Every trader faces bumps in the road. It’s part of the journey, especially when working with prop firms. Whether it’s a string of unexpected losses or hitting a crucial drawdown limit, challenges are inevitable.

Apex Trader Funding has grown popular among prop traders. It offers a structured path to trade with significant capital. But what happens when things don’t go as planned?

So, let’s get straight to it: can you rest a funded Apex account? If you’re asking this, chances are you’ve either hit a rough patch or you’re planning ahead. The answer isn’t a simple yes or no – it all comes down to one crucial detail: whether you’re in an Evaluation or a live Performance Account.

This guide will thoroughly explore the mechanics, costs, and strategic considerations of resetting an Apex account, clarifying when you can, and what happens when you can’t.

Key takeaways:

- Reset availability: You can reset an Apex Evaluation Account for $80-$100, but funded Performance Accounts (PAs) cannot be reset and are permanently closed if breached.

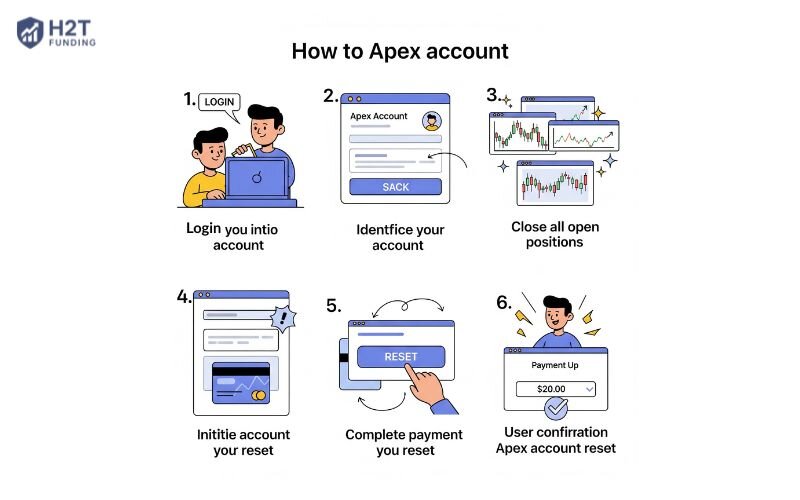

- Reset process: Log into the Apex dashboard, select the Evaluation Account, close all positions, initiate the reset, and pay the fee. Resets typically complete within 10 minutes but may take up to 4 hours.

- Free reset perk: Apex offers a free reset with each subscription renewal, which can be strategically used to avoid additional costs.

- Key rules: Maximum trailing drawdown, daily loss limits, and restrictions on news trading or holding trades over weekends are critical rules that, if violated, may necessitate a reset or lead to account closure.

- Strategic considerations: Evaluate performance, emotional state, and cost-benefit before resetting. Alternatives like taking a break or refining strategies may be more effective.

- Long-term success: Focus on building a robust trading strategy, mastering risk management, and continuous learning to minimize the need for resets and enhance trading resilience.

1. What exactly does a reset mean for an Apex Evaluation Account?

What exactly does a reset mean for an Apex Evaluation Account? It is a mechanism to restore your evaluation account to its initial starting balance. This allows you to continue your evaluation journey after hitting a maximum trailing drawdown or violating a specific trading rule.

In the world of proprietary trading, hitting a “reset” button isn’t like simply restarting your computer. It’s a specific mechanism designed to help traders regain their footing. This becomes crucial when you’ve hit certain financial thresholds or perhaps run afoul of trading rules.

It is crucial to understand that this reset function does not apply to funded Performance Accounts (PAs). Once a funded account is breached, it is permanently closed.

So, why would a trader even need to consider a reset for their Apex account?

- Hitting the maximum trailing drawdown: This is often the most common reason. If your account equity falls below a certain threshold, a reset brings it back up.

- Violating consistency rules: Some prop firms have rules about maintaining a certain level of consistency in your trading. While not always a direct trigger for Apex, breaking such rules could lead to issues that necessitate a reset.

- Desire for a fresh start: Sometimes, after a prolonged period of poor performance, a trader might simply want to clear the slate and begin with a clean record.

Let’s be clear: hitting the reset button is a lifeline, not a ‘get out of jail free’ card. It won’t magically fix a broken strategy or poor discipline. Think of it as a second chance to prove you’ve learned your lesson, not a way to erase it.

2. Can you rest a funded Apex account? A step-by-step guide

So, you’ve decided a fresh start is in order, and you’re asking, Can you reset a funded Apex account? The good news is, the process is straightforward, designed to get you back to trading as quickly as possible. From my observation, the steps are quite clear within the Apex system.

Here’s a step-by-step guide on how you can reset an Apex account:

- Access your member’s area: The first step is always to log in to your Apex Trader Funding dashboard. This is your central hub for managing all your accounts.

- Identify the account: Once logged in, find the specific Evaluation Account you wish to reset. It’s crucial to understand that this option is only available for Evaluation Accounts, not for funded Performance Accounts. Choosing the wrong account cannot be undone.

- Close all open positions: This is a critical step, one I can’t emphasize enough. Before initiating any reset, you must ensure all your trading positions are closed. Trying to reset with open trades will likely lead to issues.

- Initiate the reset: Next to the account you’ve selected, you’ll find a “Reset” option. Simply click this to begin the process.

- Complete the payment: Follow the on-screen prompts to finalize the payment for your reset. We’ll discuss the costs in detail shortly.

- Confirmation and activation: After successful payment, you’ll typically receive a confirmation. Your account should be active and ready for trading again within a short period.

From what I’ve seen, resets are usually completed quite quickly, often within 10 minutes. However, it’s worth noting that they can sometimes take longer, perhaps up to four hours, especially during peak times or if there are any underlying server issues.

A couple of vital considerations when you reset your Apex account:

- Irreversibility: Once you initiate a reset, there’s no going back. This is why carefully selecting the correct account in the initial steps is so important.

- No change to subscription or expiration date: A reset gives you a clean balance, but it doesn’t extend your current subscription period. Your renewal or expiration date will remain the same.

3. How much does it cost to reset an Apex Evaluation account?

Understanding the financial aspect of resetting your account is just as important as knowing the steps. Many traders wonder, “How much does it cost to reset an Apex evaluation account?” It’s a valid question, as these fees directly impact your trading budget and overall strategy.

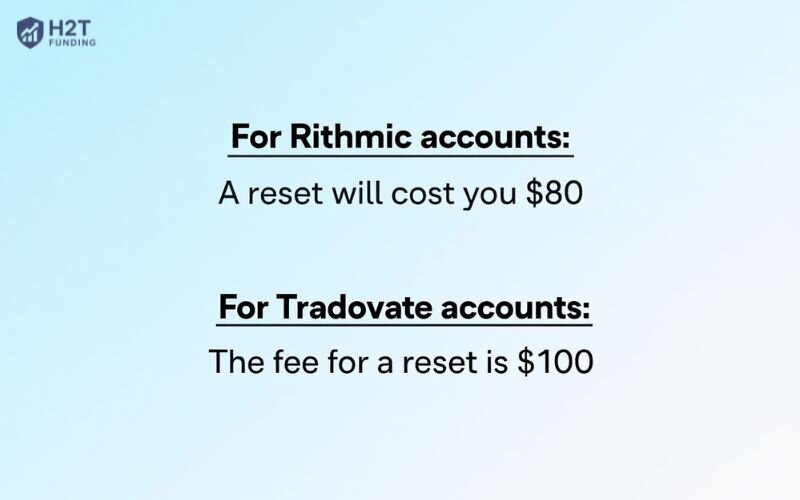

Here’s a detailed breakdown of the reset fees:

- For Rithmic accounts: A reset will cost you $80.

- For Tradovate accounts: The fee for a reset is $100.

These costs are relatively standard within the prop trading industry for similar services. However, Apex Trader Funding also offers a significant benefit that can help ease the financial burden of frequent resets.

This brings us to the “free reset” perk. From my experience, one of the most beneficial features Apex offers is a free reset provided with each subscription renewal. This means that if your account hits a negative balance or is “burned out” by the time your subscription renews, you get a chance to start fresh without incurring an additional reset fee.

This is a valuable feature that you can strategically factor into your planning, especially if you anticipate needing a reset around your renewal date.

View more:

4. What are the rules for Apex Funded accounts?

While knowing how to reset an Apex account is crucial, understanding the rules that often lead to needing a reset is even more important. It’s about proactive management rather than just reactive solutions. From my experience, grasping these core regulations can significantly improve your longevity as a trader.

Here are the most critical rules that frequently trigger the need for a reset in Apex accounts:

4.1. Maximum trailing drawdown

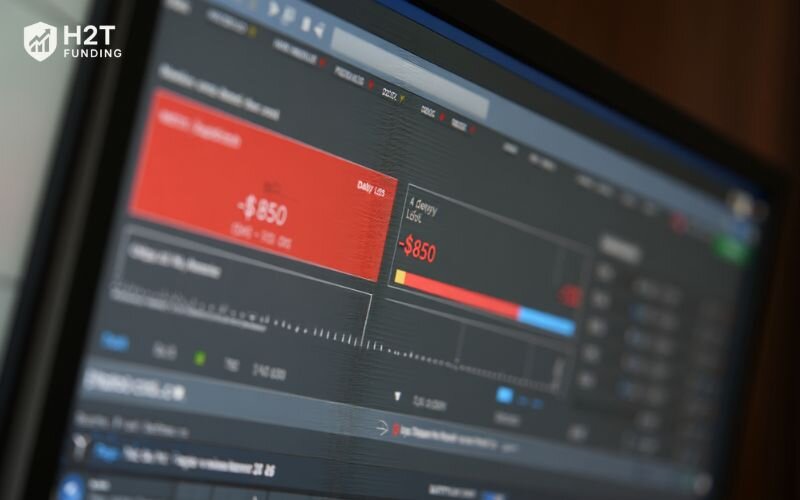

This is perhaps the most vital rule. The maximum trailing drawdown is the most money your account can lose. It “trails” your highest profit point.

If your account equity falls below this specific threshold, the account will be breached and permanently closed. This is the strictest rule for funded accounts.

4.2. Consistency rules

While not always a direct trigger for a forced reset by Apex, some prop firms implement consistency rules. These rules aim to prevent “one-hit wonder” trading, ensuring a more stable performance.

If Apex has specific consistency rules for funded accounts, violating them might lead to account review or the denial of a payout request. Always check the latest terms.

4.3. Daily loss limits

These limits define the maximum amount you can lose within a single trading day. While hitting a daily loss limit doesn’t immediately close the account, consistently hitting it will quickly lead you to your maximum trailing drawdown, which would breach the account.

4.4. News trading restrictions

Some prop firms impose restrictions on trading during major news events. Breaking these rules could lead to penalties, potentially including profit forfeiture or account closure, depending on the firm’s policy and the severity of the violation.

4.5. Holding trades over the weekend or news

Similar to news trading, holding positions through weekends or significant news announcements might be restricted to mitigate firm risk. Violations can lead to account issues.

Understanding these rules isn’t just about avoiding a reset. It’s about cultivating disciplined and sustainable trading habits. By internalizing these guidelines, you’ll naturally develop better risk management practices. I always tell traders: The best way to avoid a reset is to never need one in the first place, and that comes from respecting the rules.

6. How to troubleshoot Apex Reset issues when your account doesn’t show up

It can be incredibly frustrating to pay for a reset, eager to get back to trading, only to find your Apex account isn’t showing up. This is a common concern among traders, and it’s something I’ve seen discussed in various communities. Don’t panic if this happens; there are typically steps you can take.

If your Apex account isn’t appearing after resetting, here’s what you should do:

- Initial checks: Start by logging out of your trading platform (like NinjaTrader) and your Apex dashboard. Then, log back in. Sometimes, a simple refresh can resolve the display issue. Also, ensure you’re checking the correct dashboard for your account status.

- Patience is key: Resets aren’t always instantaneous. While many are completed within 5-10 minutes, I’ve observed that they can sometimes take up to 4 hours. In rare cases, especially during high volume or system maintenance, it might take even longer. Give it a reasonable amount of time before escalating.

- Contacting Apex support: If your account still hasn’t appeared after a few hours, the next step is to contact Apex support. Creating a support ticket is the most effective way to communicate. When you do, be sure to provide all relevant details:

- Your account number.

- The exact time you initiated the reset.

- Any transaction IDs or payment confirmations.

- A clear description of the issue.

- Potential technical issues: It’s worth noting that sometimes these delays stem from technical issues on the provider’s side. For instance, there have been instances where issues with Rithmic servers affected account creations and resets. This means it might not be a problem with your actions but rather a system-wide hiccup.

If delays persist, continue to communicate with support. Documenting your attempts to resolve the issue can be helpful. Avoid making impulsive trading decisions or trying to purchase another reset unless instructed by support.

7. Strategic considerations: When to reset vs. when to call it quits (for now)?

Knowing that you can reset an Apex evaluation account offers a safety net during the challenge phase. However, the real skill lies in knowing when to use it strategically and when to consider taking a step back. I’ve seen many traders fall into the trap of resetting repeatedly without addressing underlying issues.

Here’s a framework I often recommend for making that crucial decision:

- Evaluate your trading performance: Look beyond just the current drawdown. Are you consistently hitting your maximum loss limits? Is it just one particularly bad trading day, or does it signal a deeper flaw in your strategy or discipline?

- Assess your emotional state: Trading under duress, trying to “revenge trade” losses, or feeling overwhelmed are clear signs to pause. A reset button won’t fix a compromised mindset.

- Conduct a cost-benefit analysis of resetting: Is the $80 or $100 reset fee truly worth it, given your recent performance and your current confidence level? Sometimes, that money might be better spent on further education or simply taking a break.

- Leverage the “free reset” advantage: If your subscription is due for renewal soon, and you know a free reset is coming, it might influence your decision to wait or push through until that point. This can save you a fee.

Sometimes, the best “reset” isn’t a paid one through the platform. Consider these alternative actions:

- Taking a break: Stepping away from the charts for a few days or even a week can do wonders for mental clarity and perspective. This is a reset for your mind, which I believe is just as important as an account reset.

- Reviewing your strategy: Use the time away to meticulously review your past trades. Identify weaknesses in your current approach, your entry/exit criteria, or your risk management.

- Backtesting and forward testing: Before jumping back in, validate any revised strategies. Use historical data (backtesting) and then perhaps demo accounts (forward testing) to build confidence.

- Seeking mentorship or education: Instead of continually paying for resets, invest in your skills. Learning from experienced traders or enrolling in targeted courses can provide a more sustainable path to improvement.

This stage of the trading journey, the “consideration” phase, is where traders truly deepen their understanding of strategy and risk management, extending far beyond the mechanical act of clicking a reset button.

8. Enhancing your trading edge: Beyond resets

Constantly needing to reset an Apex account can be a taxing cycle. While it’s a valuable feature, true growth as a trader comes from building a robust skillset that minimizes the need for it. I believe in empowering traders with knowledge and tools, not just quick fixes.

Here’s how you can proactively enhance your trading edge and build more sustainable habits:

- Build a battle-tested strategy: A real strategy isn’t just a vague idea; it’s your personal rulebook for the market’s chaos. Know exactly what your entry trigger looks like, where you’ll cut your losses, and when you’ll take profits before you even place the trade. This isn’t about being rigid; it’s about preventing those gut-wrenching, impulsive decisions that blow up accounts.

- Leverage analytical tools effectively: The market offers a plethora of free and paid tools. Learn to use indicators, chart patterns, and other analytical instruments to confirm your biases and refine your trade setups. Whether it’s MT4, MT5, or TradingView, mastering your platform’s analytical capabilities can provide significant insights.

- Master risk management: This is perhaps the single most crucial skill in trading, especially with funded accounts. Understand position sizing, set clear stop-loss levels, and never risk more than a small percentage of your capital on any single trade. Effective risk management is your primary defense against needing a reset.

- Embrace continuous learning: The financial markets are constantly evolving. What worked yesterday might not work today. Stay updated with market news, learn new techniques, and adapt your strategies. My personal observation is that traders who commit to ongoing education are far more resilient in the face of market volatility.

Ultimately, focusing on these areas will not only reduce the frequency of needing a reset but also cultivate a more profitable and less stressful trading experience. I’ve found that proactive learning and constant strategy adjustment are key factors in avoiding those frustrating account resets.

Explore more blog posts from this category:

9. FAQs about resetting a funded Apex account

No, you cannot reset a funded Apex account (known as a Performance Account or PA). The reset feature is exclusively for Evaluation Accounts. If a funded account violates a rule, such as the maximum trailing drawdown, it is permanently closed. To trade with Apex again, you must purchase and pass a new evaluation account.

The process involves logging into your Apex member area, selecting the specific account you wish to reset, ensuring all open positions are closed, and then initiating the reset process by paying the required fee.

Reset fees are $80 for Rithmic accounts and $100 for Tradovate accounts. Remember, Apex also offers a valuable free reset with each subscription renewal, which can be a great way to save on costs.

The primary rule leading to the closure of a funded account is hitting your maximum trailing drawdown. Other important rules include daily loss limits and potential restrictions on news trading or holding trades over the weekend. Always refer to Apex’s most current terms for complete details.

10. Conclusion

So, to definitively answer the central question, can you reset a funded Apex account?, The clear answer is No.

The reset function is an invaluable lifeline reserved exclusively for Evaluation Accounts, giving you a second chance during the challenge phase. However, once you are funded, there is no reset button. A rule violation leads to the permanent closure of the account. This hard rule is exactly why your focus, from the moment you start, should be on building bulletproof discipline and a strategy you can trust.

At H2T Funding, our mission is to equip you with the knowledge and tools for sustainable success, rather than relying on quick fixes. We encourage you to delve deeper into our Prop Firm & Trading Strategies section to build the risk management skills, strategies, and effective trading methods needed to protect your funded account and thrive in the dynamic world of trading.