To learn how to prioritize expenses, especially if you’re new to beginner financial literacy, start by listing all your costs and separating essentials from discretionary spending. Rank each item by urgency and necessity to build clarity.

Cover needs like rent and food first, then align other spending with your financial goals.

Budgeting apps can help you stick to your financial plan. Ready to learn how to put this into practice? Let’s break it down step by step.

Key takeaways

- Prioritizing expenses helps you take control of your finances by clearly identifying where your money goes. This approach reduces stress, builds confidence, and sets the foundation for achieving long-term financial goals.

- Covering essentials, such as housing, utilities, groceries, and healthcare, first ensures financial security. Once these are handled, you can focus on savings, debt repayment, and discretionary spending.

- Automating your bill payments and savings contributions reduces emotional decision-making. This helps you stay consistent, avoid late fees, and steadily grow your emergency and investment funds.

- Using budgeting frameworks like the 50/30/20 rule or 70/20/10 rule simplifies expense planning. These rules give clear percentages for essentials, savings, and lifestyle spending, making budgeting easier to follow.

- Reviewing and adjusting your budget regularly is essential to keep it aligned with income changes, life events, and evolving financial goals.

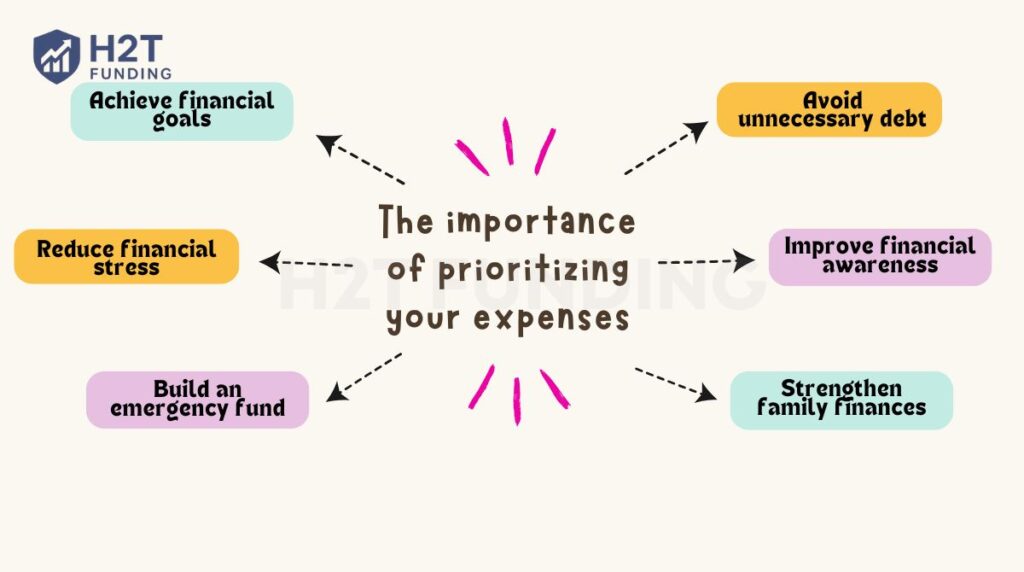

1. The importance of prioritizing your expenses

Understanding why it is important for all adults to have a budget is key to building strong financial planning skills and long-term financial health. For financial literacy beginners, creating a personal budget early helps establish healthy spending habits, track cash flow, and make smarter financial decisions.

Key benefits of having a budget:

- Achieve financial goals: A well-structured budget aligns spending habits with what matters most, from saving for a home to retirement planning or other major milestones.

- Reduce financial stress: Covering essential expenses first provides stability and reduces anxiety about living paycheck to paycheck.

- Build an emergency fund: Controlling discretionary spending frees up cash flow for unexpected costs, boosting your financial security.

- Avoid unnecessary debt: A clear plan keeps impulsive purchases in check, reducing high-interest credit card debt.

- Improve financial awareness: Tracking income, expenses, and your credit report creates a clearer view of your financial health and supports smarter investment decisions.

- Strengthen family finances: A transparent plan fosters financial education within households and minimizes money-related conflicts.

For all adults, especially those following a beginner’s guide to financial literacy, budgeting is a core skill that drives stability, builds confidence, and opens opportunities to grow wealth through better financial education and strategic use of investment vehicles. Think of your budget as a personal guide to long-term security and freedom, no matter your current income or stage of life.

Personal note: When I got my first apartment, I was shocked at how quickly my paycheck seemed to disappear between rent and other bills. I constantly felt one unexpected expense away from trouble. Simply figuring out where my money was actually going was the first step to finally building a small savings buffer and feeling like I was in control.

2. Step-by-step: How to prioritize expenses

Knowing how to prioritize your expenses is key to managing your budget effectively. Follow these simple steps to make sure your money goes to what matters most.

Step 1: List all your expenses

Begin by gaining full visibility into your spending habits. Break down your expenses into categories:

- Fixed expenses: These are consistent each month (e.g., rent, subscriptions).

- Variable expenses: These change monthly (e.g., groceries, gas).

- Essential vs. Discretionary: Essentials cover needs (like utilities and food), while discretionary items are wants (like streaming services or eating out).

Read more:

Step 2: Identify essential expenses first

Focus on needs before wants. Essentials typically include:

- Housing: Rent or mortgage

- Utilities: Electricity, water, internet

- Groceries: Food and household basics

- Healthcare: Insurance, medications

Ask yourself: “Would my well-being or safety be at risk if I cut this?”

Step 3: Create a tiered system for prioritization

Use a color-coded or tiered method:

- Tier 1 (High Priority): Basic needs, minimum debt payments

- Tier 2 (Medium): Building emergency fund, paying down extra debt

- Tier 3 (Low): Subscriptions, dining out, upgrades

Example:

Maria created a simple three-tier system using colored sticky notes on a budget board in her kitchen. She used red for essential expenses, yellow for mid-level financial goals, and green for flexible or optional spending.

At the beginning of each month, Maria spent about 10 minutes reviewing her expenses. She adjusted the notes based on any life changes, like a child’s school fee or an unexpected bonus.

This visual system helped her see the big picture and make smarter, more intentional spending decisions.

Step 4: Align expenses with your financial goals

Once essentials are covered, align spending with your personal goals. A useful concept here is asking yourself: What does “pay yourself first” mean? It reminds you to prioritize saving before spending on non-essentials.

- Emergency fund: Aim for 3–6 months of expenses

- Debt repayment strategy: Use the avalanche or snowball method

- Automate savings: Automate contributions where possible

Tip: Use the 50/30/20 rule as a starting point: 50% needs, 30% wants, 20% savings/debt

See another helpful budgeting rule:

Step 5: Adjust based on income & life changes

Your priorities should evolve as your life does. Review your budget when:

- Income changes (job loss or raise)

- Life stages shift (marriage, children, moving)

- Emergencies arise (medical bills, car repairs)

Revisit your expenses monthly or quarterly.

Step 6: Use tools and templates to stay on track

For those seeking tips on financial literacy, using free and paid tools helps you stick to your plan:

- YNAB: take control of your money before you spend it

- PocketGuard: spending alerts

- Google Sheets Templates: manual control

Download free budget templates online or from personal finance blogs for tailored solutions.

3. Common mistakes to avoid

When learning how to prioritize expenses, I realized that even small money habits could derail progress. Understanding how a budget can help you reach your financial goals starts with avoiding these common mistakes.

Key mistakes to watch out for:

- Treating all expenses equally: Not all bills carry the same weight. Essentials like housing, utilities, transportation, and healthcare should come first, while less critical expenses can be adjusted or delayed.

- Ignoring your goals: Without clear financial goals, your spending can become scattered. Attaching purpose to every dollar helps you make decisions that align with your long-term priorities, from building an emergency fund to retirement planning.

- Overlooking “just because” purchases: Small, unplanned splurges, like coffee runs, online impulse buys, or takeout meals, can quietly erode your budget. Consistently tracking these expenses provides insight into your spending habits and highlights areas to cut back.

Avoiding these errors is a key financial literacy tip for building lasting financial stability and confidence in your money management journey. By staying mindful of where your money goes, you’ll gain more control over your finances, reduce unnecessary debt, and steadily move closer to achieving your financial goals.

I still remember the first time I tracked every single expense for a month; I was shocked at how much I spent on takeout coffee alone. That simple realization motivated me to create a realistic budget, cut back on daily splurges, and redirect that money into an emergency fund. It was a small change that made me feel in control for the first time.

4. Expert insights: how financial planners prioritize

Certified Financial Planners (CFPs) recommend approaching personal finance with a clear hierarchy: ensure financial safety first, build stability, and then focus on long-term wealth growth.

“Think of your income like a funnel. If you plug leaks at the top, more reaches your goals.” – CFP Amy Irvine

Amy Irvine’s “income funnel” metaphor underscores the importance of controlling cash flow from the start. By reducing unnecessary spending, more of your money flows toward your most important financial goals, whether that’s an emergency fund, retirement savings, or investments.

CFPs typically apply this philosophy through three practical strategies:

- Start with survival, then stability, then success: Cover essential needs first (housing, food, insurance, debt payments), build financial stability (emergency funds, paying off high-interest debt), and only then optimize for wealth growth.

- Bucket budgeting – Essentials → Goals → Lifestyle: Allocate income by priority. Essentials get funded first, followed by savings and financial goals, with lifestyle spending last to ensure security and progress.

- Automation: Automate bill payments and savings to remove emotion from financial decisions, maintain discipline, and make consistency effortless.

CFPs emphasize a systematic, cash-flow-first approach to money management. By securing your financial foundation, prioritizing long-term goals, and leveraging automation, you create a disciplined system that protects against financial crises while setting you up for sustainable wealth growth.

Continue reading: 4 walls of budgeting that will change how you spend

5. FAQs

It’s best to cover minimum debt payments first to avoid penalties and damage to your credit score. Next, focus on building an emergency fund with 3–6 months of expenses. Once that’s in place, aggressively pay down high-interest debt to reduce overall financial burden.

Review your budget at least once every quarter or whenever you experience major changes such as a new job, salary change, family additions, or unexpected expenses. Frequent reviews keep your budget on target.

Create a bare-bones budget based on your lowest monthly income to cover essentials. Save any extra income or windfalls into a buffer fund to smooth out months with lower earnings. This approach reduces stress during lean periods.

Build and maintain an emergency fund dedicated to unplanned costs like medical bills or car repairs. If emergencies arise beyond your savings, consider temporary cuts in discretionary spending until you recover financially.

To prioritize expenses, start by covering your essential needs first, like housing, food, utilities, transportation, and healthcare. Next, focus on paying down high-interest debt and building an emergency fund. Once your basics are secure, allocate money toward savings goals (retirement, education, investments) and finally, discretionary spending like dining out or travel.

The priority of expenses is a structured way of deciding where your money should go first. Essentials such as shelter, food, and health come at the top, followed by debt repayment, savings, and insurance. Lower-priority items include entertainment, shopping, and luxury purchases. Having a clear hierarchy prevents overspending on wants before needs are met.

The 70/20/10 rule is a simple budgeting framework: spend 70% of your income on needs and lifestyle, save or invest 20%, and dedicate 10% to giving or donations. It’s a flexible guideline that helps you control expenses while still building savings and supporting causes you care about.

When prioritizing payments, always handle critical bills first: rent or mortgage, utilities, insurance, and minimum debt payments to avoid penalties. Next, tackle high-interest debt to save on interest costs, then put money into savings or investments. Finally, allocate funds to optional expenses like entertainment or hobbies. Paying essentials first keeps you financially stable and stress-free.

6. Conclusion: Mastering financial control through prioritization

Learning how to prioritize expenses empowers you to regain financial control, even during tough times. It reduces stress, builds confidence, and creates a clear path toward long-term goals.

So, what is the positive outcome of creating a financial plan? It gives you structure and direction, helping you stop guessing about money, make smarter choices, and focus on building your future. From my own experience, prioritizing expenses helped me break free from living paycheck to paycheck and start building real savings.

You might struggle at first, but the payoff is worth it. The goal isn’t perfection, it’s progress. Instead of trying to fix everything at once, just take one small step. Maybe that’s simply listing out your subscriptions or tracking your spending for a single weekend. You might be surprised by what you learn.

If this guide helped you, leave a comment below and share which step you’ll start with. Explore more tips in the Budgeting Strategies section at H2T Funding.