Thousands of aspiring traders hold back because they believe you need $25,000 to actively trade. This myth, rooted in U.S. stock market regulations, has led to widespread confusion, especially among beginners.

But here’s the truth: the rule doesn’t apply to CFDs at all.

In this definitive guide, we’ll break down why CFD trades with less than USD 25k account are not only possible but common, and show you exactly how to enter the markets safely, even with limited capital. Whether you’re starting with $500 or $5,000, there’s a clear path forward, and this article will walk you through it.

1. What is the CFD meaning in trading?

Before exploring whether you can place CFD trades with less than a USD 25k account, it’s critical to understand how CFDs actually work. Unlike buying and holding traditional assets, CFD trading is a more flexible way to speculate on financial markets, without owning the asset itself.

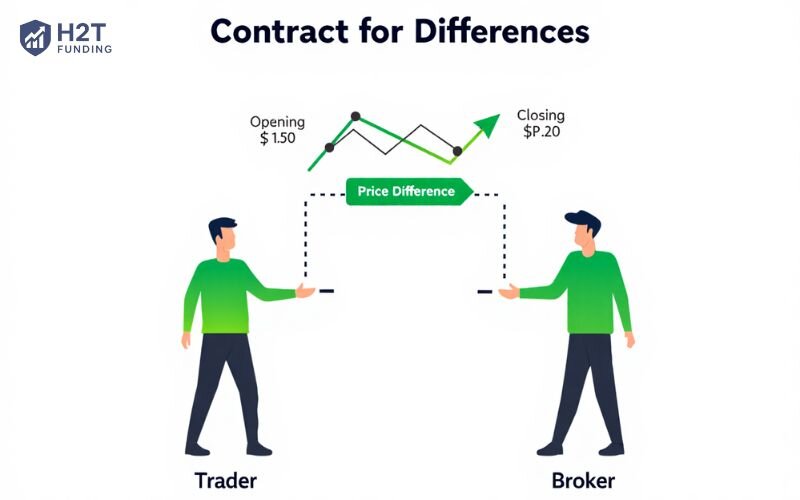

1.1. A simple explanation of Contract For Differences (CFD)

Simply put, a Contract for Differences (CFD) is an agreement between you and your broker. You agree to exchange the difference in an asset’s price from when you open the position to when you close it.

Let’s say you open a CFD on gold. You’re not purchasing physical gold bars; instead, you’re entering a position that mirrors the price movement of gold. The same applies to trading stocks like Apple, oil contracts, or indices like the S&P 500.

One of the biggest advantages of CFDs is access. You can trade across multiple markets from a single account, including forex pairs (EUR/USD, USD/JPY), global equities, stock indices, commodities (oil, gold), and even cryptocurrencies.

1.2. The Pattern Day Trader (PDT) rule

The PDT rule comes from the U.S. Financial Industry Regulatory Authority (FINRA). It applies to traders who execute four or more day trades, buying and selling the same stock within a single trading day, within five consecutive business days, using a margin account.

If you’re flagged as a PDT, you must maintain a minimum account balance of $25,000. If your balance drops below this threshold, your broker will restrict your ability to make further day trades until the account is topped up.

But here’s the key detail that’s often missed: the PDT rule is only for U.S. stocks and options. It simply doesn’t apply to the CFD market. Because most CFD brokers are regulated internationally (by bodies like the FCA or ASIC), they don’t fall under U.S. law. This is why it’s completely legitimate to make CFD trades with less than a USD 25k account.

Discover more related articles:

2. So, can you trade CFD with less than a $25k account?

Now that we’ve clarified the PDT rule and its limits, let’s answer the real question: Can you legally and effectively trade CFDs with less than $25,000 in your account? The short answer is: Absolutely, yes.

CFD trading is designed to be accessible. It doesn’t require high capital, and most brokers do not impose minimum balance restrictions. In fact, many retail traders around the world start with just a few hundred dollars.

Here’s why CFD trades with less than a USD 25k account are not only possible, but practical:

- CFD brokers are not subject to the U.S. PDT rule, meaning there’s no $25k restriction on day trading activities.

- Initial margin requirements for CFDs are much lower, allowing you to open trades with a small deposit.

- Leverage enables you to control larger positions, making efficient use of limited capital, though this comes with added risk, as we’ll explore next.

2.1. How CFD brokers operate outside the PDT rule

Most CFD brokers are headquartered and regulated outside the United States. That means they are not subject to FINRA regulations, including the Pattern Day Trader (PDT) rule. As a result, they do not require traders to maintain a $25,000 account balance to place frequent or intraday trades.

Many of these brokers are licensed by trusted financial authorities such as:

- FCA: Financial Conduct Authority (United Kingdom)

- ASIC: Australian Securities and Investments Commission (Australia)

- CySEC: Cyprus Securities and Exchange Commission (Cyprus)

These regulators impose their own rules to protect investors, but none of them mandate a minimum account size of $25,000 for day trading CFDs. Instead, they focus on transparency, fair pricing, and risk disclosures.

So, when you’re trading CFDs through these platforms, you’re not bound by U.S. rules, and that’s exactly what makes CFD trades with a less than USD 25k account completely viable across the globe.

2.2. The role of leverage: A double-edged sword for small capital

Leverage is one of the main reasons CFD trading is accessible to traders with smaller accounts. It allows you to control a position much larger than your actual capital by borrowing funds from your broker. However, it comes with both opportunities and significant risks.

This means your profits can get a big boost, but your losses can also get out of hand just as fast. A small market move against you can wipe out your trading capital if you’re not careful. It’s essential to understand this risk, especially when you trade CFDs with less than a $25k account.

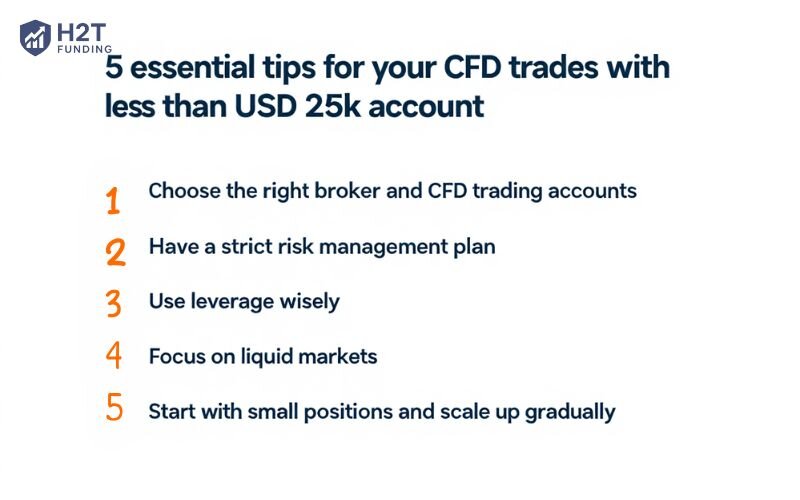

3. 5 essential tips for your CFD trades with a less than USD 25k account

Trading successfully with a smaller account isn’t about luck. It’s about having a solid plan and being disciplined. Here are five essential tips to help you protect your capital and trade more effectively.

3.1. Choose the right broker and CFD trading accounts

Choosing a good broker is one of the most important first steps. You need a broker that is regulated by a major authority like the FCA or ASIC. This ensures your funds are kept safely and the trading conditions are fair.

Look for low spreads, clear fees, and a stable platform like MT4 or MT5. Good customer support is also important if you run into any issues.

Avoid brokers without proper licensing or those promising unrealistic profits, as these often pose significant risks. Making the right choice from the start can save you from costly mistakes and create a safer trading environment.

3.2. Have a strict risk management plan

This is the most important rule in trading, period. If you don’t manage your risk properly, you will eventually lose your money; it’s that simple. Your plan should include these core rules:

- Risk only 1-2% of your total capital on a single trade to limit potential losses.

- Always set a stop-loss order to automatically exit losing positions before they grow.

- Calculate your position size carefully to ensure your risk matches your risk tolerance.

Sticking to these rules is non-negotiable. It’s the foundation of protecting your capital and staying in the game long-term.

3.3. Use leverage wisely

Leverage can magnify both profits and losses, making it a powerful but risky tool, especially for traders with smaller accounts. While brokers often offer extremely high leverage ratios like 1:500 or even 1:1000, this does not mean you should use the maximum available.

For beginners and small-cap traders, starting with low leverage (e.g., 1:10 or 1:20) is safer and helps build experience without excessive risk. Think of leverage as a tool that requires experience. High leverage is for seasoned traders, not for those still learning the ropes.

3.4. Focus on liquid markets

Stick to markets with high trading volume, like major forex pairs (EUR/USD), big indices (S&P 500), or gold.

Why? Because lots of buyers and sellers mean you can get in and out of trades easily, with lower costs (tighter spreads). For a small account, keeping transaction costs down is a big deal.

3.5. Start with small positions and scale up gradually

When you’re starting out, your goal is to learn, not get rich overnight. Use the smallest trade sizes your broker allows. Get comfortable and prove you can be consistent with small amounts first.

Once you have a track record of steady, disciplined trading, you can then think about slowly increasing your position size. Don’t rush this step.

Continue reading: Can you trade options on a funded account?

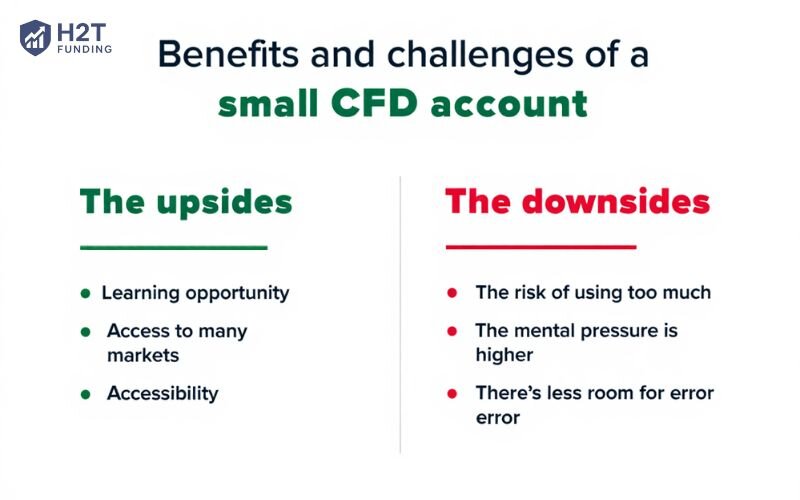

4. Benefits and challenges of a small CFD account

Trading with a small account has its pros and cons. It’s important to be realistic about both before you start.

4.1. The upsides: A great learning ground with high flexibility

Starting with a small CFD account offers several clear advantages:

- Learning opportunity: You gain real-world trading experience without putting a large amount of money on the line.

- Access to many markets: CFDs let you trade everything from forex to indices and commodities from a single account.

- Accessibility: You don’t need a huge account to get access to professional-level trading platforms and charts.

These benefits make small accounts an ideal environment for traders to grow their skills and confidence gradually.

4.2. The downsides: Managing risk and psychological pressure

CFDs with an account balance under USD 25K come with significant challenges that can impact both your financial stability and mental well-being.

- The risk of using too much leverage: It’s very easy to use high leverage, which can wipe out a small account quickly.

- The mental pressure is higher: Every loss feels bigger when your account is small. This can lead to stress and poor decisions, like “revenge trading” to win your money back.

- There’s less room for error: You don’t have a large financial cushion. A few bad trades can do significant damage to your account.

With a solid trading plan, disciplined execution, and a focus on building resilience against emotional swings, traders can navigate these pressures.

5. FAQs about CFD trading with a small account

The minimum balance to open a CFD trading account varies widely among brokers. Many brokers allow you to start with as little as $100 or even less. However, it’s very difficult to manage risk properly with an extremely small amount like $50, as a single trade could violate the 1-2% risk rule.

Yes, you can freely day trade CFDs without being bound by the $25,000 PDT rule. Since most CFD brokers operate internationally and are not subject to U.S. regulations, you can make as many intraday trades as you like, even with a small account. However, that freedom means you have to be extra disciplined with your risk management, as there are no built-in limits to stop you from over-trading.

Yes, it can be, because you don’t need a lot of capital to start. However, you have to be realistic about the risks. Because of leverage, you can lose money very quickly. If you’re a beginner, your first job is to educate yourself, practice on a demo account, and learn solid risk management before you put significant money on the line.

Yes, absolutely. Unlike U.S. stock trading, CFD trading is not subject to the Pattern Day Trader (PDT) rule that enforces a $25,000 minimum. Most CFD brokers operate under international regulations and allow clients to open accounts and actively trade with far less capital.

6. Conclusion

Successfully executing CFD trades with less than USD 25k account is entirely achievable and increasingly common among traders worldwide.

The key takeaway is this: your success won’t be determined by how much money you start with. It will be determined by your discipline, your strategies, and how seriously you take risk management. Focus on trading smart, not just trading big.

To learn more about becoming a professionally funded trader and discover effective trading strategies, we invite you to explore the Prop Firm & Trading Strategies section at H2T Funding.