Figuring out your personal finances can feel like trying to solve a puzzle without all the pieces. That’s why finding the best financial planners for beginners is often the single most important step you can take. The right choice is usually a robo-advisor for simple investing, a fee-only planner for a complete strategy, or financial coaching to build strong habits.

This guide will give you the clear, straightforward answers you’ve been looking for. H2T Funding will show you exactly how to choose the right professional financial planners. Let’s get you on the path to financial confidence.

Key takeaways

- A financial planner is a professional who helps you organize your money, set clear goals, and build a long-term plan covering budgeting, debt management, investment management, and retirement planning.

- The best financial planners for beginners usually include robo-advisors, fee-only planners, and online financial planners, because they are affordable, flexible, and easy to work with when finances are still simple.

- Choosing the best financial planners for beginners starts with clear goals, followed by checking fiduciary duty, understanding fees and commissions, and evaluating communication style.

- A beginner-friendly financial planner should provide holistic financial services, including budgeting support, basic investment advice, awareness of tax consequences, and early estate planning considerations.

1. What is a financial planner, and what do they do?

A financial planner is a professional who helps you build a strategy for your money. They take a look at everything, your income, your debts, what you want to achieve, and help you create a realistic roadmap to get there.

Here’s something you absolutely need to know: the term financial planner isn’t officially regulated, so anyone can use it. That’s why you should look for someone with credentials, like a CFP® (Certified Financial Planner).

CFPs have a fiduciary duty when providing financial advice (per CFP Board standards). That means they are legally required to act in your best interest. It’s a big deal.

So what happens when you actually work with one? The process is pretty straightforward. They’ll want to understand three main things:

- Getting clear on your goals: They’ll help you define what you’re working towards, whether it’s short-term (like saving for a car) or long-term (like retirement).

- Taking stock of where you are now: This is a simple look at your financial situation, what comes in, what goes out, and what you own. It’s the starting point for any good plan and where you can dive into different budgeting business strategies.

- Figuring out your risk tolerance: If you plan to invest, they’ll ask how you feel about the market’s natural ups and downs to make sure you’re comfortable with the plan.

For beginners, this is huge. When your finances are still relatively simple, you have the perfect opportunity to build good habits from the ground up. A planner provides an objective perspective and helps you navigate big life changes, a first home, marriage, and a new baby, without making costly mistakes.

2. How to choose the best financial planners for beginners

Picking the best financial advisor for beginners can feel like a shot in the dark. You’re not just looking for a numbers person. You need someone you can trust, who actually listens and doesn’t make you feel lost in jargon.

The good news? There’s a simple process to find someone who’s actually on your side, not just selling something.

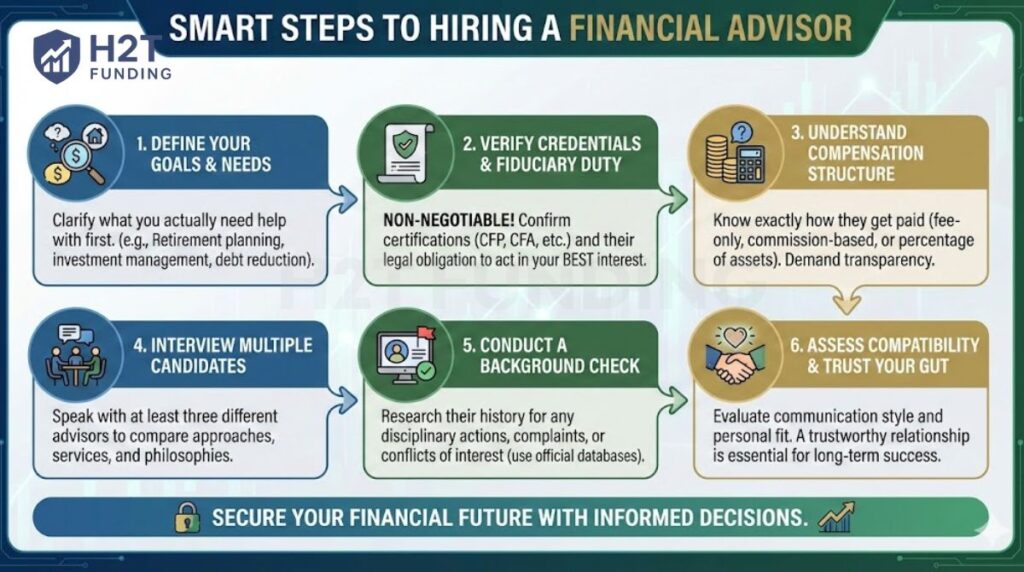

Here’s a quick checklist for finding your ideal financial planner:

- Clarify what you actually need help with first.

- Verify their credentials and fiduciary duty (this is non-negotiable!).

- Understand exactly how they get paid.

- Interview at least three different candidates.

- Do a quick background check for transparency and history.

- Trust your gut on communication style and personal compatibility.

Let’s dive into what each of these steps actually means for you.

2.1. Clarify your financial goals first

Start by getting clear on what you actually need help with. Is your main priority getting out of credit card debt? Or are you trying to figure out how to invest your first $1,000? Maybe you’re saving for a down payment. Knowing what you want to achieve helps you find someone who specializes in that area, instead of paying for a one-size-fits-all plan you don’t need.

Read more:

2.2. Look for credentials like CFP and a fiduciary duty

This part is crucial. Not all “advisors” are created equal. Look for two things. First, a certification like CFP® (Certified Financial Planner) shows they’ve gone through rigorous training and are held to a high ethical standard. Second, and this is non-negotiable, make sure they are a fiduciary.

That’s a legal term meaning they must act in your best interest, not their own. For CFPs, this duty applies when giving advice, asking directly, and verifying via Form ADV. This simple word protects you from someone pushing a product just because it earns them a bigger commission.

2.3. Understand their fee structure

Before you agree to anything, you need to know exactly how they get paid. With a fee-only planner, you pay them a flat fee or an hourly rate directly. This is often the most transparent choice.

Be more cautious with planners who charge a percentage of your assets (AUM). While fine for large portfolios, it can be expensive when you’re just starting. Always ask for a simple breakdown of all costs.

2.4. Interview at least three candidates

Don’t just go with the first name that pops up in a search. You need to treat this like you’re shopping around for anything important. Make it your goal to have a real conversation with at least three different planners. This is less about grilling them with questions and more about just checking the vibe.

If you want to find out how they treat beginners. Ask them about their process and see how they handle explaining a topic you find confusing. The right person will make you feel smarter, not intimidated. Trust your gut on this one.

2.5. Check their background and transparency

Before you sign anything, do a little digging. It’s not as intense as it sounds. A quick search on FINRA’s BrokerCheck can show you their professional history and if there are any complaints against them. It’s free and easy to use.

A trustworthy planner will be an open book. They’ll be upfront about their qualifications and exactly how they get paid. If you feel like you’re getting a sales pitch instead of advice, or if they’re cagey about fees, that’s your cue to walk away.

- Look up their certifications and disciplinary history (if available).

- Check for online reviews or testimonials.

- Avoid planners who dodge questions about fees, push you toward certain financial products, or are vague about their qualifications.

A reliable financial planner should be transparent, easy to reach, and open about how they operate.

2.6. Evaluate communication style and compatibility

Finally, this is a personal relationship. Do you feel comfortable with them? Do they explain things in a way you understand, without making you feel intimidated? You need to feel like you can ask the “stupid” questions. Your planner should empower you, not talk down to you.

See more articles on this topic:

3. The three types of financial planners

Okay, so where do you actually find a planner? Finding the best financial advisors for beginners isn’t a one-size-fits-all situation. The right choice really boils down to your budget, your personality, and how much guidance you’re looking for.

You can break down your options into three main categories:

- The Traditional Planner (face-to-face)

- The Online or Hybrid Planner (virtual advice)

- The Robo-Advisor (automated investing)

Let’s look at the pros and cons of each so you can figure out which one fits you best.

3.1. Traditional financial planners

Traditional financial planners are in-person advisors who meet with clients face-to-face (or sometimes virtually) to provide personalized financial guidance. These professionals often have certifications like CFP (Certified Financial Planner) and years of experience helping clients manage their money.

| Pros | Cons | Best for |

|---|---|---|

| Deeply personalized, comprehensive advice | The most expensive option | Beginners who want a deep, personal relationship with an advisor and have a more complex financial life. |

| Builds a long-term, trusted relationship | Often requires a high account minimum to start | |

| Can handle very complex financial situations | Less flexible than online alternatives |

3.2. Online financial planning services

Online financial planners offer financial advice through digital platforms. These services may include access to human advisors via chat or video, along with financial tools to help you track progress and set goals. They strike a balance between convenience and human touch.

| Pros | Cons | Best for |

|---|---|---|

| Much more affordable than a traditional planner | Lacks the personal touch of in-person meetings | Most beginners. It offers the perfect mix of real human advice and affordable, flexible access. |

| You still get personalized advice from a real person | The quality of advice can vary between platforms | |

| Very convenient and flexible scheduling |

3.3. Robo-advisors

Robo-advisors are automated platforms that use algorithms to manage your investments based on your financial goals, risk tolerance, and time horizon. After answering a few questions, the system creates and maintains a diversified investment portfolio for you.

| Pros | Cons | Best for |

|---|---|---|

| Extremely low-cost, sometimes even free to start | Investing only. It does not provide holistic financial advice. | Beginners who just want a low-cost, hands-off way to start investing and don’t need broader financial advice yet. |

| Very easy to begin with, even with a small amount of money | No human to talk to for guidance or questions | |

| Completely automated and requires no knowledge | Can’t help with debt, budgeting, or major life decisions |

Note: Many robo-advisors now offer optional human guidance or AI-enhanced planning tools, giving beginners more personalized support than in previous years.

As you can see, there isn’t one best type of planner; there’s only the one that’s best for you. The right choice depends entirely on your needs right now. Are you looking for a deep partnership, a flexible guide, or just a simple tool to get started? Understanding these options is the first step to choosing a path that feels right.

4. Top 5 best financial planners for beginners

You’ve learned what to look for, but where do you actually find a good financial advisor for beginners? A great starting point is looking at networks and platforms designed for people just like you, with low or no asset minimums, flat/hourly fees, and a focus on holistic planning.

These are quality templates for what to seek: CFP® credentials, fiduciary duty, transparent fees, and experience with entry-level clients. Use them as your search guide.

| Network/Platform | Key Features | Best For Beginners | Starting Cost |

|---|---|---|---|

| XY Planning Network (XYPN) | Fee-only fiduciaries specializing in Gen X/Y/millennials. Virtual-first, hourly/flat fees. No AUM minimums. | Young adults, first-time savers, debt payoff. | $100–$400/hour or $1,500–$5,000 flat plan |

| Garrett Planning Network | Hourly fee-only planners (no AUM). Focus on accessible advice. | Budgeting, basic investing, life transitions. | $200 – $400/hour |

| Advice-Only Network | Flat-fee planners for one-time plans. CFP® heavy. | Goal-setting, emergency funds, starter portfolios. | $750 – $3,000 per plan |

| Facet Wealth (now Facet) | Subscription model ($2,400–$8,000/year). Unlimited CFP® access. Low minimum ($0). | Ongoing coaching without asset fees. | $200/month+ |

| Northwestern Mutual Planning | Hybrid online/in-person for beginners. Some flat-fee options. | Basic retirement/debt plans. | Hourly or project-based (~$150/hour) |

Note: These are examples based on 2025 data; always verify on their sites, check BrokerCheck, and confirm fiduciary status. Fees vary by location/experience. Start with a free consult to test fit.

The key takeaway? Seek networks like XYPN or Garrett for beginners; they prioritize affordability and empowerment over big portfolios. This is your quality checklist in action: credentials + low barriers = perfect match.

5. Understanding financial planner costs for beginners

This is probably the most important part of the process and answers the big question many beginners have: Are financial planners free? The way a planner is paid directly influences the advice they give you. Let’s break down the common models so you know exactly what you’re walking into.

5.1. Assets under management (AUM) fees

AUM fees are the most traditional way planners get paid. Basically, you pay them a small percentage of the money they manage for you, usually once a year. So, if they manage $100,000 for you and charge a 1% fee, you’ll pay them $1,000 for the year.

Typical rates:

- Most advisors charge between 0.5% to 1.5% of assets under management annually.

- Some may offer tiered pricing, where the percentage drops as your investment amount increases. Tiered rates often drop for large assets (e.g., 1% on $100k, down to 0.5% for >$1M).

But for a beginner, this model isn’t always the best fit. If you don’t have a lot to invest yet, you might get more value from a planner who charges a flat fee instead.

5.2. Flat or hourly fees

Some planners charge a fixed fee for a specific service (like creating a financial plan) or by the hour for consultations. This transparent approach lets you know exactly what you’re paying for upfront.

Benefits for beginners:

- You only pay for what you need, whether it’s a one-time budgeting session or help setting up a retirement plan.

- No pressure to commit long-term.

- Makes professional advice more accessible, even if you don’t have investments yet.

When to choose this model:

If you’re looking for basic guidance, such as improving cash flow, setting financial goals, or tackling debt, this model is a cost-effective way to get started. It allows you to receive support without committing to an ongoing relationship or paying asset-based fees.

5.3. Other fee structures

Beyond AUM and flat fees, there are other models that beginners may encounter, some of which can offer flexibility, while others require caution.

Subscription-based fees:

- Some modern planners offer monthly or annual subscription plans (e.g., $50–$200/month), covering regular check-ins, unlimited email access, and ongoing plan updates.

- These models are gaining popularity for offering continuous support without asset minimums.

Commission-based compensation:

- Advisors may earn money from selling products like insurance or investment funds.

- While this model might seem “free” to the client, it often leads to conflicts of interest, where the advisor recommends products that earn them more commission, not necessarily what’s best for you.

5.4. Hidden fees to watch for

Even with a clear pricing model, some costs may sneak in if you’re not careful. As a beginner, it’s important to ask upfront and review all agreements carefully.

Common hidden or unexpected charges:

- Account setup or termination fees

- Trading or transaction costs for buying/selling investments

- Platform or technology fees if using a digital portal

- Product-related fees, such as mutual fund expense ratios

Always ask for a complete fee disclosure before signing anything. A reputable planner should be transparent and willing to explain every potential cost in simple terms.

6. Red flags to avoid when choosing a financial planner

Lots of people pick the wrong advisor the first time around. I’ve watched friends get stuck with high-fee products that went nowhere, making money only for the person who sold it.

It’s an expensive and frustrating mistake. To avoid it, you need to learn how to spot the warning signs from a mile away.

Here’s what you need to do:

- Question their fiduciary status: CFPs must act as fiduciaries when providing advice, but other certifications may not guarantee this. Always ask directly and check Form ADV.

- Demand a clear fee breakdown: You need to know exactly how this person gets paid. A professional can explain their fees in under a minute. If it sounds confusing, it’s probably on purpose.

- Spot a sales pitch disguised as advice: A real planning session starts with your goals, not a product. If they immediately start pushing a specific investment, you’re not getting advice. You’re in a sales meeting.

- Verify their credentials: Don’t just take their word for it. Look for the CFP® certification, which is the industry’s gold standard. It proves they’ve met serious ethical and educational requirements.

- Watch out for a narrow focus: Your financial life is more than just investments. If they don’t want to talk about your debt or savings, they’re not a true planner. They’re a specialist trying to sell you their one thing.

- Trust your gut on the vibe: This is a long-term partnership. If you feel intimidated or can’t get a straight answer, it’s not going to work. Find someone you feel comfortable talking to.

In the end, it all comes down to asking direct questions and expecting clear answers. That principle is your best defense in any financial arena, whether you’re vetting an advisor or trying to understand how does Apex Trader funding work. Knowing the rules of the game is what keeps you safe.

7. FAQs: Common questions about financial planners for beginners

Start by setting clear goals (saving, debt payoff, investing), tracking your income and expenses, and building an emergency fund. Then consider talking to a planner to create a plan.

A fee-only fiduciary planner or a robo-advisor is usually best, affordable, goal-focused, and beginner-friendly.

Look for non-profit financial counseling services, online platforms with flat fees, or advisors offering hourly or project-based pricing.

They help you set goals, build a budget, plan for retirement, and manage debt, step by step, based on your current financial situation.

A financial planner often focuses on holistic planning (budgeting, retirement, etc.), while a financial advisor is a broader term that can include investment-only services.

If you’re just starting and have a limited budget, a robo-advisor or online service is great. For complex needs or personal guidance, go with an in-person planner.

Yes, absolutely. With $500,000, you’ll have no trouble finding a traditional financial advisor. That amount is well above the minimum for most firms and qualifies you for more in-depth services like wealth management.

The best advice is to simply start now, even if it’s small. Live on less than you earn, automate your savings so you don’t have to think about it, and attack high-interest debt like it’s an emergency. Nailing these habits early is more important than any complex investment strategy.

It depends entirely on what you get for it. While 1% is a pretty standard fee in the industry, it’s too high if you’re only getting basic investment management. But if that fee also covers comprehensive financial planning, tax advice, and regular check-ins, it can be a fair price for expert guidance.

8. Conclusion

Finding the best financial planners for beginners can feel like a huge task, but it boils down to a few simple ideas: Know what you need help with, understand how they get paid, and never be afraid to ask the dumb questions.

The goal isn’t to find the perfect planner on day one. The goal is to simply get started. Your first step might not be hiring someone at all. It might be tracking your spending for a month to see where your money really goes. It might be setting up an automatic transfer of $50 a month into a savings account. It might be reading one more article.

Whatever it is, take that first step. The sooner you begin, the sooner you’ll move from feeling uncertain about money to feeling confident and in control of your future.

For more practical tips, case studies, and money strategies tailored to beginners, don’t forget to explore the Strategies section and Budgeting Strategies of H2T Funding. There, you’ll find helpful guides, beginner-friendly insights, and tools to support your next financial move.