Sticking to a family budget isn’t always easy, but the right tools can make it manageable.

When my partner and I had our first child, our expenses changed overnight, and we quickly realized we were losing track of where the money was going. What truly helped was using a family budget template free to see everything in one place and make decisions together.

Whether you're a parent juggling monthly bills or a couple planning long-term savings, using a family budget template free is a smart way to track spending and save more.

In this guide, I will share with you 13+ of the best downloadable options tailored to real-life family scenarios, from beginner-friendly planners to advanced trackers with visuals.

1. Why every family needs a budget template

A family budget template free can make managing money much easier. It helps you track spending, plan for savings, and stay on the same page with your partner, even when income or expenses change.

According to the Consumer Financial Protection Bureau (CFPB), families who use structured budgeting methods are more likely to meet their financial goals and avoid unnecessary debt.

Looking for the right tool to get started? Below are 13+ of the best free family budget templates you can download and customize today.

2. 13+ Best family budget template free (download & customize)

Every household has unique budgeting needs, from monthly bill tracking to holiday planning.

I’ve personally used several of these family budget template free options over the years, and they’ve made budgeting feel far less overwhelming.

Below is a curated list of the best family budget template free downloads. These templates come in Excel, Google Sheets, or printable PDF formats and are fully editable.

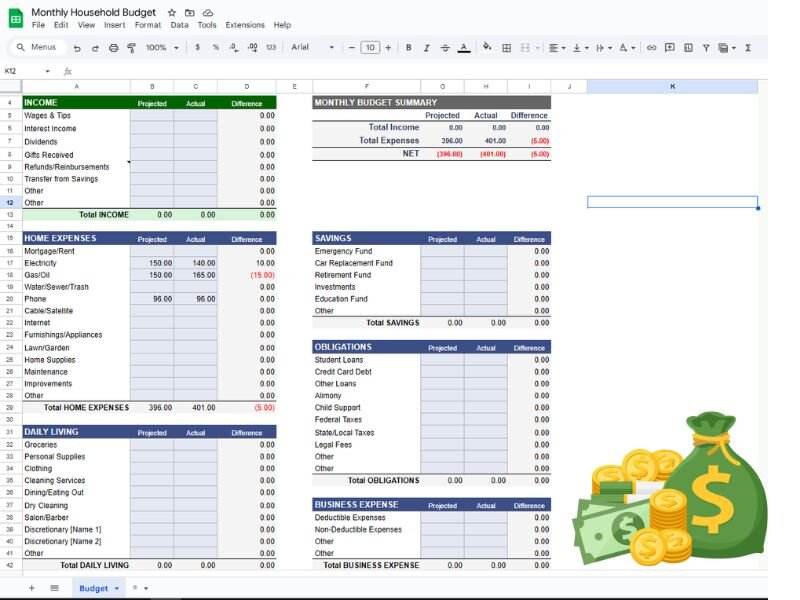

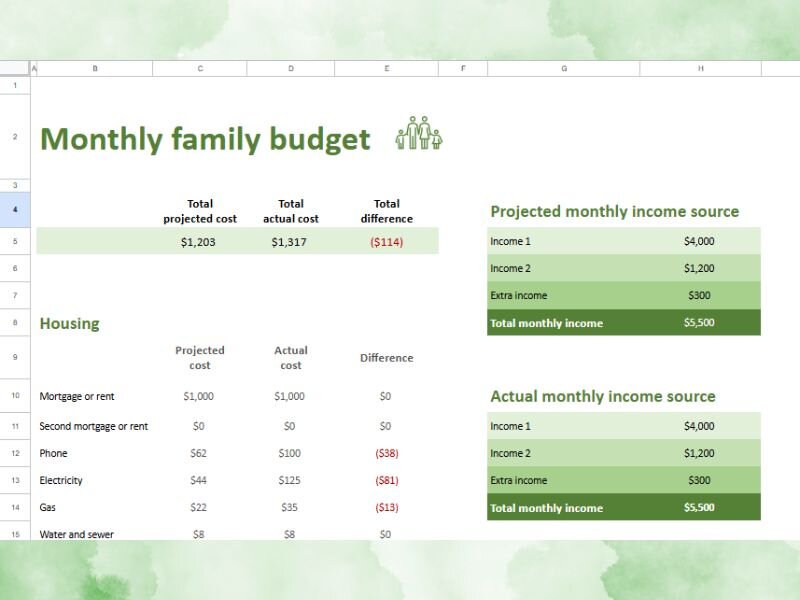

2.1. Family monthly budget template (Excel & Google Sheets)

Best for: Families who want a consistent monthly overview

Download links:

- Vertex42 Monthly Budget Template

- Google Sheets Monthly Budget Template

Key features:

- Automatically calculates income and expenses

- Includes preset essential categories

- Customizable rows and columns

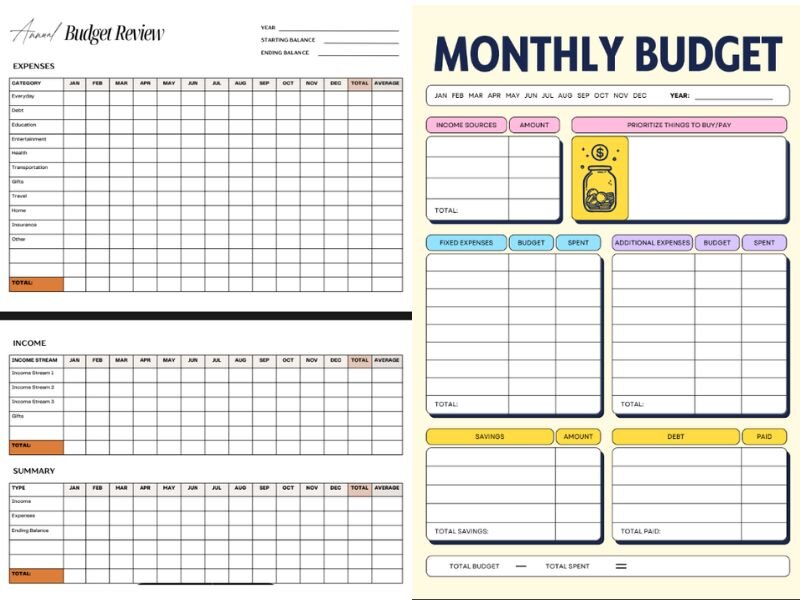

2.2. Printable family budget worksheet (PDF)

Best for: Paper-based budgeting

Download links:

Key features:

- Easy to print and write by hand

- Requires no software or login

- Ideal for a physical review with the family

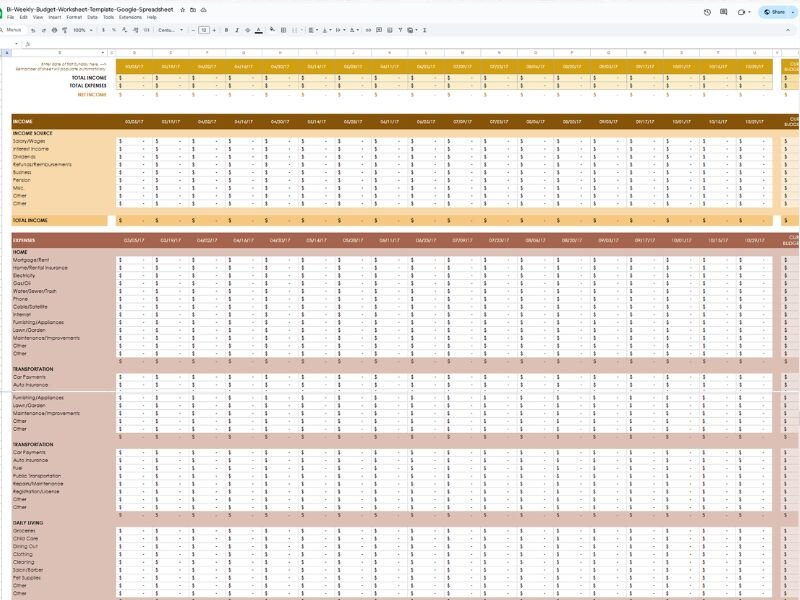

2.3. Weekly and bi-weekly budget templates (Google Sheets)

Best for: Families paid weekly or every two weeks

Download links:

Key features:

- Aligns expenses with pay periods

- Breaks down bills and cash flow by week

- Prevents overspending between paydays

-

Weekly and bi-weekly budget templates

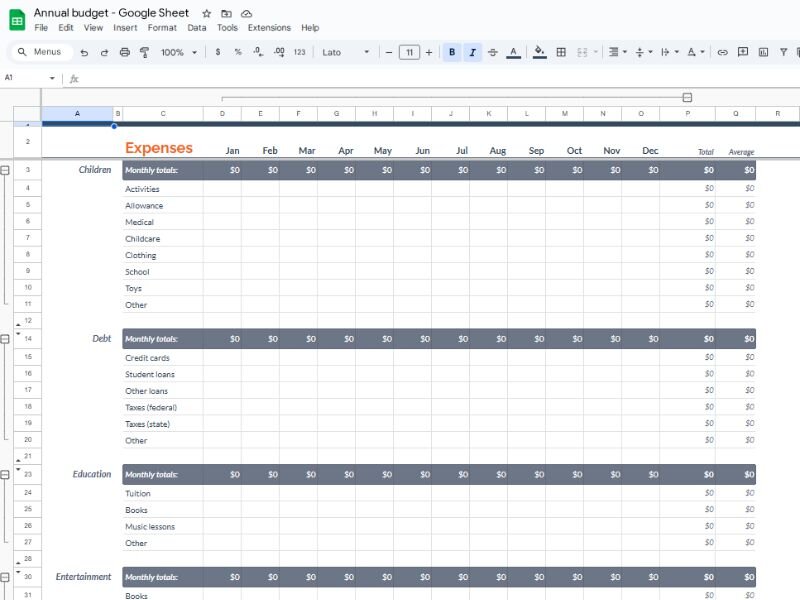

2.4. Annual household budget template (Google Sheets)

Best for: Families planning long-term financial goals

Download links:

Key features:

- Yearly breakdown in one view

- Helps forecast savings or shortfalls

- Great for reviewing year-end finances

-

Annual household budget template

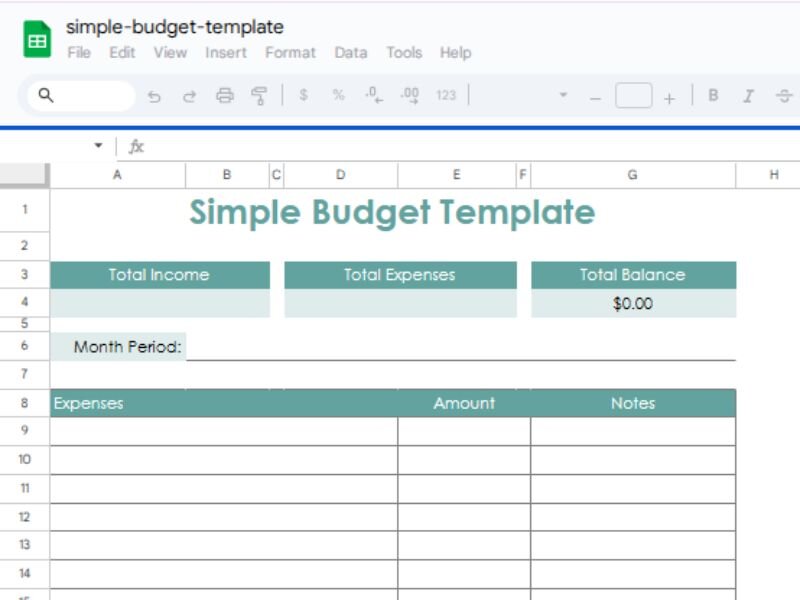

2.5. Simple budget template for beginners

Best for: First-time budgeters

Download link: General Blue - Simple Budget for Beginners

Key features:

- Minimal layout and easy structure

- Focuses on tracking expenses

Simple budget template for beginners

Simple budget template for beginners

2.6. Detailed income versus expenses tracker

Best for: Families with multiple income sources

Download links:

Key features:

- Tracks detailed income and spending

- Helps identify budget gaps quickly

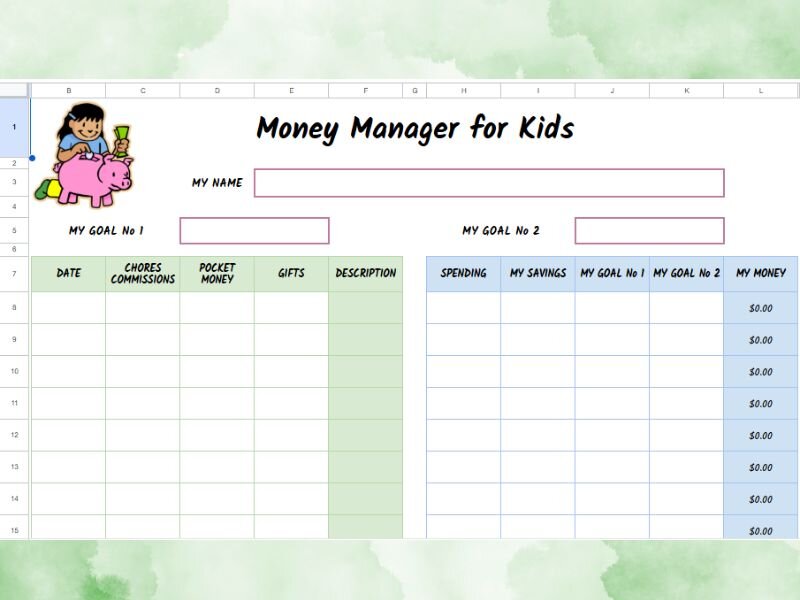

2.7. Money Manager for Kids

Best for: Teaching financial literacy to children

Download link: Money manager for kids template

Key features:

- Track allowance, spending, and savings in one place

- Helps children understand income versus expenses

- Visual, easy-to-use layout designed with kids in mind

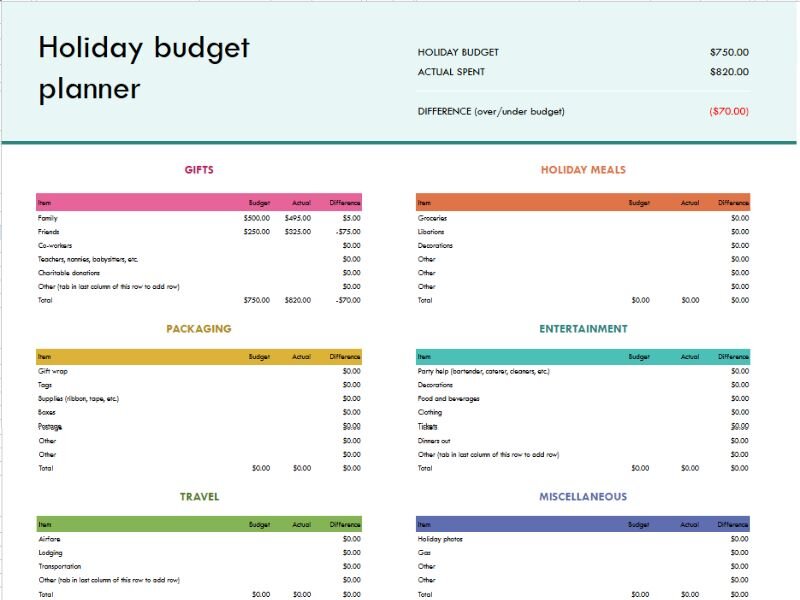

2.8. Vacation or holiday family budget template

Best for: Seasonal or travel budgeting

Download links:

Key features:

- Expense breakdowns for gifts, travel, and food

- Helps prevent post-holiday debt

- Includes countdowns and checklists

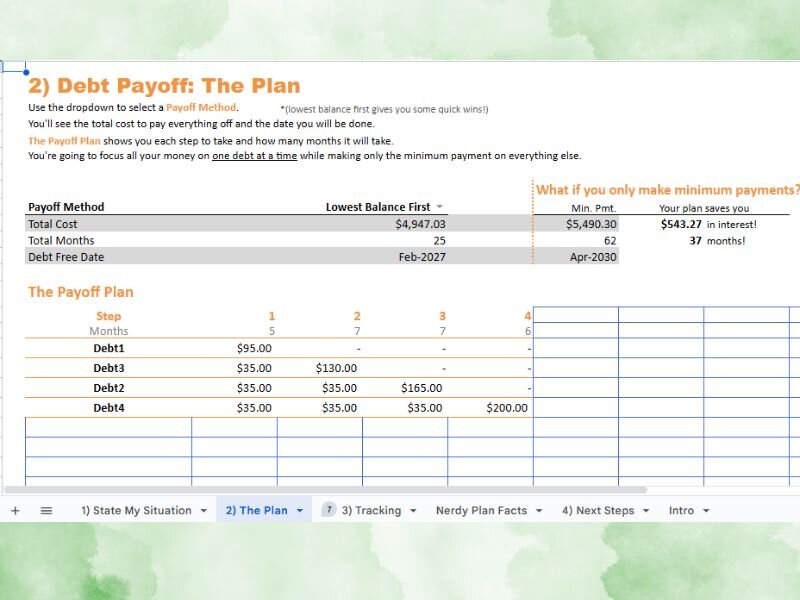

2.9. Family debt payoff planner

Best for: Paying off debt with structure

Download links: The Happy Giraffe Debt Payoff Tracker Template

Key features:

- Tracks interest and payment progress

- Visual payoff thermometers

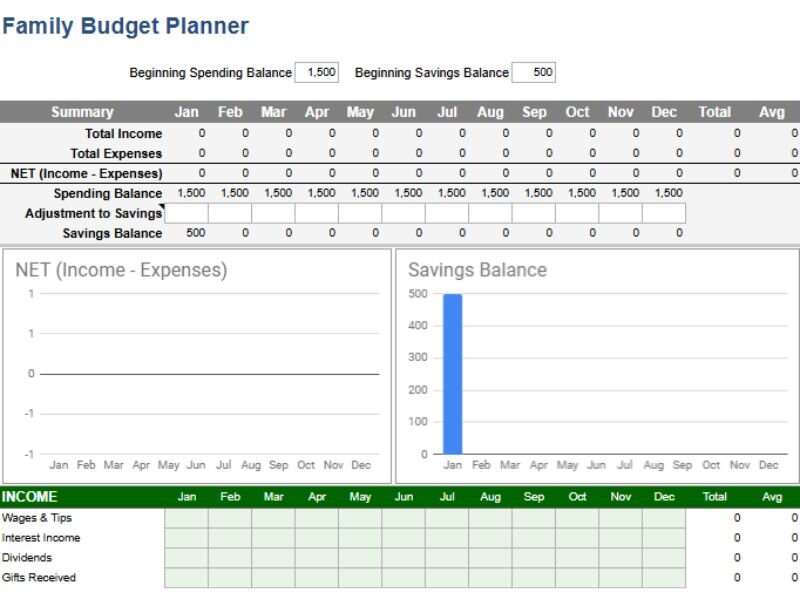

2.10. Family Budget Planner - Very detailed

Best for: Fully customizable budgeting

Download link: Family Budget Planner Template (Google Sheets and Excel)

Key features:

- Includes detailed monthly and yearly budget tracking

- Customizable categories for housing, food, kids, transportation, and more

- Built-in formulas for income, savings, and expense summaries

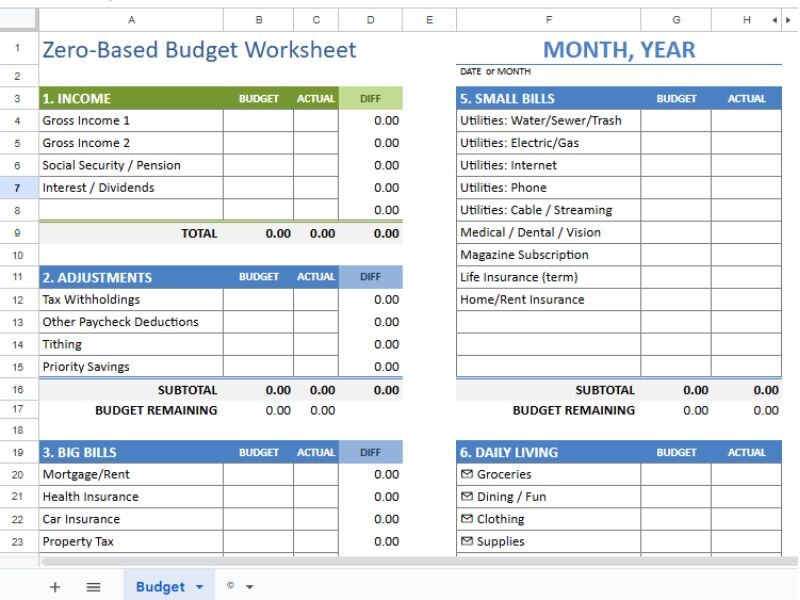

2.11. Zero-based family budget template

Best for: Fans of the "every dollar has a job" method

Download link: Zero-Based Budget Worksheet

Key features:

- Ensures income minus expenses equals zero

- Improves money mindfulness

- Encourages intentional spending

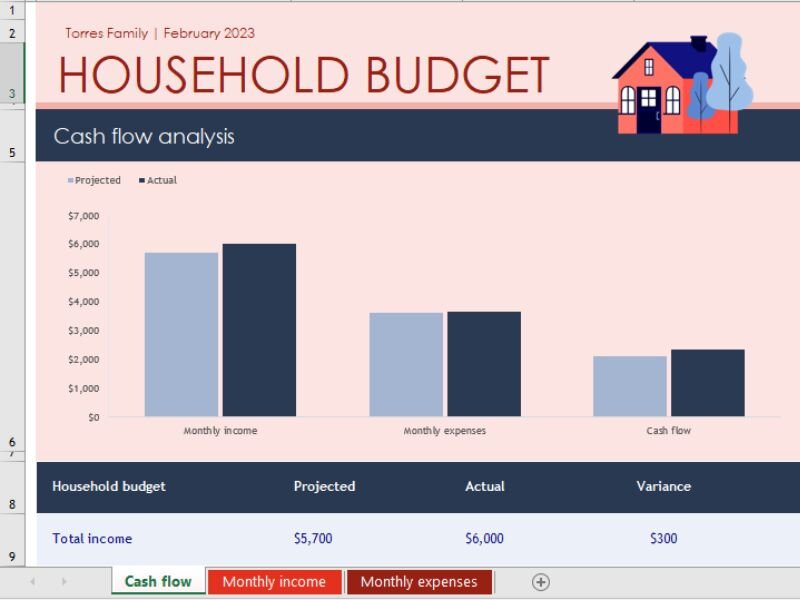

2.12. Family budget template with charts and visuals (Excel)

Best for: Visual learners

Download links:

Key features:

- Easy to interpret and share

- Helps identify spending habits

Note: Download as an Excel file, don’t use directly on a Google sheet.

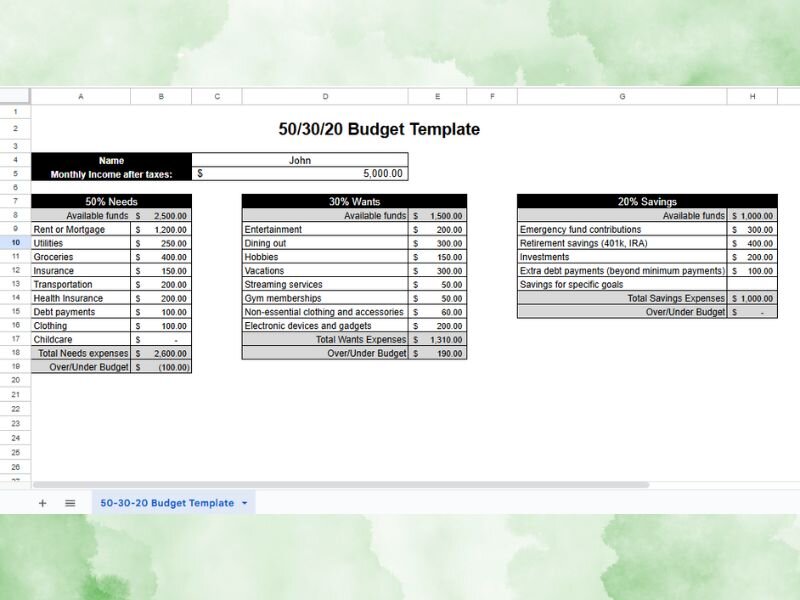

2.13. 50/30/20 budget template

Best for: Simplifying budgeting by spending categories

Download links: 50/30/20 budget template

Key features:

- Breaks down income into needs, wants, and savings based on the 50/30/20 rule

- Ideal for those who prefer a guided spending structure

Easy to adjust for various income levels and financial goal

View more:

- How to Stop Living Paycheck to Paycheck (2025 Guide)

- What is a sinking fund and how can it help your budget?

- 10 Real-life sinking fund examples to improve your budgeting

3. How to choose the right budget template for your family

Choosing the best family budget template free is all about matching the tool to your specific needs and financial situation. Not every household budgets the same way, so here are some helpful tips to guide your decision:

3.1. Based on income frequency

If you get paid weekly or bi-weekly, look for templates that break down budgets by pay period. This helps you allocate money as it comes in rather than trying to stretch it monthly.

For monthly salaries, a standard monthly planner works well to monitor recurring bills and savings.

If you have irregular income (e.g., freelance work), opt for flexible templates that let you forecast variable earnings and track expenses in real time.

3.2. Based on financial goals

If your priority is debt repayment, consider a debt payoff tracker or zero-based budget.

For savings goals like vacations or emergency funds, use visual-based planners that show progress.

For overall financial control, a general planner with income, expenses, and goals combined can give a full picture.

3.3. Digital vs. printable: what works best?

Use digital templates (Google Sheets or Excel) if you want automatic calculations, cloud syncing, or sharing with a partner.

Printable PDFs are better for those who prefer writing things down or need offline access.

4. Recommended tools and apps for family budgeting

Budgeting is even more powerful when paired with the right tech. Here are tools to complement your templates:

4.1. Best free budgeting apps

Goodbudget: Based on the envelope system, this app allows families to allocate money into digital envelopes for different categories. It supports syncing across devices, making it easy for couples or family members to stay aligned.

YNAB (You Need a Budget): Although it’s not permanently free, YNAB provides a free trial and focuses on helping users assign every dollar a purpose. It’s ideal for families who want to build strong budgeting habits and long-term savings strategies.

4.2. Syncing with Google Sheets or Excel Online

Google Sheets + Google Drive: If you're using a Google Sheets template, storing it in Google Drive allows you to access it from any device and collaborate with family members in real time. You can also set editing permissions and receive update notifications.

Excel Online (Microsoft 365): Perfect for those already using Microsoft tools. Excel Online supports real-time collaboration, cloud backups, and cross-platform access without needing the desktop version.

Pairing your chosen family budget template free with these digital tools can greatly improve accuracy, accountability, and overall success in managing your household finances.

5. Download all free templates (one-click access)

I’ve compiled all the templates mentioned in this article in one place for easy access. You can download them quickly: Family budget template free

6. FAQs

6.1. What is a family budget template free?

It’s a premade spreadsheet or worksheet designed to help families plan, track, and manage income and expenses, without any cost.

6.2. Which is better: Excel or Google Sheets?

Google Sheets is best for sharing and syncing in real time. Excel is powerful for offline work and more advanced formulas.

6.3. Are printable templates effective?

Yes, especially for those who like physical tracking. They’re also useful for kids and family budgeting discussions.

6.4. How do I stick to a budget consistently?

Choose a template that fits your routine, review it weekly, and involve your partner or kids to stay accountable.

6.5. Can I use multiple templates at once?

Absolutely. For example, use a monthly budget for bills, a debt tracker for loans, and a vacation planner for special goals.

7. Conclusion

Budgeting as a family does not have to be difficult. With the right family budget template free, you can simplify financial planning, avoid money stress, and work toward shared goals.

From basic monthly trackers to advanced visual planners, the tools listed here are designed to meet your household’s unique needs.

Take the time to explore the templates, test what works, and make budgeting a consistent part of your family routine. Over time, you’ll see the impact not only on your finances but also on your peace of mind and teamwork at home.

For more templates and practical budgeting tips, explore Budgeting Strategy at H2T Funding.

Comments (0)

Leave a Comment