You passed your evaluation and landed a funded Apex account. It feels amazing, right? You’re trading, you’re profitable, and you’re ready for that first payout. But then you hit an unexpected roadblock.

The most common reason? The consistency rukle for Apex Trader Funding for payouts. This rule isn’t just fine print; it’s the gatekeeper to your withdrawals. In this guide, H2T Funding will show you exactly how the Apex Trader Funding consistency rule payout works and how to build your trading strategy.

Key takeaways:

- Core rule: The consistency rule for Apex Trader Funding for payouts or the 30% Windfall mandates that no single day’s profit can exceed 30% of your total profit when requesting a payout.

- Purpose: Encourages disciplined, sustainable trading by preventing reliance on one-off large wins, ensuring traders demonstrate a repeatable strategy.

- Additional requirements: Payouts require at least 8 trading days (5 with profits over $50), maintaining the “safety net” balance, and adhering to risk management rules like trailing drawdown.

- Strategic shift: Focus on consistent, smaller daily profits (“singles and doubles”) rather than chasing large trades to comply with the 30% rule.

- Practical steps: Maintain a trading journal, use the Apex dashboard, backtest strategies, and diversify trade entries to ensure compliance and avoid pitfalls like the “big day” trap.

- Long-term benefits: Mastering the consistency rule fosters disciplined trading habits, leading to sustainable profitability and reliable payouts.

1. What is the consistency rule in Apex Trader Funding?

The consistency rule in Apex Trader Funding is a key guideline that promotes steady and disciplined trading performance. It’s designed to prove that a trader can generate profits through a reliable strategy and proper risk management under Apex’s consistency rules, not through a single lucky day.

At its core, the rule ensures your profits are earned consistently over time, reflecting patience and structure in your approach. Apex’s system rewards traders who show balanced growth, stable decision-making, and awareness of drawdown and position sizing, all signs of professional trading behavior.

In short, this rule separates short-term luck from long-term skill. Traders who master it show they can follow risk management principles, maintain control under changing market conditions, and trade with genuine discipline.

See also:

2. The consistency rukle for Apex Trader funding for payouts

Now, let’s get into the specifics that truly matter for your payouts: The Apex Trader Funding consistency rules. This is a fundamental requirement you need to grasp to successfully withdraw your profits.

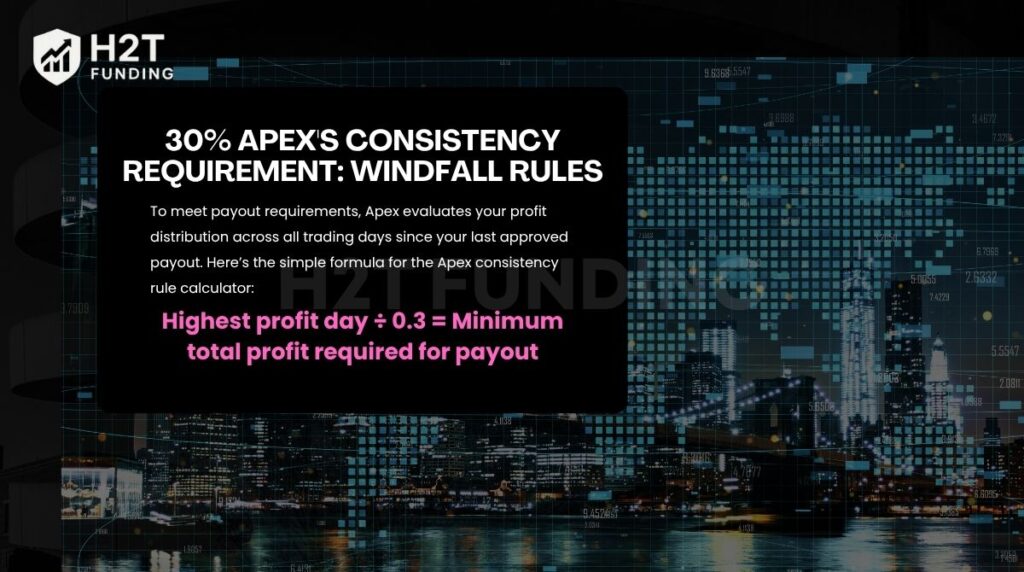

2.1. 30% Apex’s consistency requirement: Windfall rules

The Apex 30% Consistency Rule, also called the Windfall Rule, defines how traders must manage profits to qualify for payouts. It ensures that no single trading day makes up more than 30% of your total profit at the time of a payout request. This structure promotes stable, sustainable performance and protects traders from overleveraging or emotional trading.

To meet payout requirements, Apex evaluates your profit distribution across all trading days since your last approved payout. Here’s the simple formula for the Apex consistency rule calculator:

Highest profit day ÷ 0.3 = Minimum total profit required for payout

For example, if your biggest profit day is $1,500, divide it by 0.3, and you’ll need at least $5,000 total profit to qualify. This formula ensures your profits come from multiple consistent sessions, not one oversized day.

After each approved payout, the counter resets, and the 30% rule applies again until you reach your sixth payout or transition to a Live Prop Trading Account.

Note: After each approved payout, the total accumulated profit and the 30% threshold are completely reset to zero for the next payout cycle. This means that all 30% consistency checks only apply from the most recent payout onward, not from previous cycles.

2.2. Real-life examples: How the 30% rule affects payouts

Seeing the 30% Apex Trader consistency rule in action makes its purpose clear. Many traders hit one huge winning day, celebrate early, then wonder why their payout is delayed. The examples below reveal how your profit distribution can make or break your payout eligibility, and what true consistency looks like.

2.2.1. Scenario 1 (violation)

Imagine you make $2,000 on Monday, then $500 on Tuesday, and $300 on Wednesday. Your total profit balance is $2,800. Your highest single day was Monday, with $2,000. If you try to request a payout now, Apex will see that $2,000 is approximately 71% of your total $2,800 profit.

This clearly violates the 30% rule. To become eligible, you would need to continue trading profitably until your total profit significantly increases, bringing that $2,000 day down to less than 30% of the new total.

2.2.2. Scenario 2 (compliance)

Let’s say you make $500 on Monday, $600 on Tuesday, $700 on Wednesday, $800 on Thursday, and $900 on Friday. Your total profit is now $3,500. Your highest single day was Friday, with $900. If you check the percentage, $900 divided by $3,500 is roughly 25.7%. This falls within the 30% limit, making you eligible for a payout, assuming all other market conditions are met.

It’s a classic situation I see all the time: a trader lands a huge winning day and is thrilled, ready to cash out. Then comes the confusion when their payout request gets stuck. This rule really forces you to stop thinking about one-off home runs and start planning your profits across the entire process.

2.3. Related payout requirements (Apex 3.0 rules)

The 30% rule doesn’t operate in isolation; it ties closely with other Apex 3.0 payout rules that reinforce stable and sustainable trading practices:

- Minimum trading days: You must complete at least 8 trading days, with 5 profitable days (each earning over $50).

- Safety Net requirement: Your balance must remain above your starting capital + trailing drawdown + $100 buffer before requesting a payout.

- Contract scaling rule: You can trade only up to half your maximum contract sizes until your end-of-day balance exceeds your trailing drawdown limit.

Together, these payout conditions ensure performance accounts maintain risk-aware habits, maintain proper position sizing, and respect the trailing drawdown limits. All of which are vital for long-term trading success and eligibility for consistent payouts.

View more:

3. Adapting your trading strategy for Apex’s consistency rule

Understanding the consistency rule for Apex Trader Funding for payouts is one thing; truly adapting your trading strategy to meet it is another. This rule isn’t just a hurdle; it’s a guide that subtly pushes you towards more disciplined and sustainable trading practices.

3.1. Shifting mindset from home run to singles and doubles

Let’s be honest, the temptation to land one massive, account-changing trade is huge. But with Apex, that’s actually counterproductive.

The biggest mental shift you need to make is to stop chasing those home runs. Instead, focus on hitting consistent singles and doubles, smaller, more reliable profits that add up day after day. That’s the real secret to getting paid here

3.2. Refining your risk management

The consistency rule directly impacts how you manage risk. It encourages a more conservative and calculated approach:

- Position sizing: This rule significantly influences your contract sizes. Over-leveraging for one massive trade, even if it’s profitable, becomes counterproductive. It can easily make that single day’s gain an outlier, pushing you over the 30% threshold. You’ll find yourself needing to trade for many more days just to “dilute” that big win.

- Daily profit targets: Setting realistic daily profit limits becomes crucial. Instead of thinking about hitting a huge number each day, aim for a consistent, achievable amount that steadily contributes to your overall profit balance. This minimizes the chance of one day becoming an outlier and strengthens risk management discipline.

- The 5:1 risk-to-reward ratio: Apex’s maximum 5:1 risk-to-reward ratio for all trades naturally complements the consistency rule and encourages consistent use of stop losses to maintain control. It guides you towards sensible trade setups where your potential loss is manageable relative to your potential gain, fostering more balanced outcomes rather than wildly skewed ones.

3.3. Trade management for consistency

Effective trade management is essential for adhering to the consistency rule:

3.3.1. Taking profits consistently

It’s important to take smaller, regular profits rather than letting trades run for extreme gains and always place stop losses to protect your equity. While letting a winner run is often good advice, here, it needs to be balanced against the 30% rule. Locking in profits more frequently can help spread out your gains across multiple days.

3.3.2. Avoiding overtrading after a big win

This is a subtle trap. After a particularly profitable day, there’s a temptation to either stop trading for the day/week or to immediately jump into another large trade. If you stop, that big day might become your defining profit, violating the rule.

If you continue with large trades, you risk another outlier or a significant loss. I’ve seen this play out many times; traders celebrate a massive win, then realize it’s created a new challenge for their payout eligibility.

3.4. Developing a consistency-first trading plan

Your overall trading plan needs to be geared towards consistency:

- Trading strategy selection: Consider strategies that inherently generate frequent, smaller wins rather than infrequent, massive ones. Think about scalping or disciplined day trading strategies that aim for modest, consistent gains on many trades.

- Discipline and patience: These aren’t merely abstract concepts here; they are practical necessities. Consistently executing your plan, even when market conditions tempt you to deviate, is paramount. Patience is key when building up that cumulative profit without one day dominating.

4. Practical steps to ensure compliance and accelerate payouts

To consistently qualify for payouts with Apex Trader Funding, you need more than just good trades; you need repeatable habits. The traders who get paid regularly are those who apply structure, track their performance, and stay disciplined every single day.

Here’s what you should focus on:

- Keep a trading journal to track profits and detect irregular patterns.

- Use the Apex dashboard to monitor payout eligibility metrics.

- Backtest and simulate trades to refine your consistency strategy.

- Diversify entries to smooth out your daily profit curve.

- Focus on discipline and maintaining a steady profit balance.

Each of these steps will help you stay compliant with the 30% rule while building long-term trading stability. For a deeper dive into developing mental focus and emotional control, read our full guide on how to be more disciplined in your trading.

4.1. Maintain a detailed trading journal

This is perhaps the simplest yet most powerful tool at your disposal. A well-kept trading journal goes beyond just recording profits and losses.

- Tracking key metrics: You need to meticulously track not only your daily profit/loss but also your trading history, running total profit balance, and highest single-day profit. Calculate the percentage of the highest day against your total profit. This gives you a real-time consistency dashboard.

- Analyzing performance: Use this journal to analyze your trading patterns. Do you tend to have one breakout day followed by several flat ones? This insight can help you adjust your strategy to spread out your gains more evenly.

4.2. Utilize the Apex dashboard effectively

Apex provides a dashboard for a reason. Make sure you understand how it displays your metrics, especially your current profit, and how it’s calculating your eligibility for payouts. Don’t just glance at the profit number; understand the underlying data.

4.3. Simulate and backtest with consistency in mind

Before you even step into a live funded account, practice. Use a simulated environment to fine-tune your trading strategy.

When you’re backtesting, don’t just look at overall profitability; specifically, analyze how your daily profit distribution would impact the 30% rule. This proactive approach can save you a lot of frustration later.

4.4. Diversify trade entries (if applicable to your strategy)

If your trading strategy allows for it, consider diversifying your trade entries throughout the day, even applying light dollar cost averaging when appropriate. Instead of putting all your eggs in one basket with a single large entry, multiple smaller entries can help spread out your potential profits. This makes it less likely for one trade or one hour to dominate your entire day’s performance.

4.5. Focus on the process, not just the outcome

This is a mindset shift that I truly believe separates consistent traders from the rest. Instead of fixating solely on the dollar amount of your profit, prioritize the disciplined execution of your trading plan.

Follow a solid process, manage risk, and trade with discipline, and profits will then come consistently, often satisfying the consistency rule automatically.

5. Common pitfalls and how to sidestep them

Even with a clear understanding of the consistency rule for Apex Trader Funding for payouts, it’s easy to fall into traps that can derail your progress. I’ve observed several common missteps traders make, and knowing them beforehand can save you a lot of frustration.

5.1. The big day trap

This is probably the most frequent pitfall.

| Problem | Solution |

|---|---|

| You hit one exceptionally large profit day early in your payout cycle. You feel great, perhaps even invincible. However, this single “big day” can become a dominant outlier, pushing its percentage far above the 30% threshold. | If you have a massive day, understand that you can’t just stop trading and expect a payout. You’ll likely need to continue trading profitably and consistently for several more days. |

The goal is to accumulate enough additional profit to dilute that single large day’s impact, bringing its percentage of your total profit down below 30%. Don’t let a great day lead to an immediate pause in your disciplined trading.

Continue reading: Can I Use Failed Apex Accounts Has Tax Write Offs?

5.2. Ignoring the safety net

Many traders focus so intently on the consistency rule that they overlook other critical risk management payout criteria.

| Problem | Solution |

|---|---|

| You might meet the consistency rule perfectly. However, if you fail to maintain your safety net, your payout will be blocked. The safety net is your account’s trailing drawdown plus an extra $100, especially for the first three payouts. | Always keep a vigilant eye on your safety net level. Manage your risk on every trade, ensuring your account balance stays well above this critical threshold. |

5.3. Inconsistent contract sizes

Consistency isn’t just about profit; it’s also about how you approach your trades.

| Problem | Solution |

|---|---|

| Feeling confident after a few good days, you might suddenly increase your contract sizes too aggressively. This can lead to either an inconsistent profit spike (violating the 30% rule) or, worse, a significant loss that hurts your overall consistency and drawdown. | Stick to your predefined contract scaling rules and avoid making emotional decisions about your position size. Gradual and controlled increases are far better than erratic jumps. |

5.4. Lack of a clear trading plan

Without a roadmap, you’re likely to get lost.

| Problem | Solution |

|---|---|

| Winging it, trading without a well-defined strategy and set of rules, almost always leads to erratic results. This makes consistent profitability, let alone adherence to a consistency rule, nearly impossible. | Develop a clear, written trading plan. This plan should include precise entry and exit criteria, robust risk management protocols, and specific profit-taking rules. Stick to it rigorously. |

5.5. Emotional trading

Emotions are perhaps the biggest enemy of consistency.

| Problem | Solution |

|---|---|

| Letting fear, greed, or frustration dictate your trades. Impulsive decisions often lead to overtrading, revenge trading, or breaking your established rules, all of which destroy consistency. | Practice emotional discipline. If you’re feeling overwhelmed, step away from the screen. Stick to your plan regardless of market conditions’ volatility. Taking short breaks can be incredibly effective. |

6. Beyond the consistency rule: Other essential Apex payout considerations

The consistency rule for Apex Trader Funding payouts is a primary focus for traders seeking their first withdrawal. However, it’s important to remember that it’s just one piece of a larger puzzle.

Overlooking any of the other key rules can be just as detrimental to your payout eligibility. I’ve seen traders perfect their consistency, only to be tripped up by another, seemingly minor, regulation.

6.1. Trailing drawdown

This is arguably the most critical risk management rule in prop trading, often linked to the Apex 30% drawdown rule, and Apex is no exception.

- Understanding it: Your trailing drawdown is a dynamic limit that rises with your highest account balance. It increases as your balance grows and contract sizes expand, but never decreases.

- Its impact: Breaching this limit, even for a moment, on your evaluation or funded account, results in account termination or account closure, depending on severity. This is why a deep understanding of its calculation and how it progresses with your profits is paramount.

6.2. End-of-day (EOD) balance

The end-of-day (EOD) balance plays a significant role in Apex’s rules, particularly for determining your trailing drawdown and your eligibility to increase your contract size.

Your EOD balance is the reference point for how your trailing drawdown adjusts. It’s also the key metric based on current contract sizes.

6.3. Profit target (for evaluation accounts)

Before you even think about the consistency rule for payouts, you must first achieve your designated profit target during the evaluation phase without hitting the trailing drawdown. This is your ticket to a funded account.

6.4. Accessing 100% profits

Apex incentivizes long-term consistency and growth.

Apex features a very attractive profit-sharing structure. Initially, you keep 100% of the first $25,000 in profits you make per account. After surpassing this milestone, the profit split becomes 90% for you and 10% for Apex.

From the sixth payout onwards, the rule about accessing 100% of your profits usually removes the maximum withdrawal restrictions and payout caps. This allows you to withdraw your full available profits, instead of being limited as in the first few payouts.

Progressing to a Live Prop account can also alter these terms more favorably, which serves as a strong motivator for maintaining discipline and consistency.

6.5. News trading rules

For those who incorporate news events into their strategy, Apex has specific guidelines.

Apex Trader Funding does permit trading during news events. However, it comes with a strict one-direction-only rule. This means you cannot open trades on both sides of a potential news move.

You must commit to either a long or short position. While news can offer larger, more volatile moves, you must still manage these trades to ensure they don’t violate the 30% consistency rule.

6.6. Prohibited activities

Finally, common sense and ethical trading apply.

Activities like market manipulation, exploiting platform glitches, or engaging in group trading schemes designed to circumvent rules are strictly prohibited and will lead to account closure. Maintaining trader compliance is key. These rules reinforce the firm’s commitment to fair and legitimate trading.

7. Related questions (FAQs)

Yes, Apex Trader Funding implements a specific 30% “Windfall Rule” as its primary consistency requirement for payouts.

Payouts require meeting the 30% consistency rule, completing 8 trading days (with at least 5 profitable days over $50), and maintaining the “safety net” balance, among other risk management rules.

Your highest single-day profit must not exceed 30% of your total cumulative profit balance at the time of your payout request. If it does, you need to generate more cumulative profit to dilute that percentage.

The 30 consistency rule, Apex primarily applies to PA (Payout Accounts) and performance accounts, ensuring fair payout distribution. Evaluation accounts have their own distinct rules focused on hitting a profit target and managing drawdown without specific daily profit consistency requirements for qualification.

Violating the consistency rule will prevent your payout request from being processed. You will need to continue trading profitably and consistently to bring your highest single-day profit below the 30% threshold relative to your total profit before you can request a payout.

Apex Trader Funding does permit news trading, but it must adhere to a “one-direction-only” rule. While news trading can lead to larger, more volatile profits, you must still manage these trades to ensure they don’t violate the 30% consistency threshold.

No. The Apex consistency rule evaluation doesn’t apply in the evaluation account, only in Performance (PA) and Funded Accounts. During evaluation, your focus is on hitting the profit target and managing drawdown correctly. Though applying the Apex consistency rule evaluation mindset helps you transition smoothly later.

If one day’s profit exceeds 30% of your total, your payout will be delayed until the results balance out. In evaluation accounts, this means a reset is required. In funded accounts, serious or repeated violations can lead to payout denial or even account closure.

Trade with steady daily profits and avoid large spikes. Use a trading journal to track performance, apply strict risk management, and keep position sizing consistent. This helps you stay under the 30% limit and qualify for payouts faster.

Yes, but you must follow Apex’s one-direction-only rule, open either a long or short position, not both. Be cautious with volatility so a news trade doesn’t push one day’s profit above the 30% threshold.

It’s a rule stating that no single trading day can account for more than 30% of the total profit when you request a payout. It resets after every approved payout and remains active until your sixth payout or when you move to a Live Account.

To qualify for a payout, traders must complete at least 8 trading days with 5 profitable days earning over $50 each. The account balance must remain above the Safety Net level, which includes the starting balance, trailing drawdown, and a $100 buffer. Additionally, traders must follow the contract size limit, contract scaling, and consistency rule to demonstrate responsible, stable trading behavior before withdrawing profits.

The Apex 30% rule, also known as the Windfall Rule, limits a trader’s single-day profit to no more than 30% of their total accumulated profit for the payout cycle. This rule promotes consistent, low-risk trading and ensures traders build sustainable habits that lead to long-term profitability and smooth payout approvals.

8. Conclusion: Cultivating a sustainable trading career with Apex Trader funding

Ultimately, mastering the consistency rukle for Apex Trader Funding for payouts is about more than just getting your money. It also strengthens trading performance, builds accountability, and ensures compliance for long-term success. Instead of seeing it as a barrier, view it as a roadmap to sustainable success. When you truly understand and apply it, you empower yourself to:

- Turn the 30% rule from a frustrating hurdle into a strategic tool for risk management and combine it with disciplined stop losses to ensure stability.

- Build the confidence to request payouts without the fear of being rejected for avoidable mistakes.

- Develop the habits of a professional performance accounts trader who builds a steady income, not just a speculator chasing jackpots.

At H2T Funding, our mission is to provide exactly this kind of clear, actionable insight in our blog. We believe a deep understanding of the rules is the first step to mastering the game. For more in-depth guides and prop firm comparisons, be sure to explore our blog’s Prop Firm & Trading of Strategies section. Your journey to consistent profitability starts with knowledge.