Goat Funded Trader is a relatively new proprietary trading firm that promises traders flexible challenges, profit splits up to 100%, and opportunities to scale capital. With platforms like MT5, TradeLocker, and Match-Trader, plus a strong community presence on Discord, it has attracted significant attention in the prop trading industry.

But behind the appealing features, my experience and many Goat Funded Trader Trustpilot reviews reveal concerning patterns: payout delays, lack of transparency on spreads and leverage, and traders passing challenges without receiving funded accounts.

In this Goat Funded Trader review, I will share my trusted insights on the pros and cons to help you decide if it’s worth it or if safer firms suit you better.

1. Our take on Goat Funded Trader

Goat Funded Trader is a proprietary trading firm launched in 2023 in Spain and now operating out of Hong Kong. Edward XL (Edoardo Dalla Torre) is the leader of the firm. Under his guidance, Goat Funded Trader claims to have paid out over $10 million to traders and provides scalable funding programs of up to $2 million.

From my experience reviewing prop firms, though, the story is far from perfect. While Goat Funded Trader markets generous profit splits and frequent bi-weekly payouts, community feedback tells another side.

On Reddit and Trustpilot, traders often highlight issues such as unclear rules, capped profits on news trades, and reduced leverage after funding. Some even report passing challenges without being granted a funded account.

Beyond these complaints, Goat Funded Trader also restricts users from more than 30 countries. This makes the scope of opportunity feel much narrower than what’s promised.

Pros and cons of Goat Funded Trader

| Pros | Cons |

|---|---|

| ✅ Profit splits up to 100% with scaling potential to $2M | ❌ 18% one-star reviews on Trustpilot, with many traders calling it a scam |

| ✅ Multiple challenge types, including instant funding | ❌ Vague and restrictive rules on leverage, spreads, and payouts |

| ✅ Access to MT5, TradeLocker, and Match-Trader | ❌ News trading profits capped at 1% if executed around major releases |

| ✅ Refundable challenge fees | ❌ Strict drawdown rules, most accounts have tight daily and max limits, especially Instant Funding programs |

| ✅ Bi-weekly payouts and global scaling options |

In my view, Goat Funded Trader may suit disciplined traders who grasp its rules, but with 18% one-star reviews, payout issues, and little transparency on spreads and leverage, it remains a high-risk choice versus established U.S. firms.

2. Challenge and funded program

Goat Funded Trader provides traders with multiple evaluation pathways, designed to match different risk tolerances and trading styles. The firm now offers:

- One-step challenge

- Two-step challenge

- Three-step challenge

- Instant funding

While the absence of time limits adds flexibility, each program carries strict rules on drawdowns, leverage, and payout conditions that demand careful consideration.

Below is a side-by-side comparison of Goat Funded Trader’s programs:

| Account Type | One-Step | Two-Step (Goat) | Two-Step (Standard) | Two-Step (Pro) | Three-Step | Instant (Goat) | Instant (Standard) |

|---|---|---|---|---|---|---|---|

| Account Sizes | $15K – $200K | $5K – $150K | $5K – $200K | $5K – $200K | $10K – $200K | $5K – $100K | $2.5K – $50K |

| Profit Target | 10% | 8% (Step 1) 6% (Step 2) | 10% (Step 1) 5% (Step 2) | 8% (Step 1) 4% (Step 2) | 6% (Step 1) 6% (Step 2 & 3) | No Target | No Target |

| Daily Drawdown | 4% | 4% | 5% | 4% | 4% | 3% | 4% |

| Max Drawdown | 6% | 10% | 10% | 8% | 8% | 6% | 8% |

| Time Limit | No time limit | No time limit | No time limit | No time limit | No time limit | No time limit | No time limit |

| Reward Schedule | Bi-Weekly (On-demand add-on) | First payout on demand or every 30 days | Bi-Weekly (On-demand add-on) | Bi-weekly + On-demand add-on | Bi-Weekly (On-demand add-on) | Bi-Weekly | Every 10 Days |

| Leverage | Up to 1:30 | Up to 1:100 | Up to 1:100 | Up to 1:100 | Up to 1:100 | Up to 1:50 | Up to 1:50 |

| Profit Split | 80% (100% add-on) | 80% (100% add-on) | 80% (100% add-on) | 80% (100% add-on) | 80% (100% add-on) | 80% (100% add-on) | 65% – 95% (Triple Payday) |

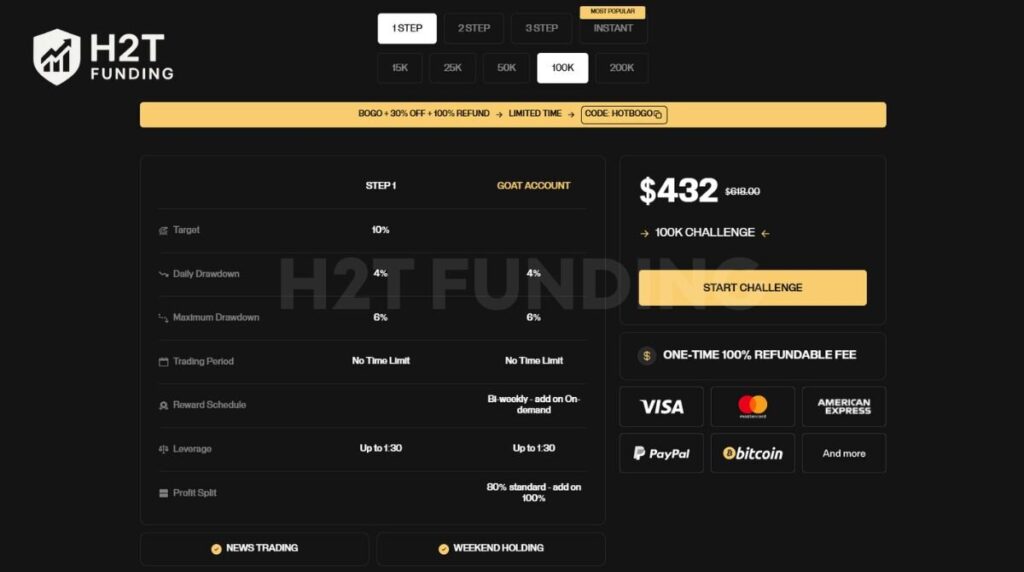

2.1. One-step challenge

The One-Step Challenge at Goat Funded Trader offers traders a straightforward way to qualify for funding, but this program requires traders to hit a 10% profit target in a single phase, while strictly adhering to a 4% daily drawdown and 6% maximum drawdown. Passing this challenge grants access to a funded account immediately, without any additional verification stages.

While I find the idea of a single-phase evaluation appealing, the tight drawdown limits quickly reminded me how critical precise risk management is. From my experience, traders must stay disciplined and conservative, planning each trade carefully to avoid breaches that could erase all progress toward the funding goal.

| Account Size | One-Time Fee | Profit Target (10%) | Daily Drawdown (4%) | Maximum Drawdown (6%) |

|---|---|---|---|---|

| $15,000 | $178 | $1,500 | $600 | $900 |

| $25,000 | $248 | $2,500 | $1,000 | $1,500 |

| $50,000 | $358 | $5,000 | $2,000 | $3,000 |

| $100,000 | $618 | $10,000 | $4,000 | $6,000 |

| $200,000 | $1,098 | $20,000 | $8,000 | $12,000 |

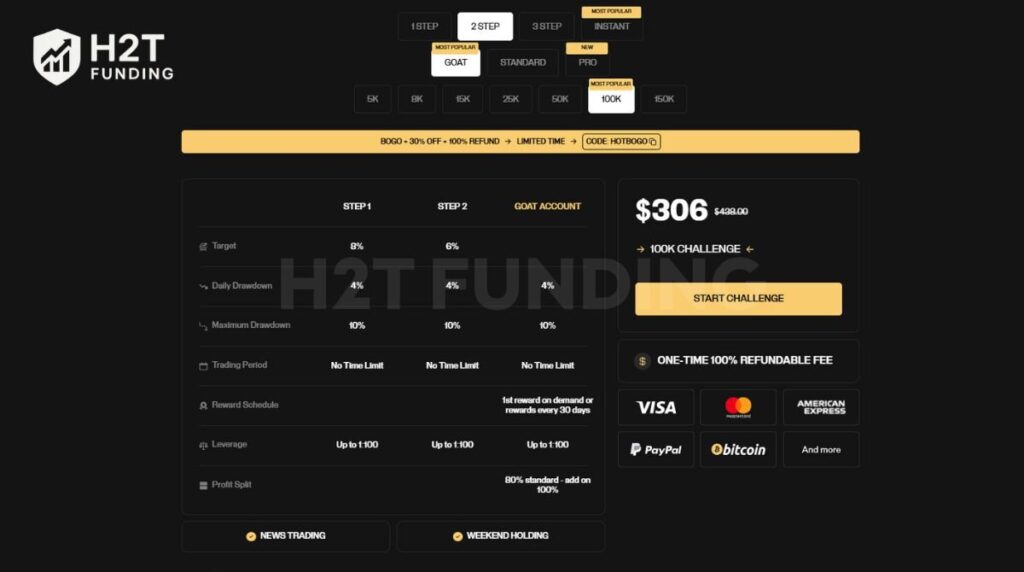

2.2. Two-step challenge

The Two-Step Challenge is a more traditional evaluation model that tests consistency across two phases before granting funded account access. Traders can choose from Goat, Standard, or Pro accounts, each with different profit targets, drawdown limits, and leverage. This tiered system provides more flexibility than the One-Step Challenge but still demands disciplined risk management.

2.2.1. Goat Account

The Goat Account in the Two-Step Challenge feels tailored for traders chasing aggressive growth but under very strict limits. It’s appealing, yet I found it leaves little room for error.

To earn funding, traders face two phases: an 8% profit target in Step 1 and 6% in Step 2, while staying within a 4% daily drawdown and 10% max loss. Personally, I see this as a real test of discipline and risk control.

| Account Size | One-Time Fee(Refundable) | Profit Target (Step 1: 8% / Step 2: 6%) | Daily Drawdown (4%) | Maximum Drawdown (10%) |

|---|---|---|---|---|

| $5,000 | $36 | $400 / $300 | $200 | $500 |

| $8,000 | $56 | $640 / $480 | $320 | $800 |

| $15,000 | $98 | $1,200 / $900 | $600 | $1,500 |

| $25,000 | $148 | $2,000 / $1,500 | $1,000 | $2,500 |

| $50,000 | $268 | $4,000 / $3,000 | $2,000 | $5,000 |

| $100,000 | $438 | $8,000 / $6,000 | $4,000 | $10,000 |

| $150,000 | $658 | $12,000 / $9,000 | $6,000 | $15,000 |

2.2.2. Standard Account

The Standard Account strikes me as a balanced choice for traders who prefer a moderate evaluation path. It doesn’t feel as punishing as Goat accounts, yet it still demands focus and consistency.

Step 1 sets a 10% profit target, followed by 5% in Step 2, with drawdowns capped at 5% daily and 10% overall. To me, this structure offers more breathing room, making it suitable for those who want a clear framework but with a bit more flexibility.

| Account Size | One-Time Fee (Refundable) | Profit Target (Step 1: 10% / Step 2: 5%) | Daily Drawdown (5%) | Maximum Drawdown (10%) |

|---|---|---|---|---|

| $5,000 | $52 | $500 / $250 | $250 | $500 |

| $8,000 | $92 | $800 / $400 | $400 | $800 |

| $15,000 | $188 | $1,500 / $750 | $750 | $1,500 |

| $25,000 | $218 | $2,500 / $1,250 | $1,250 | $2,500 |

| $50,000 | $318 | $5,000 / $2,500 | $2,500 | $5,000 |

| $100,000 | $568 | $10,000 / $5,000 | $5,000 | $10,000 |

| $200,000 | $1,068 | $20,000 / $10,000 | $10,000 | $20,000 |

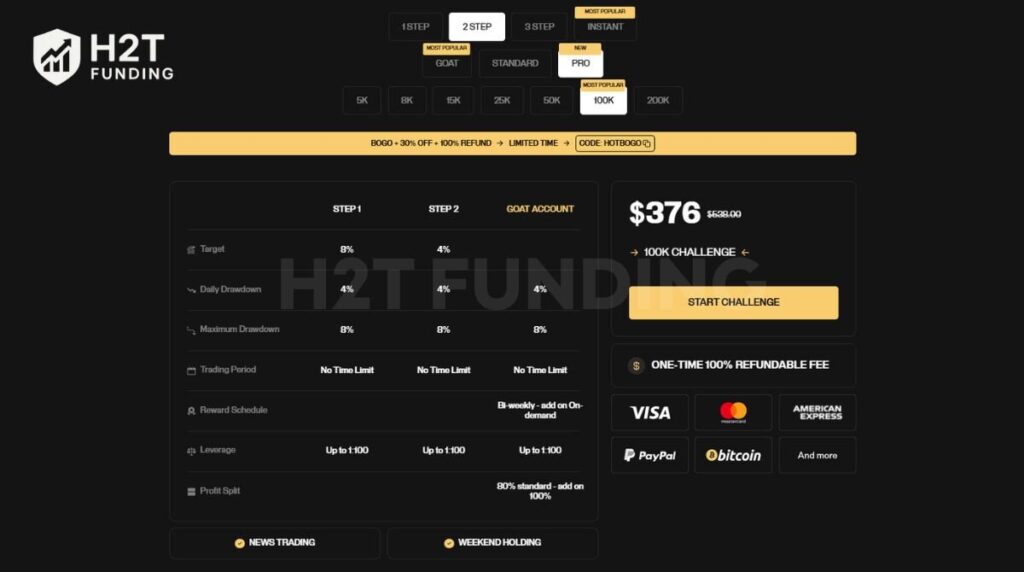

2.2.3. Pro Account

The Pro Account is tailored for experienced traders seeking maximum scalability with moderate risk. Step 1 requires 8% profit, followed by Step 2 with 4% profit, while keeping daily drawdown at 4% and maximum drawdown at 8%. This account type is ideal for traders who can manage positions carefully and prefer high leverage flexibility.

| Account Size | One-Time Fee (Refundable) | Profit Target (Step 1: 8% / Step 2: 4%) | Daily Drawdown (4%) | Maximum Drawdown (8%) |

|---|---|---|---|---|

| $5,000 | $62 | $400 / $200 | $200 | $400 |

| $8,000 | $92 | $640 / $320 | $320 | $640 |

| $15,000 | $168 | $1,200 / $600 | $600 | $1,200 |

| $25,000 | $218 | $2,000 / $1,000 | $1,000 | $2,000 |

| $50,000 | $318 | $4,000 / $2,000 | $2,000 | $4,000 |

| $100,000 | $538 | $8,000 / $4,000 | $4,000 | $8,000 |

| $200,000 | $1,098 | $16,000 / $8,000 | $8,000 | $16,000 |

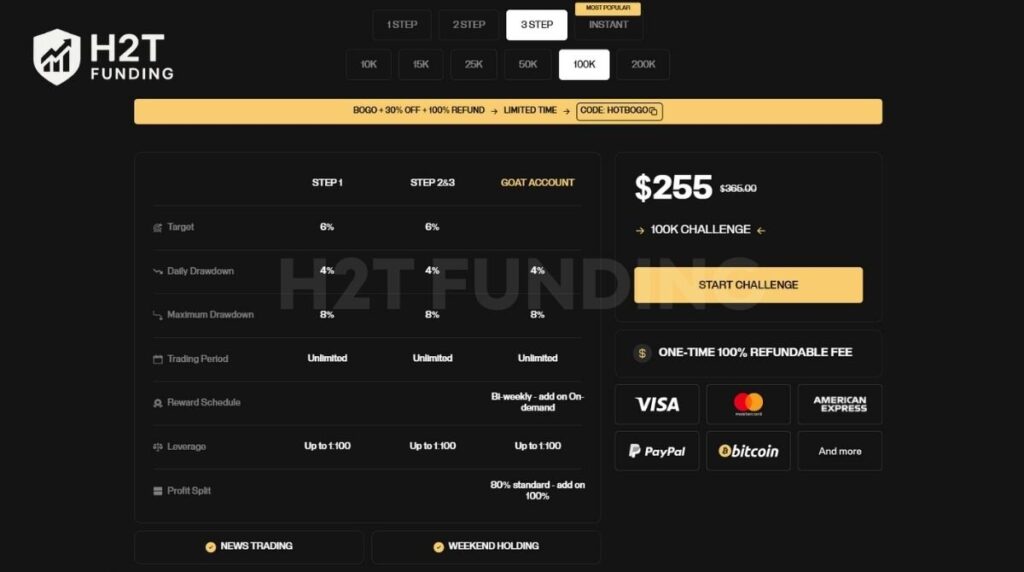

2.3. Three-step challenge

To me, the Three-Step Challenge feels like the most rigorous model Goat Funding offers, clearly aimed at traders who value consistency and patience over quick funding. Each phase sets a 6% profit target with strict limits, 4% daily drawdown, and 8% overall, which I found demanding but fair.

I see this challenge as a filter that discourages aggressive, high-risk trading and instead rewards systematic discipline. For traders serious about proving long-term profitability, it provides a solid framework to build credibility under tight controls.

| Account Size | One-Time Fee | Profit Target (6%) | Daily Drawdown (4%) | Max Drawdown (8%) |

|---|---|---|---|---|

| $10,000 | $48 | $600 | $400 | $800 |

| $15,000 | $63 | $900 | $600 | $1,200 |

| $25,000 | $108 | $1,500 | $1,000 | $2,000 |

| $50,000 | $168 | $3,000 | $2,000 | $4,000 |

| $100,000 | $273 | $6,000 | $4,000 | $8,000 |

| $200,000 | $498 | $12,000 | $8,000 | $16,000 |

2.4. Instant Funding

Instant Funding accounts at Goat Trader provide immediate access to live capital without requiring an evaluation phase. These accounts are ideal for experienced traders who already have tested strategies and want to start earning profits right away.

However, the absence of an evaluation phase means higher upfront fees and strict drawdown limits (3-4% daily and 6-8% maximum), making risk management critical. Unlike evaluation accounts, there is no refund option, so traders must be confident before committing.

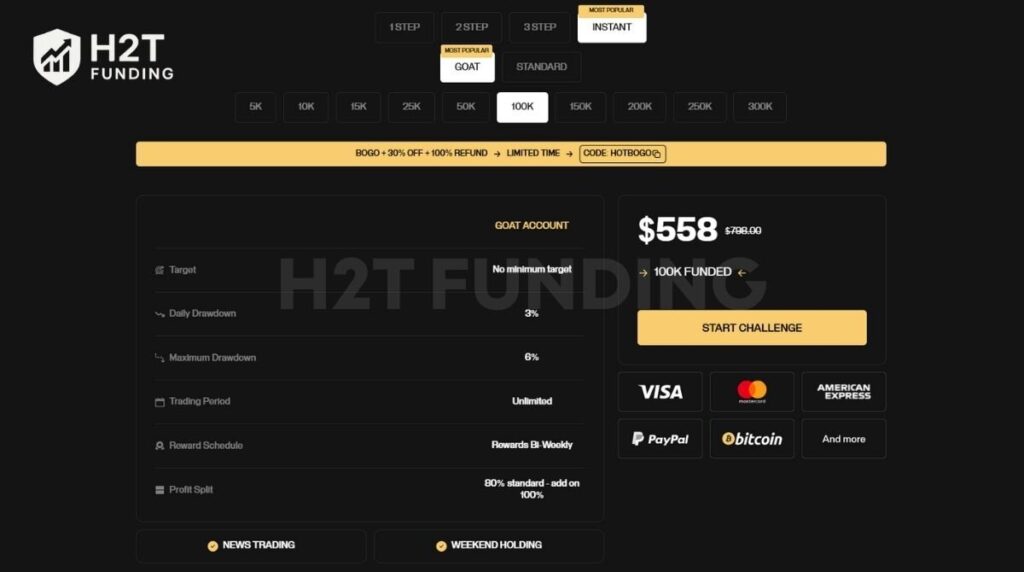

2.4.1. Goat account

The Goat Instant Funding Account allows traders to bypass the challenge entirely, starting with live capital immediately. There is no minimum profit target, but daily and maximum drawdowns are strictly enforced, requiring disciplined trading.

| Account Size | One-Time Fee | Daily Drawdown (3%) | Max Drawdown (6%) |

|---|---|---|---|

| $5,000 | $107 | $150 | $300 |

| $10,000 | $147 | $300 | $600 |

| $15,000 | $217 | $450 | $900 |

| $25,000 | $307 | $750 | $1,500 |

| $50,000 | $467 | $1,500 | $3,000 |

| $100,000 | $767 | $3,000 | $6,000 |

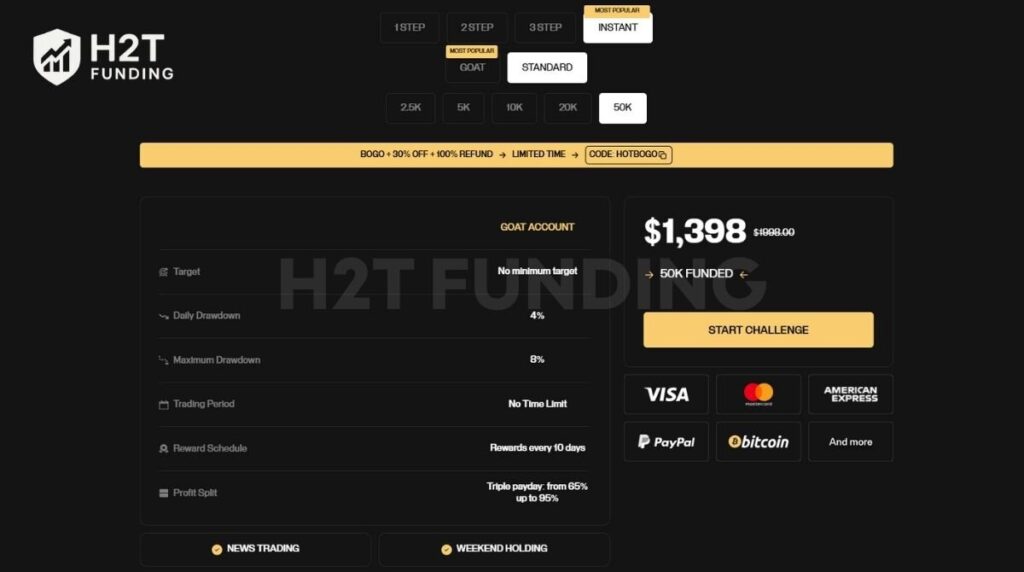

2.4.2. Standard account

The Standard Instant Funding Account offers similar immediate capital access but with slightly higher drawdown limits and a triple payday payout system. This account type is suitable for traders who want more frequent payouts and can manage slightly looser daily risk limits.

| Account Size | One-Time Fee | Daily Drawdown (4%) | Max Drawdown (8%) |

|---|---|---|---|

| $2,500 | $73 | $100 | $200 |

| $5,000 | $148 | $200 | $400 |

| $10,000 | $309 | $400 | $800 |

| $20,000 | $609 | $800 | $1,600 |

| $50,000 | $1,434 | $2,000 | $4,000 |

Verdict on Challenge and Funded Program

From my experience, Goat Funded Trader offers flexible challenges and Instant Funding, but unclear details on spreads, leverage, and scaling make real earnings hard to judge. Strict drawdowns, especially in the One-Step Challenge, demand disciplined trading with little margin for error.

While profit splits and fast payouts look appealing, the lack of transparency makes me cautious. Traders should approach with tested strategies and realistic expectations.

3. Trading rules and restricted countries

Goat Funded Trader enforces strict trading rules across all evaluation and funded accounts. These regulations are designed to protect both traders and the firm while maintaining a fair trading environment. Understanding what is allowed and what is prohibited is crucial before participating in any challenge of any prop firm.

3.1. Allowed trading practices

Traders are allowed to engage in certain strategies as long as they respect risk limits and firm guidelines. These include:

- News Trading: Trading around major news events is permitted, but trades opened or closed within two minutes of a high-impact event are capped at 1% of the account’s initial balance. Excess profits are removed without penalties.

- Expert Advisors (EAs): Risk and trade management EAs are allowed if owned by the trader. The source code may be requested for verification.

- Copy Trading: Only allowed between funded accounts belonging to the same user.

- Weekend Holding: Positions can be held over weekends; the risk team may review evaluation accounts before approval.

- Consistency Rule (Instant GOAT Programs): Payout requests require that no single trading day accounts for more than 15% of total profits.

- Minimum Trading Days: A minimum of three trading days with a net profit of at least 0.5% per day is required to pass the evaluation or funded phases (except for Instant Funding).

Additionally, Goat Funded Trader restricted countries apply: traders from Bangladesh, Bulgaria, Chile, Cuba, Ethiopia, Hong Kong, Indonesia, Iran, Japan, Jordan, Lebanon, Libya, Malaysia, Myanmar, North Korea, Russia, Senegal, Singapore, Somalia, South Korea, Sri Lanka, Sudan, Syria, Togo, Thailand, and Vietnam are not allowed to register. Only traders aged 18 or older from permitted countries can participate.

While these rules provide flexibility for strategic trading, strict caps on news trading profits, consistency requirements, and weekend oversight mean traders must carefully plan trades. Relying on high-frequency trading, hedging, or aggressive account scaling may not be viable under these allowed rules.

3.2. Prohibited trading practices

Goat Funded Trader strictly forbids high-risk behaviors and violations of capital management rules. Breaking these rules may result in account breaches, loss of profits, or termination:

- No Hedging: Opposite trades on the same instrument are not allowed, even across different accounts.

- No Trade Copying Across Accounts: Mirroring trades on multiple evaluation accounts is prohibited.

- No Strategy Switching: Any EA or strategy used to pass evaluation must continue in the funded account.

- No High-Frequency Trading (HFT): More than 50% of trades cannot be held for less than one minute.

- No “All-or-Nothing” Trading: The account balance cannot be fully risked on a single trade or series of trades.

- Max Risk per Trade (Instant Programs): No more than 2% of initial balance can be risked per trade. First violation triggers a warning; a second violation may terminate the account.

- News Trading Limits: Trades opened or closed within two minutes of major news have profits capped at 1% of the account balance.

Traders who adhere to these rules can operate safely within the firm’s risk framework, while those who push limits risk immediate penalties or account termination.

Verdict on Goat Funded Trader Rules

From what I’ve seen, the rules are clear and well structured to enforce discipline, though their complexity can easily overwhelm less experienced traders. The flexibility in allowed strategies is helpful, but the strict prohibitions and risk caps leave almost no margin for error.

Overall, this setup favors traders who are methodical and consistent in managing risk. Those with a steady, rules-based approach will find it easier to succeed under these conditions.

4. Payments and profit payout

Getting paid is one of the most important factors when choosing a prop firm, and Goat Funded Trader has built a payout system that combines structure with flexibility. While the default setup requires patience, optional add-ons and different withdrawal routes allow traders to access earnings faster if needed.

Payment method

All withdrawals are processed via Rise, a global payout platform that supports both crypto transfers and direct bank deposits. Once a payout request is approved, funds are credited to the trader’s Rise account, from which they can withdraw through their preferred method. This offers global accessibility, especially for traders who value speed and borderless transactions.

Payout schedule

- Standard cycle: The first payout can be requested after 30 days from the first trade. Following that, payouts follow a 30-day cycle.

- Bi-weekly payouts (Add-On): With an upgrade, traders can withdraw every 14 days, cutting the waiting period in half.

- Reward on demand: After only 3 trading days, traders can withdraw up to 40% of profits immediately, while the remaining 60% is paid on the next scheduled cycle.

Conditions & limits

- Minimum withdrawal: $100, ensuring profits must be realized before requesting payouts.

- First two payouts: Capped at a maximum of 6% of account balance, with the rest carried forward.

- Daily cap: $3,000 withdrawal limit per day, which can slow down larger profit withdrawals.

- Processing time: Typically within 2–3 business days (sometimes 1–2 with Rise), though delays can occur depending on banking networks or crypto confirmations.

Verdict on payments and payouts

Goat Funded Trader provides a structured payout system with multiple options, quick processing times, and flexibility through Rise. However, restrictions on the first two withdrawals, the $3,000 daily limit, and the requirement to wait 30 days for the initial payout may frustrate high-performing traders.

Important note: While the firm’s system looks efficient on paper, some trader reviews have raised concerns about payout consistency and delays. Prospective traders should carefully consider these reports and evaluate whether Goat Funded Trader’s payout model aligns with their expectations before committing.

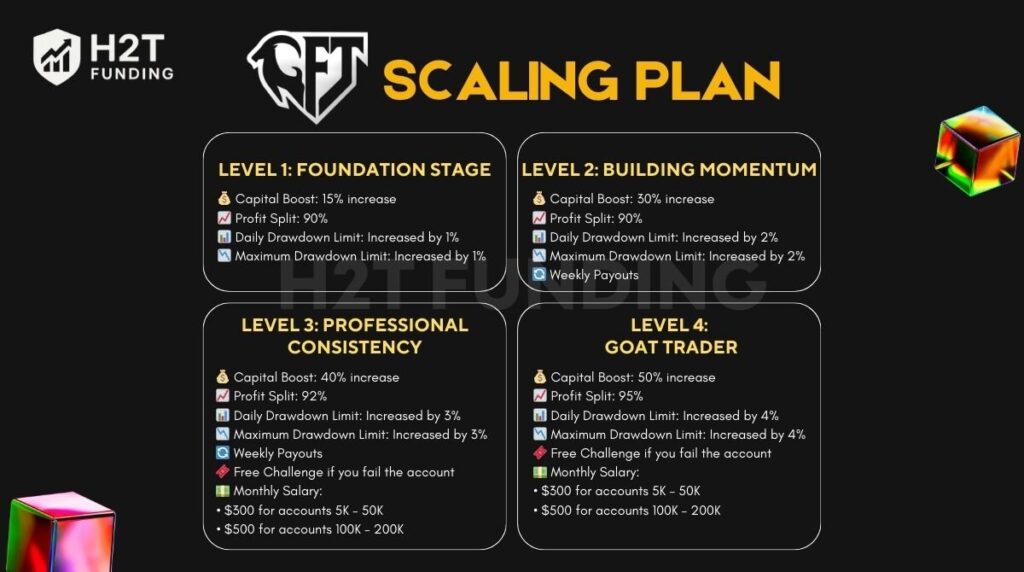

5. Goat Funded Trader scaling plan

Goat Trading provides a tiered pathway where traders can access higher profit splits, stronger drawdown limits, weekly payouts, and even monthly salaries. The program progresses through four levels, each with specific eligibility requirements and increasingly attractive benefits.

Level 1: Foundation stage

The first stage focuses on proving discipline beyond simply passing the challenge. Traders who remain consistent for two months gain access to improved trading conditions.

Eligibility:

- 2 months in the funded phase

- 4 successful payouts

Benefits:

- +15% capital increase

- Profit split raised to 90%

- Daily and maximum drawdown increased by +1%

This stage sets the tone for long-term growth, encouraging traders to prioritize steady results over short-term gains.

Level 2: Building momentum

At level 2, Goat Funded Trader rewards traders who have shown steady performance and established a trading rhythm.

Eligibility:

- 4 months in the funded phase

- 6 successful payouts

Benefits:

- +30% capital increase

- 90% profit split maintained

- Daily and maximum drawdown increased by +2%

- Weekly payouts unlocked

By Level 2, traders not only manage larger capital but also enjoy smoother payout cycles, providing more flexibility in managing profits.

Level 3: Professional consistency

Level 3 separates disciplined professionals from occasional performers. At this stage, benefits expand to include salaries and added safety nets.

Eligibility:

- 5 months in the funded phase

- 10 successful payouts

Benefits:

- +40% capital increase

- Profit split upgraded to 92%

- Daily and maximum drawdown increased by +3%

- Continued weekly payouts

- Free challenge reset if the account is lost

- Monthly salary: $300 (5K–50K accounts) or $500 (100K–200K accounts)

Here, trading transforms from funded access to a structured professional opportunity, with both fixed and performance-based income streams.

Level 4: GOAT status

The highest stage represents elite trader recognition, providing significant capital, maximum profit splits, and ultimate payout flexibility.

Eligibility:

- 6 months in the funded phase

- 15 successful payouts

Benefits:

- Capital boost up to $2,000,000 (or +50% of the original account)

- Profit split raised to 95%

- Daily and maximum drawdown increased by +4%

- On-demand payouts enabled

- Free challenge reset if the account is lost

- Monthly salary: $300 (5K–50K accounts) or $500 (100K–200K accounts)

Reaching this stage means achieving full partnership benefits with Goat Funded Trader, where capital, profit share, and flexibility peak.

Verdict on Goat Funded Trader Scaling Plan

Goat Funded Trader’s scaling system stands out because it blends capital growth with practical perks that traders genuinely value, from weekly payouts to free retries and even monthly salaries. It’s a structure that pushes you to stay consistent over time rather than just focus on short-term results.

From my perspective, this feels less like chasing bonuses and more like building a career step by step. That’s why traders with patience and a steady approach are the ones most likely to benefit from it.

6. Spreads and commissions fee

Trading costs are a key factor for profitability, and Goat Funded Trader provides a structure designed to balance accessibility with competitive pricing. Across MT5, Match-Trader, and TradeLocker, spreads and commissions vary by asset class, offering low-cost opportunities for different trading strategies.

Spreads

Goat Funded Trader offers raw spreads starting from 0.1 pips, allowing traders to access tight market pricing. This applies across all assets and platforms, providing better entry points, particularly for scalpers and high-frequency strategies. While spreads are generally competitive, actual execution conditions may vary depending on market liquidity and the chosen platform.

Commissions

The commission structure is straightforward:

- Cryptocurrencies, indices, commodities, and stocks: $0 per lot

- Forex pairs and metals: $5 per lot round-turn

- Challenge accounts: one-time entry fee applies, no recurring fees

This combination of low commissions and tight spreads enables cost-efficient trading for both short-term and longer-term strategies. Traders can control costs effectively, but must consider that spreads, although advertised as raw, may fluctuate during high volatility.

Verdict on Spreads and Commissions

The firm offers one of the most competitive commission structures in the industry, combined with raw spreads from 0.1 pips. This makes trading cost-effective across multiple asset classes.

However, the lack of full transparency on actual spread ranges during market fluctuations means that traders should verify execution conditions during active trading. For those relying on precise spread management, particularly scalpers, practical testing is essential before committing to a challenge.

7. Trading platform

Goat Funded Trader provides three trading platforms, each tailored for different trading styles and levels of automation. Understanding the strengths and limitations of each platform is crucial for effective trading and complying with prop firm rules. The table below summarizes the core features, supported devices, and automation capabilities.

| Platform | Key Features | Supported Devices | Automation / EA Support | Ideal For |

|---|---|---|---|---|

| MetaTrader 5 (MT5) | Advanced charting, multi-asset support, fast execution, and custom indicators | Desktop, Web, Mobile | Full EA support; must verify ownership if requested | Traders using EAs, algorithmic or automated strategies |

| TradeLocker | TradingView integration, modern interface, built-in risk tools | Web-based, Desktop, Mobile | Limited automation; no full EA support | Discretionary traders, chart-focused analysis |

| Match-Trader | Real-time market data, analytics, economic news, lightweight execution | Desktop, Web, Mobile | Limited automation; not suitable for complex EAs | Traders prioritizing speed and simplicity |

Notes:

- MT5: Leading platform for automation and flexibility; supports advanced analysis and custom scripts.

- TradeLocker: Ideal for visual traders relying on TradingView charts; simple and browser-based.

- Match-Trader: Fast execution platform suitable for quick discretionary trading.

All three platforms include essential risk management tools, reporting, and customizable settings.

Verdict on Trading Platforms

Goat Funded Trader’s platform suite balances flexibility and accessibility. MT5 is optimal for traders relying heavily on automation, TradeLocker suits chart-based discretionary traders, and Match-Trader prioritizes fast execution.

The absence of MT4, coupled with strict rules on hedging, trade copying, and EA verification, may limit certain high-frequency or automated strategies. Selecting the right platform ultimately depends on your trading style and the tools you prioritize.

8. Trading instruments & leverage

Goat Funded Trader provides access to a diverse range of markets, allowing traders to implement multi-asset strategies while managing risk according to firm rules. Each asset class comes with distinct leverage limits during evaluation and funded phases, which affect position sizing and overall risk exposure.

| Asset Class | Evaluation Leverage | Funded Account Leverage |

|---|---|---|

| Forex | Up to 1:100 (Two-Step & Three-Step), 1:30 (One-Step) | 1:50 standard; One-step leverage not clearly confirmed |

| Indices | 1:20 | 1:10 |

| Commodities | 1:20 | 1:10 |

| Cryptocurrencies | 1:2 | 1:2 |

| Stocks | 1:5 | 1:5 |

Notes:

- Leverage reductions after funding are designed to safeguard firm capital and control risk on larger accounts.

- One-step accounts face tighter evaluation leverage, making it harder to take large positions.

- Scaling leverage over time is possible, but criteria and timelines are not publicly detailed, so traders should plan conservatively.

Verdict on Trading Instruments & Leverage

Goat Funded Trader offers a broad set of trading instruments with competitive leverage during evaluation, particularly for Forex accounts. The One-Step challenge is limited to 1:30, which constrains more aggressive strategies.

Post-funding leverage is lower across all asset classes, and the rules for increasing leverage over time lack transparency. Traders need to factor in these limitations when designing strategies, especially for those aiming to scale or move from evaluation to funded accounts.

9. Education & resource

Goat Funded Trader provides some educational content, though it is limited in scope. While traders can access tutorials and trading tips, the firm does not offer a structured learning program, mentorship, or in-depth strategy breakdowns. Most educational materials are designed to familiarize traders with the platform and company policies rather than to teach advanced trading techniques.

Available Educational Resources:

- Blog Section: Articles cover general topics, trading tips, affiliate programs, contests, and trader interviews.

- YouTube Channel: Includes platform tutorials, trader interviews, and occasional strategy insights.

- VIP Goat Traders Content: Some exclusive tips for select funded traders.

- Community Interaction: Insights can sometimes be gained through forums and social media discussions.

Verdict on Education & Resources

While Goat Funded Trader provides basic educational tools and content for platform navigation, it does not support comprehensive trading education. Traders seeking structured programs, mentorship, or in-depth strategy guidance will need to supplement their learning elsewhere. The firm assumes participants have a working knowledge of trading before joining.

10. Customer support of Goat Funded Trader

Customer support at Goat Funded Trader is available via multiple channels, but can vary in responsiveness. While basic inquiries are usually addressed quickly, complex account or policy-related questions may require multiple follow-ups, and answers are not always fully clear.

Support Options:

- Live Chat: Available on the website; suitable for general questions and quick clarifications.

- Email Support: Used for account-specific concerns, payouts, or technical issues; response times can be up to 24 hours or longer.

- Social Media & Community: Some assistance and updates can be obtained from official channels or community discussions.

Verdict on Customer Support

In my own experience, Goat Funded Trader’s support feels functional but not always consistent. General inquiries were usually handled quickly, but when I asked more detailed or policy-related questions, the responses often took longer than expected.

I’ve learned to do my own research alongside their guidance, because while the support team is reliable, it doesn’t always cover everything I need. Don’t rely on Goatfundedtrader support for every detail; being proactive saves both time and frustration.

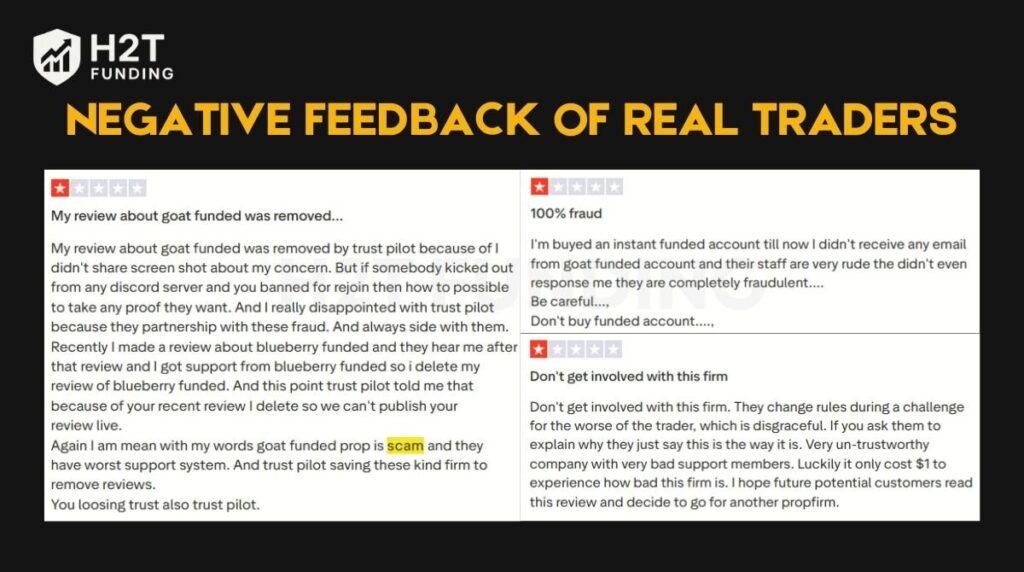

11. Trader feedback and reputation

Goat Funded Trader has built a sizable international user base and maintains strong visibility online, but trader feedback presents a mixed picture. While the firm attracts attention for flexible challenges and high profit splits, many users report concerns about payouts, account restrictions, and customer service responsiveness.

Many traders note significant issues with withdrawals and account management. For instance, one user on Trustpilot shared:

This highlights the frustration some traders experience when payouts are delayed despite meeting account age requirements. Such experiences suggest that international traders may face additional hurdles when withdrawing profits.

Despite these issues, Goat Funded Trader Discord maintains a strong community with 72,100+ members, and X, Instagram, and YouTube. Traders often use these channels to share strategies, payout proofs, and concerns.

However, the firm responds to only about 14% of negative reviews, leaving the majority of complaints unresolved. Readers can visit the TrustPilot page themselves to see how many customer issues remain unaddressed.

Verdict on Trader Feedback and Reputation

Although Goat Funded Trader has a large, engaged community and visibility in multiple regions, the firm’s mixed reviews and low response rate to complaints highlight potential risks.

Issues such as delayed or denied payouts, account restrictions, and poor customer support suggest that traders should approach Goat Funded Trader cautiously. Anyone considering signing up should review TrustPilot and other community forums to understand potential obstacles in accessing funds and resolving account-related issues.

12. How to start with Goat Funded Trader

Starting your journey with Goat Funded Trader is relatively simple, but careful attention to rules, account types, and payout policies is crucial before committing. Following the step-by-step process ensures a smoother registration and avoids potential issues later on.

Step 1: Access the sign-up page

- Visit the Goat Funded Trader official website.

- On the main page, locate and click the “Login” button.

- In the login section, select the “Create one” link to open the registration form.

Step 2: Submit your personal details

- Enter your first and last name, a valid email address, and create a secure password.

- Confirm your password and click “Register Now” to submit your information.

Step 3: Verify your email

- After registering, check your inbox for a confirmation email.

- Click the verification link to activate your account and gain access to the dashboard.

Step 4: Select your evaluation type and account size

- Choose between One-Step, Two-Step, Three-Step, or Instant Funding challenges depending on your experience and trading goals.

- Select the account size you wish to start with.

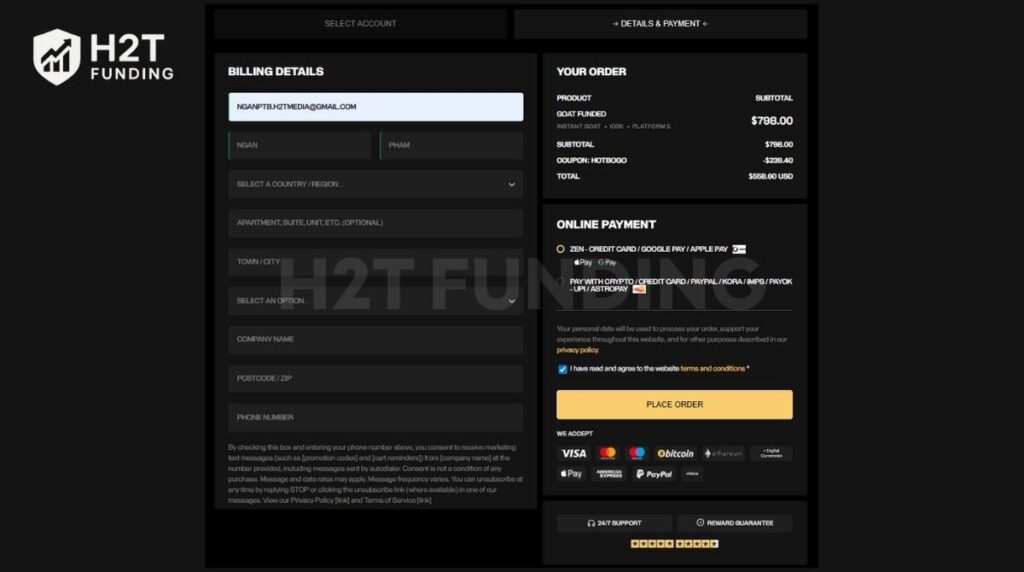

Step 5: Complete payment

- Pay the challenge fee using available methods such as credit/debit card, bank transfer, or cryptocurrency.

- Check for promotions or discount codes on social media before making a payment.

While the registration process itself is straightforward, Goat Funded Trader’s account rules, payout restrictions, and leverage adjustments require careful attention. Following each step methodically ensures you start on a solid footing and reduces the risk of unexpected complications during your funded trading journey.

13. Goat Funded Trader vs other prop firm

When deciding which prop firm to choose, many traders weigh factors like challenge costs, evaluation steps, and payout structures. Comparisons such as FundedNext vs Goat Funded Trader vs The Funded Trader are common among traders looking to find the best balance between funding size, flexibility, and fees.

Before diving into the details, note that each firm has different strengths. Understanding these differences is crucial for aligning your trading style with the right provider.

| Criteria | Goat Funded Trader | FundedNext | FTMO | The Funded Trader |

|---|---|---|---|---|

| Minimum challenge price | $17 | $32 | $168.02 (for $10,000 account) | $49 |

| Maximum fund size | $200,000 | $200,000 | $2,000,000 | $200,000 |

| Evaluation steps | Instant Funding, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, Instant Funding | 2-Step Evaluation (Challenge & Verification) | 2-Step Evaluation (Phase 1 & Phase 2) |

| Profit share | 80–90% | Up to 95% | Up to 90% | Up to 90% |

| Max daily drawdown | 4% | 3–5% | 5% | 5% |

| Max total drawdown | 8% | 6–10% | 10% | 10% |

| First profit target | 8% | 8–10% | 10% | 10% |

| Challenge time limit | Unlimited | Unlimited | 30 days for Challenge, 60 days for Verification | 30 days for each phase |

| Maximum leverage | 1:100 | 1:100 | 1:30 | 1:100 |

| Payout frequency | On-Demand | 5 Days / Bi-Weekly / Monthly | Bi-weekly | Bi-weekly |

| Trading platforms | MetaTrader 5, Match-Trader, TradeLocker | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader 4, MetaTrader 5, cTrader | MetaTrader 4, MetaTrader 5, cTrader |

Notes:

- Goat Funded Trader is the most cost-effective option and offers multiple evaluation paths, ideal for traders seeking flexibility and low entry fees.

- FTMO is suited for experienced traders who prioritize structured evaluations, higher funding amounts, and formal support.

- The Funded Trader works best for disciplined traders focused on consistent profitability and straightforward account rules.

14. FAQs

Edward XL (also known as Edoardo Dalla Torre) is the CEO of Goat Funded Trader.

Goat Funded Trader is a legit prop firm with thousands of funded traders worldwide. However, payout delays and support issues have been reported, so approach with caution and do your own research.

Goat Funded Trader operates with multiple platforms and liquidity providers, primarily through MetaTrader 5, TradeLocker, and Match-Trader. Specific broker partnerships are not publicly disclosed.

Yes, Goat Funded Trader pays traders according to its payout rules. First two withdrawals are capped, and processing times are typically 2–3 business days. Some users report delays, so it’s important to follow all rules.

Yes, news trading is allowed, but profits from trades around major events may be capped. Traders should review evaluation rules to avoid account breaches.

Goat Funded Trader sets both maximum daily and total drawdowns. Daily drawdowns usually range around 4–5%, while total drawdowns vary by account type and challenge. Violating these limits can lead to account termination.

Yes, funded accounts can increase capital allocation over time based on consistent trading performance, although exact rules and timelines are not fully disclosed.

Goat Funded Trader does not accept clients from the following countries: Bangladesh, Bulgaria, Chile, Cuba, Ethiopia, Hong Kong, Indonesia, Iran, Japan, Jordan, Lebanon, Libya, Malaysia, Myanmar, North Korea, Russia, Senegal, Singapore, Somalia, South Korea, Sri Lanka, Sudan, Syria, Togo, Thailand, and Vietnam.

Goat Funded Trader prohibits trading strategies that violate risk rules, such as hedging beyond limits, exceeding drawdowns, or using unapproved bots. Following the rules is essential to maintain account status.

Traders can access Forex, Indices, Commodities, Metals, and Cryptocurrencies. Leverage and available instruments depend on the account type and evaluation phase.

Yes, you can join multiple Goat Funded Trader challenges at the same time, as there are no restrictions against holding several evaluation accounts. However, you cannot merge evaluation accounts, and any merges for funded accounts are only allowed under specific conditions, such as being untraded or reset after a payout.

Using a VPN or sharing your login details with others is strictly prohibited at Goat Funded Trader. Doing so can lead to account suspension or termination, so always access your account personally and without masking your location.

Goat Funded Trader strictly forbids strategies like arbitrage, high-frequency trading (HFT), extreme scalping, Martingale, all-in trades, and any type of hedging, either within a single account or across multiple accounts. Breaking these rules results in immediate disqualification, reflecting the firm’s focus on genuine and compliant trading practices.

Goat Funded Trader, originally based in Spain, relocated operations to Hong Kong in December 2024, under CEO Edward XL (Edoardo Dalla Torre). Following this move, starting around April 2025, the firm began facing criticism due to widespread payout delays.

15. Conclusion

Goat Funded Trader review offers traders access to multiple platforms, diverse instruments, and competitive profit splits, making it attractive for disciplined traders seeking structured growth. Low commissions and multi-step challenges provide opportunities for both new and experienced traders to scale their accounts effectively.

However, transparency issues regarding spreads, leverage adjustments, and payout reliability remain concerns. TrustPilot reviews indicate mixed experiences, especially with withdrawals and support responsiveness, so careful planning and rule adherence are essential.

Overall, Goat Funded Trader is suitable for traders who value multi-asset access and structured funding plans, but caution is advised regarding account management and payout timelines. Explore other prop firm reviews by H2T Funding, and share your experiences with us to help the trading community make informed choices.