Learning how to improve your personal cash flow can honestly transform your life.

For me, it wasn’t about getting rich overnight. It was about quieting that constant knot of anxiety in my stomach every time I thought about bills. When I finally got serious about tracking my money, the emergency fund I painstakingly built was the only thing that kept me afloat during an unexpected job transition.

If you’re tired of that same month-end stress, this guide is for you. I’m sharing the real, proven strategies I used to finally get control of my finances. Ready to find some financial peace of mind? Let’s get started.

Key takeaways

- Personal cash flow is the balance of income minus expenses, showing whether you have a surplus or deficit.

- Tracking income and expenses is the first step to identify spending leaks and regain control.

- Budgeting methods like the 50-30-20 rule or zero-based budgeting help allocate money wisely.

- Boosting cash flow comes from both reducing unnecessary costs and increasing income streams.

- Building an emergency fund and planning for future goals ensures long-term financial stability.

1. What is personal cash flow?

Personal cash flow represents the inflow and outflow of money in day-to-day financial activity, highlighting the balance between your earnings and your expenses. It provides a clear picture of whether you have a surplus that can be saved or invested, or a deficit that needs to be managed.

Creating a personal cash flow statement helps you monitor income sources and track expenses more effectively. This makes it easier to identify spending patterns, cut unnecessary costs, and allocate resources wisely. Good personal cash flow management is essential for building long-term stability and achieving financial goals.

2. What you need to learn how to improve your personal cash flow

Before you make changes, gather the right tools:

- Tools like YNAB (You Need A Budget) or Monarch Money make tracking your budget easier.

- A spreadsheet (Excel or Google Sheets)

- Bank and credit card statements

- A clear financial goal (e.g., save $500/month, pay off $2,000 in debt)

These tools help you visualize where your money goes and set a baseline.

3. How much money is going out

Before you know how to improve personal cash flow, you need to understand your current financial situation. This means calculating your net cash flow, the difference between your total income and your total expenses each month.

Start by listing all sources of income, then subtract every expense, from rent and groceries to coffee and streaming services. This simple step helps you see whether you’re spending more than you earn or if you have surplus funds, an essential practice if you want to stop living paycheck to paycheck, and it’s a foundation for anyone learning how to manage personal cash flow.

Formula: Net Cash Flow = Total Monthly Income – Total Monthly Expenses

If the result is negative, you’re living beyond your means. If it’s positive, you can decide how to best use that extra money: saving, investing, or paying off debt.

Example: Let’s use some real-world numbers. Say your take-home pay is $3,000/month. Your rent is $1,200, groceries are around $450 (depending on the week), utilities are $180, and your car payment is $250.

Then there are the subscriptions like Netflix, Spotify, that gym you keep meaning to go to, maybe $75. After all that, plus random takeout and a few too many Amazon purchases, you’re left wondering where the rest went. Let’s say it all adds up to $2,655.

$3,000 – $2,655 = $345

This means you have a positive cash flow of $345. It’s not a fortune, but it’s a starting point, money you can use to build savings or attack debt.

See more related articles:

Improving your cash flow isn’t about big leaps but consistent, intentional actions. From tracking expenses and budgeting to paying off debt, planning ahead, each step builds a stronger financial foundation. By applying these strategies, you’ll not only free up more money each month but also create lasting stability and confidence in your financial future.

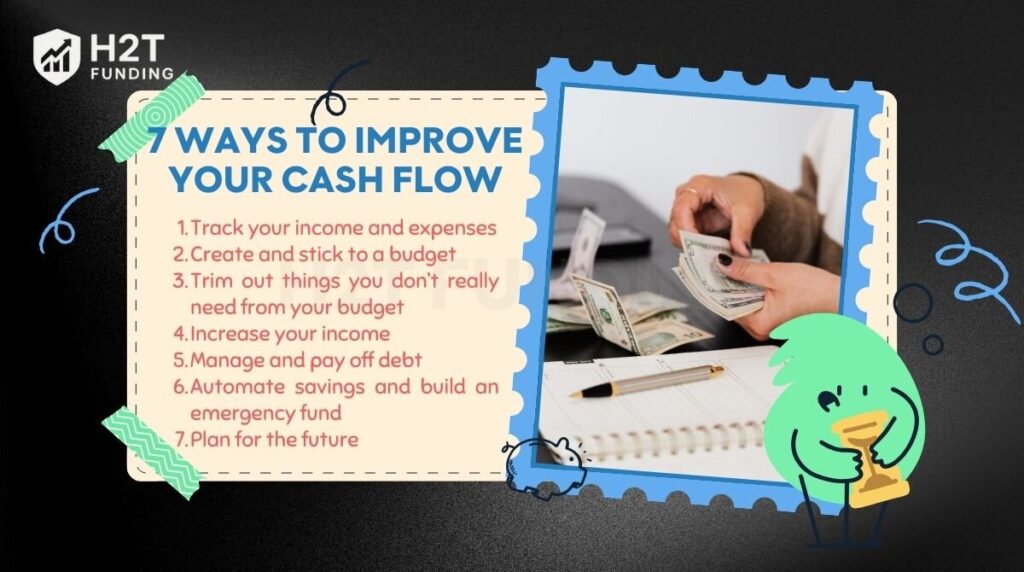

4. 7 ways to improve your cash flow

Strengthening your cash flow starts with small but consistent changes. Before diving into the details, here’s a quick overview of seven proven ways you can take control of your finances:

- Track your income and expenses

- Create and stick to a budget

- Trim out things you don’t really need from your budget

- Increase your income

- Manage and pay off debt

- Automate savings and build an emergency fund

- Plan for the future

Each of these steps plays a key role in helping you build financial stability. Let’s break them down one by one so you can start applying them effectively.

4.1. Track your income and expenses

Use spreadsheets or apps to list all your income sources and both fixed (e.g., rent, insurance) and variable expenses (e.g., dining out, shopping). Tools like PocketGuard can automatically sync with your accounts.

Identify patterns and leaks by analyzing your expenses from the last 1–3 months. Look closely for spending habits that may be draining your cash, like frequent takeout meals, unused subscriptions, or random online shopping sprees. These small expenses can add up quickly without you realizing it.

Real example: Digging into my bank statements, I found a $15 charge for Paramount+ and a $13 charge for a Babbel account I hadn’t touched in months. That, plus a few others, added up to over $80. Cutting them was the easiest “pay raise” I ever gave myself, freeing up cash for my emergency fund.

Expert insight: “You are never powerful in life until you are powerful over your money.” Suze Orman

4.2. Create and stick to a budget

Try the 50-30-20 rule:

- 50% of income for needs (e.g., rent, groceries)

- 30% for wants (e.g., entertainment, dining out)

- 20% for savings and debt repayment

You can also use zero-based budgeting, which means assigning every dollar a specific job so nothing is left unallocated.

Tip: Label each expense clearly. Is it a “need” or a “want”?

4.3. Trim out things you don’t really need from your budget

- Subscription audits: Use tools like Truebill to find and cancel unused services.

- Reduce impulse purchases: Wait 24 hours before buying anything over $50. Add to a “wishlist” and revisit later.

Real example: I did the math on my daily coffee shop run. That $6 latte and occasional pastry was adding up to over $120 a month. I didn’t cut it out completely, but by brewing my own coffee on weekdays, I cut that expense by about $90. It’s a small change that made a huge difference.

4.4. Increase your income

- Ask for a raise: Prepare data on your performance and market rate. Rehearse your pitch.

- Explore side gigs or freelancing: Platforms like Upwork or Fiverr offer flexible opportunities.

Case in point: A friend of mine, who’s a great writer but never thought of it as a skill to monetize, started offering blog post editing on Fiverr. In her first few months, she was making an extra 400 – 600, which went directly toward paying down her high-interest credit card debt. It wasn’t easy, but it accelerated her progress immensely.

4.5. Manage and pay off debt

Try the debt snowball or avalanche method to stay focused and make progress.

- Avalanche: Pay the highest-interest debt first.

- Snowball: Pay the smallest debt first for motivation.

Consider refinancing or consolidating if you qualify for lower interest rates. Tools like Credible or LendingClub can help you compare options.

4.6. Automate savings and build an emergency fund

- Set up your bank to automate savings the moment your paycheck hits.

- Aim to save enough to handle 3–6 months of living costs. Start with $500 as a micro-goal.

- Suggested app: Chime lets you save automatically and round up purchases.

Expert insight: “Do you have an emergency fund? If not, build one – aim for three months of expenses to start, then boost it to six. It will ease your anxiety and get you out of a potential jam.” — Jean Chatzky

4.7. Plan for the future

As your cash flow improves, start looking at long-term stability and growth:

- Adjust for inflation and life changes: Revisit your budget at least once per quarter or after major events (marriage, having kids, moving jobs).

- Invest for the future: Once you’ve built an emergency fund, consider putting money into a retirement account like a Roth IRA or 401(k). Little by little, your savings can snowball with compound interest.

- Protect your progress: Consider getting basic insurance coverage like health, life, or renters’ insurance to prevent financial setbacks.

- Plan for retirement: Estimate how much you’ll need later in life using retirement calculators, and start saving now, even 1–2% of your income helps.

5. Bonus tips to boost your cash flow

Beyond the main strategies, there are a few simple but powerful tactics that can give your cash flow an extra push. These small adjustments often require minimal effort yet bring noticeable results in your monthly budget.

- Negotiate bills: Don’t hesitate to call your service providers and ask for a better deal on internet, phone, or insurance. Even a small reduction adds up over time.

- Use cashback and rewards: Leverage platforms like Rakuten or credit card reward programs to earn money back on everyday purchases. It’s a smart way to save while spending on essentials.

- Declutter and sell: Turn unused items into extra cash by selling them on Facebook Marketplace, eBay, or other resale platforms. This not only boosts your cash flow but also clears your space.

- Seek expert guidance: Working with a financial coach can provide tailored strategies on how cash flow can be improved in your unique situation.

These bonus tips may seem minor, but together they can create meaningful improvements in your financial flexibility and peace of mind.

6. FAQs

It’s the net amount of money moving in and out of your finances monthly. If your income is greater than your expenses, that’s positive cash flow.

Try YNAB or a spreadsheet to stay organized financially. Link your bank to budgeting tools to automate your expense tracking.

A budgeting guideline: 50% needs, 30% wants, 20% savings/debt. It helps structure spending priorities.

Aim for 3–6 months of expenses. Start with $500, then build gradually.

If you have high-interest debt (like credit cards), focus on paying that first while saving a small emergency fund ($500–$1,000).

Unused subscriptions, dining out too often, impulse buys, and overdraft fees. Tracking helps catch these.

Trusted apps like YNAB use secure, bank-grade encryption. Turn on two-factor authentication for added security.

7. Conclusion

Learning how to increase personal cash flow is a journey, not a race. By sticking to these strategies, I was able to build a solid emergency fund and finally clear my credit card debt after two years of consistent effort. The feeling of control I gained was even better than the numbers in my bank account.

You can start small, too. Just pick one thing from this list, track your expenses for a week, cancel one subscription, or make your coffee at home tomorrow. Every small step builds momentum.

I’d love to hear what works for you. Let me know your favorite tip in the comments.

You can read more practical tips and personal finance guides, like how to improve your personal cash flow in the Strategy section and Cash Flow & Saving Strategies of H2T Funding.