Only 29 % of Americans reviewed their budget in the last 30 days, a sobering figure from Bankrate’s May 2026 Money & Mental Health Survey. That gap between I should and I did is exactly where a debt payoff tracker printable shines: it turns scattered intentions into one clear sheet you can see, touch, and update in seconds.

Writing goals down isn’t busywork; a Dominican University study found people are 42 % more likely to achieve their objectives when they put pen to paper.

I learned that first‑hand after college, when three maxed‑out cards felt impossible to tame. Printing a simple tracker, taping it to the fridge, and shading a square for every 100 USD I knocked out transformed dread into daily motivation, and wiped out the balance eight months ahead of schedule.

Grab your own free PDF below and let each checkmark pull you closer to zero.

Key takeaways

- Writing debt goals down increases follow-through and accountability.

- A printable tracker turns vague intentions into a clear repayment plan.

- Visual progress (coloring, checkmarks) boosts motivation and consistency.

- Offline tracking avoids app fatigue, fees, and data-privacy risks.

- Works well with both debt snowball and debt avalanche strategies.

1. Why should I use a debt payoff tracker printable?

Using a debt payoff tracker printable is a powerful way to take control of your finances and stay motivated on your journey to becoming debt-free. As someone who has navigated the challenges of managing multiple debts, I’ve seen firsthand how a structured, visual tool can transform the overwhelming process of debt repayment into a clear and achievable plan.

I’ll share why these printable trackers are invaluable, drawing from practical experience and insights gained from helping others achieve financial clarity.

- Writing by hand boosts commitment: Research from Dominican University found that people who wrote down their goals, committed to action steps, and regularly reported their progress to a supportive friend were 42% more likely to succeed. A debt payoff tracker printable is the perfect tool for this process, helping you formalize both the goal and the action steps, which helps you internalize your commitment.

- Tangible progress keeps you motivated: Printable trackers often include charts, bars, or grids you can color in as you make payments. This creates a visual reward system for your brain, similar to a progress bar in a video game. Each shaded section becomes a small victory that fuels momentum toward your debt-free goal.

- It encourages mindful spending: Unlike automated apps, a printable tracker forces you to manually log each payment, making you more conscious of your spending habits. This intentionality helps build healthier financial behavior over time.

- No data privacy concerns or device dependency: Unlike apps that store your sensitive financial data online, printable trackers are 100% offline. That means:

- No risk of hacking or data leaks

- No need for Wi-Fi or battery life

- No app crashes or subscription lockouts

- You’re fully in control, and your financial plan is always accessible.

When I first started tackling my student loan and credit card debt, I kept everything in my head: numbers, due dates, and interest rates. I thought I was saving time. But what I was really doing was avoiding reality.

It wasn’t until I saw my total debt written down on a single sheet, line by line, balance by balance, that the weight of it truly hit me. That printable debt tracker didn’t just organize my finances; it confronted me with the truth I had been dodging.

Each time I updated it, it reminded me of why I was doing this: how to stop living paycheck to paycheck, to build savings, to stop feeling anxious every time an unexpected bill arrived. My mindset shifted from “I’ll deal with it later” to “I’m in control now.”

Whether you’re managing household bills, student loans, or a mountain of credit card debt, a debt payoff tracker printable can be more than a budgeting tool. It can be the turning point.

2. Free debt payoff tracker printables

If you’re serious about getting out of debt, a debt payoff tracker is one of the most effective tools you can use. Luckily, there are free printable options that let you track your progress, stay motivated, and plan your payments all without spending a dime. Below, we’ve organized the best free trackers into three main types, so you can choose the one that fits your style.

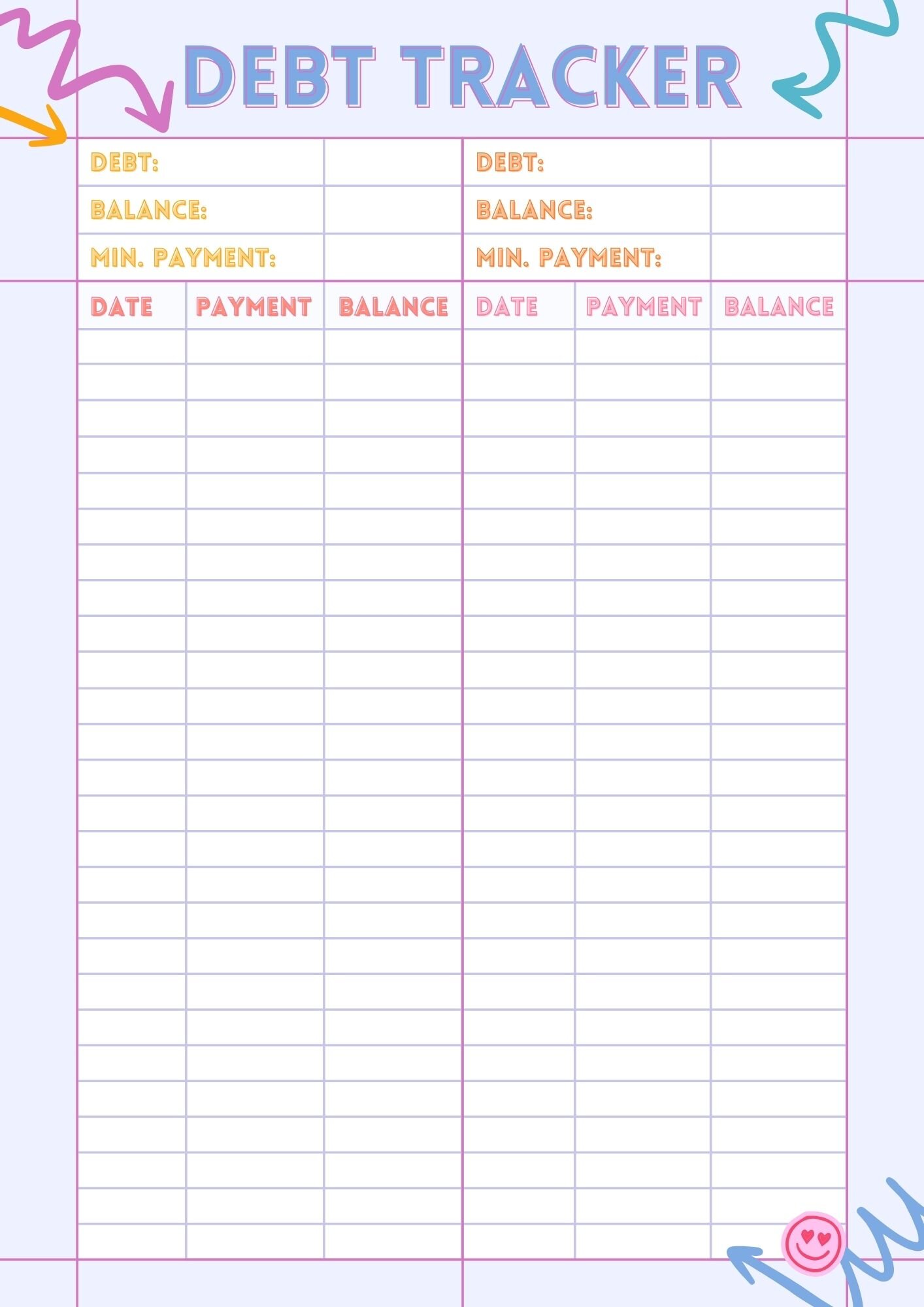

2.1. Printable PDF trackers

Printable PDF trackers are simple, ready-to-use sheets that you can print and fill out by hand. They’re perfect if you like seeing your progress visually on paper.

Here are a few free options:

- Simple Debt Snowball Tracker – Focuses on paying off small debts first. Includes sections for balance, minimum payment, extra payment, and progress bars.

- Monthly Debt Tracker PDF – Great for tracking multiple debts in one month. Shows starting balance, payments, and remaining balance.

- Debt Payoff Goal Chart – Lets you set a target payoff date and color-code your progress for motivation.

✅ Tip: Print multiple copies to plan monthly or weekly payments, or keep one visible at your desk for daily motivation.

2.2. Excel / Google Sheets Trackers

If you prefer something digital, Excel or Google Sheets trackers are perfect. They automatically calculate remaining balances, interest, and payment schedules, saving you time and effort.

Popular free options:

- Debt Snowball Spreadsheet – Automatically calculates how each payment reduces your total debt.

- Debt Avalanche Tracker – Helps prioritize debts with the highest interest rates first, showing how fast you can pay off your debt.

- Monthly Payment Tracker – Lets you track multiple debts in one spreadsheet and view charts or graphs to visualize progress.

Not all debt trackers are created equal. Depending on your personality, debt type, and financial habits, the right layout can make a big difference in how motivated and consistent you stay. Fortunately, there’s no shortage of free printable debt payoff tracker options available to help you hit the ground running.

💡 Pro Tip: Use Google Sheets if you want to update your tracker on the go from your phone or tablet.

2.3. Customizable Trackers

Customizable trackers give you full control over how you track your debt, so you can add multiple debts, set personal goals, or include reminders for upcoming payments.

Features often include:

- Add unlimited debts with separate balances, interest rates, and payment schedules.

- Set payoff goals and track progress toward each goal.

- Optional reminders for due dates, extra payments, or milestones.

- Visual charts or graphs to see your payoff journey at a glance.

✅ Tip: Customizable trackers are perfect if your debt situation changes frequently or if you like a more personalized approach.

3. How to create a debt repayment plan with a printable tracker

A well-structured debt repayment plan transforms the daunting task of paying off debt into a clear, actionable process. By using a debt tracker printable, you can visualize your debts, choose a repayment strategy, and track your progress systematically.

This approach not only organizes your finances but also builds confidence as you see tangible results. In my journey, having a plan helped me pay off $8,000 in credit card debt within 18 months by keeping me focused and accountable.

Step 1: Complete the debt summary sheet

Start by gathering all your debts in one place. This includes credit cards, personal loans, student loans, or any other balances you owe.

- List each debt’s name and total balance

- Record the interest rate to understand which debts cost you more over time

- Note the minimum monthly payment to avoid penalties

- Set a target payoff date to keep your timeline realistic and focused

Organize your debts by balance or interest rate, depending on your repayment strategy (which you’ll choose next). To simplify this step, download a free printable debt payoff worksheet PDF that’s already structured with these fields.

This overview gives you a clear snapshot of your financial obligations and helps prioritize where to focus your payments.

Step 2: Choose your debt repayment strategy

Once you have a clear picture of your debts, decide on a repayment strategy that suits your financial situation and personality. The two most effective methods are:

- Debt snowball method: Focus on paying off the smallest debt first while making minimum payments on others. Once the smallest debt is paid, roll that payment into the next smallest debt, creating a “snowball” effect.

- Debt avalanche method: Prioritize the debt with the highest interest rate to minimize total interest paid, while making minimum payments on other debts. After clearing the highest-interest debt, move to the next highest.

So, which method is right for you: snowball or avalanche?

- If motivation from small victories keeps you going, snowball is ideal.

- If minimizing cost is your priority and you can stay patient, Avalanche works best.

Try testing both approaches with a free debt payoff tracker printable to see which keeps you more engaged.

Step 3: Track your progress with a debt payoff printable

Consistent tracking is the backbone of any repayment plan. Use your debt payoff tracker printable to:

- Record each payment made against each debt.

- Update balances monthly to see your progress in real time.

- Mark debts as fully paid when cleared; this visual milestone boosts morale.

- Adjust your payments if extra funds become available or if circumstances change.

Make updating your tracker a regular habit. Set reminders to ensure accuracy and prevent slipping into missed payments or overlooked debts.

The simple act of filling out your printable tracker turns repayment from a vague goal into tangible steps, and watching your debts shrink on paper can be profoundly motivating.

4. Tips for maximizing your printable debt tracker

To get the most out of your debt payoff tracker printable, consider these practical tips:

- Choose a design that inspires you: Look for trackers with engaging visuals, such as progress bars or milestone markers, to keep you excited about updating them. Websites like debtfreecharts.com offer a variety of free, fun designs.

- Update regularly: Set a weekly or monthly schedule to record payments and review your progress. Consistency reinforces your commitment.

- Pair with a repayment strategy: Use your tracker alongside proven methods like the debt snowball (smallest debt first) or debt avalanche (highest interest rate first) to structure your plan effectively.

- Celebrate milestones: Reward yourself for hitting key targets, such as paying off a credit card, to maintain enthusiasm.

Discover more on this topic:

5. FAQs about the debt payoff tracker printable

A debt tracker printable PDF is a downloadable, ready-to-use worksheet that helps you record and monitor your debt repayment progress on paper.

You can download one from trusted websites like: Debt-Free Charts Vertex42 Free Organizing Printables Frugal Fanatic

It helps you focus on paying off your smallest debt first. Once a debt is cleared, you roll that payment amount into the next smallest one, visually tracking each payoff step-by-step.

Free trackers usually include basic layouts for listing balances and payments, while paid versions often offer enhanced features like automation-friendly formats or custom goal sections.

Update your tracker monthly after each round of payments. For tighter control, a weekly check-in can help reinforce habits and catch issues early.

Absolutely. Most templates are designed to track several debts at once, making them effective tools whether you’re managing 2 or 10 balances across different lenders.

A debt payoff tracker printable is a downloadable document usually in PDF, Excel, or Google Sheets format that you can print out and fill in by hand. It helps you organize and track all your debts, including balances, interest rates, minimum payments, and extra payments. By having a visual overview, you can see your progress clearly, stay motivated, and plan your debt repayment more effectively.

A debt payoff tracker helps you pay off debt faster by: Showing exactly how much you owe and how payments affect your balances. Helping you prioritize debts, like using the Debt Snowball or Debt Avalanche methods. Encouraging regular tracking, which increases accountability and prevents missed payments. Allowing you to visualize progress, so even small payments feel rewarding and motivate you to keep going.

Yes! Most debt payoff trackers are designed to handle multiple debts simultaneously, such as credit cards, student loans, personal loans, or car loans. You can enter each debt’s balance, interest rate, and minimum payment, and track progress for each debt individually. This helps you see the big picture and plan which debts to tackle first.

It depends on your personal preference: Printable tracker: Great if you like writing things down, seeing your progress on paper, or having a visual chart at your desk. No devices or apps needed. Digital app or spreadsheet: Offers automatic calculations, reminders, and the ability to update on the go. Some apps can generate charts and graphs automatically.Many people find a hybrid approach works best: use a printable tracker for motivation and a digital app for precise calculations.

Yes! There are many free debt payoff trackers available online, both in PDF and spreadsheet formats. They are designed to be downloaded and used without any cost. Some websites may offer premium versions with extra features, but the basic printable trackers are typically completely free and ready to use immediately.

6. Conclusion

A debt payoff tracker printable is a true game-changer for anyone looking to conquer debt and achieve financial clarity. This simple yet powerful tool helps you organize your debts, select a repayment strategy like the snowball or avalanche method, and monitor your progress with ease. By using a free printable debt tracker, you can visualize your journey toward becoming debt-free, with each payment marked on paper serving as a motivating milestone. Turn intention into action starting today.

Ready to deepen your knowledge and accelerate your debt-free journey? Visit the Strategies and Budgeting Strategies section at H2T Funding for a wealth of resources, including articles on budgeting tips, advanced debt repayment techniques, and financial planning tools.