes, most countries require you to declare side income and pay taxes once it passes a certain threshold. For example, in the UK, income above £1,000 must be reported to HMRC, while in Canada, all additional income must be declared to the CRA. Always check local regulations.

The seven streams of income refer to having multiple income sources: earned income (salary), profit income (business), interest income, dividend income, rental income, capital gains, and royalty or licensing income. Building across these streams helps diversify financial stability.

The 50/30/20 rule is a simple budgeting method: allocate 50% of income to needs (housing, food, bills), 30% to wants (leisure, lifestyle), and 20% to savings or debt repayment. This framework ensures a balance between living expenses and financial growth.

9. Conclusion

Ultimately, how to earn extra income while working full-time comes down to picking what fits your skills and goals, rather than chasing the “perfect” hustle. From freelancing to online ventures, there are many ways to make extra money while working full-time if you stay consistent and focused.

Don’t wait until you have more free time; create that time and invest it wisely to build a stronger financial future. For more practical tips on managing money and growing your income, explore our Budgeting Strategies articles at H2T Funding.